Click Here to view today’s Global Momentum Guide WEEKLY SECTOR PERSPECTIVE Four Fidelity Select Sector funds moved up two spots last week. Biotechnology (FBIOX), Computers (FDCPX), Communications Equipment (FSDCX) and […]

Month: February 2017

Market Perspective for February 18, 2017

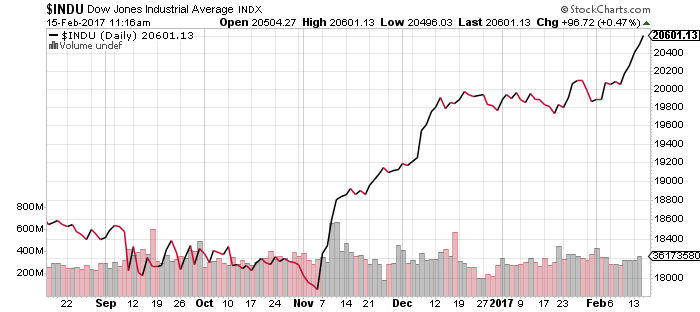

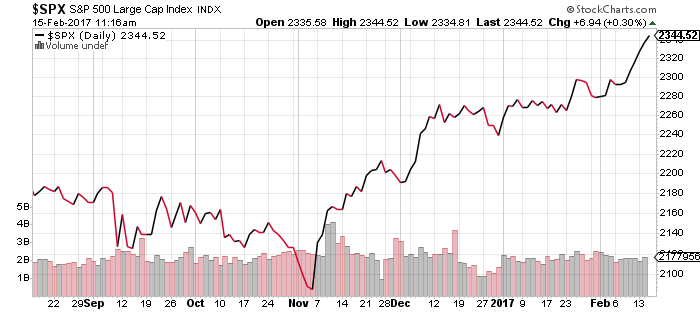

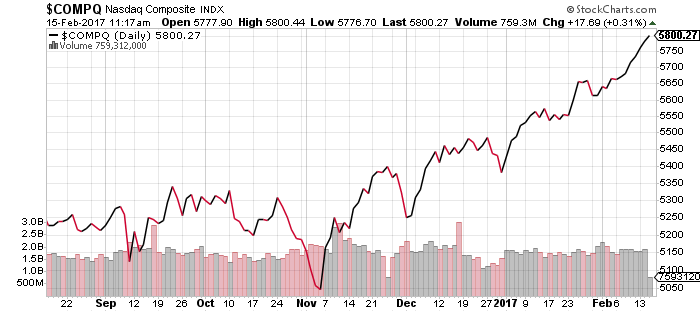

Federal Reserve Chair Janet Yellen’s Congressional testimony and faster-than-expected inflation pushed major indexes to new all-time highs this week. Large-cap indexes gained close to 1 percent, led once again by the Nasdaq.

