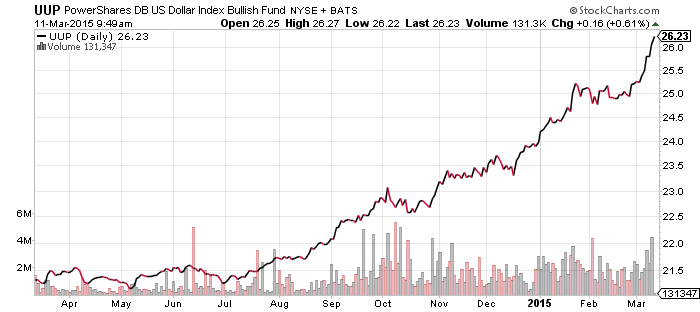

PowerShares U.S. Dollar Index Bullish Fund (UUP)

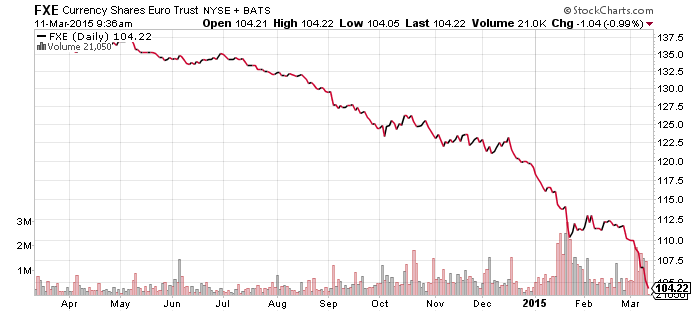

CurrencyShares Euro Trust (FXE)

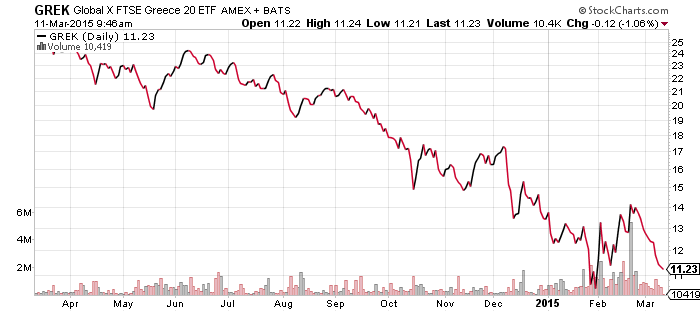

Global X FTSE Greece 20 (GREK)

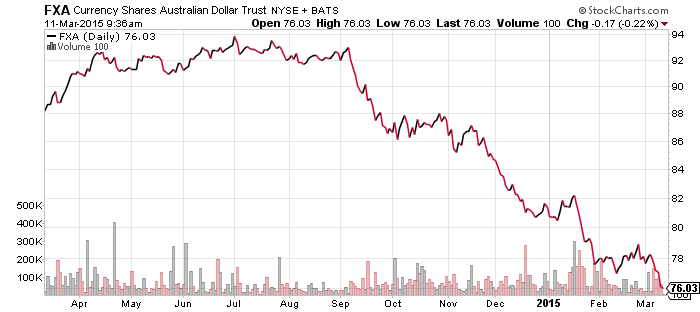

CurrencyShares Australian Dollar (FXA)

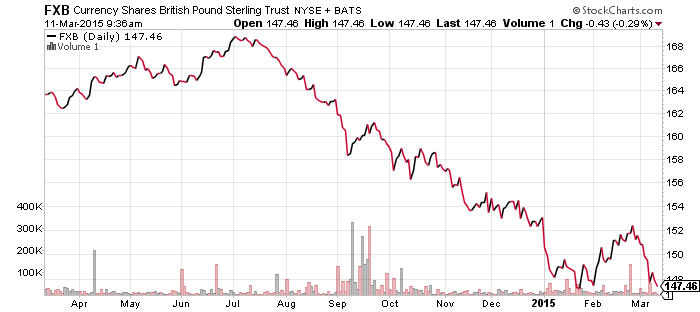

CurrencyShares British Pound (FXB)

