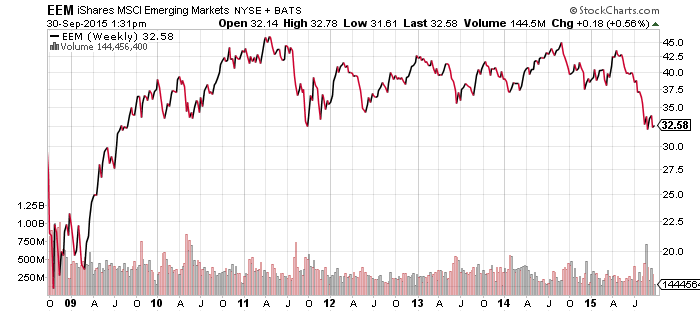

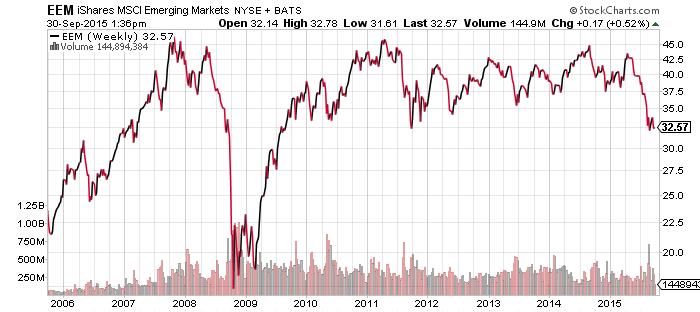

iShares MSCI Emerging Markets (EEM)

Numerous charts look similar these days, with many at multi-year lows or highs. Those at new lows, such as copper, are already in a bear market. One chart that has thus far refused to give in to new lows, and could help commodities and related assets over the weeks and months ahead, is emerging markets.

Emerging markets are currently at the bottom of its 5-year trading range. Nearly every six months, emerging markets have gone through a bull-bear cycle of rising and falling within this range, but are now back to 2011 support. A bounce would indicate current fears are overblown and emerging markets may be headed for a larger rally.

If this level is broken, it opens up the 2008 lows. Given what is going on in commodities, China, emerging markets and the strong U.S. dollar, current problems bear a strong resemblance to the 1997 Asian Crisis. Back then, Thailand set off a chain of currency devaluations, though China held firm and defended the yuan. This time however, China is at the center of the problem.

The big risk is China’s foreign exchange reserves are not large enough to defend its currency against a run on the yuan. Even though they have about $3.5 trillion in total reserves, some economists estimate China may only have a few hundred billion that is liquid reserves and it is already spending at a rate of $50 to $100 billion a month to defend the yuan.

At present, investors are generally cautious and pricing further risk into high-yield, commodities and emerging markets. The fuel for a strong bull rally is due to extreme bearish sentiment. Whether we see a strong rebound in October, or another leg down, it will likely be foretold by the direction EEM moves over the days ahead.

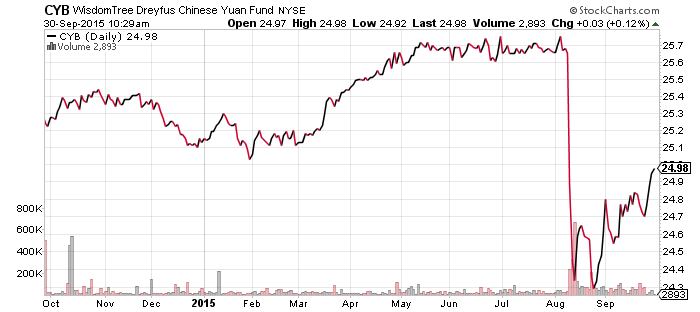

WisdomTree Chinese Yuan (CYB)

