No one expected the Federal Reserve to raise rates at the October meeting, and few expect a hike in December, but the Fed’s statement today removed a reference to global economic weakness. Speculators and forecasters continue to focus on the March and April 2016 meetings as the most likely candidates for an increase. The Fed’s removal of that specific language pushed the odds of a December rate hike to 47 percent, while the odds of a January rate hike spiked to 55 percent.

Gold and oil were up sharply early Wednesday as traders anticipated the Fed would signal no rate hikes until 2016, in part due to slower-than-expected growth in the third quarter. Oil held its gains following the Fed’s statement, but gold dropped. The one sector that stood out in the stock market was financials, which rallied as the broader market fell on the news.

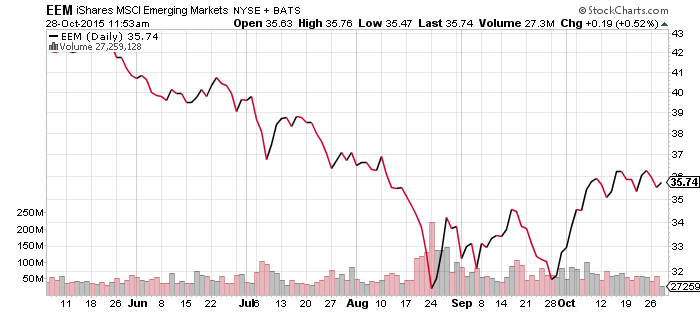

iShares MSCI Emerging Markets (EEM)

The concerns surrounding emerging markets has faded, despite remaining in a tight trading range. Any fluctuation would likely be followed by commodities and foreign currencies. Although commodities and resource producers rebounded on Wednesday, emerging markets saw a much smaller move. This gap should close over the week ahead.

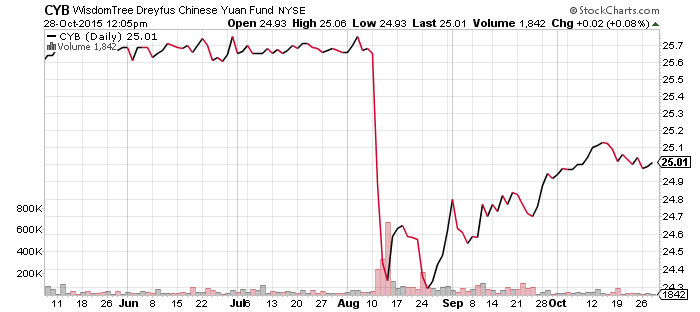

WisdomTree Chinese Yuan (CYB)

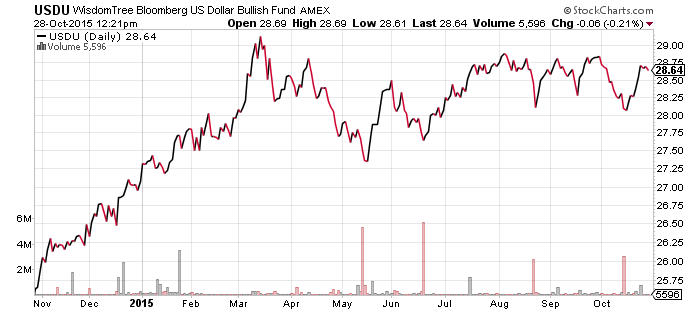

WisdomTree Bloomberg USD Bullish (USDU)

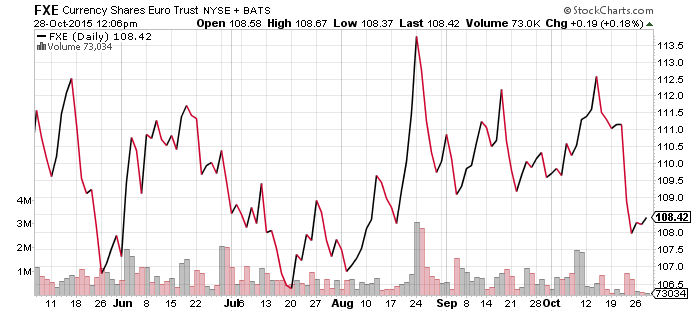

CurrencyShares Euro Trust (FXE)