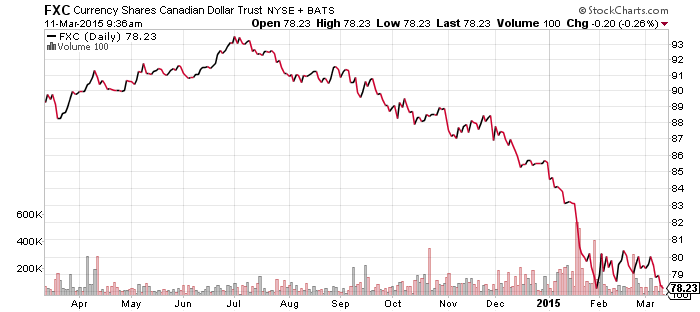

CurrencyShares Canadian Dollar (FXC)

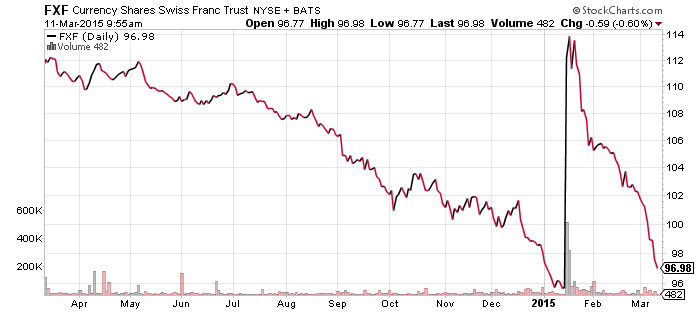

CurrencyShares Swiss Franc (FXF)

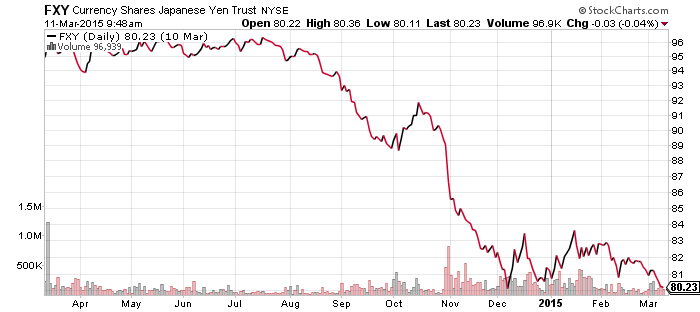

CurrencyShares Japanese Yen (FXY)

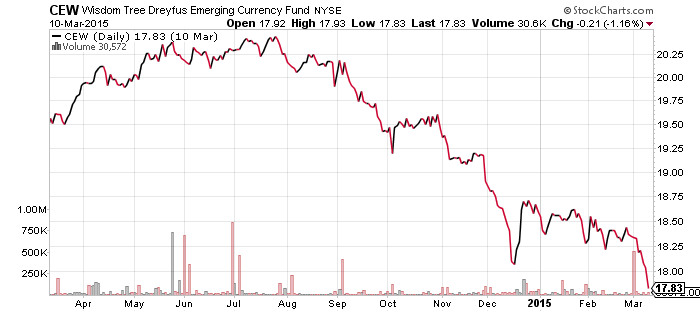

WisdomTree Dreyfus Emerging Currency (CEW)

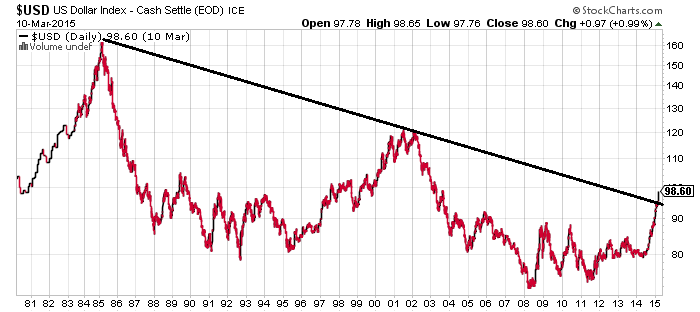

The U.S. dollar is overbought, sentiment is at a bullish extreme and speculators are completely lopsided in their positioning in the market. Despite all of this, the U.S. dollar appears to be headed higher, not lower.

The U.S. Dollar Index hasn’t experienced a correction since this bull market began in July 2014. A correction looks more likely today, if only because the vertical rise in the U.S. dollar over the past two weeks is an unsustainable move.