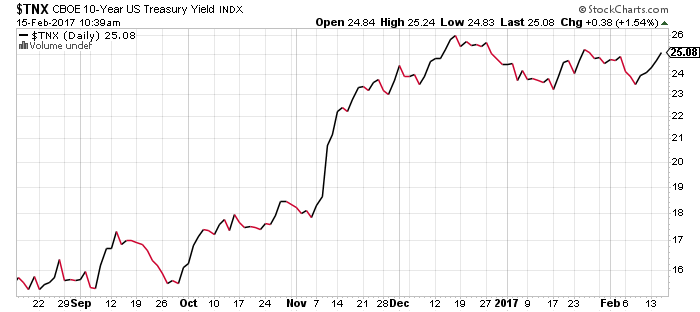

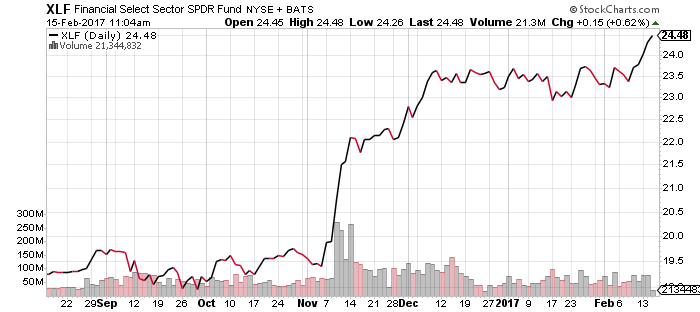

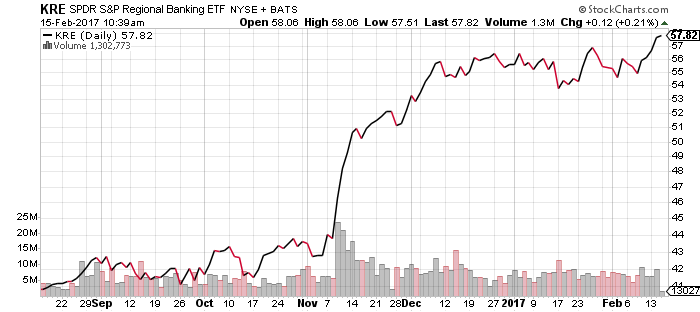

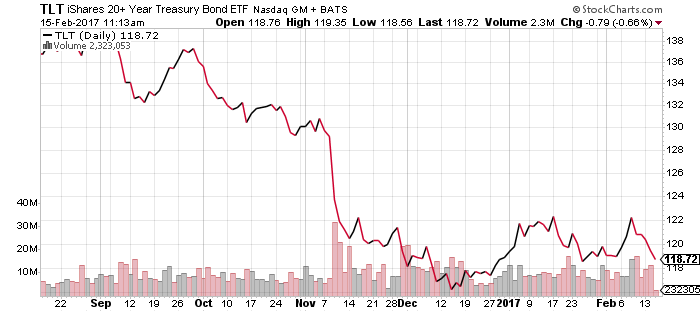

The 10-year Treasury yield hit 2.5 percent following Yellen’s testimony, before moving back to 2.4 percent by Friday. Shifting interest rate expectations cemented a breakout in the financial sector. SPDR S&P Regional Banking (KRE) gained more than 2 percent for the week and hit a new all-time high on Wednesday.

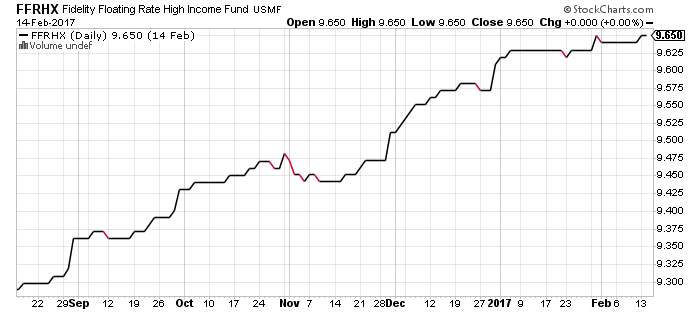

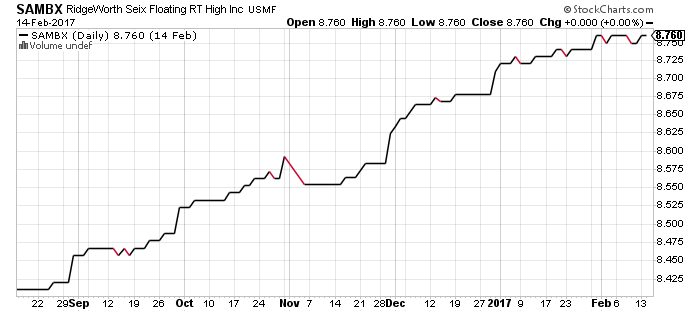

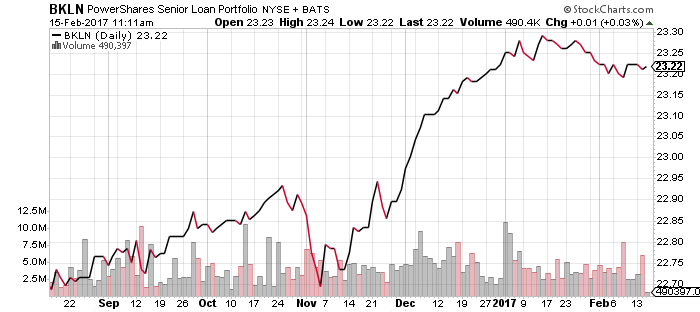

Floating-rate bond funds held steady amid rising rates. Three-month LIBOR hit a new high following after a one-month pause. In addition to higher income payments down the road, the rise in LIBOR indicates the market’s anticipation of the next rate hike.