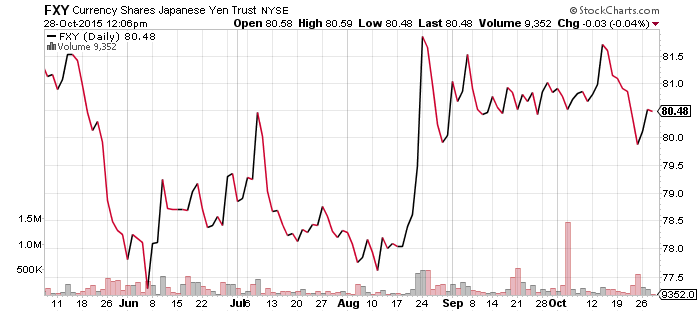

CurrencyShares Japanese Yen (FXY)

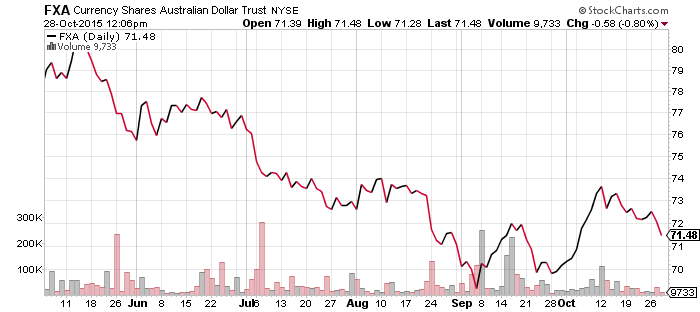

CurrencyShares Australian Dollar (FXA)

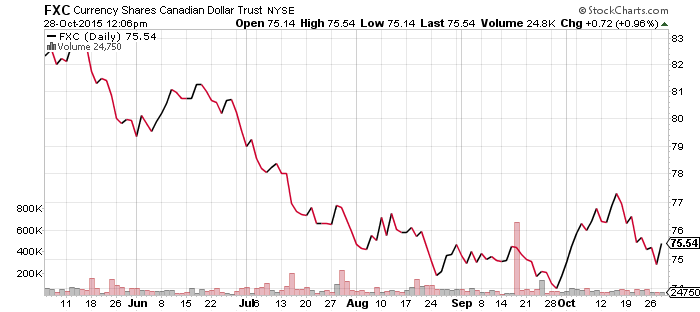

CurrencyShares Canadian Dollar (FXC)

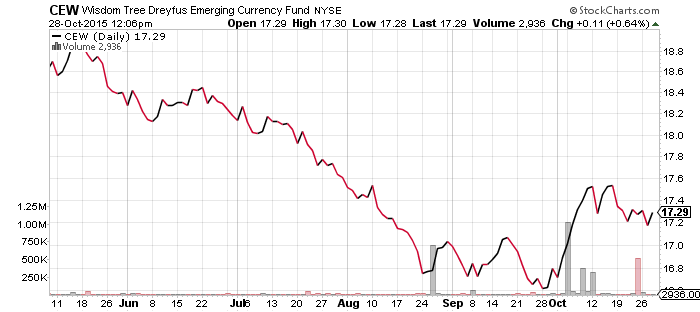

WisdomTree Emerging Market Currency (CEW)

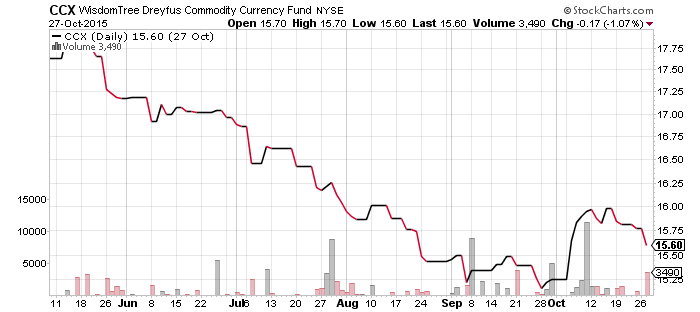

WisdomTree Commodity Currency (CCX)

