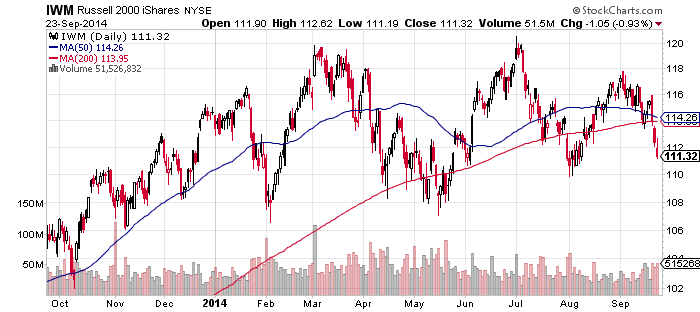

iShares Russell 2000 (IWM)

At the beginning of last week, it appeared as though the markets were going to push higher. However, over past several days, performance has not been able to sustain the momentum. Leading the way down is the small cap Russell 2000 Index, which has been the weakest of the major domestic indexes this year.

In the near term, if IWM breaks below its August lows, it could invite technical selling, which could quickly push it to the May and February lows. Longer term, as the second chart shows, the Russell 2000 is on the verge of breaking its trendline going back to the 2009 bottom. That would be a bearish signal for traders and would also invite technical selling. In short, if the Russell 2000 cannot hold here and turn higher, there is a risk of a larger sell-off unfolding in the weeks ahead.

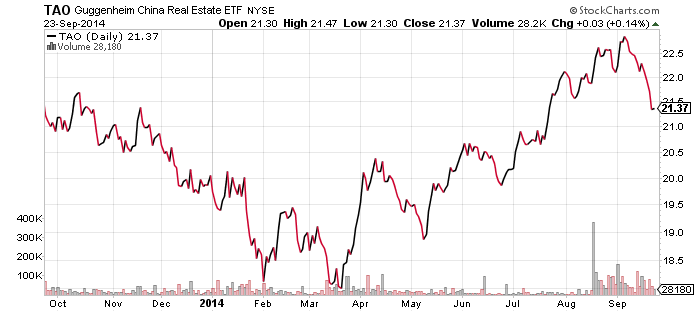

Guggenheim China Real Estate (TAO)

Investors woke up to the China slowdow story in September and it has hit emerging markets equities, commodities, and currencies of exporting countries. The epicenter of the slowdown is the real estate market. As with the rest of the Chinese stock market, shares are cheap in real estate even accounting for a big plunge in home and land values. Investors tend to overreact to current news and the news coverage of China is still far more optimistic than the data warrants. A test of the March lows would not be surprising here even if the situation doesn’t evolve into a major crisis.

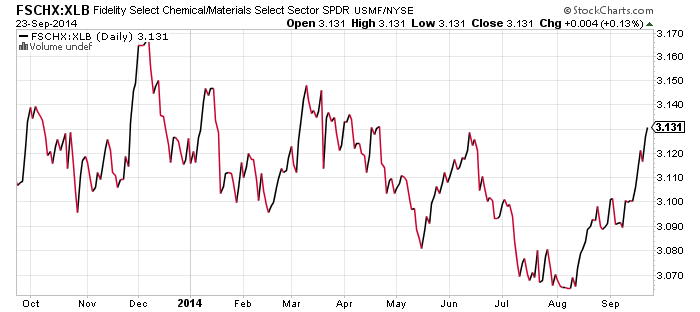

SPDR Materials (XLB)

XLB’s performance is indicating a positive signal for the U.S. economy and has been a top performer over the past week. This is surprising considering that copper prices have been collapsing, while steel, oil and other critical industrial commodities sink in price.

The explanation for the rise in materials is the chemical subsector. The chart below is a ratio of Fidelity Select Chemicals (FSCHX) and XLB, which shows how chemicals have been outperforming the already relatively strong materials sector. Lower natural gas prices are prompting foreign chemical producers to move to the United States, a benefit many domestic firms are already experiencing.