Economic data was generally positive this week, despite mixed industrial production signals. January industrial production fell 0.3 percent, but local production indexes from February climbed to multi-year highs. Retail sales exceeded expectations with an 0.8-percent rise. Retail Sales Ex-Autos growth was 0.4 percent, double expectations. Core CPI was on target at 0.3 percent. Producer prices rose 0.6 percent in January, primarily due to energy prices.

Homebuilder confidence has remained elevated in February. Housing starts and permits increased more than expected in January. New single-family residential construction drove the gains. The Atlanta Federal Reserve hiked its growth estimate for the current quarter to 2.4 percent based on rising residential housing investment.

Earnings season was eclipsed by “merger mania” this week. Kraft Heinz (KHC) missed sales estimates on Thursday, sending the stock down 4 percent. On Friday, however, the firm announced a buyout offer for Unilever (UL), sending shares up as much as 9 percent during Friday trading. Unilever immediately rejected the offer, calling it too low, and its stock subsequently rallied more than 10 percent.

Earlier in the week, Bristol-Myers (BMY) was also a rumored takeover target, with both Pfizer (PFE) and Gilead (GILD) mentioned as possible acquirers. Shares of BMY initially gained more than 5 percent. Shares of iShares Nasdaq Biotechnology (IBB) and iShares U.S. Pharmaceuticals (IHE) both advanced 3 percent. SPDR S&P Biotech (XBI) and SPDR S&P Pharma (XPH) saw slightly larger gains.

Investor Guide to Vanguard Funds for February 2017

The February Issue of the Investor Guide is NOW AVAILABLE! Links to February Data Files have been posted below Market Perspective: After a Pause to Begin 2017, Stocks Poised to […]

ETF & Mutual Fund Watchlist for February 15, 2017

Federal Reserve Chair Janet Yellen spoke in support of financial deregulation during this week’s Congressional briefing, which benefited the financial sector. Interest rate expectations also immediately shot higher, pushing up the odds of a June or July rate hike to 75 to 80 percent. The odds of a May hike are approaching 50 percent.

Inflation data was also positive for interest rates. Core consumer prices increased 0.3 percent in January, faster than the expected 0.2 percent. This helps cement core inflation above 2 percent, within the Fed’s target range of 2 to 3 percent. More importantly, producer prices climbed 0.6 percent in January, double the 0.3-percent forecast and the fastest monthly PPI jump since 2011.

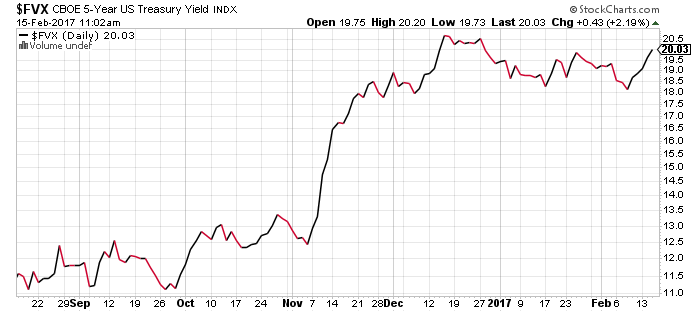

The 10-year Treasury yield bounced and the 5-year Treasury yield climbed to a 2017 high following Fed statements.

