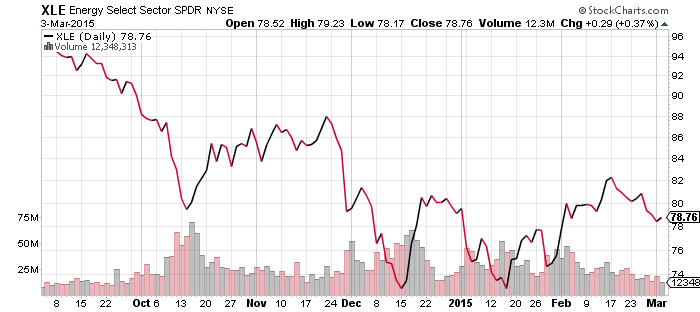

SPDR Energy (XLE)

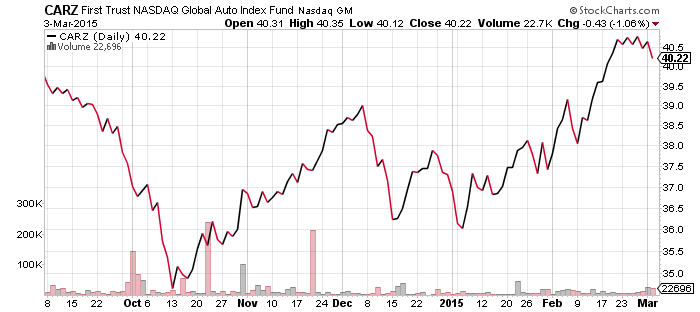

FirstTrust Nasdaq Global Auto (CARZ)

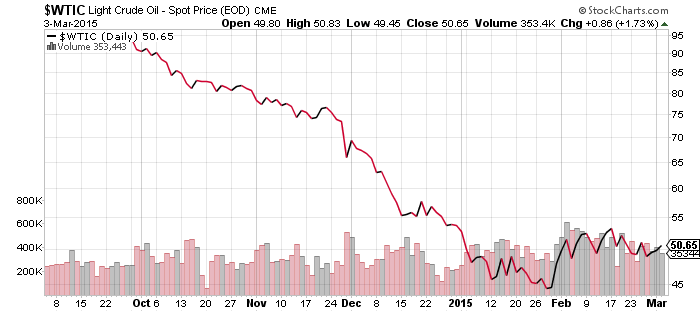

Energy prices continue to trace out a bottom in the face of rising inventory, but the action in the market over the past week has shifted to gasoline. A refinery explosion in Torrance, CA last month, plus a strike by United Steelworkers, has dented gasoline production in the United States. California is the hardest hit because the state’s strict environmental regulations require a special blend of gasoline. Other states would deal with a refinery shut-down by importing gas from out of state, but California cannot. As a result, gas prices in the state have sharply increased. Prices are back to October levels and are expected to continue climbing.

Rising gas prices could put a dent in truck sales the latest sales data from February shows trucks and SUVs were still popular with consumers, but March will be the first full month with higher gas prices.

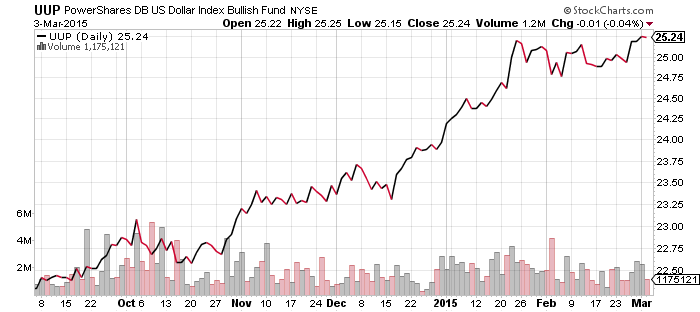

PowerShares U.S. Dollar Index Bullish Fund (UUP)

