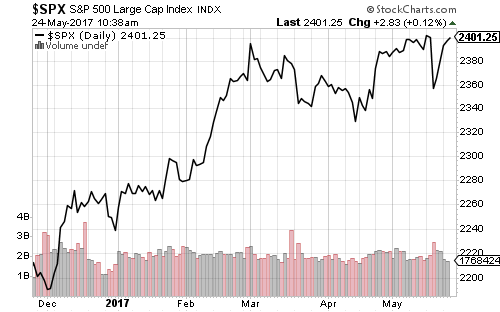

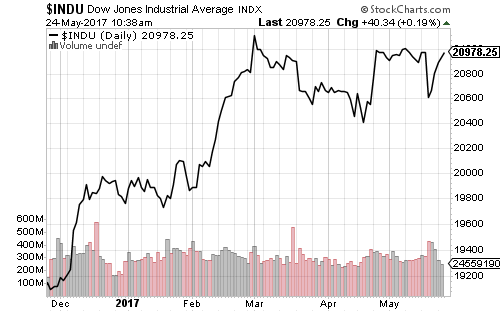

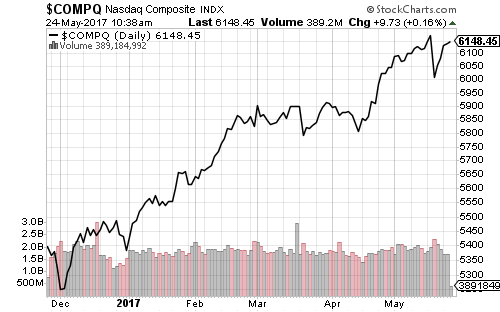

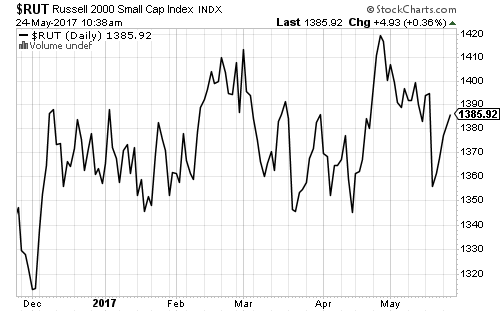

Major indexes are poised to challenge old highs in the days ahead. The Dow Jones Industrial Average is only 0.7 percent away from its all-time high. The Nasdaq is also close to setting new highs, while the Russell 2000 is in a sideways trading pattern, less than 3 percent off its all-time high.

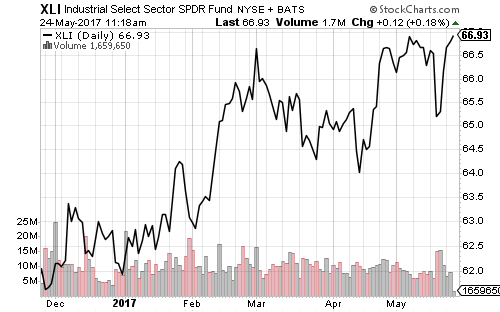

Industrials have strengthened the Dow and S&P 500. SPDR Industrials (XLI) hit a new high this week following a $110-billion arms deal with Saudi Arabia.

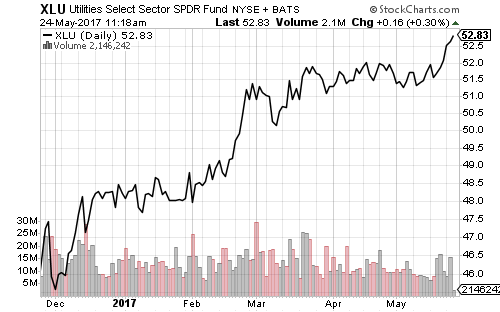

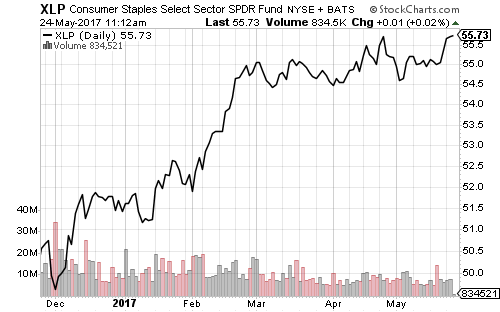

Consumer staples and utilities have also improved Dow and S&P 500 relative performance.

