Tomorrow the Federal Reserve will determine the fate of the market, at least for a few days. Investor reaction to the Fed will be very interesting, as there is a split over the direction they should go. On one side are the economic pessimists who think the U.S. economy is too weak to warrant a quarter-point rate hike. If the Fed implements a hike, they believe the economy will weaken. On the other side are the optimists who think a quarter-point rate hike is already priced into the market and is badly needed to restore Fed credibility. Then there are the moderates who have thrown out a new theory: the Fed will hike by an eighth-of-a-point, in order to say it raised rates, but not so much as to impact the market.

Due in part to today’s report of a 0.1 drop in the CPI in August (which met expectations), the current odds of a rate hike in September have tumbled to 23 percent. The market is not expecting a hike tomorrow and gold prices are rallying today as a result.

Taking a step back to look at the bigger picture, the Fed has actually been tightening monetary policy since December 2013, when it began to taper the third round of quantitative easing. The economy has improved over this period and the S&P 500 Index has gained more than 10 percent. Though financial markets could move in any direction initially, one cannot imagine a strong U.S. economy without higher interest rates. A change in policy to raise rates is both bullish, and ultimately, inevitable.

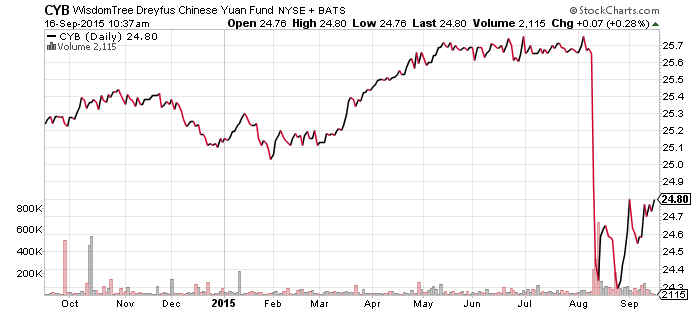

WisdomTree Chinese Yuan (CYB)

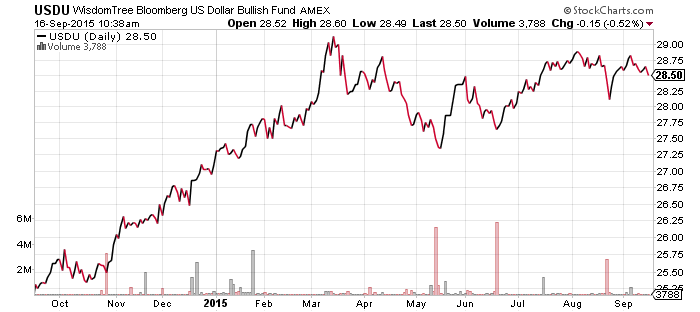

WisdomTree Bloomberg USD Bullish (USDU)

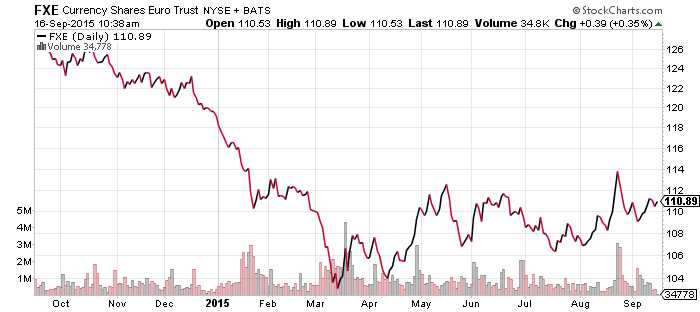

CurrencyShares Euro Trust (FXE)

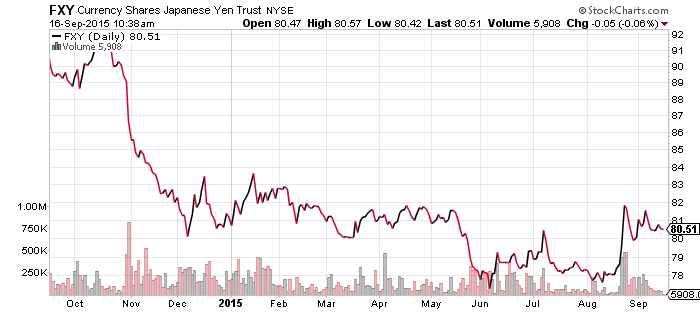

CurrencyShares Japanese Yen (FXY)