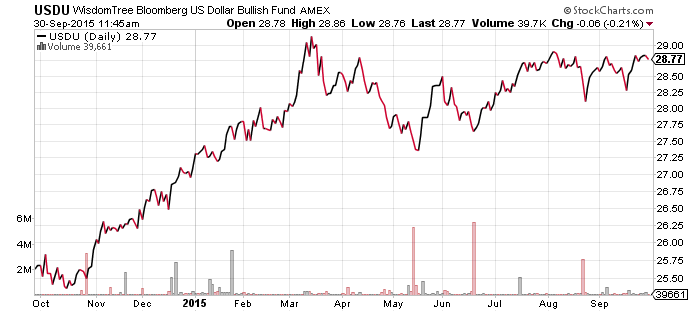

WisdomTree Bloomberg USD Bullish (USDU)

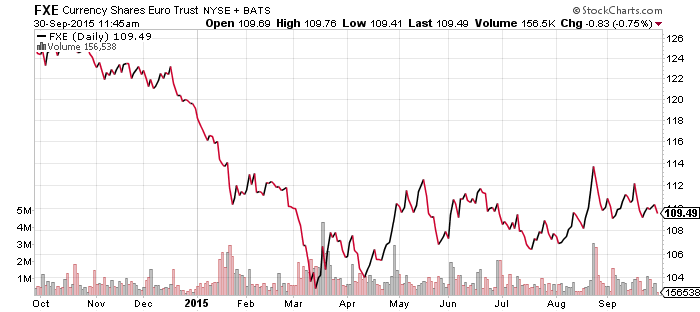

CurrencyShares Euro Trust (FXE)

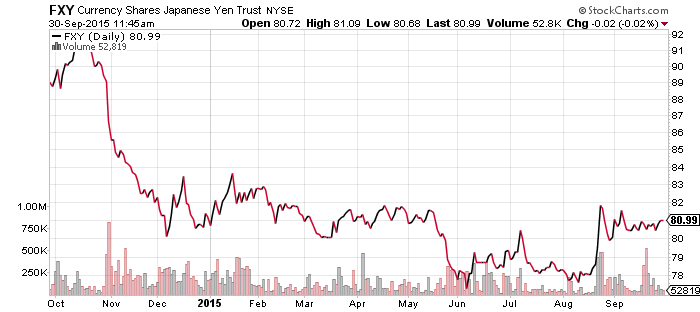

CurrencyShares Japanese Yen (FXY)

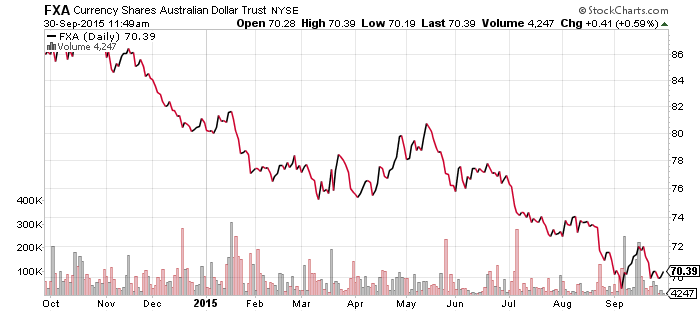

CurrencyShares Australian Dollar (FXA)

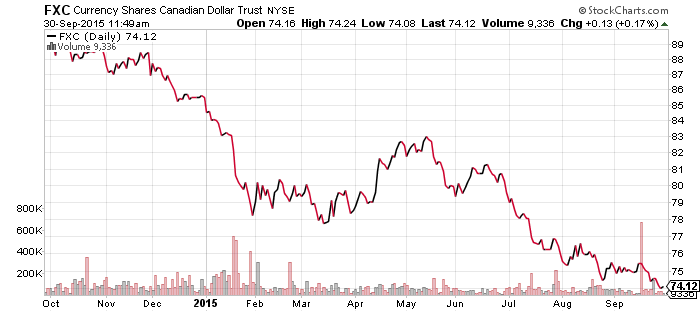

CurrencyShares Canadian Dollar (FXC)