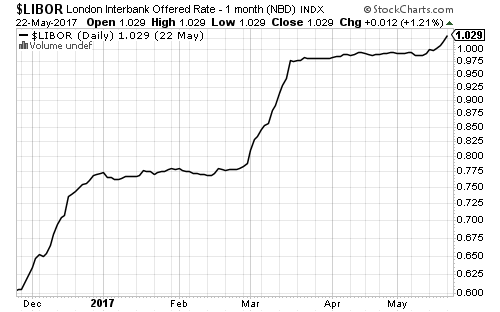

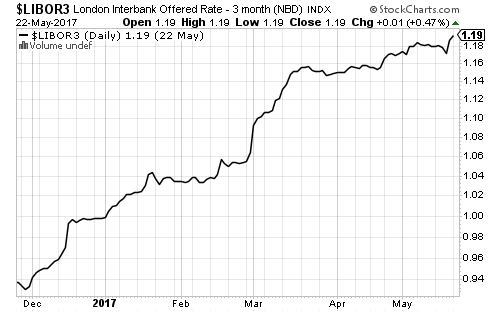

Investors are pricing a rate hike into short-term credit markets. One-month Libor hit 1.029 percent on Monday. Three-month Libor resumed its advance, climbing to 1.19 percent. Odds of a June rate hike hit 83 percent on Wednesday, up from 65 percent a week ago.

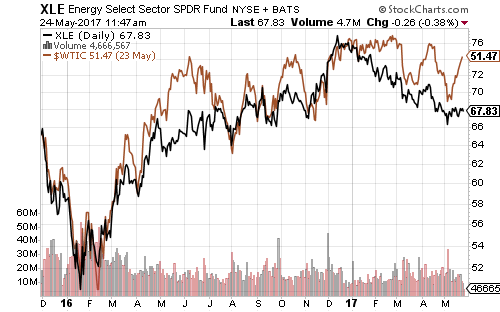

Crude oil rebounded above $50 a barrel this week, but remains volatile. Another downturn is likely in the near term.

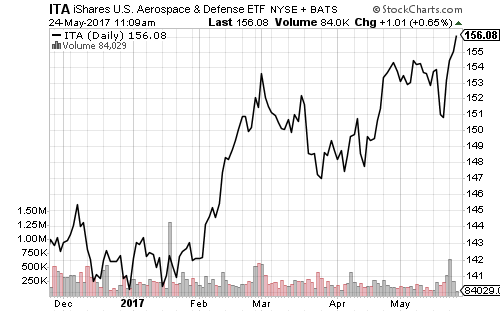

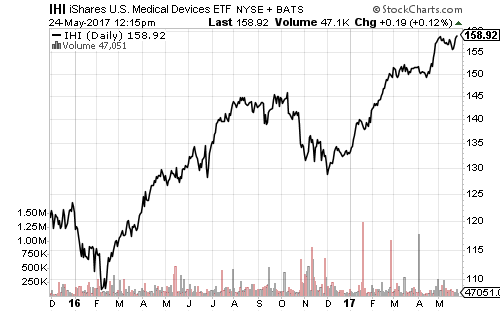

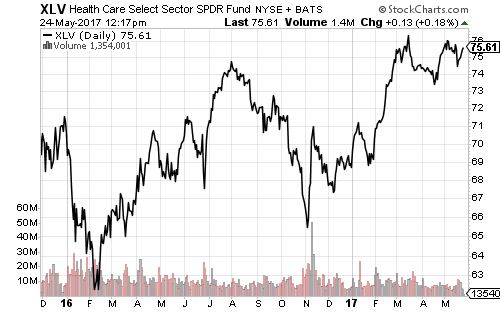

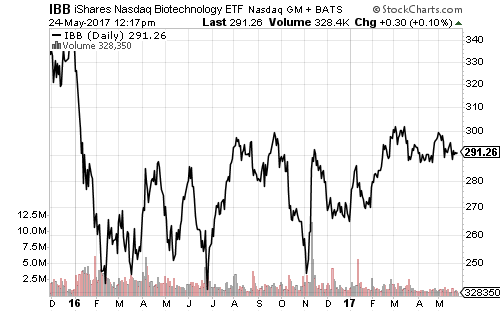

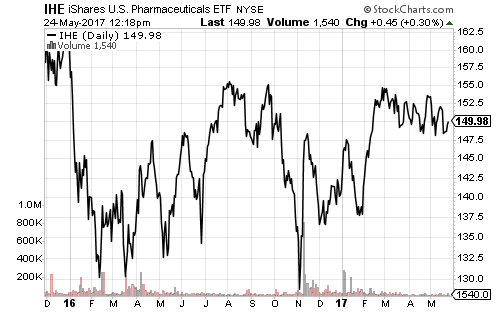

The medical device subsector remains the strongest component in healthcare. The iShares U.S. Medical Devices ETF (IHI) hit a new high this week. Bullish traders are watching IBB for a break above $300.