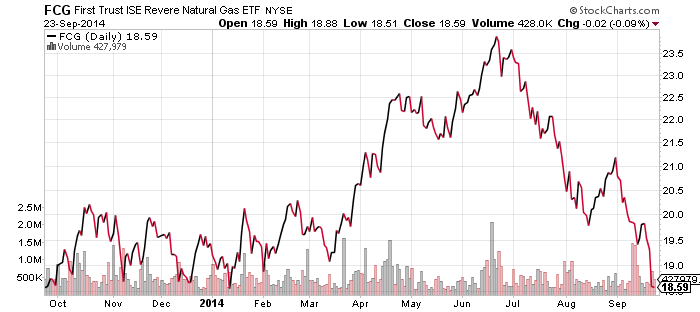

First Trust ISE Revere Natural Gas (FCG)

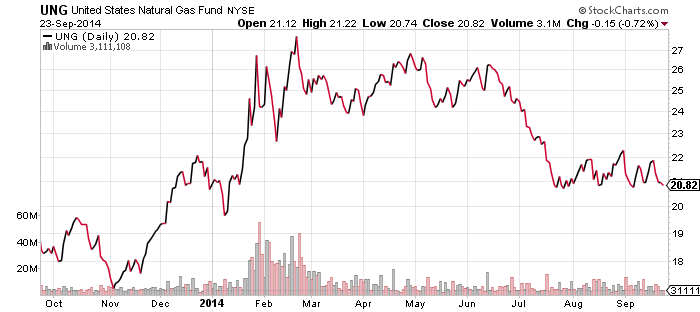

U.S. Natural Gas (UNG)

Natural gas could be poised for a breakout. FCG has fallen to a major support level and UNG is bouncing along a support line. Weather is turning cooler and it is forecasted to be a colder than normal winter, which boosts demand for natural gas in numerous parts of the country.

Besides natural gas, oil prices are slowing their descent after a nearly 3-month uninterrupted slide. Industrial commodities such as copper can be very volatile, but oil demand is more stable and prices will probably bottom out soon. Natural gas tends to be more volatile than oil, so if energy prices reverse, natural gas should see a healthy rebound.

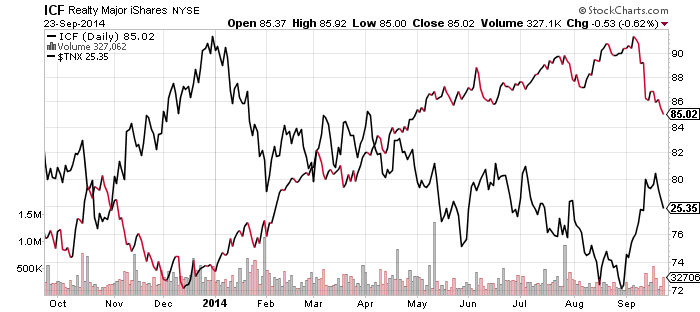

iShares Cohen & Steers Realty Majors (ICF)

The chart of ICF is one reason why bears have been optimistic. Last week, we looked at ICF and saw it sold off following a sharp spike in interest rates. Over the past few days interest rates reversed and moved lower, but ICF continued its downward move. If rates continue to decline and real estate doesn’t rebound, it’s a bearish sign for the market over the short-term.

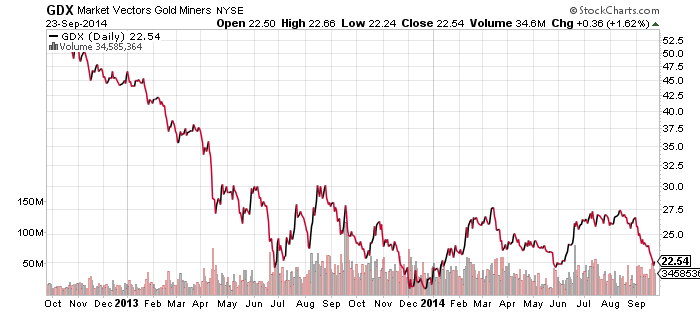

Market Vectors Gold Miners (GDX)

Gold miners have bounced off the $22 level twice before and it may occur yet again. The dip below in December was a failed breakdown. A triple bottom is a bullish indicator and gold stocks have been in a 3-year bear market. Lately, the U.S. Dollar Index has been very strong and gold tumbled in sympathy with other commodities. Foreign currencies such as the yen have broken down, but appear ready to bounce, which could make the greenback retreat over the near term. That should be bullish for gold, and a third successful hold of support could bring in bottom feeders.