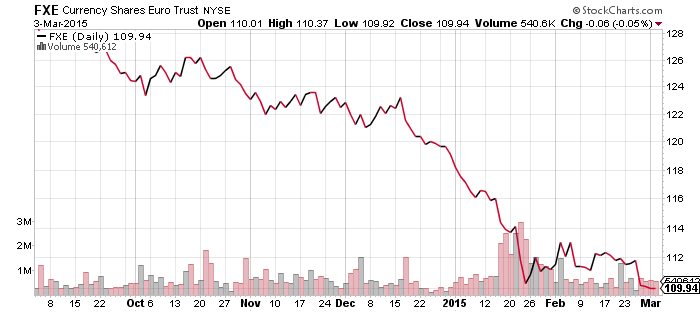

CurrencyShares Euro Trust (FXE)

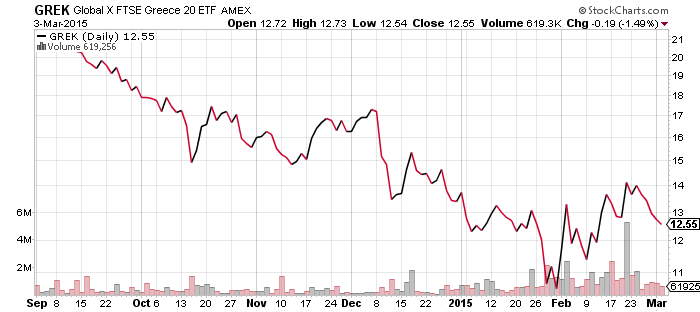

Global X FTSE Greece 20 (GREK)

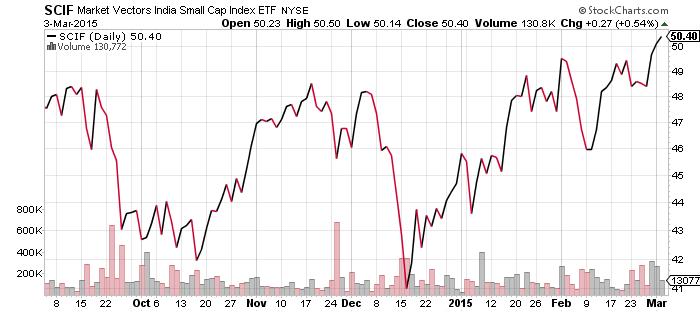

Market Vectors India Small Cap (SCIF)

WisdomTree India Earnings (EPI)

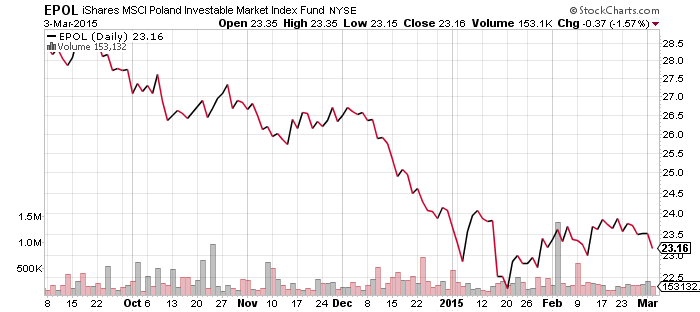

iShares MSCI Poland (EPOL)

It is do or die time for the current bear trend in the euro and bull trend in the U.S. dollar. The euro slumped below its 52-week lows in early trading on Wednesday as Greece looks for a way to repay an IMF loan. A close at a new low would open up the next leg lower for the common currency. Given the overall trend in the euro and the global currency market, a move lower is more likely than not.

Elsewhere, both Poland and India cut interest rates today. India’s central bank dubbed the move “pre-emptive,” as the move comes despite strong GDP growth. Along with the U.S., India is one of the bright spots in the world. EPI is near its 52-week high and the small cap SCIF is forming a bullish consolidation pattern.

Poland is also experiencing strong GDP growth relative to the rest of Europe, but its stock market has suffered. Since it is outside of the eurozone, Poland is not a direct beneficiary of quantitative easing. The central bank sees falling prices in 2015 and cut rates to head off deflation.