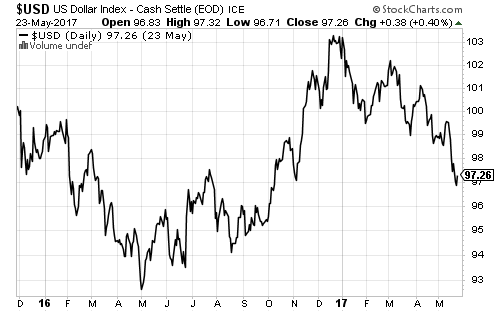

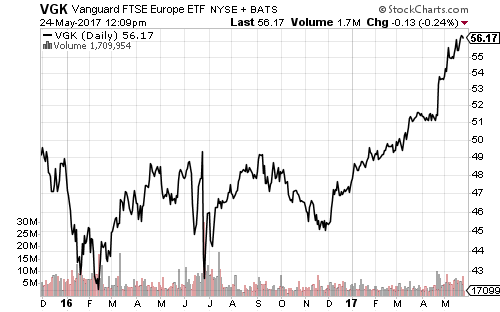

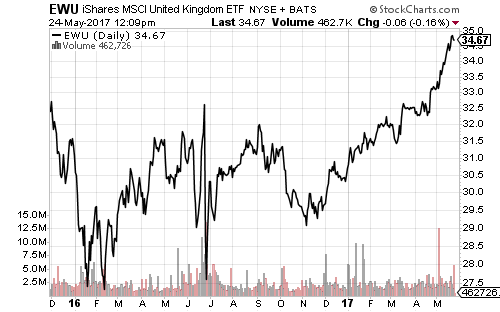

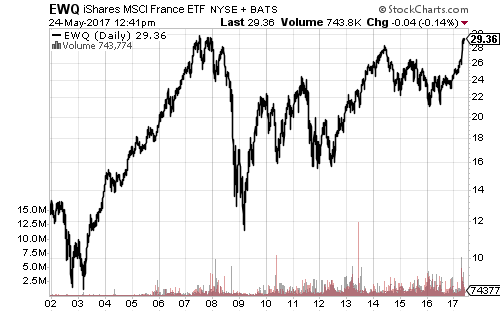

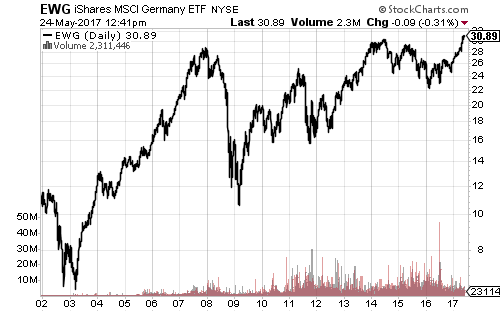

The euro extended its rally this week, lifting European shares. The U.S. Dollar Index fell to 97 before stabilizing this week. European and British equities remain in a sharp uptrend rally that stretches back to November, and accelerated in April.