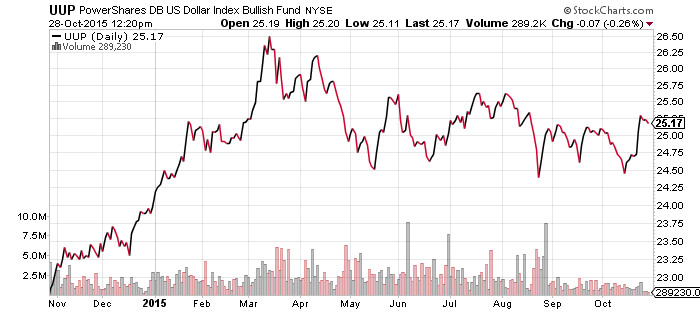

PowerShares DB U.S. Dollar Bullish Index (UUP)

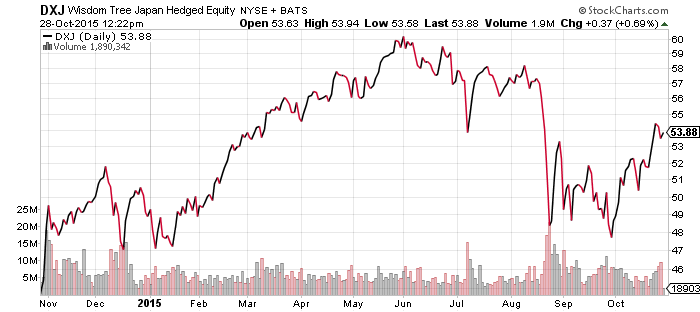

WisdomTree Japan Hedged Equity (DXJ)

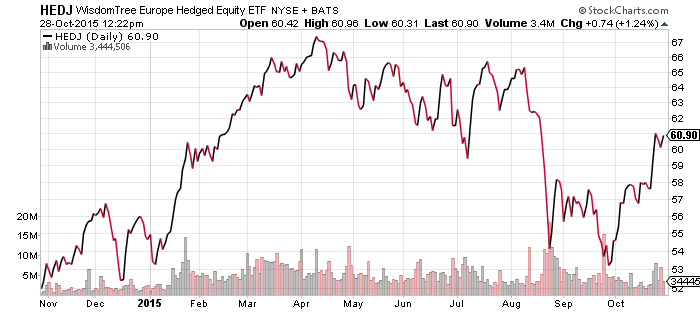

WisdomTree Europe Hedged Equity (HEDJ)

The U.S. dollar rallied strongly last week against the euro, following comments from European Central Bank (ECB) President Mario Draghi that raised expectations for more quantitative easing in December. The trend continued as the People’s Bank of China eased its monetary policy. Today, some of those gains were given back as two ECB governors warned they didn’t believe more easing was imminent.

Last week’s rally was due for a pullback this week, but thus far the U.S. dollar has held most of its gains. Both UUP and USDU are within striking distance of new highs, with USDU being closest thanks to weakness in emerging market currencies. Most notable on Wednesday is a drop in commodity currencies, tracked by CCX, on a day when oil was up nicely.

The rally in the greenback also contributed to a revival of currency hedged funds.

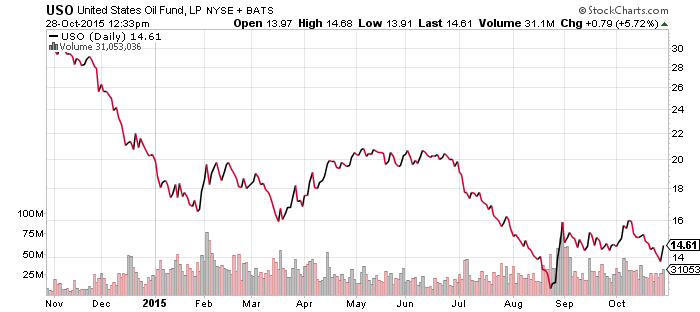

United States Oil (USO)