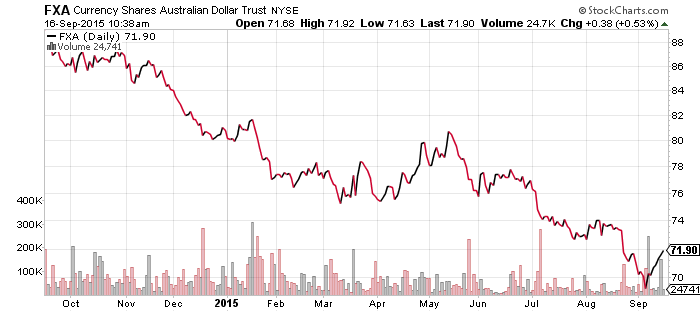

CurrencyShares Australian Dollar (FXA)

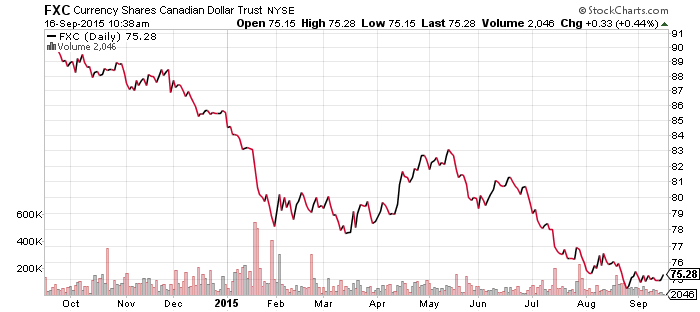

CurrencyShares Canadian Dollar (FXC)

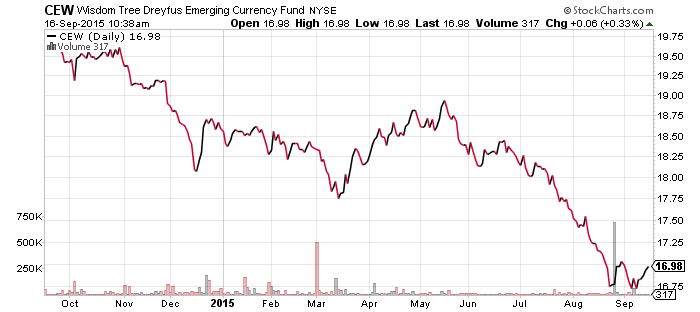

WisdomTree Emerging Market Currency (CEW)

WisdomTree Commodity Currency (CCX)

The only move in the currency markets has been the rebound in the Australian dollar. However, the move higher has yet to break the slope of the downtrend that began in May.

An interest rate hike is widely seen as bullish for the U.S. dollar and bearish for emerging market currencies. Over the next week, however, the direction of the market will be determined by expectations. If investors already expect a rate hike, such that recent weakness in funds like CEW and FXC reflects investors pricing in this change, then a rate hike may lead to a short-term rebound in these currencies as speculators take profits.

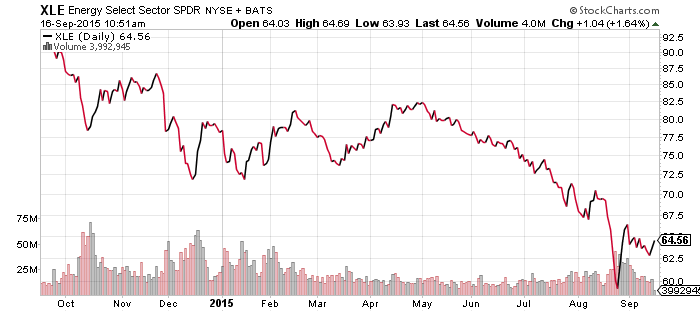

SPDR Energy (XLE)

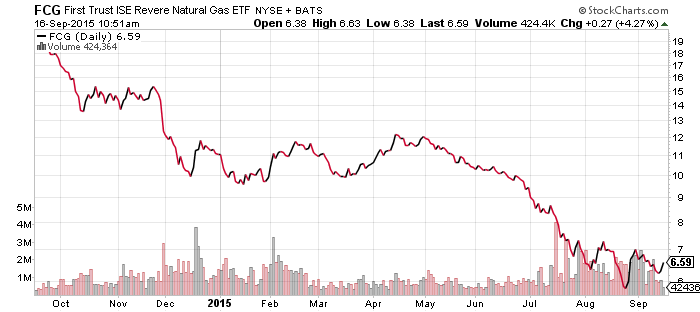

FirstTrust ISE Revere Natural Gas (FCG)

