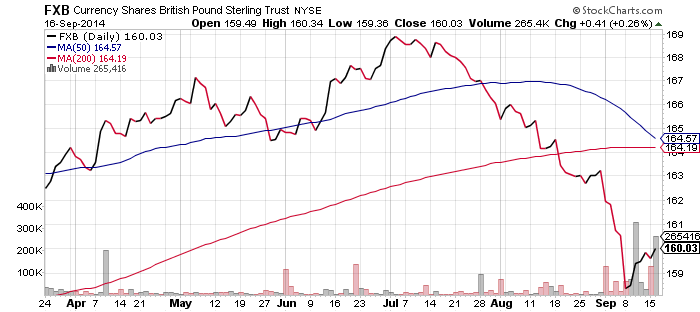

CurrencyShares British Pound (FXB)

Scotland appears set to vote No on independence tomorrow and that could lead to a strong rally in the British pound. Investors nervous about a Scottish exit from the union have been pulling cash out of the pound. The bigger effect of a Scottish Yes vote will not be an immediate financial impact though, but the long-term impact on issues such as independence in Catalonia Spain and a British exit from the European Union.

For investors who want up to the minute updates on how the vote is viewed by traders, watch the British pound exchange rate tomorrow.

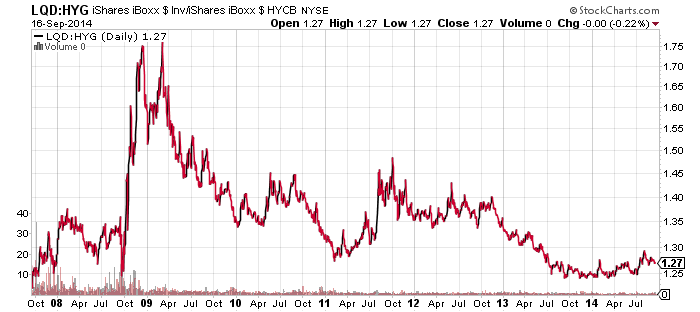

iShares iBoxx $ Investment Grade Bond (LQD)

The chart below shows the ratio of LQD and iShares iBoxx $ High Yield Corporate Bond (HYG). When investors aren’t nervous, they bid up junk bonds faster than higher rated bonds. Since mid-summer investors have been a bit nervous about the upcoming exit from quantitative easing and LQD started to outperform HYG. However, interest rates didn’t start rallying across the board until late August, which caused LQD to underperform HYG. This is a good sign for the markets.

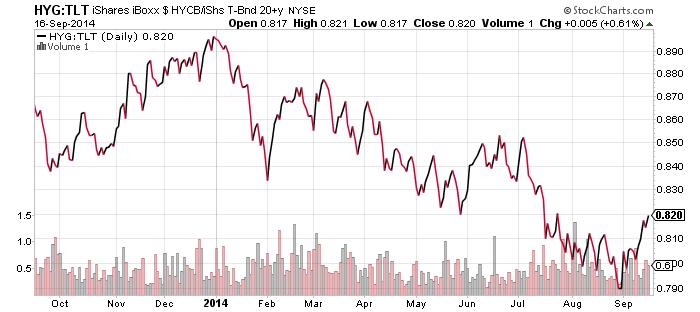

The second chart below shows the same thing, only it shows HYG compared to iShares Barclays 20+ Year Treasury (TLT). Rising rates aren’t good news for bond prices, but investors aren’t moving into safer assets as a result, which suggests that for now at least, a wider sell-off isn’t in the cards.

Of course, the Fed could change that this afternoon with their policy statement.

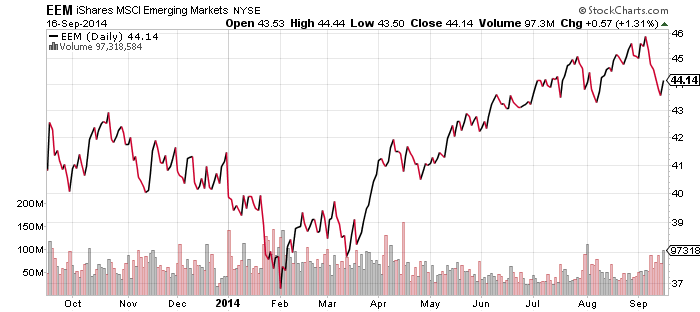

iShares MSCI Emerging Markets (EEM)

Emerging markets took a big hit in the past two weeks due to a big sell-off in Brazil. Last week (Monday through Friday), iShares MSCI Brazil (EWZ) sank 10 percent on a combination of equity and currency losses. This move came ahead of the weekend data release in China that showed the economy slowed considerably in August. If the trend continues, instead of being a one-off event, it could significantly reduce China’s GDP.