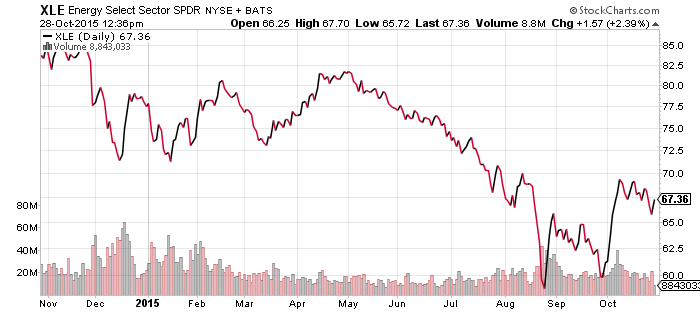

SPDR Energy (XLE)

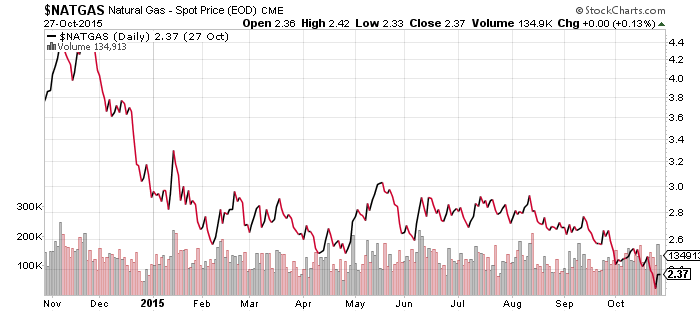

FirstTrust ISE Revere Natural Gas (FCG)

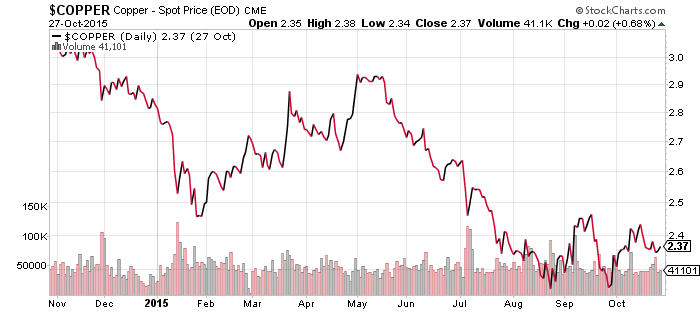

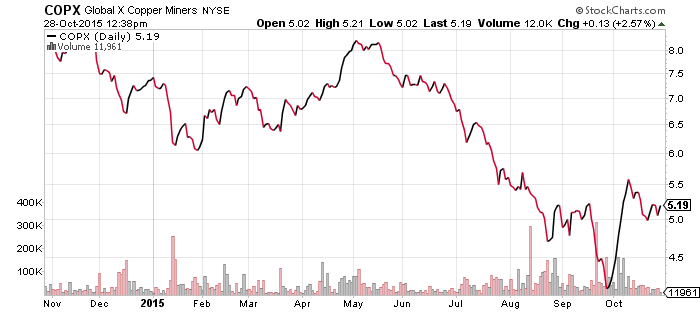

Global X Copper Miners (COPX)

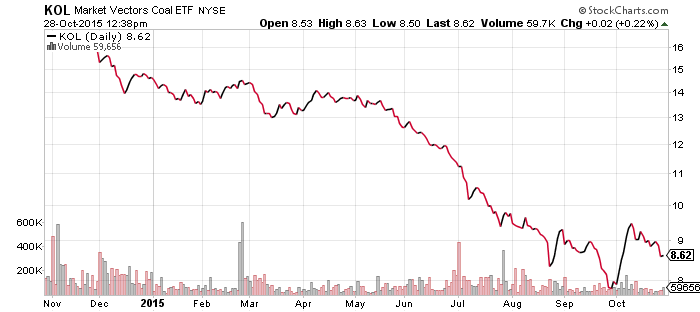

Market Vectors Coal (KOL)

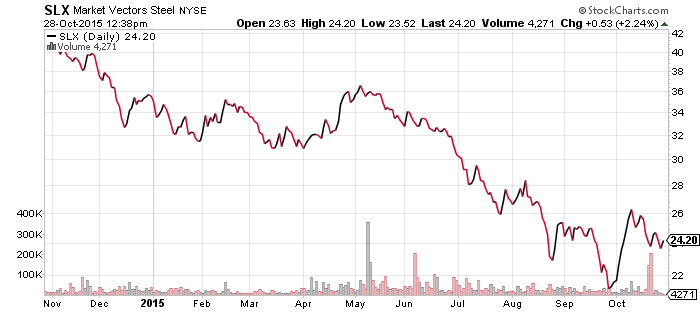

Market Vectors Steel (SLX)

Crude oil prices jumped more than 5 percent on Wednesday, following more than two weeks of near uninterrupted losses. A decline in oil inventories at Cushing, Oklahoma was positive for the commodity, but the rally began before the news came out. Oil-related equities followed crude higher, though the gains were only half of oil’s gain.