The run up is being fueled in part by expectations the Fed will remove the “patient” language from the Fed statement issued at next week’s meeting. If that happens, it would allow the Fed to hike rates as soon as June. Since the market is pushing the dollar higher in anticipation of this announcement, we could see the dollar top out, at least temporarily, by next Wednesday or Thursday.

From the perspective of foreign currencies, it is a mixed picture. The yen, Canadian dollar and British pound are holding at or slightly above their 52-week lows, but the Australian dollar, euro and emerging market currencies have broken to new 52-week lows. In a bear or bull market, it usually pays to go with the trend and expect support or resistance to break. Right now, the trend is pointing to lower prices for foreign currencies.

The chart below shows U.S. Dollar Index broke a major trendline lack week going back to the 1985 and 2002 peaks. This breakout opens the possibility of a further rally of more than 40 percent.

With sentiment so lopsided and everything seeming to break in the dollar’s direction, a correction is very possible over the short-term. That said, a major bull market is underway and given the history of USD bull markets, this one could have a long way to go, either in percentage terms, time (measured in years), or both.

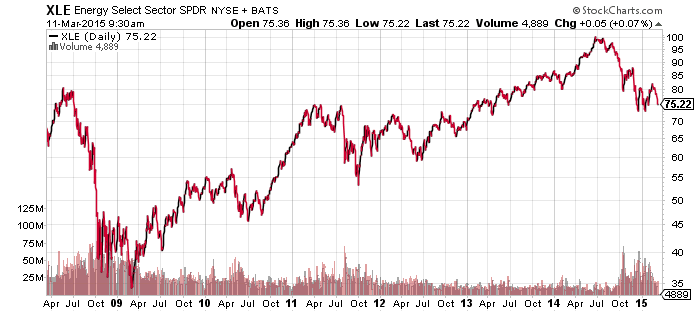

SPDR Energy (XLE)

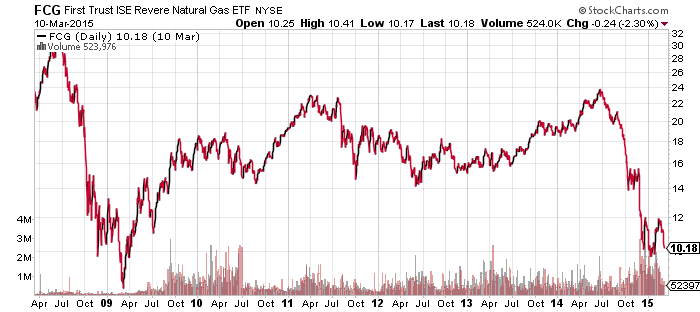

FirstTrust ISE Revere Natural Gas (FCG)

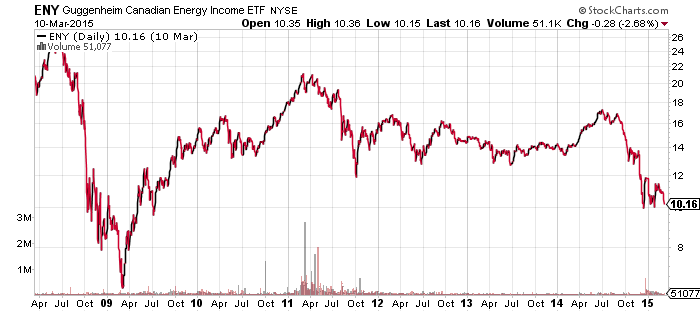

Guggenheum Canadian Energy Income (ENY)

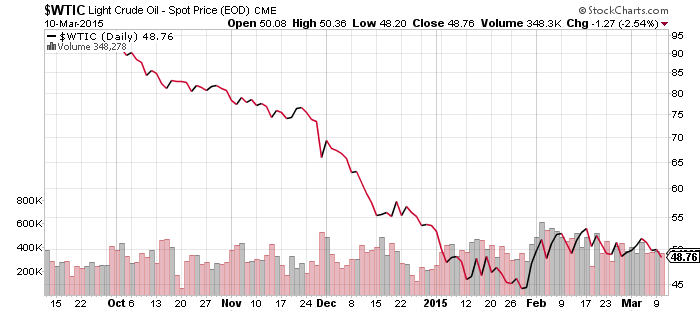

Energy related equities are looking to test their 52-week lows. A break below would be bearish in the near-term, potentially setting off another wave of selling.

Another move downwards in oil is also possible, with U.S. crude inventories climbing again last week to a new record high. The strong dollar is acting as a major headwind as well.

