iShares U.S. Technology (IYW)

SPDR Technology (XLK)

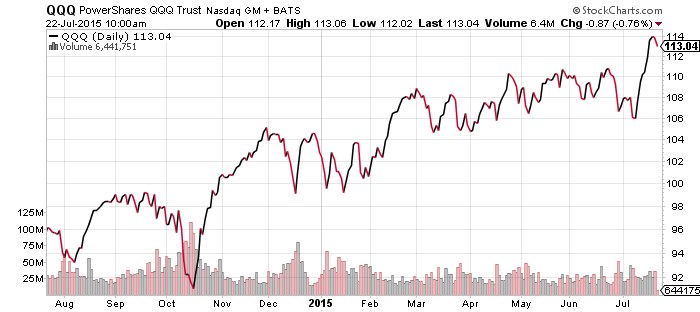

PowerShares QQQ (QQQ)

Apple (AAPL) disappointed investors on Tuesday evening; earnings were strong, well ahead of the street’s expectations, but sales of the Apple Watch were quite weak. As a result, shares dipped about 7 percent before rebounding. The drop is important for the broader market, since Apple is the largest holding in the S&P 500 Index at 4 percent of assets. A 5 percent drop in Apple caused the S&P 500 to lose 0.2 percent. The funds listed above have double digit exposure, with IYW at more than 20 percent. Apple’s 5 percent loss in early trading equates to a 1 percent decline for IYW.

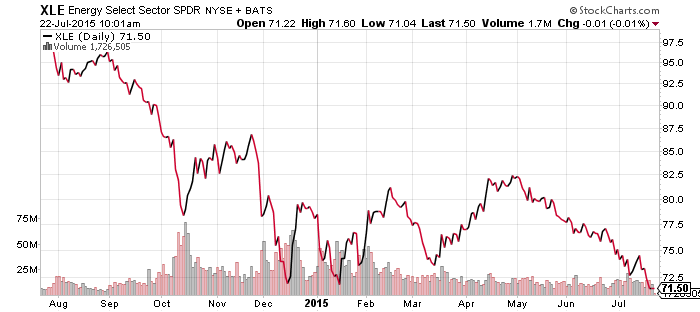

SPDR Energy (XLE)

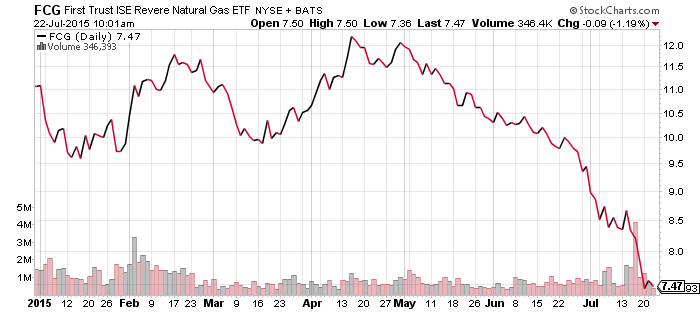

FirstTrust ISE Revere Natural Gas (FCG)

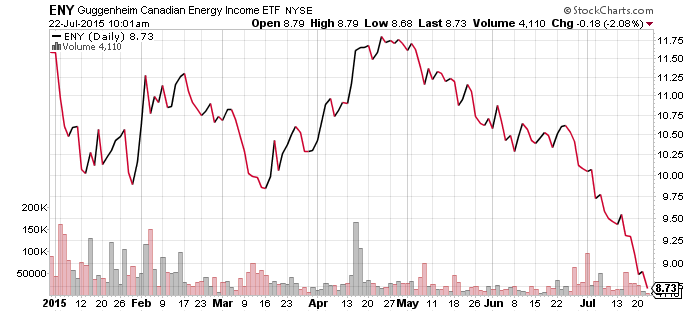

Guggenheim Canadian Energy Income (ENY)

