Troubles in the Chinese real estate market are back and banks have reduced lending to the property sector, at the same time that many trusts are coming due. There were reports over the weekend of developers slashing prices on new homes in order to move inventory. Putting the stories together, it could mean developers are facing a cash crunch and may be forced to liquidate property. With trusts coming due, however, a decline in home prices would not be good news. The risk of a major financial crisis is ever present in China due to the huge buildup of debt.

For that reason, the Shanghai Composite was down more than 2.5 percent in morning trading before recovering to a loss of 1.75 percent on the day. European markets didn’t suffer in early trading, but it can take some time before European and American markets digest the news from China. The Chinese are most sensitive to the news, but if it looks like a more serious trend is underway, Europe and the U.S. markets will head lower.

To get an idea of how large the problem could be, last week the central bank of China allowed the yuan to fall in value. It was the biggest one-week drop since 2011, when fears of a real estate slowdown first became big news, and also marks one of the few reversals during a more than 2 year period of appreciation. That 2011 drop in the yuan was also around the time of the first U.S. debt ceiling debate, when the European debt crisis was in full bloom and when gold peaked above $1900 an ounce. The real estate market didn’t slow down for long though, as developers pushed into smaller cities in order to grow. Now it appears they have overdeveloped these cities as well, and the only solution may be a drop in prices.

The situation warrants concern because China is a significant driver behind global economic growth. Unlike Japan’s crisis in the 1990s, there is no one else to pick up the ball and pull the global economy along if China stumbles. The result of a crisis in China could be a global economic recession that reignites debt problems in Europe and sends the U.S. unemployment rate in the wrong direction. For this reason, it pays to keep an eye on China. They have avoided a major crisis since the early 1990s, when the yuan was devalued by 60 percent, but this is the riskiest situation since 2008 and they will not be able to use another stimulus/lending policy to bail themselves out as they did in 2009.

Economic Reports: This is a light week for economic data. The big story of the week is likely to be Janet Yellen’s Senate testimony on Thursday.

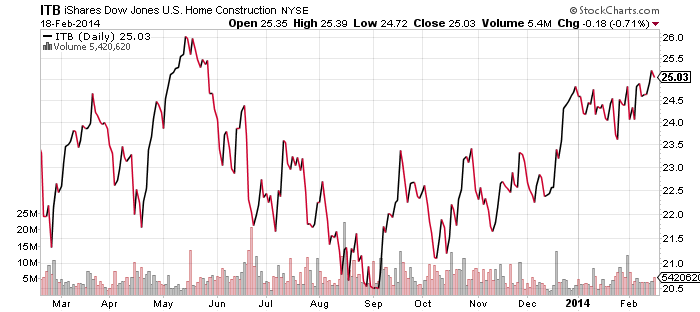

New home sales on Wednesday will be closely watched, but weak housing data in recent weeks was ignored by the home builder stocks, which suggests investors are looking ahead to more favorable data. We’ll see if they get it this week.

On Friday, the most important data point for the week will be out: the revised GDP for the fourth quarter of 2013. Friday will also see the Chicago PMI and University of Michigan consumer sentiment for February, along with pending home sales from January.

Earnings: Earnings season is trailing off, but there are still a number of retailers reporting this week. Home Depot (HD), Macy’s (M), Best Buy (BBY), Lowe’s (LOW) and Target (TGT) are among them.