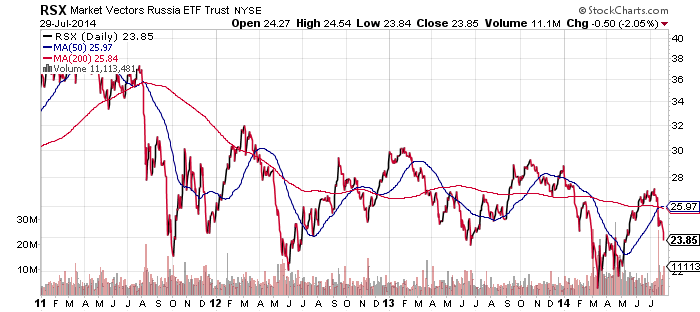

Global X Social Media (SOCL)

Two weeks ago, negative comments about social media valuations in the Federal Reserve’s semi-annual report to Congress weighed on the sector. Since then, social media stocks have rallied strongly. Facebook (FB) surprised with a much stronger than expected report last week. Yesterday, Twitter (TWTR) announced positive earnings, even though analysts have forecasted a loss. Shares jumped nearly 30 percent in after hours trading. While Twitter is less than 4 percent of SOCL, a 30 percent move, if it holds, will deliver a gain of more than 1 percent for the fund.

In order for the picture to turn bullish for SOCL, the fund needs to climb above the near $20 level seen in early July. That is a less than 2 percent move away from Tuesday’s close and if the Twitter gains hold, adding 1 percent to NAV, a new short-term high could come very soon.

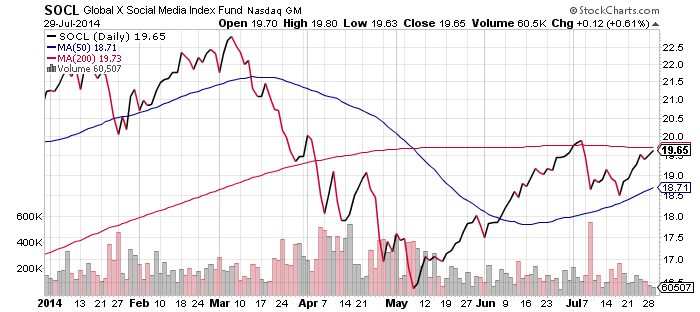

iShares FTSE/Xinhua China 25 (FXI)

Chinese shares rallied over the past week, both in Hong Kong and on the mainland. Investors turned optimistic following improvements in provincial GDP growth and some easing of real estate buying restrictions. This move can also be seen as a delayed effect. We have featured copper mining shares a few times before and China is the main driver of demand growth. Optimism over China’s economic performance pulled copper and other industrial metals higher going on three months; it was only a matter of time before China itself joined in.

A short-term rally may occur over the next month. However, we may not know before September or October if the gains will hold. By then, real estate data will indicate a major slowdown or stabilization in prices. Traders may want to play the rally, but long-term investors should wait for a clearer bullish signal. China grew faster thanks to short-term stimulus plans aimed at shoring up political support. The leadership is in the middle of a massive anti-corruption campaign that is taking down political enemies at a rapid pace. Once the leadership is confident in its position, it will have greater latitude to allow home prices to fall and GDP growth to slow as part of their reforms. On the flip side, if by September and October real estate prices have bottomed, it would be a solid sign that the government is going to ease policy and print money to avoid any slowdown, in which case the market should move higher.

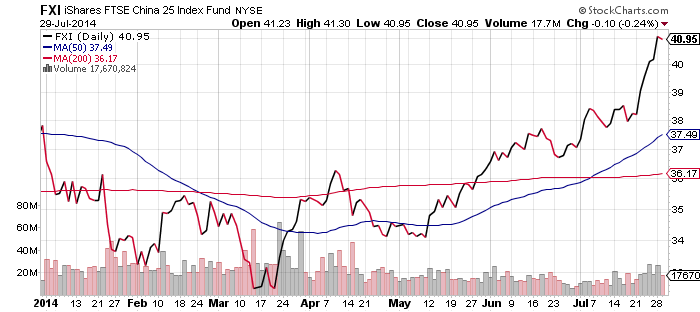

iShares PHLX SOX Semiconductor (SOXX)

Weakness in Qualcomm (QCOM) and Applied Materials (AMAT) hit the semiconductor sector for a big loss over the past week. QCOM was whacked by news that it was having trouble collecting royalties in China. Soon after, news indicated China would declare QCOM a monopoly and fine the firm. U.S. technology firms have been targeted by China’s government in the wake of the NSA spying revelations, with Microsoft (MSFT) recently hit with an investigation and IBM also coming under attack.