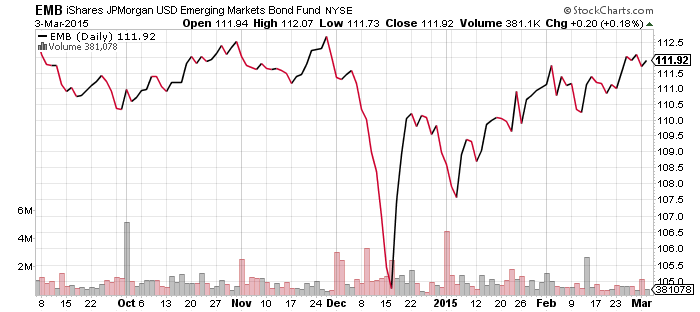

These rate cuts, in addition to the People’s Bank of China’s rate cut over the weekend, add fuel to the U.S. dollar rally and put pressure on other currencies. Given the $9 trillion in outstanding U.S. dollar debt, much of which is held by companies that do not have U.S. dollar revenues and lack access to Federal Reserve assistance, another push higher in the dollar is likely to start causing serious damage to emerging market bond funds. Bond funds such as EMB, even though they are U.S. dollar denominated, are headed for major losses if the U.S. dollar doesn’t reverse.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

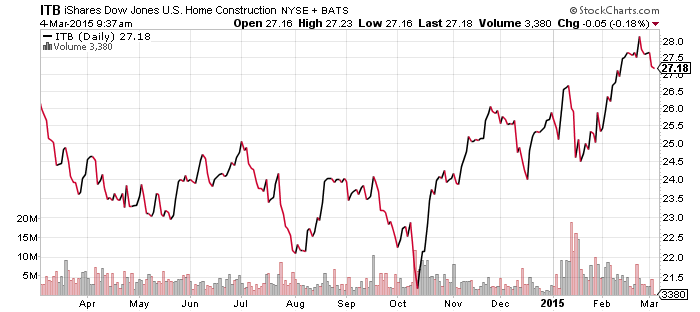

iShares US Home Construction (ITB)

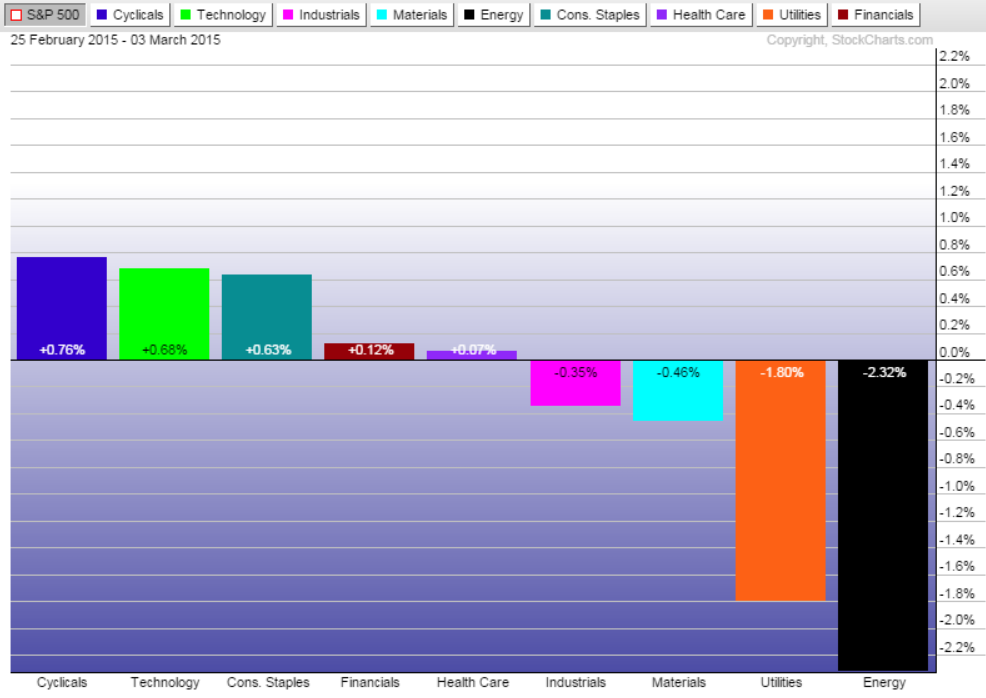

Among the major S&P 500 sectors, energy and utilities underperformed over the past week, while consumer cyclicals, consumer staples and technology outperformed the S&P 500 Index.