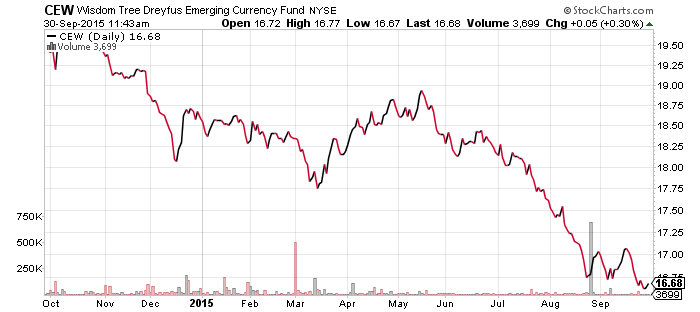

WisdomTree Emerging Market Currency (CEW)

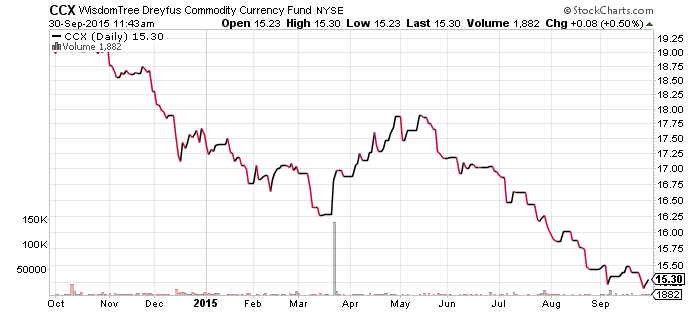

WisdomTree Commodity Currency (CCX)

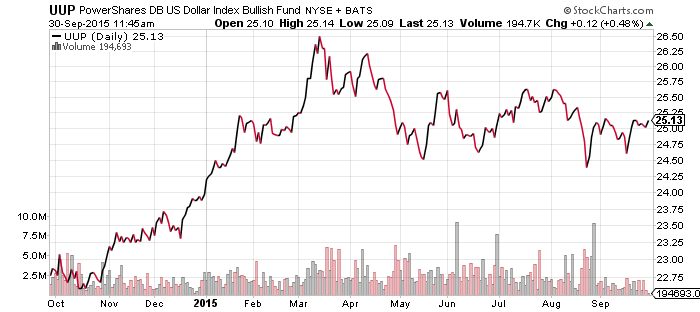

PowerShares DB U.S. Dollar Bullish Index (UUP)

China has been raising the value of the yuan by buying it in Hong Kong, leading to spikes in the interest rates for interbank loans. Today, the government announced new rules on overseas cash withdrawals from UnionPay credit cards, limiting Chinese to 50,000 yuan worth of withdrawals for the rest of 2015, less than $7900 before fees. For all of 2016, the limit is 100,000 yuan as the government tries to stem the outflow of capital.

Although the yuan has stabilized, the emerging market currency fund CEW has broken to new lows, as has CCX. This week, India cut interest rates as its economy is also beginning to slow. India is not a commodities exporter, but the wider slowdown in the region is taking a toll.

The euro and yen have held steady. However, on Wednesday we saw the eurozone’s inflation rate slipped back into deflation this month. This follows a negative inflation report in Japan. Although nothing has been announced, investors expect both countries will expand quantitative easing.

The Canadian dollar also broke to new lows, while the Australian dollar is more closely tracking with the yuan.

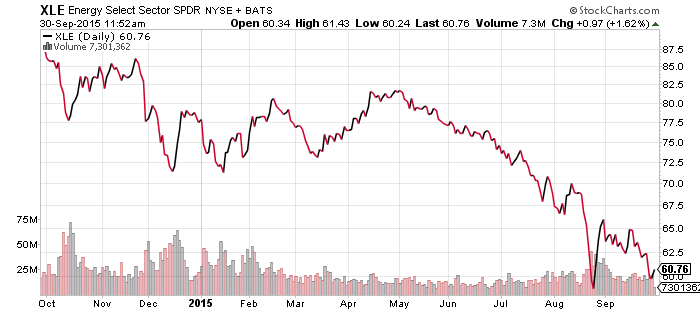

SPDR Energy (XLE)