Natural gas stocks have fared worse of late and traded close to the 52-week low, while the price of natural gas plunged to a new 52-week low.

Coal, copper and steel are worth paying attention to over the days ahead. On Wednesday the head of the Chinese Steel Association said demand is falling with “unprecedented speed,” an alarming statement considering how much demand has already declined. Chinese steel mills produce half of the world’s output and they have been dumping excess steel on the global market as demand at home cools. Protectionist policies may soon emerge to defend various national steel industries, but until then, falling demand in China could pressure global prices. Iron ore prices, a key ingredient for steel, fell 3 percent in China on Wednesday.

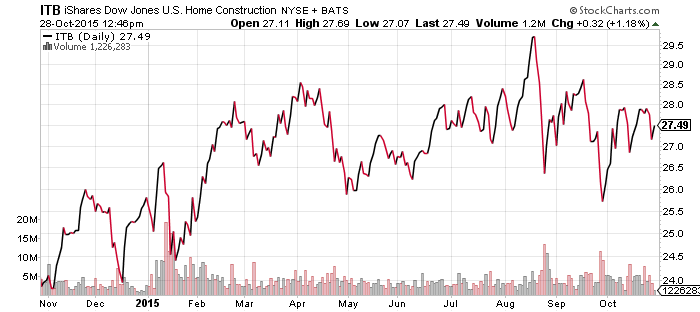

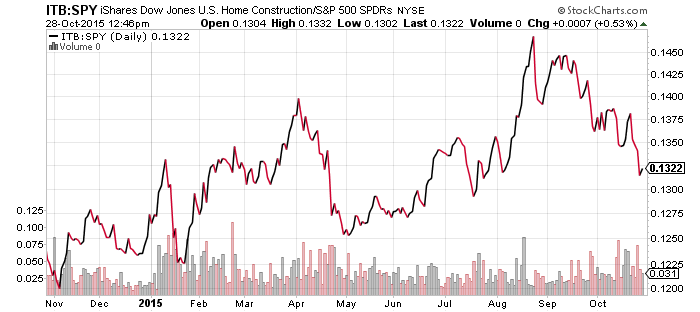

iShares US Home Construction (ITB)

Last week we examined ITB following the release of strong housing data. Instead of rallying, however, shares remained in their trading range. The continued delay of rate hike expectations is likely playing a role. We continue to expect a rate hike to raise overall confidence in the economy and should push homebuyers off the sidelines once the prospect of lower interest rates is eliminated.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