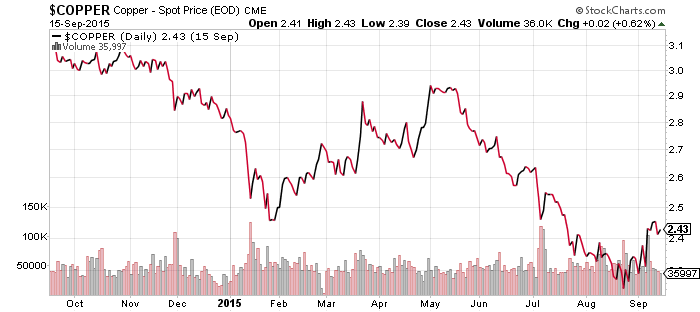

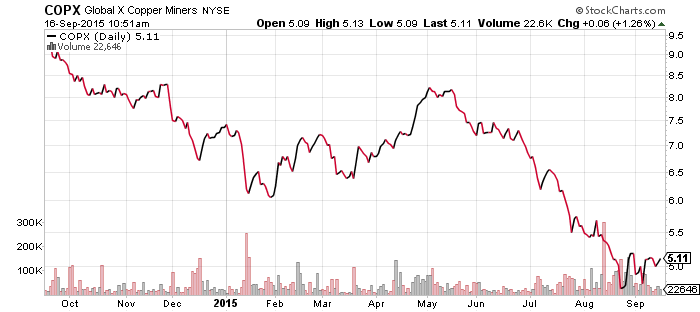

Global X Copper Miners (COPX)

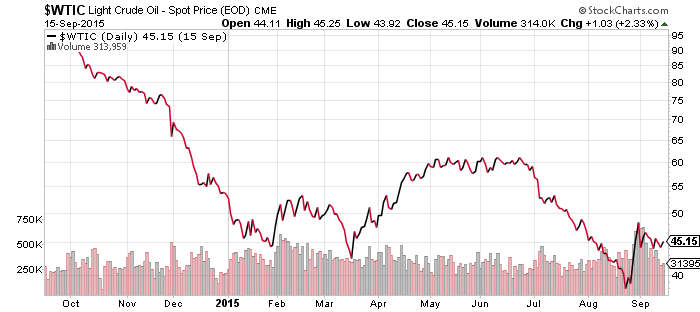

Oil and copper have held their recent gains over the past week even Chinese economic data has been subpar. Over the weekend, China revealed that real estate investment contracted in August and fixed asset investment continues to fall. The country has often used government-led infrastructure investment to boost GDP growth, but there’s no sign of it yet in the data.

Oil inventories fell last week, which helped push up oil prices on Tuesday, but gasoline inventories rose due to the end of the summer driving season. Consumers can look forward to lower gas prices moving forward, as long as oil prices don’t rally significantly.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

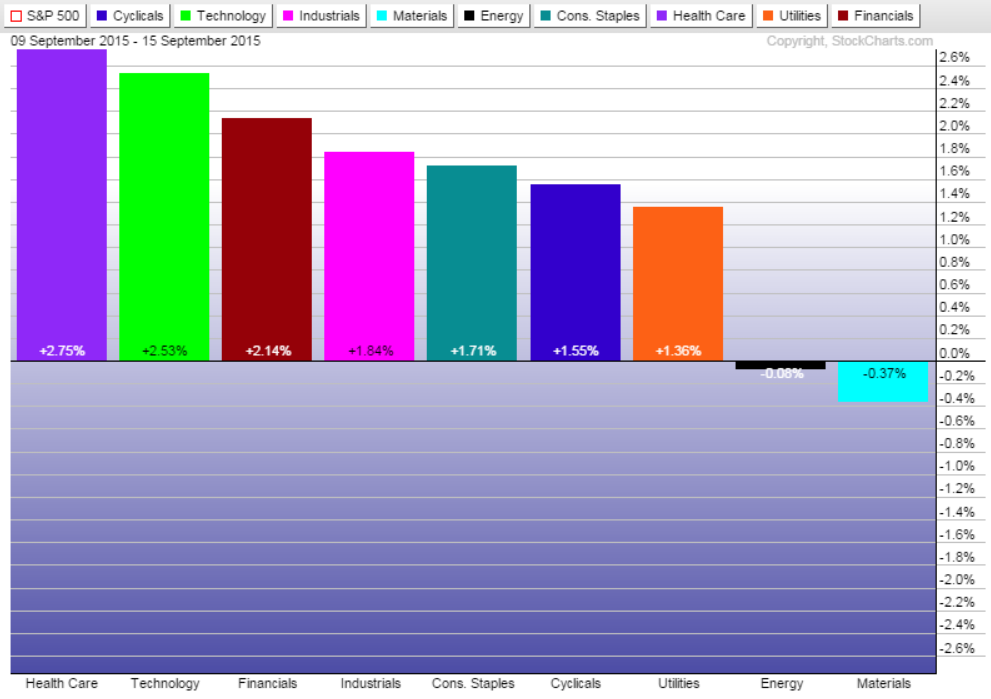

The market returned to its pre-August sell-off state last week. Healthcare led the market higher, closely followed by technology and financials. Energy and materials trailed.