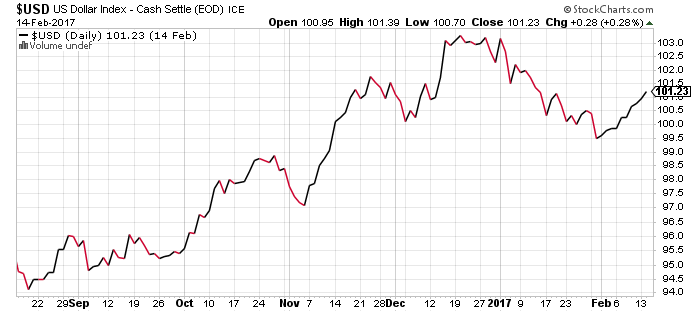

The U.S. dollar remains positively correlated with interest rates, and it too jumped on Yellen’s comments, extending a rebound that started at the end of January.

Financial stocks climbed to a new 52-week high. The trading range is broken and a new bullish advance appears to be underway.

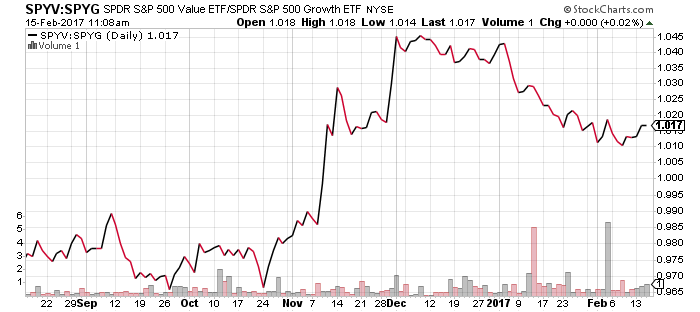

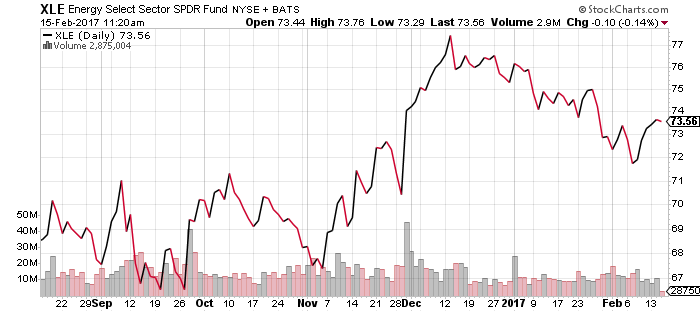

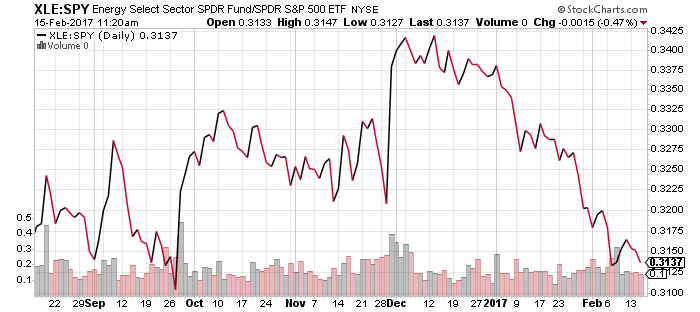

The rebound in interest rates and the dollar lifted value relative to growth. Weakness in energy limited value’s outperformance over the past week.

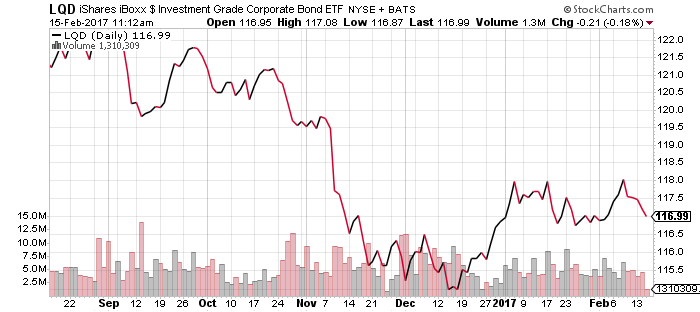

Floating-rate funds also held their value. Investment-grade bonds and long-term Treasury bonds took a hit.

