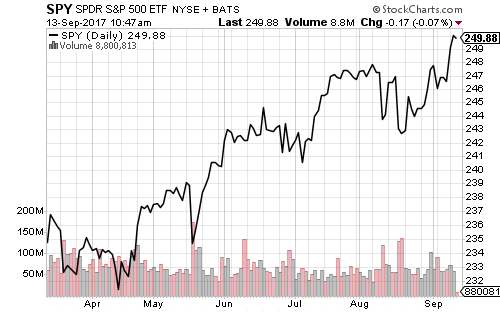

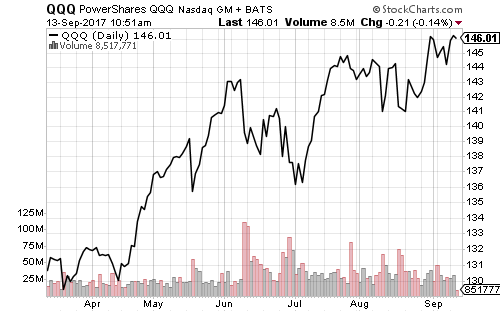

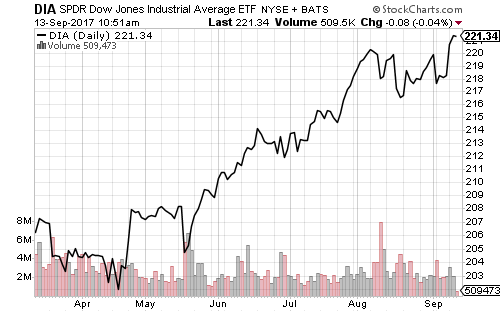

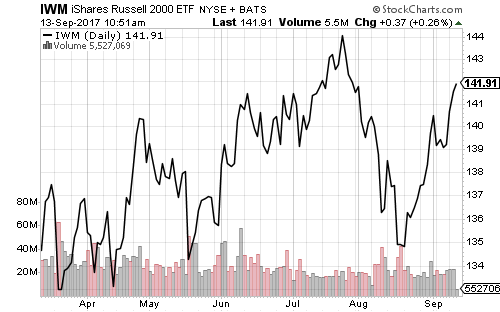

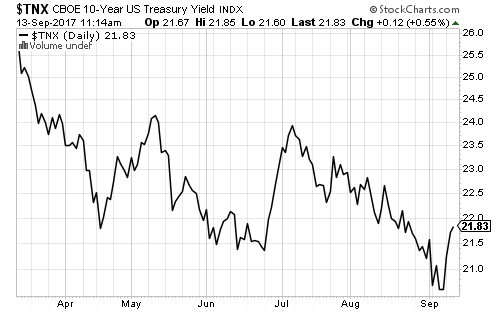

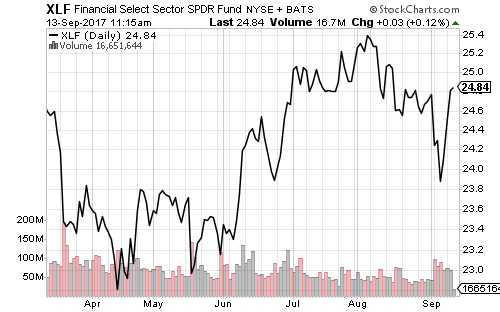

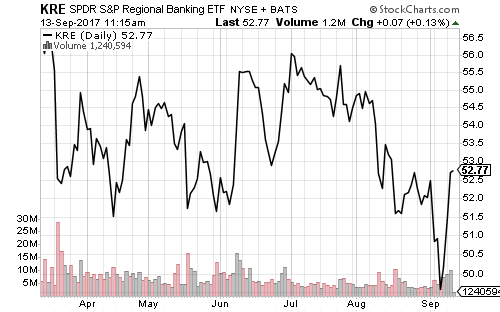

Equities climbed into record territory this week. Energy and insurance rebounded strongly and every major sector moved higher except utilities, which was weighed by rising interest rates. The Dow Jones Industrial Average and Russell 2000 were the strongest of the major indexes. They rose 2.16 and 2.31 percent, respectively.

