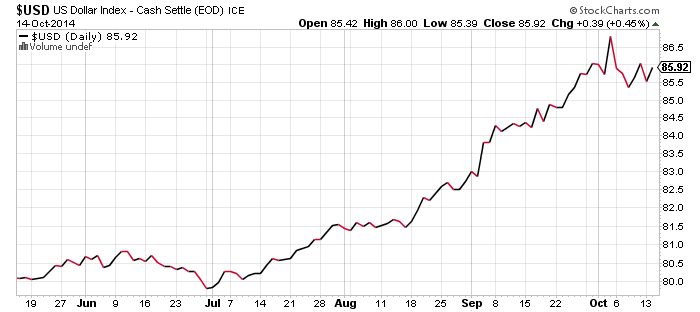

PowerShares DB U.S. Dollar Index Bullish Fund (UUP)

Investors have lost interest in the U.S. dollar since it is no longer seen as the prime driver of the market, but it is still extremely important. The rally ended a little more than a week ago but the U.S. Dollar Index hasn’t pulled back that much; ignoring the spike higher in early October, the index is sitting at its highest levels for the year. Meanwhile, it is no longer overbought. If the dollar is going to pullback further, it is going to happen in the next week or two. If the dollar doesn’t weaken considerably, the bulls won’t need to work hard to push it back to new highs, and that would weigh on Europe, emerging markets and commodities. At roughly 86, a gain of less than 5 percent would put it at a new post-2008 high and signal a major bullish breakout.

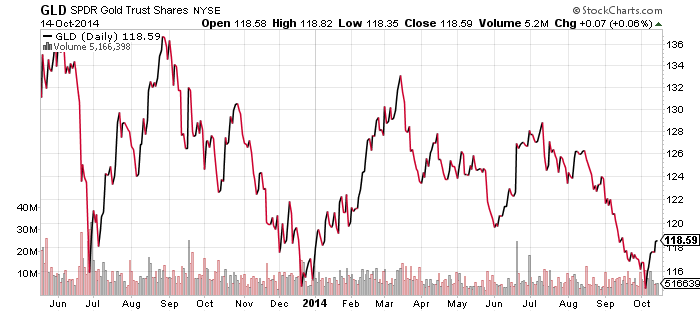

SPDR Gold Shares (GLD)

Gold has triple-bottomed over the past 18 months, with the latest bottom made on October 3. For now, a bullish stance on gold is warranted. Among the issues working in gold’s favor is a small but growing concern that the Federal Reserve will not end quantitative easing this month. Following the stock market decline and the release of Fed minutes that showed the central bankers were worried about the stronger U.S. dollar, some investors have raised the issue of whether the Fed might delay the end of quantitative easing. Whatever the reason, gold appears to have firm support here.

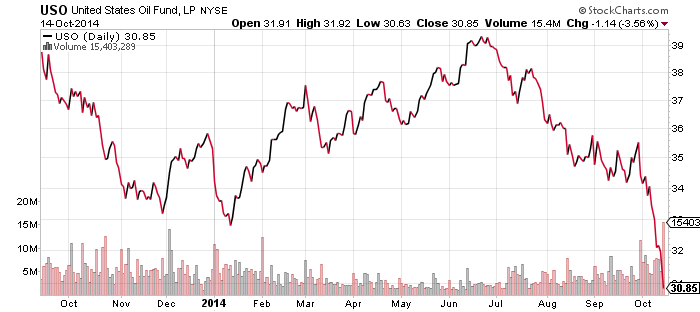

United States Oil (USO)

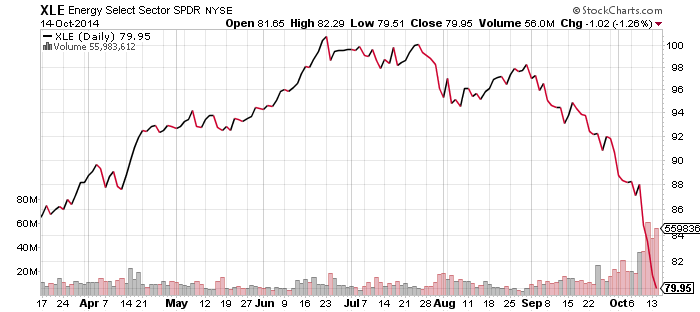

Unlike gold, oil prices have fallen through support. Brent crude was selling for $115 in June and it is now at $85 a barrel, with approximately half of those losses coming in the past two weeks. USO, which tracks West Texas Intermediate Crude, is down nearly as much on a percentage basis. This is the weakest part of the market now and until it stabilizes, the market as a whole will be volatile.