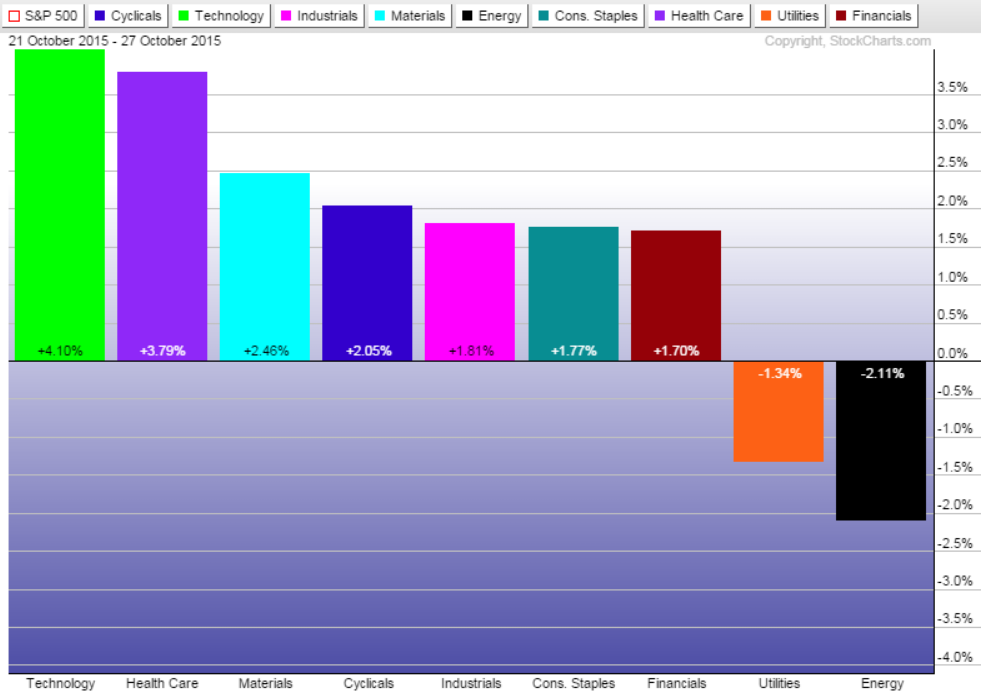

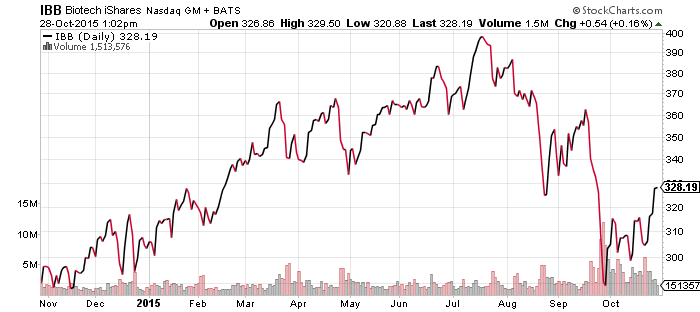

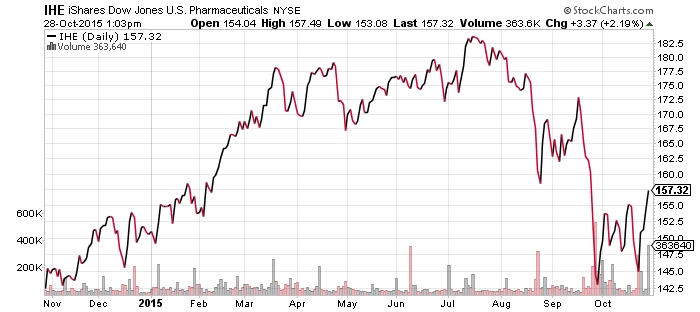

Energy and utilities were the only two sectors to fall last week. Technology and healthcare, which spent much of 2015 leading the market higher, resumed their ascent. Strong earnings from Amazon (AMZN), Google (GOOG), Microsoft (MSFT) and Apple (AAPL) have aided the tech sector’s advance. Biotechnology and pharmaceuticals had been weighing heavily on the healthcare sector recently, but both moved sharply higher over the past few days.