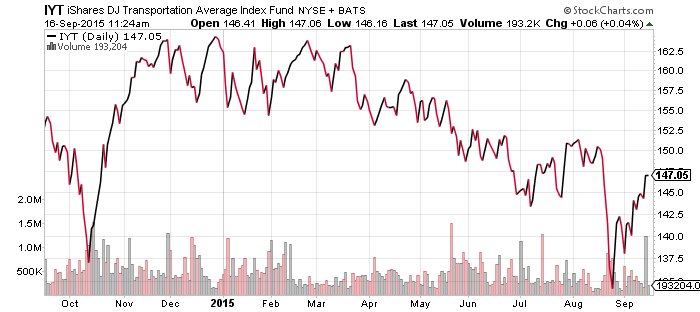

Transports are up in early Wednesday trading even though FedEx (FDX) is down more than 3 percent after missing earnings expectations and lowering full year guidance. IYT is close to breaking the downtrend started in March.

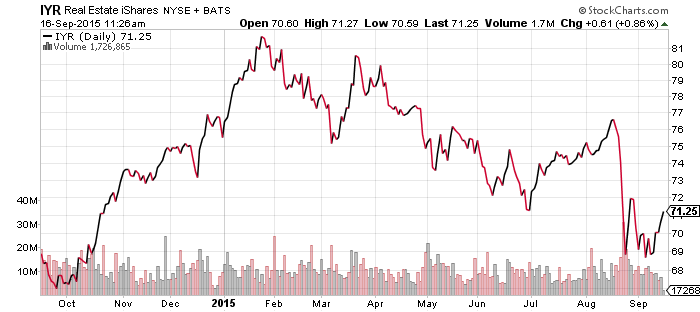

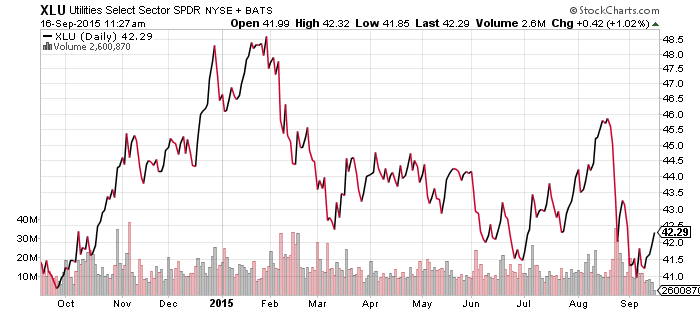

Real estate remains in a downtrend, but a drop in rate hike expectations has helped fuel a rally. Utilities show a similar spike. Both would likely fall sharply if the Fed announces a rate hike tomorrow.

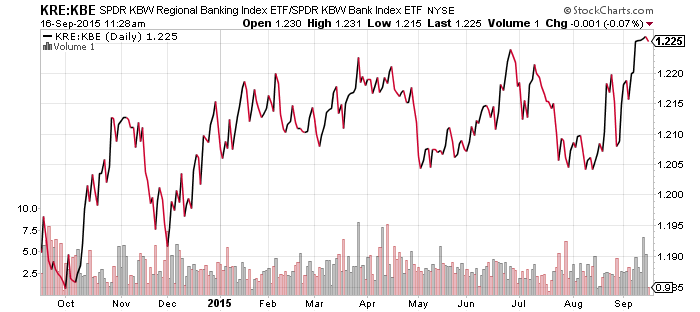

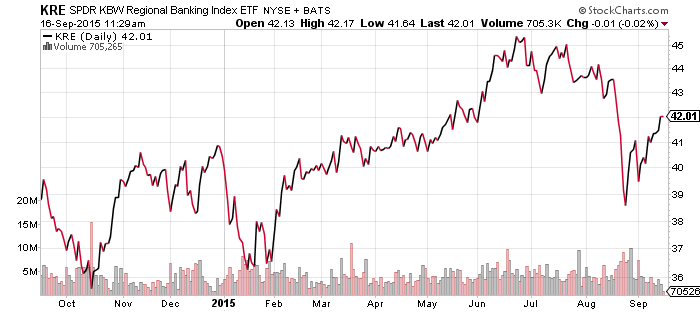

Although rate hike expectations have fallen, the regional banks continue to outperform large banks. Smaller regional banks rely more on business lending; they are more tied to the local (domestic) economy and directly benefit from higher interest rates.