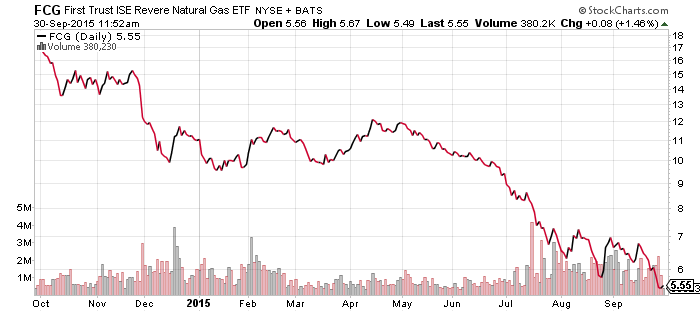

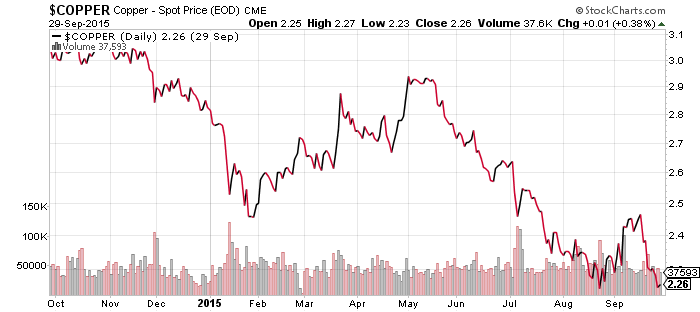

FirstTrust ISE Revere Natural Gas (FCG)

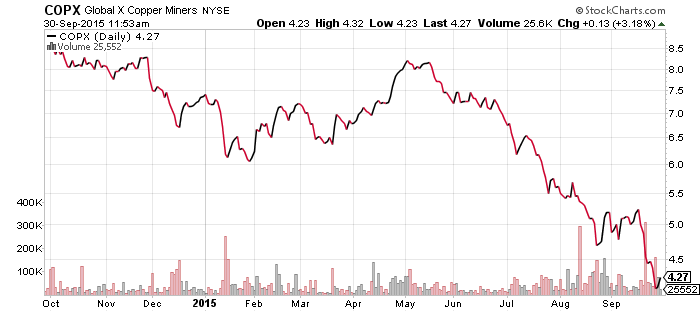

Global X Copper Miners (COPX)

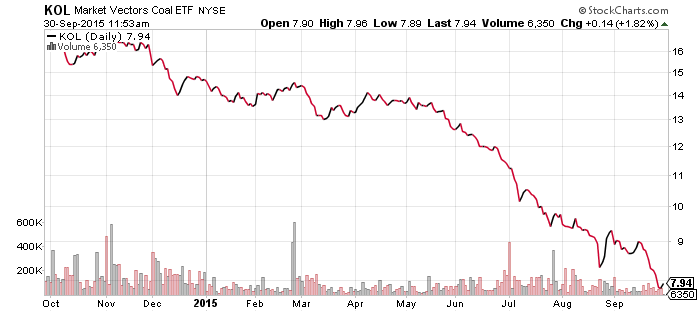

Market Vectors Coal (KOL)

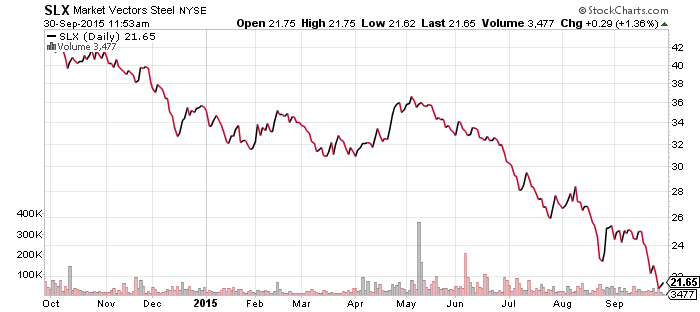

Market Vectors Steel (SLX)

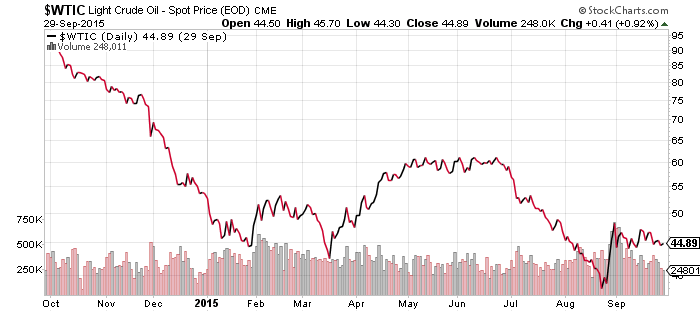

Oil prices have been holding steady in the mid-$40 range, although weakness in the stock market has brought energy stocks near their 52-week lows.