The slide in price, whatever the reason, isn’t a big surprise given that SOXX is one of the highest ranked funds in terms of momentum. Momentum stocks and funds tend to be very volatile, particularly when it comes time for a sell-off. SOXX slipped about 5 percent in a little over a week. However, it is still up 20 percent since early February, better than double the return for the S&P 500 Index.

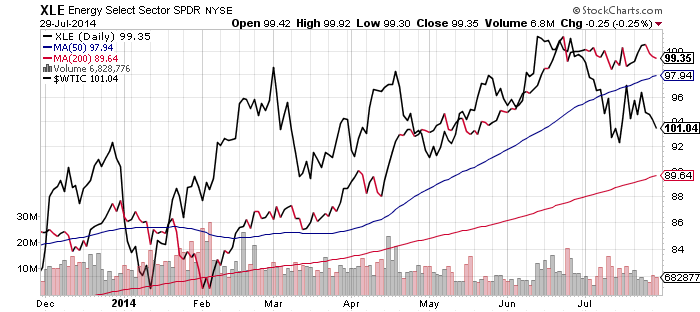

SPDR Energy (XLE)

The two best performing sectors in the first half were energy and utilities. Over the past month, they are the two worst performers. Energy has gone sideways since mid-June as oil prices (the black line) have been in a downtrend. Nevertheless, it would not take much to push XLE higher considering Exxon (XOM) reports earnings later this week and is 15 percent of the fund’s assets.

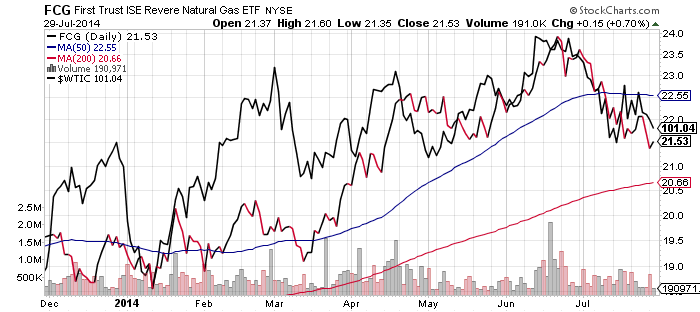

In contrast with XLE, the more volatile FCG has tracked closely with oil and natural gas prices.

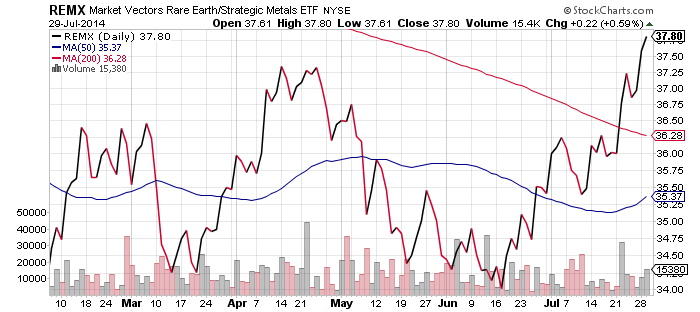

Market Vectors Rare Earth (REMX)

The rally in Chinese shares and industrial metals is branching out into the more volatile segments of the market. For example, REMX is up more than 10 percent in the past six weeks. Coal and uranium are up as well. Rare earth miners have been in a bear market since 2011. It will take some time before we are convinced this rally will be sustained.

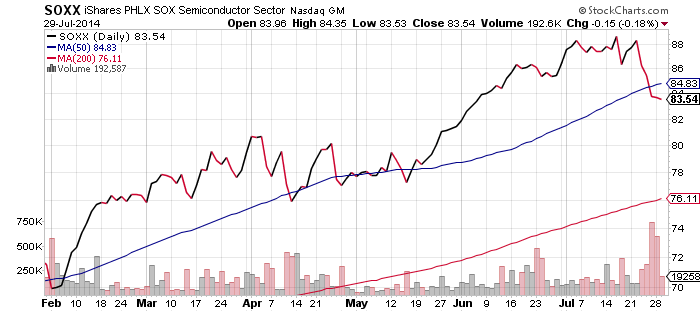

Market Vectors Russia (RSX)

Russian shares are cheap once again. New economic sanctions from the EU pushed the Russian stock market lower and the slide in energy prices doesn’t help. Shares of RSX have been making a series of lower highs and lower lows since 2011. This is a textbook bear market but Russian valuations are also very cheap relative to global markets. Until the pattern of lower highs and lows is broken, the forecast will be for lower prices. However, long-term investors looking for value should have Russia on their list of markets to investigate.