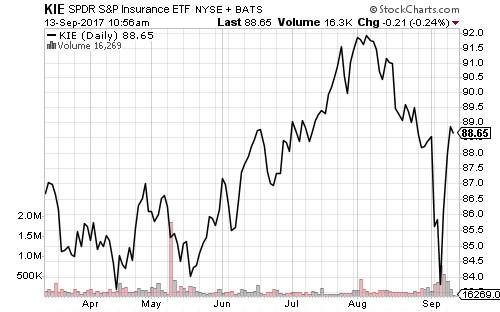

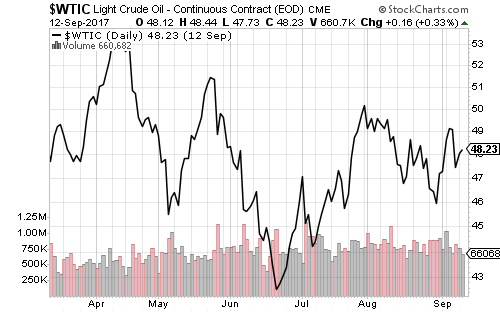

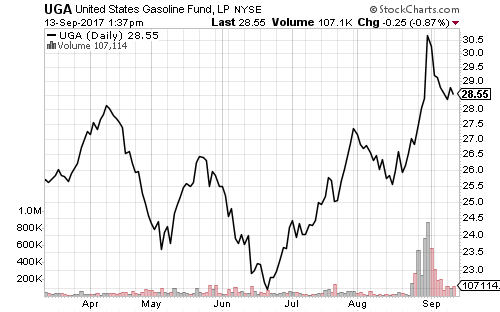

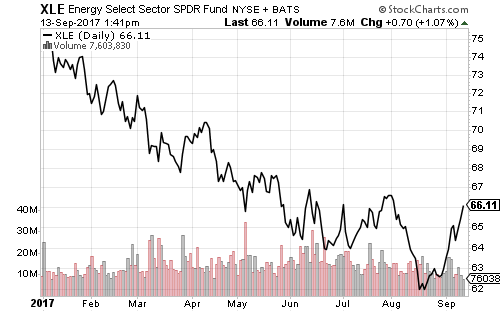

Speculators prepared for Hurricane Irma by selling insurers ahead of the storm. They spent the early part of this week unwinding those trades. SPDR S&P Insurance (KIE) climbed 2.72 percent this week. Energy was also a winner. The recovery from Harvey is bringing supply back online. Demand is also stronger than expected thanks to Irma weakening. SPDR Energy (XLE) rallied 2.24 percent. West Texas Intermediate crude oil moved above $50 on Thursday.

Weekly jobless claims hit 284,000, slightly down from last week and below estimates. It’s still about 40,000 higher than the pace seen before the hurricanes. Retail sales missed expectations, falling 0.2 percent. Sales ex-autos increased 0.2 percent.

The Job Openings and Labor Turnover Survey showed 6.2 million openings. The quit rate climbed to 2.2 percent. The Producer Price Index (PPI) rose 0.2 percent in August. Average oil prices were about 10 percent higher than August 2016. This bump will fade in the coming months unless oil sustains a rally into the mid-to-upper $50 range. Consumer prices also rose with gasoline prices and rent. Core inflation met analyst forecasts of 0.2 percent. Consumer sentiment remained strong in September, though the hurricanes likely contributed to the small decline from the August reading.

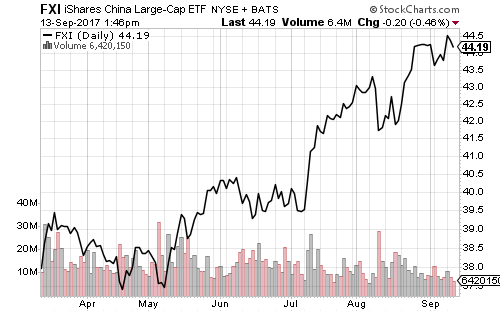

Chinese fixed-asset investment and industrial production has slowed. Copper is down 7 percent from its high a week ago. China’s credit growth is slowing as well. The money supply growth rate hit a new 20-year low in August. Bank loans have increased slightly, due primarily to the crackdown on shadow banking.

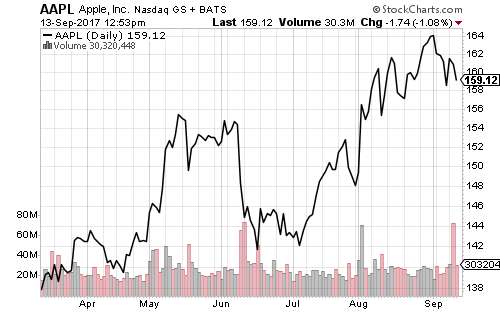

Apple (AAPL) unveiled the iPhone 8 and iPhone X this week. The iPhone X uses face recognition technology to unlock and the cheapest version will retail for $999. Shares of Apple fell as traders reversed bets made ahead of the announcement.

North Korea fired another missile over Japan on Friday morning (local time), but the news barely impacted financial markets. iShares MSCI South Korea (EWY), the fund most sensitive to North Korean provocation, rallied 0.61 percent on Friday. Defense stocks rallied as well. iShares U.S. Aerospace & Defense (ITA) gained 1.79 percent on the week.

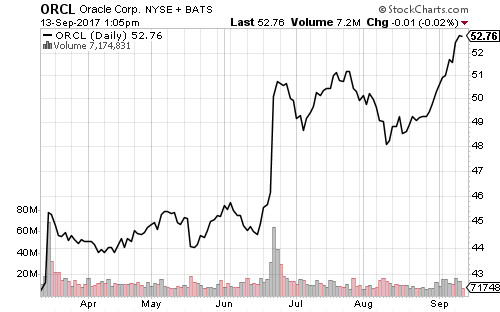

Oracle (ORCL) beat earnings and sales estimates this week, but guidance disappointed investors. Cloud services increased 50 percent. Software and services increased 62 percent. Going forward, Oracle sees that growth slowing to around 40 percent. Analysts forecast earnings of 68 cents in the coming quarter, but Oracle guided them down to a range of 64 to 68 cents. Shares fell 7.67 percent on Friday. The dip weighed on iShares North American Software (IGV), which dipped 0.84 percent. Broader technology funds such as Vanguard Information Technology (VGT) climbed on the day. VGT increased .50 percent on the week.