Copper is in worse shape, despite a spike on Wednesday keeping it from closing the quarter at another new 52-week low. Part of the reason for the drop has been the bankruptcy concerns surrounding major commodities firm Glencore. Traders are pushing up the price of insuring against a credit default. The trend in these assets remains bearish and new lows are likely in the weeks ahead.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

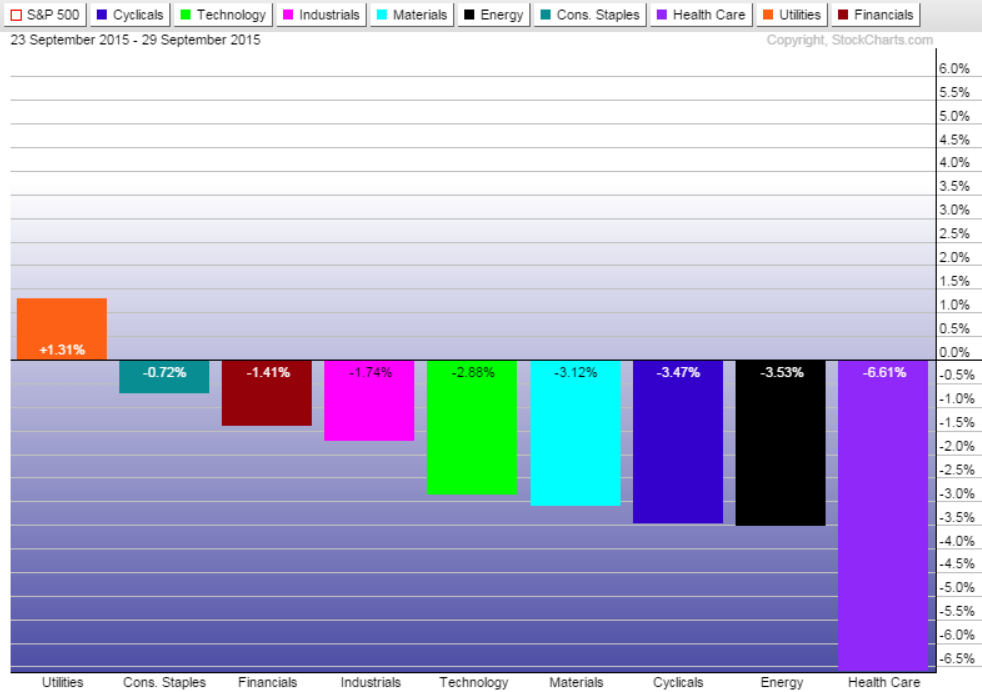

It was a rough week for equities, so it is no surprise to see utilities as the only sector in the black. Healthcare was the biggest loser due to losses in the biotechnology sector.

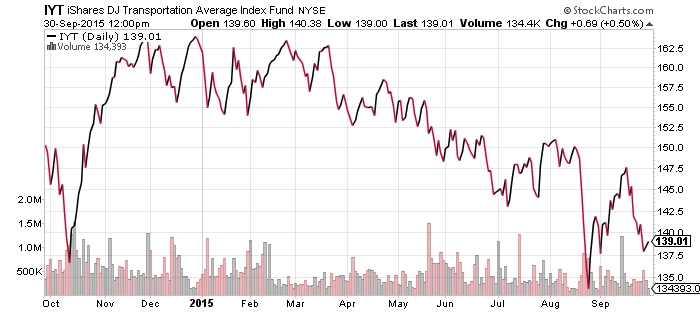

The transportation sector has been solid. It fell over the past week, but remains off its late August lows. For much of this year, transportation stocks were weaker than the broader market and this is a small hopeful sign that there is reason for optimism. That said, shares of IYT would need to crack $145 in order for the short-term technical picture to turn bullish.