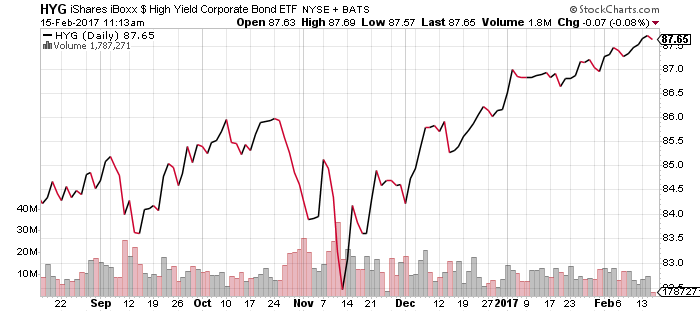

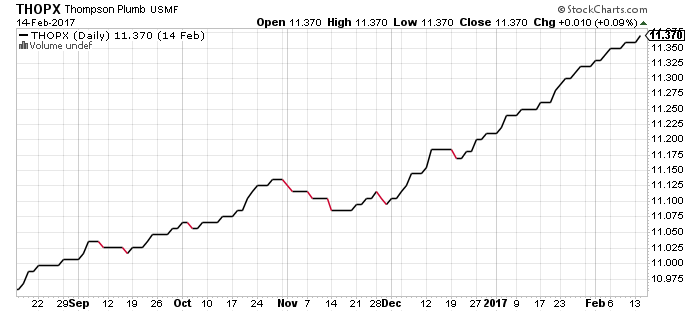

High-yield funds pushed higher on economic optimism. The low-duration, higher yield Thompson Bond (THOPX) continues to steadily advance.

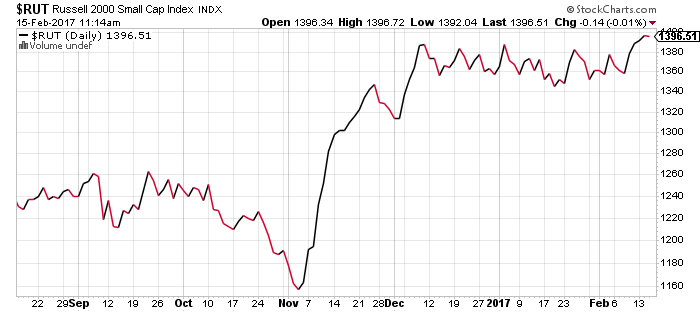

Yellen sent the Russell 2000 to a new all-time high. The Dow Jones Industrial Average and S&P 500 Index had already broken out of their trading ranges and swiftly advanced. A similar move in the Russell 2000 should follow if the bulls stay in control.

