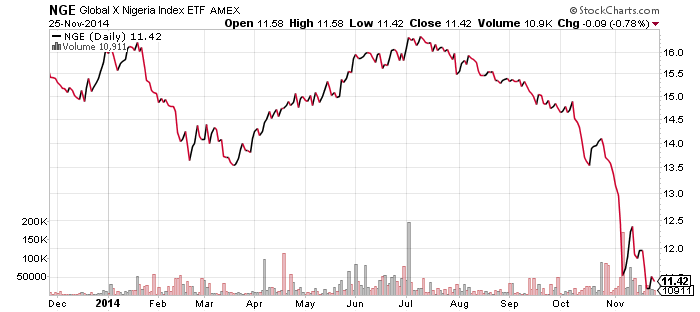

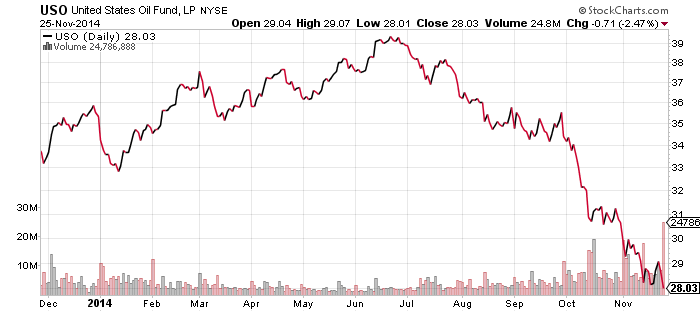

United States Oil (USO)

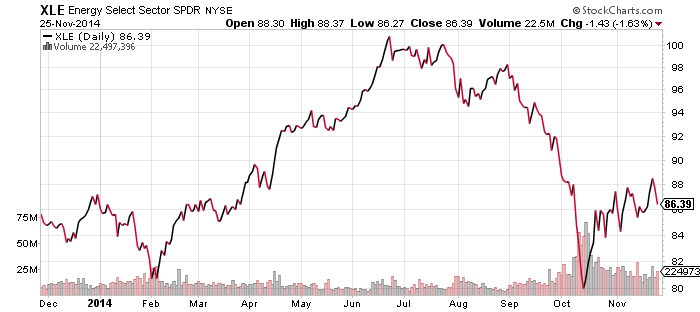

SPDR Energy (XLE)

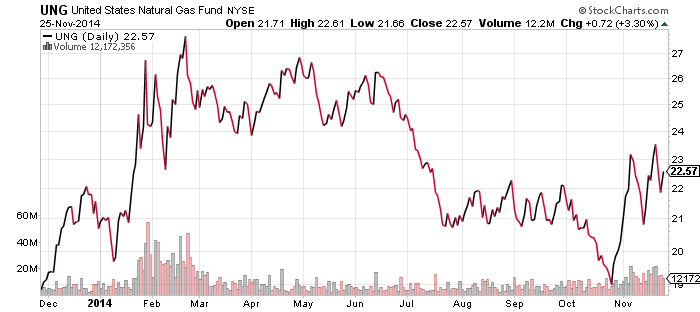

United States Natural Gas (UNG)

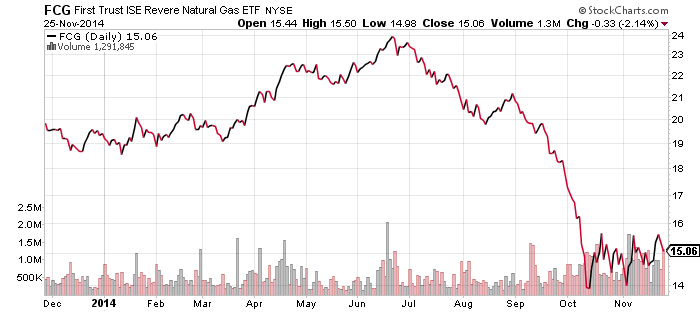

First Trust ISE Revere Natural Gas (FCG)

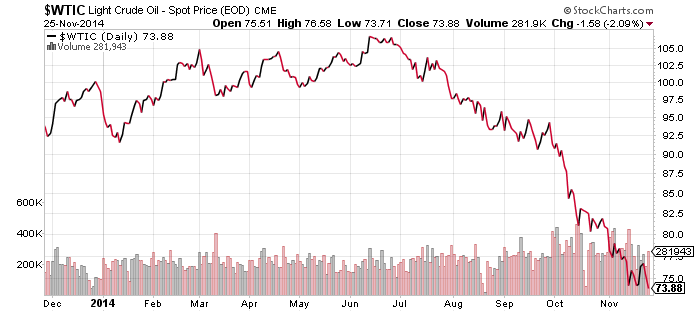

Global X Nigeria (NGE)

Energy ETFs are in focus this week as OPEC meets on Thanksgiving Day in Vienna. The Washington Post dubbed this week’s meeting as “the most important in years” and investors are in near unanimous agreement. OPEC is weaker than ever because of, ironically, high prices.