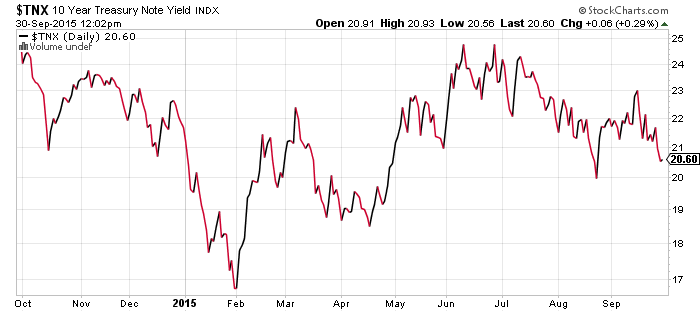

A dip in the 10-year yield helped real estate. Nevertheless, the downtrend that began in January is still firmly in place.

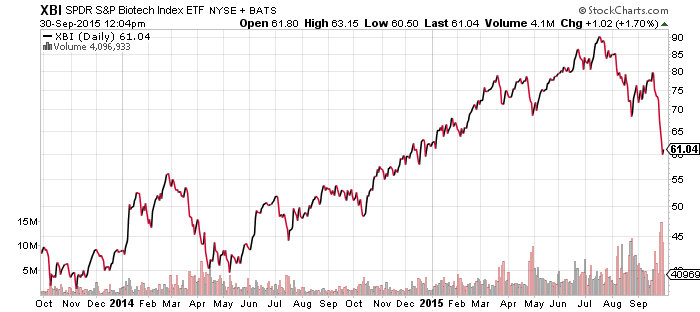

Biotechnology is at the center of attention after it plummeted over the past two weeks. This volatile sector is prone to sell-offs and concerns over drug pricing was the same impetus for a similar plunge in the spring of 2014. At that time three members of Congress raised an issue with the price of Gilead’s (GILD) hepatitis C drug. Last week, a small drug company which hiked the price of a drug from $13.50 to $750 per pill, before lowering the price amid a storm of criticism. Other firms are under fire for smaller price hikes.

These periodic sell-offs should not be surprising. Biotech companies rely on a few successful drugs to fund their operations. If the government threatens to step in and restrict pricing, the industry would be a far less attractive area for investment. Since it is election season, there could be more criticisms coming over the months ahead. In the end, very little is likely to be done because the biotechnology industry is an American success story.

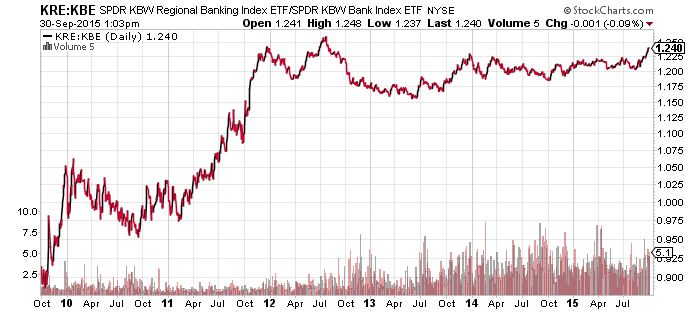

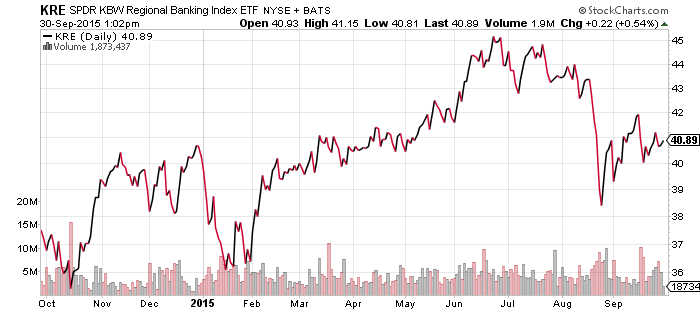

Regional bank stocks continue to beat their larger bank counterparts. This trend has been sharp, with no corrections over the past month. Relative performance has been in a basing pattern since 2012. If regional banks add another 2 percent of outperformance, it could signal a significant relative performance breakout.