For energy equities, the main concern is long-term energy prices. Futures prices are now below $60 a barrel until April 2016, which indicates the market is turning a bit more pessimistic. Unless the prices come down substantially though, energy stocks are unlikely to break their lows.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

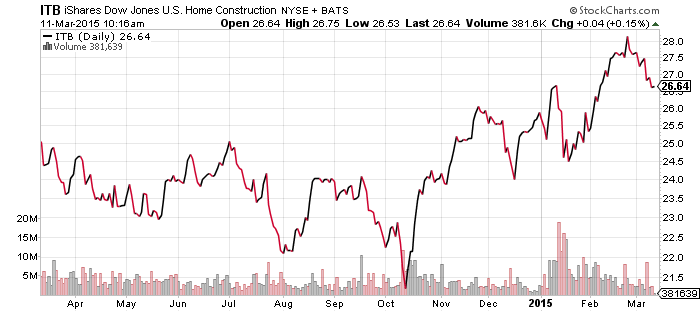

iShares US Home Construction (ITB)

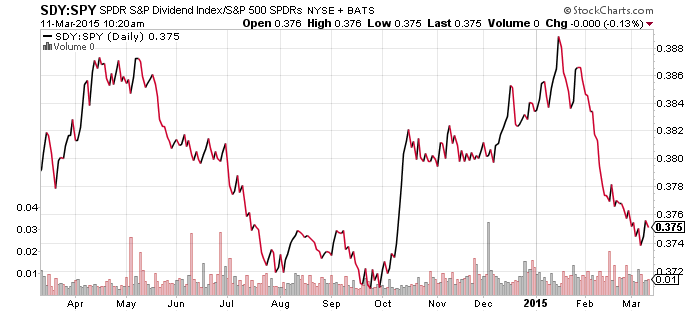

SPDR S&P Dividend (SDY)

SPDR S&P 500 (SPY)