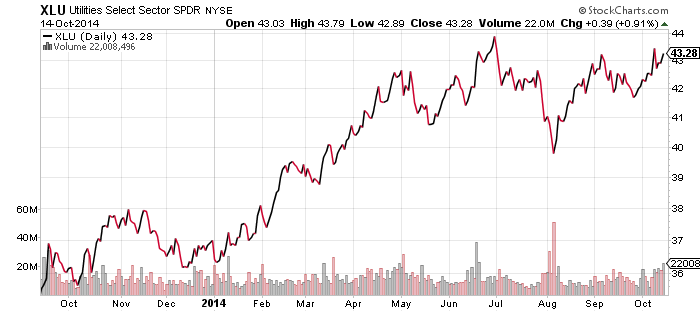

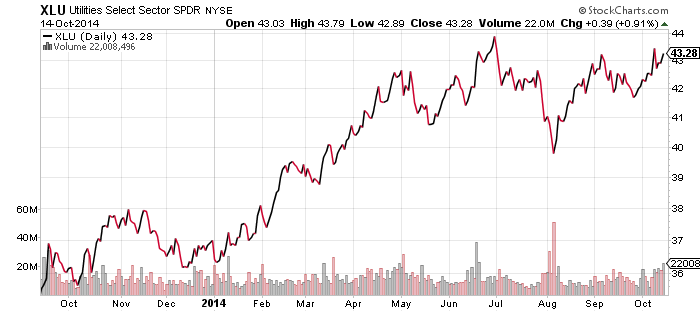

SPDR Utilities (XLU)

Several sectors have been outperforming the broader stock market lately. The best of the bunch in terms of performance in October is utilities, which has steadily marched higher in the face of selling.

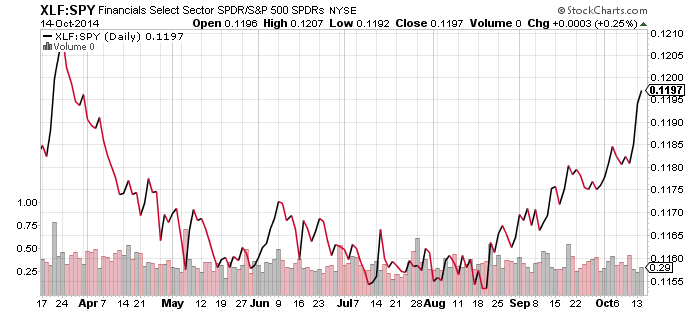

SPDR Financials (XLF)

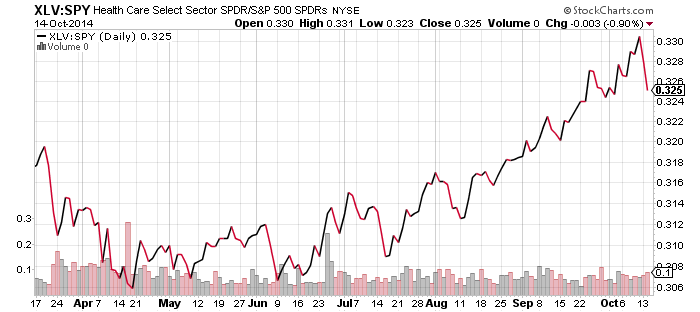

SPDR Healthcare (XLV)

SPDR Consumer Staples (XLP)

Aside from utilities, healthcare, consumer staples and financials are all outperforming the broader market. Consumer staples are up as a defensive play and an alternative for investors seeking safety. As can be seen in the chart below, which is a price ratio of XLP versus SPDR S&P 500 (SPY), the sector has done extremely well relative to SPY as selling accelerated in October.

Healthcare has been consistently strong versus the market since the beginning of summer, with only the most recent bit of selling causing the sector to underperform recently. For now, there is no sign that healthcare has given up its mid-term market leadership.

Financials have also been surprisingly strong. Interest rates have slumped in recent weeks, but financials are holding up better than the broader market. This week will see the vast majority of the financial industry report earnings. A solid reporting season will help this sector make the case for market leadership once the bull rally resumes.

Earnings were mixed on Tuesday: Citigroup was rewarded by investors, but both J.P. Morgan and Wells Fargo slipped following their reports.

Finally, here also is a chart of SPDR Energy (XLE). This is the candidate for the largest bounce, if the market rallies. It has been almost non-stop losses since September.