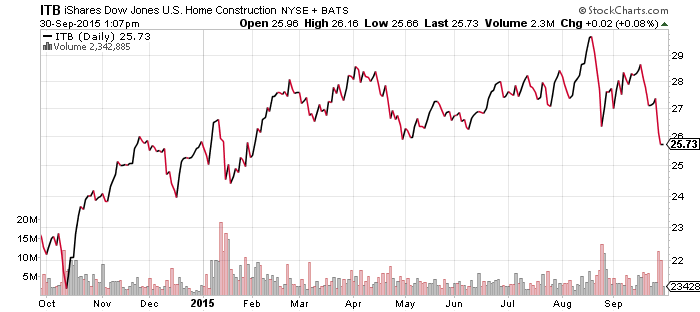

The impressive rally in housing stocks has been hampered by the Federal Reserve’s decision to leave interest rates unchanged. Since that decision, it has been almost non-stop losses for home builders. ITB is now at important support levels. Shares could find support at $25 or $24, but if they drop, the shares could slide into the low $20 range.

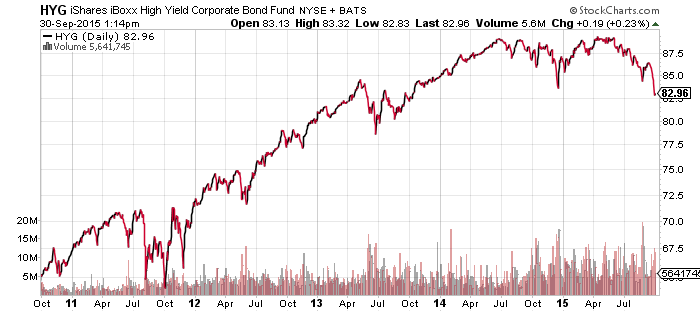

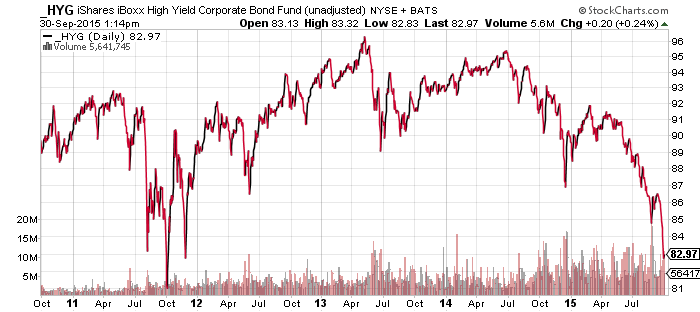

iShares iBoxx High Yield Corporate Bond (HYG)

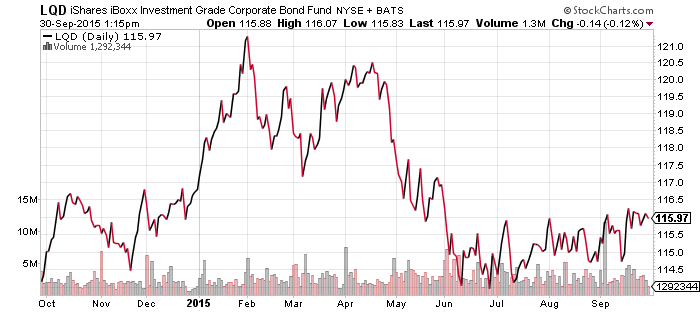

iShares iBoxx Investment Grade Corporate Bond (LQD)

HYG broke its 52-week low this week as concerns about commodities weighed on the high-yield sector. The second chart of HYG is the unadjusted figure, essentially showing the value of the bonds in the portfolio over time. This chart clearly shows high-yield is at its weakest point since a small panic in 2011.