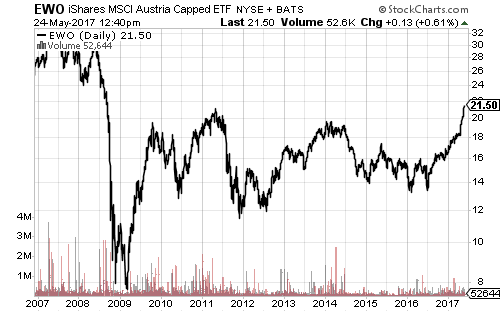

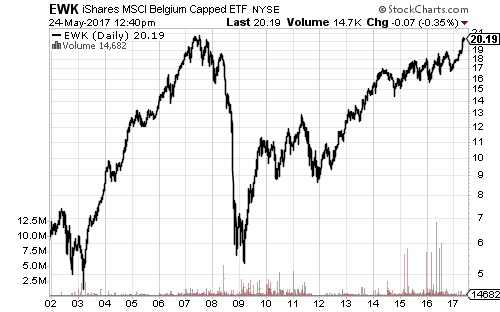

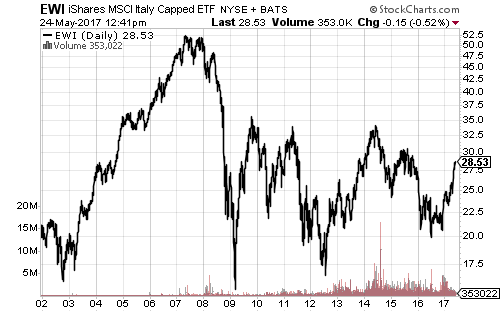

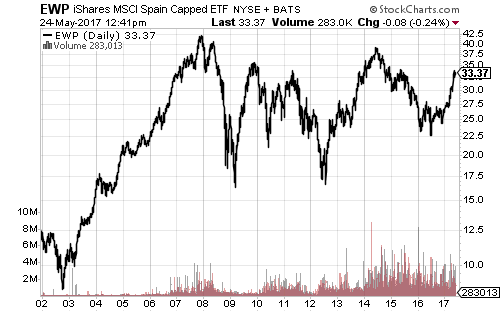

Shares of individual Eurozone countries are at or near multi-year highs. iShares MSCI Germany (EWG) and Netherlands (EWN) are at new all-time highs, France (EWQ) and Belgium (EWK) are very close, and Austria is at a multi-year high. The major debtors, Spain and Italy, have much further to go.

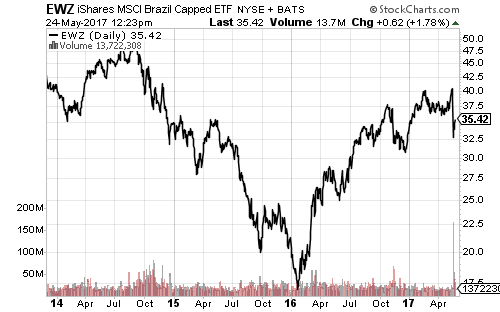

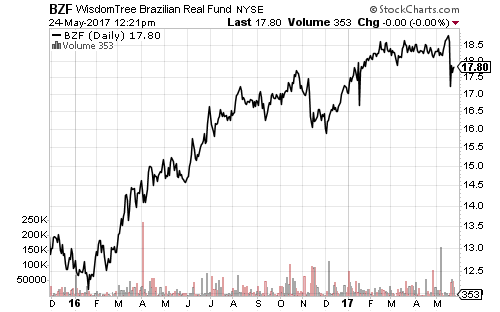

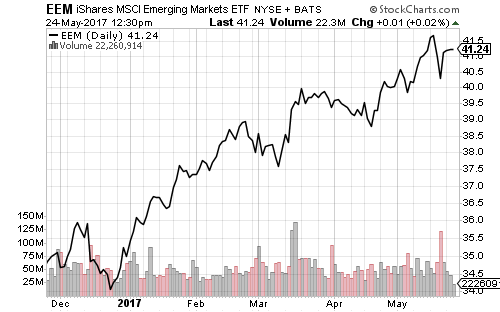

Emerging-market funds were hit by a plunge in Brazilian stocks and currency last Thursday. Brazil’s president is being investigated for bribery, less than a year after the former president was removed from office on corruption charges.

The Brazil ETF rebounded in early 2016 with commodities. Commodity prices outweigh politics moving forward, but in the short-term the bribery case could spark more volatility.

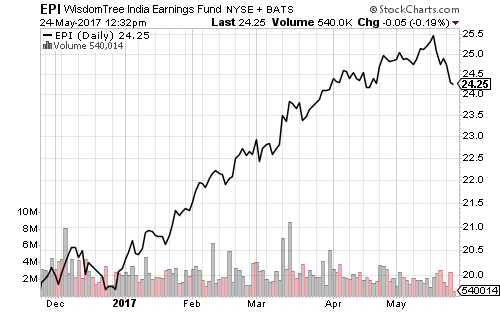

Elsewhere in emerging markets, India funds started correcting after a non-stop year-to-date rally.

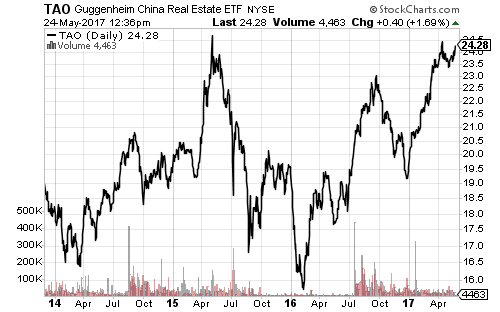

Chinese real estate stocks are near their highs in 2017. The government launched a major crackdown on shadow banking and the real estate sector in March and April. Similar efforts led to a sharp decline in 2015.