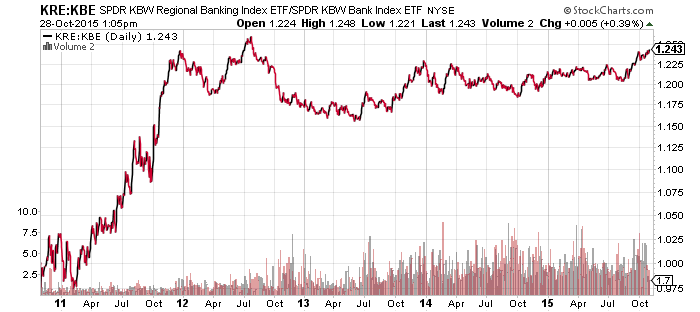

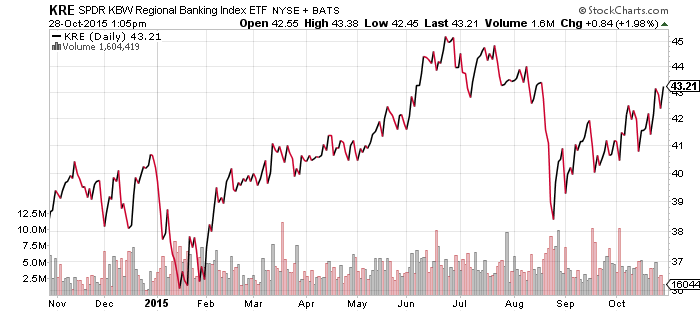

Regional banks continued to beat their larger bank counterparts last week and the price ratio chart of SPDR KBW Regional Banking (KRE) versus SPDR KBW Bank (KBE) broke out to a new 52-week high. Financials remain below their 52-week highs in part due to the Fed’s interest rate decisions, but there is underlying strength in regional banks. The relative price ratio of KRE to KBE is approaching a 5-year high.

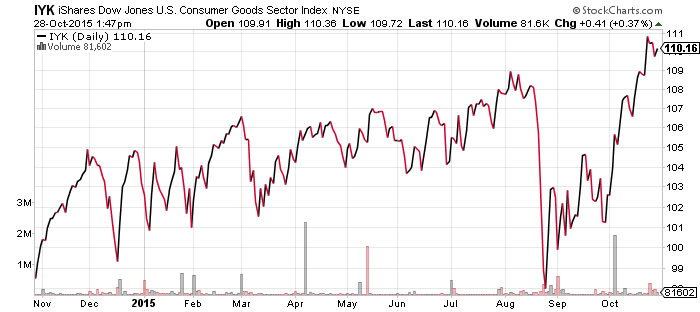

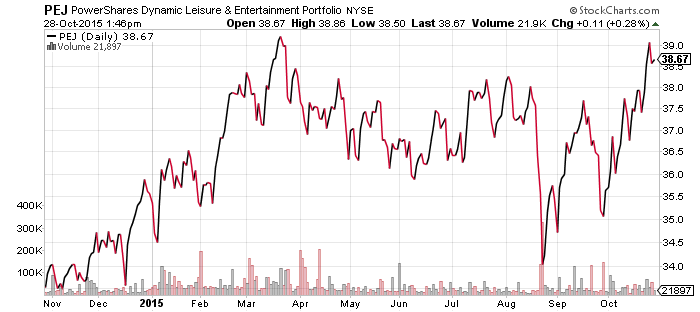

Consumer stocks have been doing very well of late, led by consumer staples ETFs that have recently set new 52-week highs. Yesterday, Walgreens (WAG) announced it would buy Rite Aid (RAD), delivering another shot in the arm to the retail sector. PowerShares Dynamic Leisure & Entertainment (PEJ) is near its 52-week high.

SPDR Gold Shares (GLD)

With the ECB talking about quantitative easing and the Chinese central bank cutting both interest rates and reserve requirements last week, gold prices should have seen a rally, but instead consolidated previous gains. The rally in gold since August is partly the result of fading rate hike expectations, but decisions at foreign central banks are having an impact. Sweden’s Riksbank also announced it would increase quantitative easing. The Riksbank decided to hold interest rates steady at negative 0.35 percent.

In the near term, gold bulls need to see the metal push above $118, which requires a gain of nearly 5 percent. Shares of GLD have gained 5 percent in October already, but every rally over the past 5 years has failed. The Fed’s statement today, putting a December rate hike back on the table in the minds’ of investors, was a blow to the bulls, but with most central banks easing, the current rally still has support.

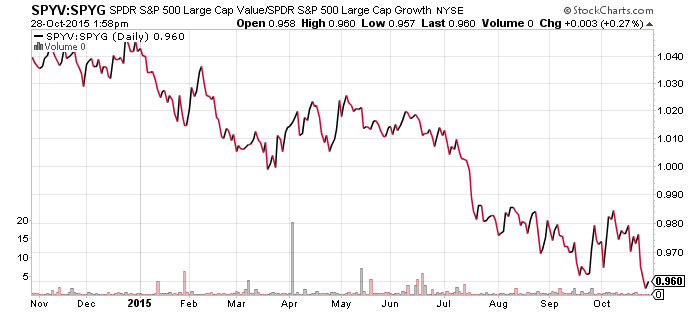

SPDR S&P 500 Large Cap Value (SPYV)

SPDR S&P 500 Large Cap Growth (SPYG)

Earlier this year it appeared value was ready for a rebound versus growth, after years of underperformance. Then the bottom dropped out of the oil market and the Federal Reserve pushed back its rate hike plans. Last week’s earnings beats by several Internet and technology companies exacerbated the trend.