OPEC has been facing competition from Russia for more than a decade after it grew to become the world’s largest oil producer in the 2000s. Over the past few years, the shale revolution in the United States has us poised to surpass Saudi Arabian production. Shale oil isn’t a new discovery and the technology needed to tap these reserves is decades old, but low prices had made it unprofitable. High prices have changed the picture and rising production outside of OPEC has reduced its ability to control prices. Mix in a slowing energy demand, partially a result of China’s economic reform efforts, and OPEC is in a tight spot. Several member states are in financial straits. If OPEC cuts production to raise prices, non-OPEC members will benefit and may grab market share. If OPEC doesn’t cut production, they can push high cost shale producers out of the market, but those OPEC nations will still be earning less due to lower prices.

One important aspect of the oil market is that prices are set by the marginal buyer, and that buyer needs someplace to store the oil. Recently, China has been supporting prices by buying up cheaper oil, but even China will eventually run out of storage. If there’s no present demand for oil production and buyers have no place to store their oil, prices could tumble.

Countries that rely on oil prices are starting to see their currencies tumble. On Tuesday, Nigeria devalued their currency and raised interest rates in order to defend their rapidly depleting foreign reserves.

The charts below show rising natural gas prices are helping to stabilize the equity ETFs in the energy sector. Equities are forward looking and investors may also be signaling they believe oil prices will stabilize. Whether that happens may depend to a large degree on what happens at the OPEC meeting tomorrow.

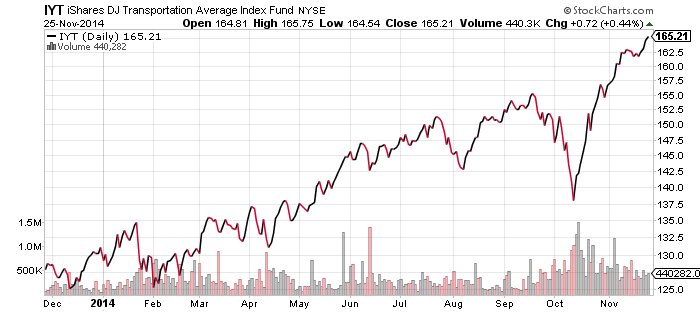

iShares DJ Transportation Index (IYT)

Transportation stocks remain in a strong uptrend. Yesterday, the Bureau of Economic Analysis released their second estimate of third quarter GDP growth and it increased from the initial estimate of 3.5 to 3.9 percent. A rise in exports and drop in imports helped drive growth in the quarter, as did non-residential fixed asset investment. The one segment on the economy that wasn’t up to speed was the consumer sector, but that has kicked into gear in the fourth quarter thanks to falling oil prices. The U.S. economy is now firing on all cylinders and the highly sensitive transportation sector is poised to benefit.

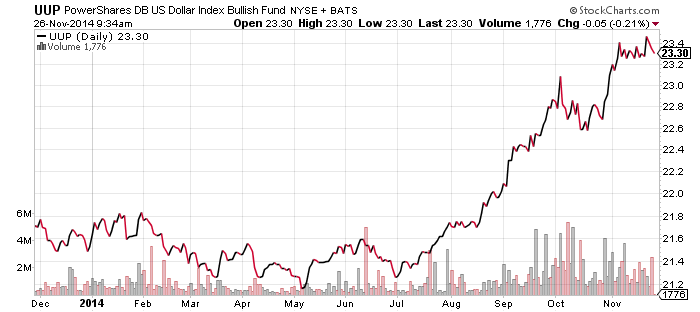

PowerShares U.S. Dollar Index Bullish Fund (UUP)

The discussion of the oil market above is very important for the U.S. dollar. Until now, the U.S. dollar has been rallying based on short-term trends: central bank actions in Japan and central bank talk in Europe. The surprise interest rate cut by China on Friday has the U.S. dollar gaining on Asian currencies as well. Everything is working in favor of the dollar, but a major bull market in the U.S. dollar is often accompanied by turmoil overseas. If oil prices tumble, countries such as Nigeria will be at great risk of a currency crisis that could spill over into other emerging markets, providing the fuel for a much larger U.S. dollar rally.