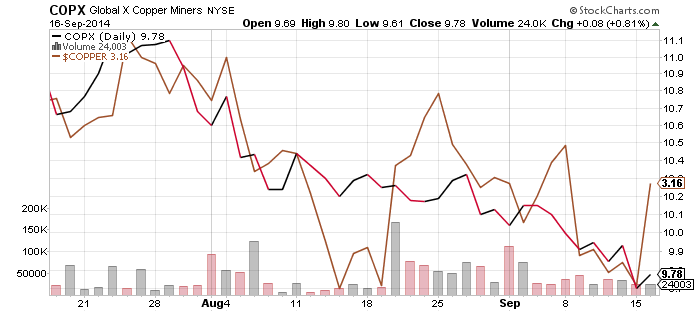

Global X Copper Miners (COPX)

Copper prices were also hit hard in last week’s selling. On Tuesday, rumors that the bank of China had injected $81 billion into the five largest banks caused a rally in commodities and emerging markets, with copper seeing the biggest gains. Equity investors didn’t buy the move though, which implies the move may have been driven by short-covering. As can be seen, the trend in copper has been down and equity traders, reflected in COPX, have ignored the periodic sharp rallies.

SPDR Financials (XLF)

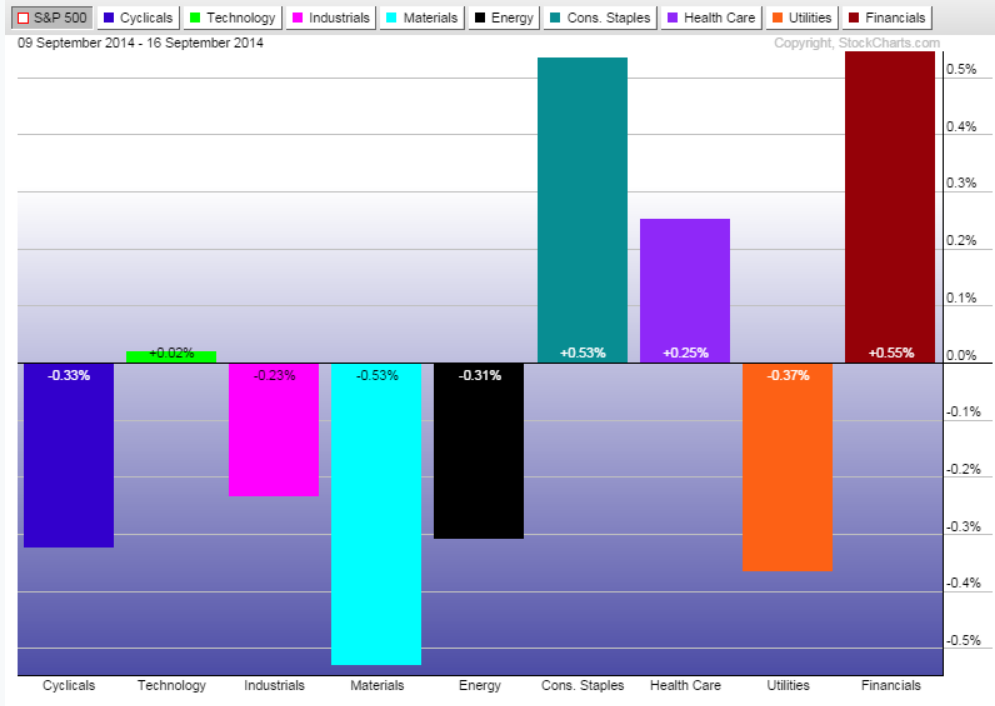

The rise in interest rates over the past week helped the financial sector outperform the S&P 500 Index by 0.55 percent.

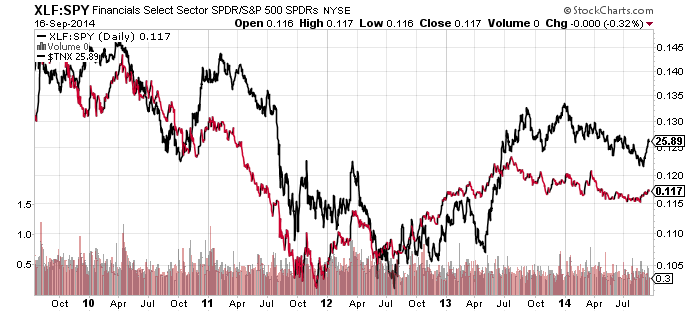

The second chart shows the price of XLF relative to the price of SPDR S&P 500 (SPY). Behind it is the yield on the 10-year treasury. There is a clear correlation between rising bond yields and financial outperformance. Financial stocks have underperformed the market since the financial crisis due to low interest rates, but this looks to have ended in the summer of 2012 when interest rates bottomed.