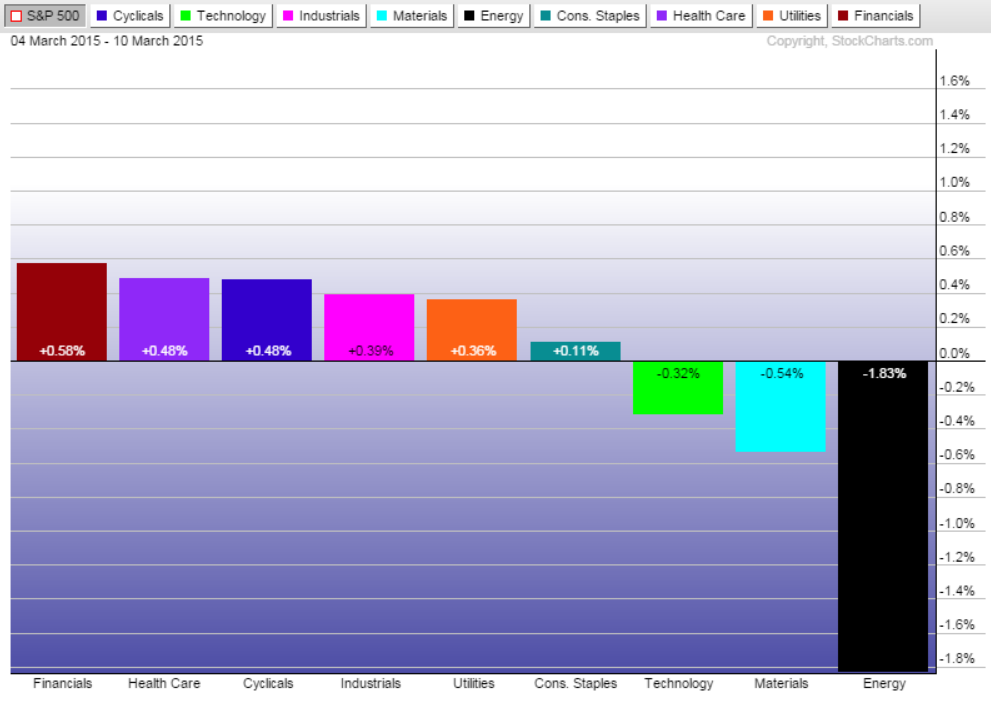

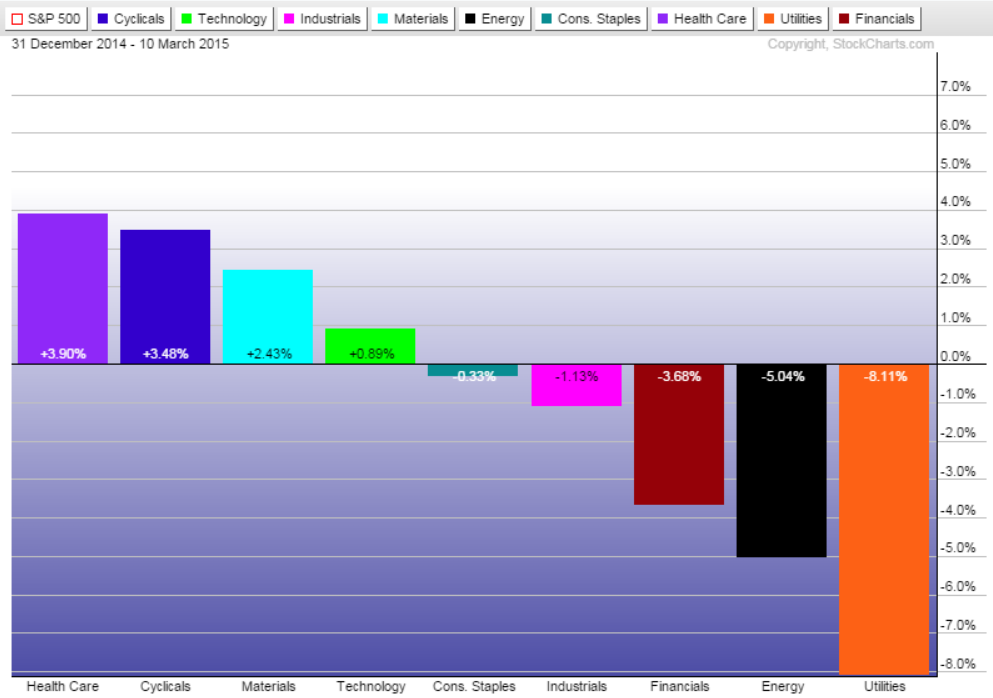

Over the past week, financials were the best performing sector. (Every sector fell on the week, but the week return chart below shows the relative performance.) The sector was lifted by the surge in February payrolls, which caused investors to expect a rate hike will be coming soon. As noted above, the Fed agrees and may remove the word “patient” from the Fed statement next Wednesday.

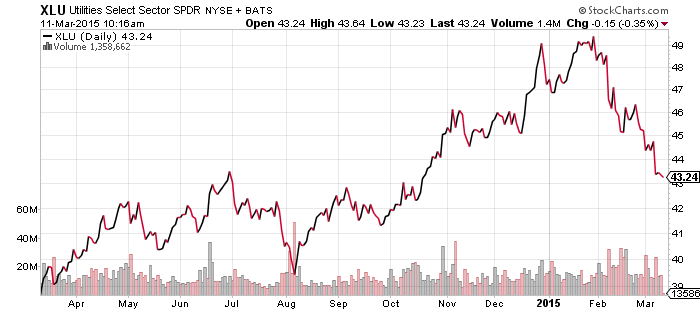

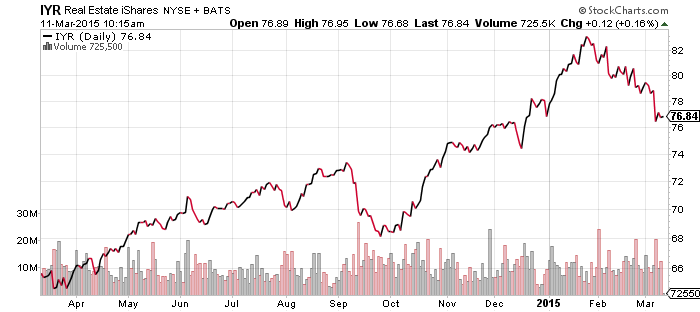

Year to date, utilities continue to correct after topping in February. Fears of higher interest rates are weighing on the sector, along with real estate and home builders. Higher interest rates are also causing dividend paying stocks to underperform the broader market.