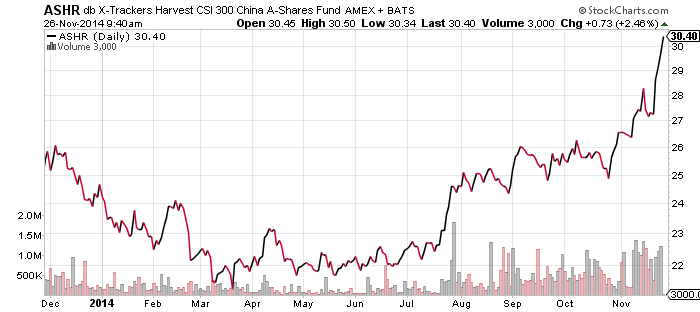

db X-Trackers Harvest CSI 300 A-Shares (ASHR)

Just when it looked as if Chinese stocks had run out of steam, the People’s Bank of China (PBOC) reignited the market with an interest rate cut. The Hong Kong-Shanghai stock connect scheme saw a big first day on Monday of last week, but interest declined over subsequent days. The PBOC’s decision to cut rates ignited stocks, sending some financial sector equities up double digits in one day. Whether this rally lasts is another question. Rate cuts typically herald bad news because central bankers are a lagging indicator: they start cutting rates once a downturn is well underway and they raise rates well after the recovery is going strong. Rising bad debts at Chinese banks, which make up a large portion of many China indexes and ETFs, could weigh on stock performance. On the other hand, Chinese stocks are still very cheap, as they are still technically in a bear market that began in 2008.

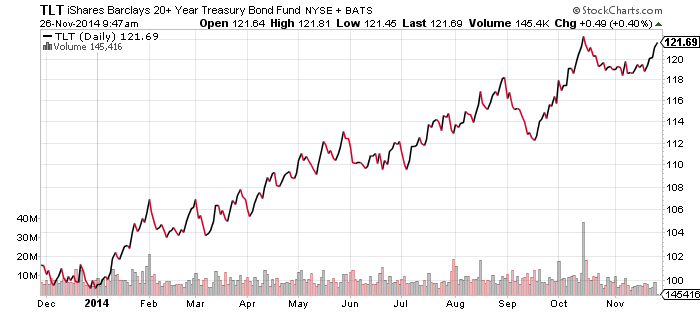

iShares Barclays 20+ Year Treasury (TLT)

Treasury bonds could be on the verge of another breakout, which would also mean interest rates are headed for a tumble. Shares of TLT are climbing back towards their high for the year and building a rounded bottom pattern that often leads to a bullish breakout. Although bonds tend to do well when stocks do poorly, if there is a major U.S. dollar rally or turmoil overseas, foreign buyers of treasury bonds could hold interest rates low even as the U.S. economy and stock market remain strong.

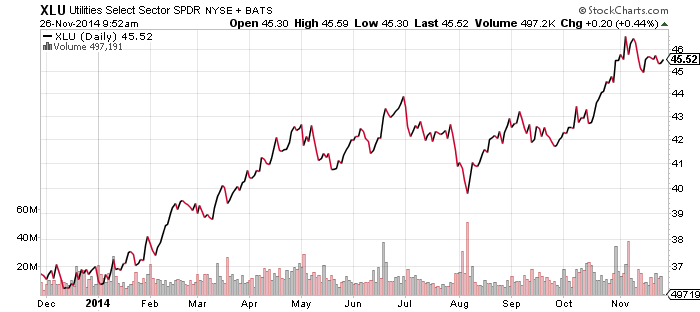

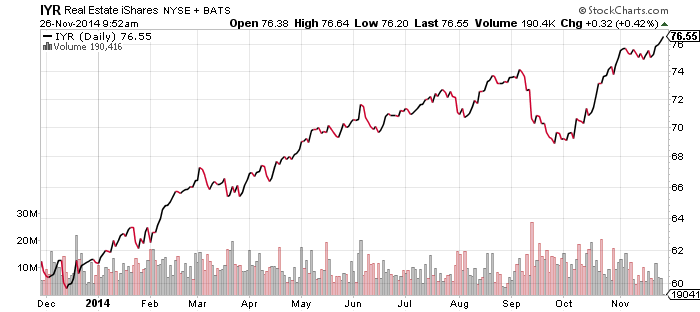

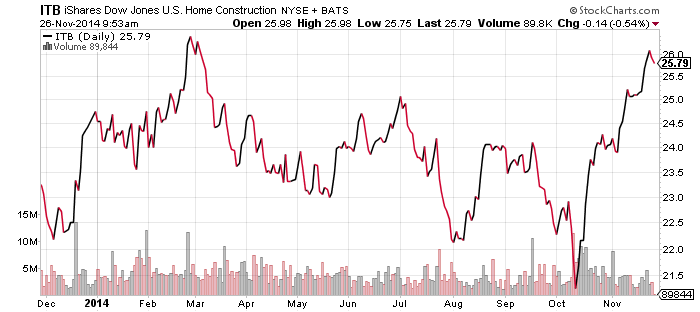

Lower interest rates would be good news for interest rate sensitive sectors such as housing, real estate and utilities. All three sectors have been performing well and are at or near their highs for the year.