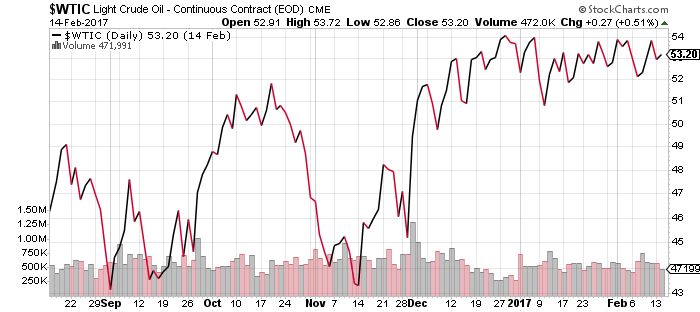

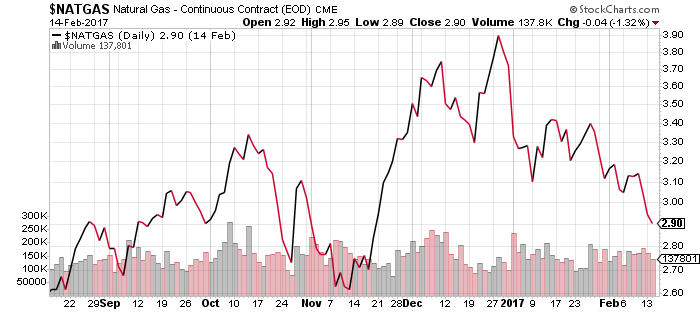

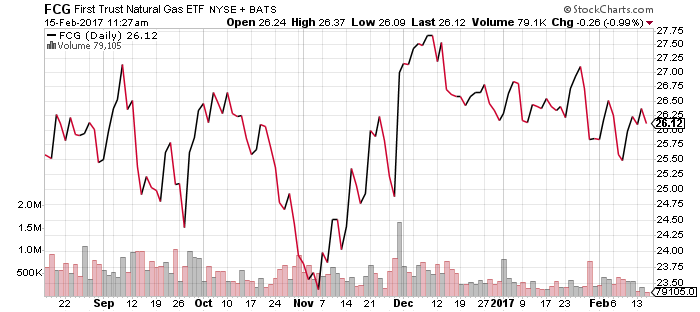

Crude prices remain in a trading range, drifting lower over the past week on larger-than-expected inventory builds. While funds such as XLE advanced on the week, they underperformed the broader stock market. Natural gas prices are also correcting from their late-2016 rally.

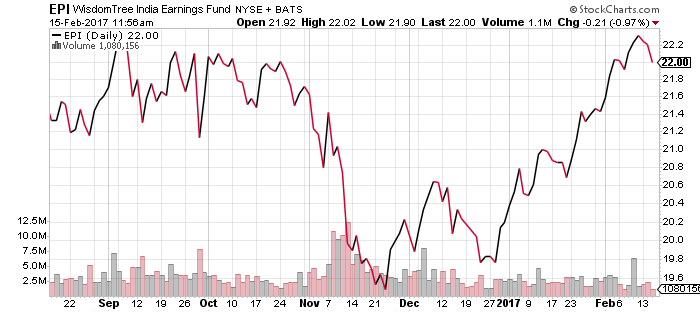

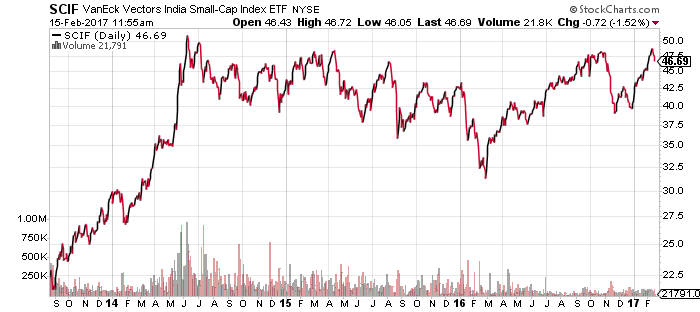

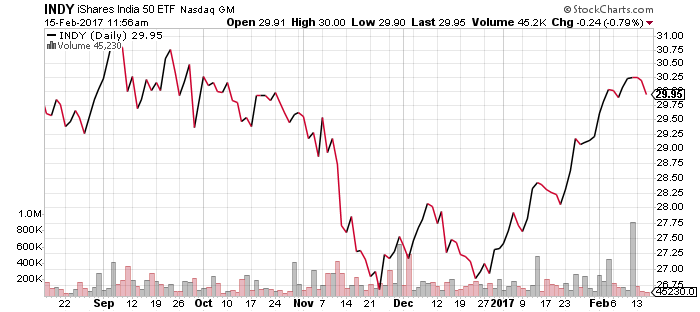

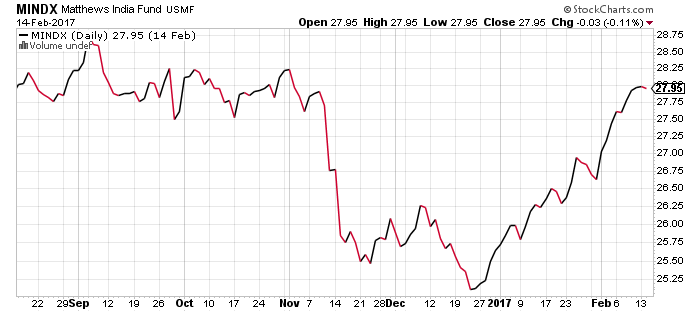

The small-cap SCIF hit a new multi-year high this past week, but subsequently pulled back. A long-term bullish breakout will occur when it exceeds the 2014 high. WisdomTree’s India fund EPI has finally recovered from the cash ban losses, while iShares fund INDY and Matthews India fund MINDX both have further to go.