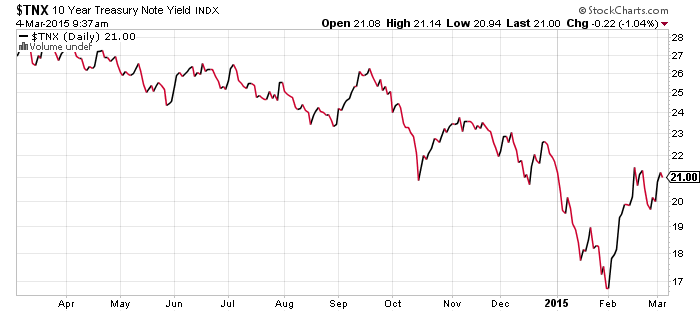

Homebuilders joined utilities and other rate sensitive sectors moving lower in the past week, all hurt by rising rates.

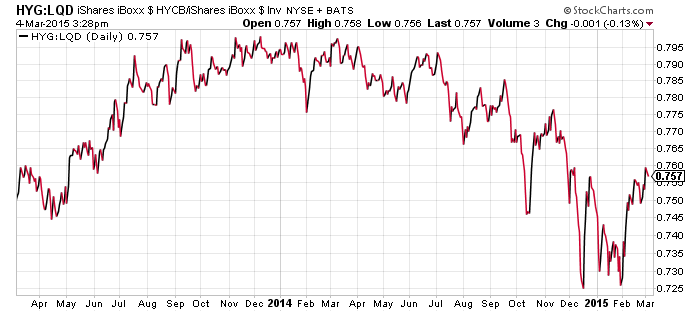

iShares iBoxx Investment Grade Corporate Bond (LQD)

iShares iBoxx High Yield Corporate Bond (HYG)

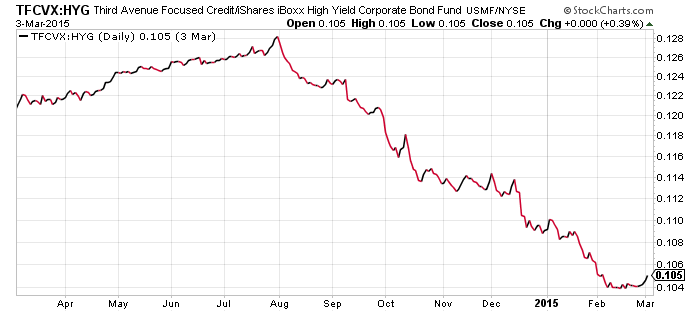

Third Avenue Focused Credit (TFCVX)

Investors continue to move back into high-yield debt and we are finally starting to see move into the higher risk debt that is a staple of TFCVX. This return to risk is in the very early stages though, and doesn’t yet signal an all clear signal for high yield debt.

SPDR S&P 500 (SPY)

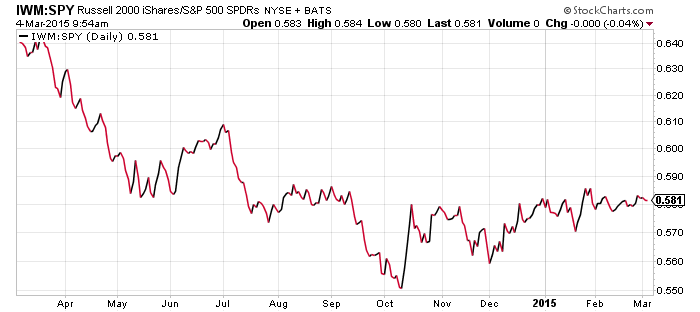

iShares Russell 2000 (IWM)