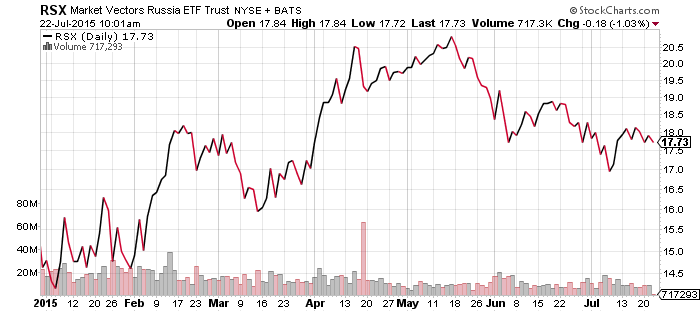

Market Vectors Russia (RSX)

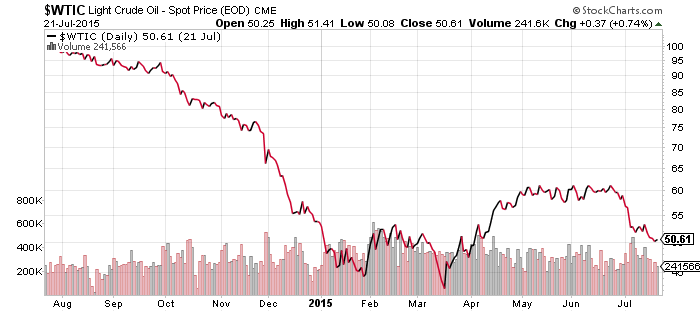

Domestic oil prices are battling to hold the $50 level as energy related equities begin to probe new lows. FCG and XLE both fell to new lows in July. Foreign country ETFs dominated by oil exporters, such as RSX, are faring much better.

There are four factors working to pressure oil at the moment. First, the Iran nuclear deal will put their oil back on the world market. Additionally, Iran is believed to have stored between 30 and 50 million barrels of oil in tankers in expectation of an agreement. Secondly, concern surrounding China has pressured all commodities over the past two weeks. Third, the stronger U.S. dollar is also hurting commodity prices. Fourth, U.S. inventories increased last week according to the American Petroleum Institute and the Energy Information Administration. It was the largest weekly increase in inventory since April.

SPDR Gold Shares (GLD)

iShares Silver Trust (SLV)

ETFS Platinum (PPLT)

ETFS Palladium (PALL)

iPath Bloomberg Copper (JJC)

Oil isn’t the only commodity under pressure. Gold, platinum, palladium and copper were also hit as concerns about China’s economy weighed on all industrial commodities. Gold is not an industrial commodity, but an investor in China dumped 5 tons of physical gold in the span of approximately 2 minutes on Monday. Whether it was a desperate seller looking to cover losses in the stock market, or an opportunistic seller looking to push the market lower, it could be a sign of potential deflation for the global economy as China’s credit bubble unwinds.

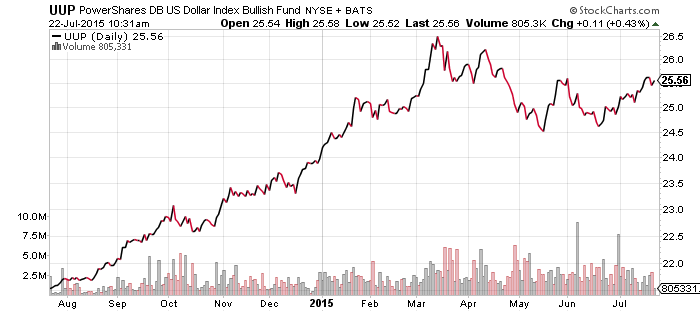

PowerShares U.S. Dollar Index Bullish Fund (UUP)

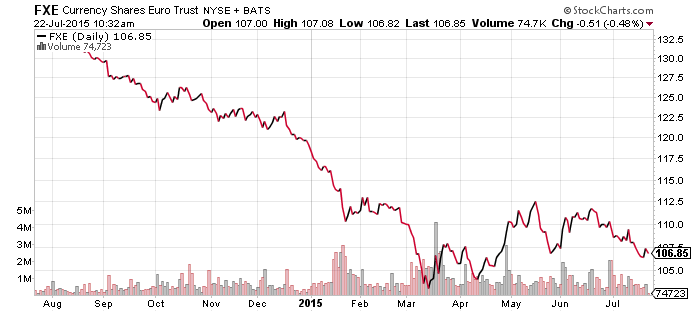

CurrencyShares Euro Trust (FXE)