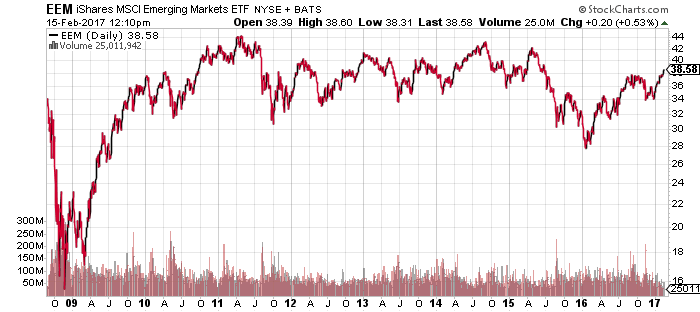

India funds are benefiting from general strength in emerging markets. iShares MSCI Emerging Markets (EEM) has been in a trading range since 2009, spending most of the time between $32 and $44. It currently sits at just over $38. The fund has remained in an intermediate-term bull market since the start of 2016.

\

Market Perspective for February 14, 2017

The volume of economic data from the United States and abroad will pick up this week. Federal Reserve Chair Janet Yellen, Atlanta Fed President Dennis Lockhart, and Richmond Fed President Jeffrey Lacker are expected to deliver prepared remarks this week. As stocks have continued to reach new all-time highs over the past month, insider buying has also increased. Strong economic reports, positive news from Fed officials, and favorable tax and regulatory reforms from the Trump Administration should continue to propel the major averages higher.

Chinese Consumer and Producer Price Index readings will be out on Tuesday. While the CPI is expected to increase 2.3 percent year-over-year, analysts are forecasting a 5.6-percent PPI increase. Domestic PPI figures are expected to rise 0.4 percent month-over-month. Eurozone fourth quarter Gross Domestic Product (GDP) estimates will also be released Tuesday. Economists are forecasting 1.8 percent growth.

U.S. CPI data and the latest oil inventory report will be available on Wednesday. Domestic consumer prices are expected to reflect 1.8 percent year-over-year rise. Analysts anticipate another large build in oil stockpiles. The Empire State Manufacturing Survey and the latest domestic retail sales figures will also be out on Wednesday. The consensus estimate is for an increase of 0.1 percent in sales. Economists are forecasting continued growth in the New York Fed region. Thursday’s weekly unemployment claims figures are expected to be slightly higher than last week’s multi-decade low. The latest Philly Fed Manufacturing Survey, also scheduled for Thursday, anticipates a marginal increase in activity.

Just over 60 percent of the S&P 500 index has reported earnings so far. T-Mobile, Express Scripts, Cisco Systems, John Deere, and Campbell Soup will report this week. T-Mobile (TMUS) is expected to report its fourth quarter results Tuesday before the opening bell. Analysts forecast that the mobile service provider will report greater market share as it benefits from consolidation in the mobile internet space. Express Scripts (ESRX) will report after markets close. Over the past year, the company has reported earnings and revenues in line with expectations. The pharmacy benefits manager should continue to benefit from an aging population, an increase in the use of generic drugs, a shift toward mail order and strong growth in its specialty drug offerings.

The only Dow component reporting this week, Cisco (CSCO) will deliver its fiscal second quarter results Wednesday after the bell. Analysts are forecasting a slight drop in year-over-year earnings per share and revenues. When John Deere & Company (DE) reports Friday, analysts will pay close attention to sales of its agricultural equipment through the global farming recession. Campbell Soup’s (CBP) quarterly returns on Friday will determine whether the recent rally in the firm’s share price was justified. Gold stocks will also be in focus with earnings reports expected from Barrick (ABX), Yamana (AUY) and Kinross (KGC).