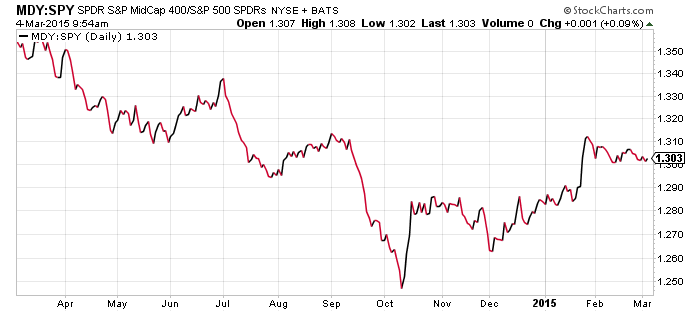

S&P Midcap 400 (MDY)

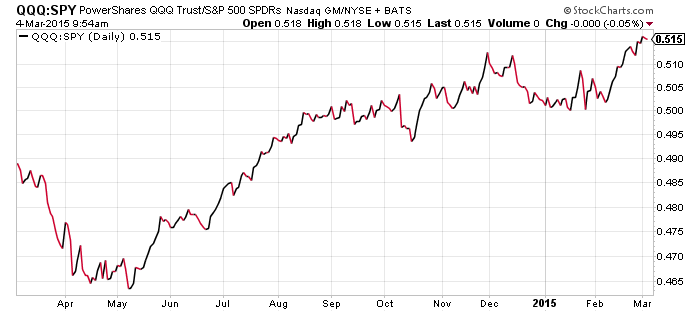

PowerShares QQQ (QQQ)

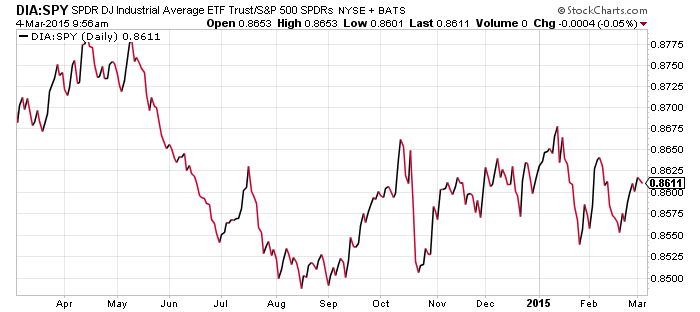

SPDR DJIA (DIA)

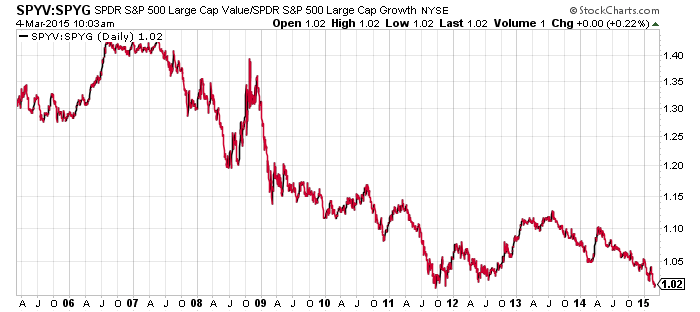

SPDR S&P 500 Large Cap Value (SPYV)

SPDR S&P 500 Large Cap Growth (SPYG)

The Nasdaq cracked 5000 for the first time since the Internet bubble, while the other major indexes pushed to new all-time highs. The Nasdaq has been a lone outperformer in the past few weeks thanks to a strong rally from technology stocks, led by subsectors such as biotechnology, semiconductors, Internet and networking. Both mid- and small- caps are holding steady with the broader S&P 500 Index. The DJIA has been a bit more choppy in its performance relative to the S&P 500, but it too is holding steady in 2015.

In terms of growth versus value, the growth stocks in the S&P 500 Index continue to beat their value counterparts, a streak that goes back to before the financial crisis. Financials have been a big reason why value has struggled versus growth, and the Fed’s delaying a rate hike hasn’t helped.