SPDR S&P 500 (SPY)

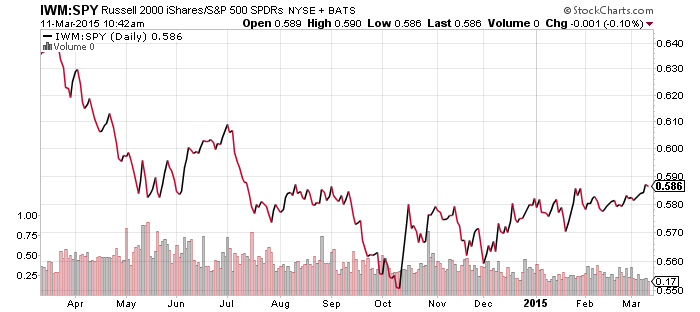

iShares Russell 2000 (IWM)

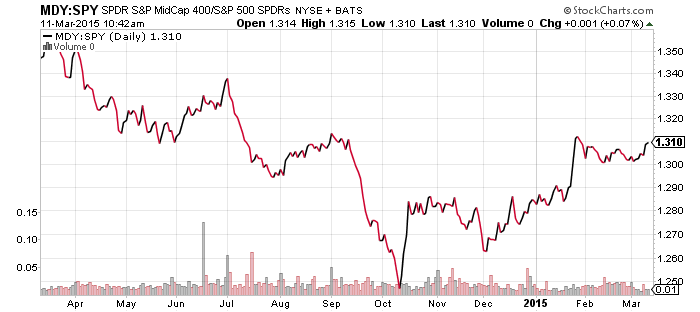

S&P Midcap 400 (MDY)

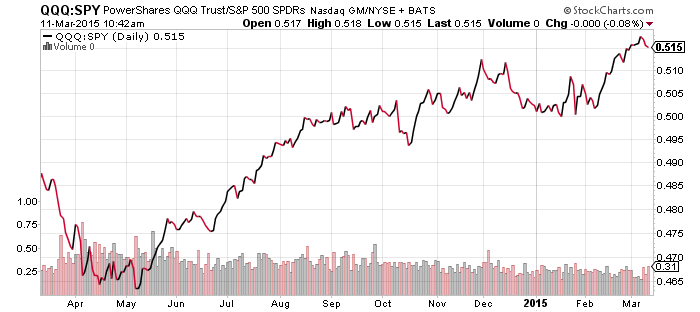

PowerShares QQQ (QQQ)

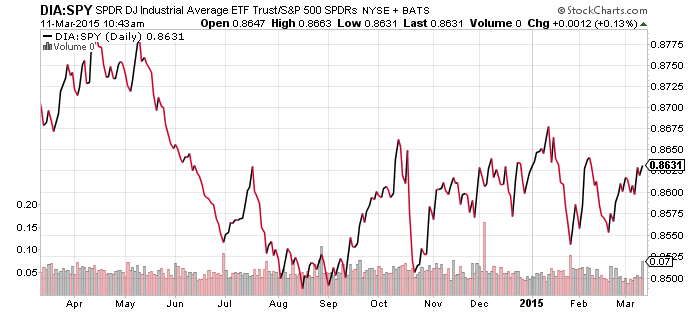

SPDR DJIA (DIA)

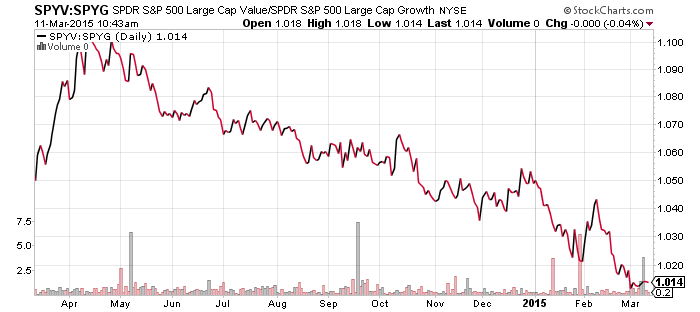

SPDR S&P 500 Large Cap Value (SPYV)

SPDR S&P 500 Large Cap Growth (SPYG)

Small- and mid-caps continued to outperform the S&P 500 Index last week, a positive sign considering the market retreated. Additionally, the DJIA beat the S&P 500, while the Nasdaq underperformed. Value and growth stocks delivered largely the same result, causing the price ratio to flatline.