SPDR S&P 500 (SPY)

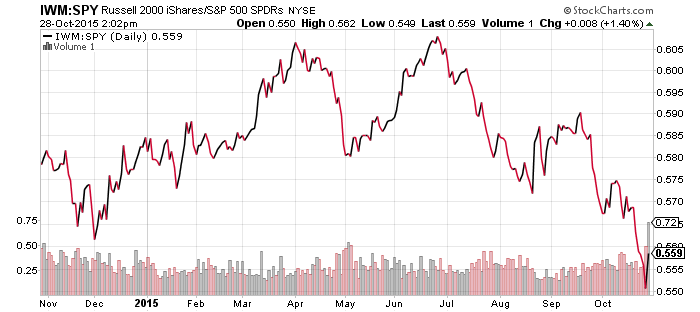

iShares Russell 2000 (IWM)

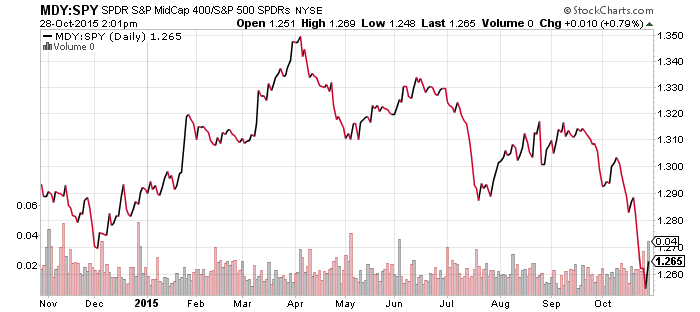

S&P Midcap 400 (MDY)

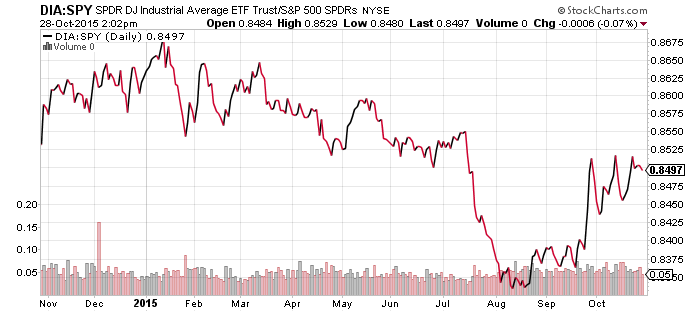

SPDR DJIA (DIA)

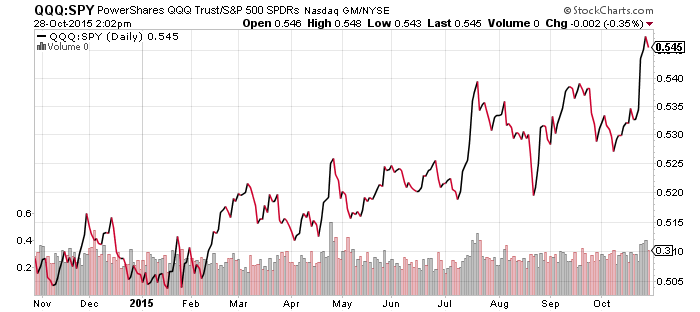

PowerShares QQQ (QQQ)

SPDR S&P Dividend (SDY)

Mid- and small-caps underperformed last week, continuing the pattern we have seen over the past month. The Nasdaq has been beating the other major indexes by a wide margin this year and it added to its lead. The Dow has improved since August and remains in a relative uptrend versus the S&P 500 Index. Calm in the bond market has dividend stocks, represented by SDY, holding steady versus SPY.

As for SPY itself, the ETF is right back to the middle of the six month trading range that was in place from February through August. Over the next week or two, SPY and the underlying S&P 500 Index could push to a new all-time high, leading a new bullish breakout for the market.