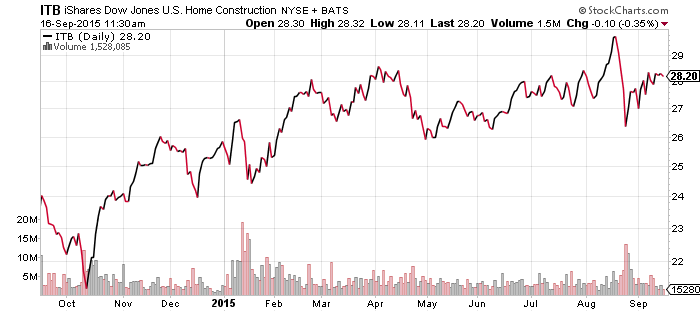

Probably the most bullish economic signal in the stock market right now is home builder stocks. Today, we learned that homebuilder confidence in September is at its highest level since November 2005, near the peak of the housing bubble.

SPDR Gold Shares (GLD)

Gold is highly sensitive to Fed policy and it enjoyed a small rally on Wednesday as rate hike expectations fell ahead of tomorrow’s announcement. The August low is a mutli-year low for gold and until a bottom forms, expect the lows to be taken out. On the upside, resistance falls in the $114 to $116 trading range seen in the spring.

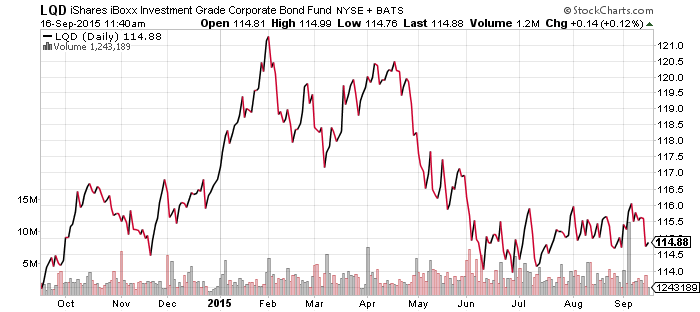

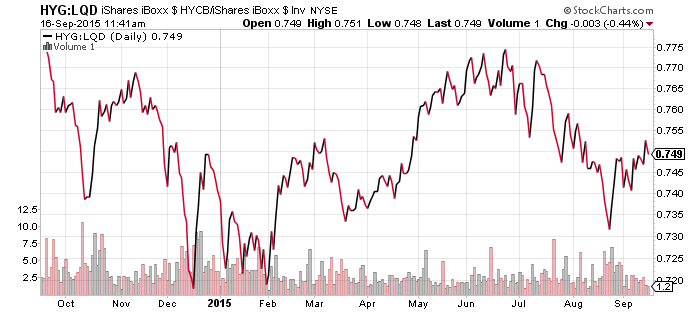

iShares iBoxx High Yield Corporate Bond (HYG)

iShares iBoxx Investment Grade Corporate Bond (LQD)

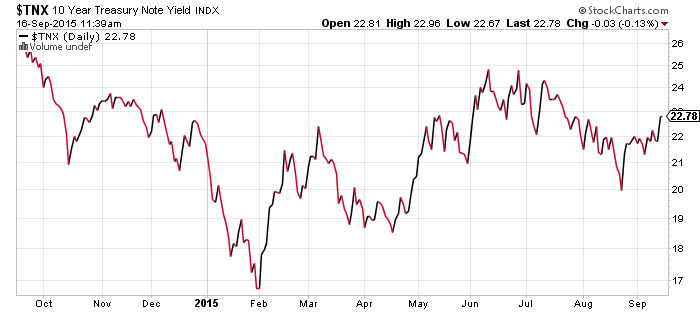

Even though it is questionable whether the Federal Reserve may or may not hike rates tomorrow, the bond market is sending a clear signal. In the past week, both HYG and LQD dipped, while the 10-year Treasury bond yield moved higher. HYG has been outperforming LQD since the August sell-off in stocks. Stronger oil prices have helped, as have the decline in Fed rate hike expectations.