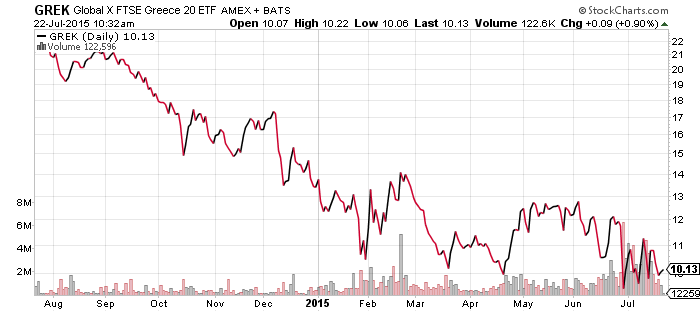

Global X FTSE Greece 20 (GREK)

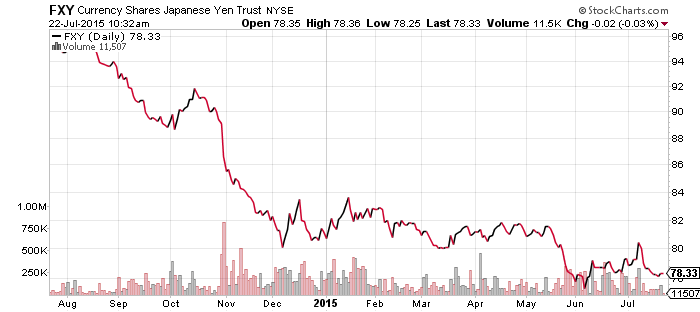

CurrencyShares Japanese Yen (FXY)

WisdomTree Emerging Market Currency (CEW)

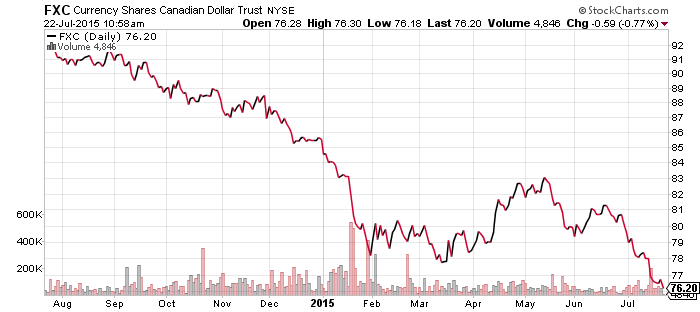

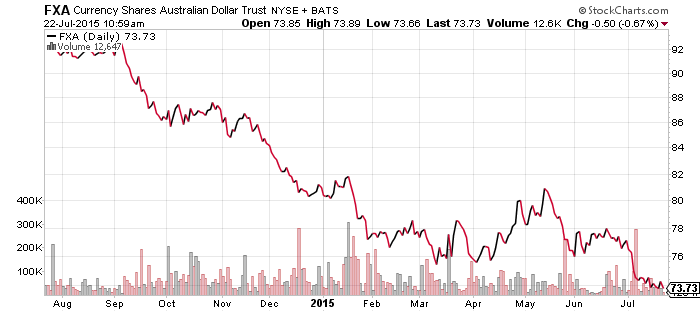

The U.S. dollar moved closer to its 2015 highs over the past week due to the Greek bailout deal pushing the euro lower. Canada also made a surprise interest rate cut that sent the Canadian dollar lower. The Asian Dollar Index is at a new low versus the U.S. dollar, as is the Australian dollar. The yen and emerging market currencies are close to their lows.

The Greek bailout will be a key factor in the weeks ahead. Negotiations are underway and a final deal still needs to be reached. There is talk of new elections in September or October as well, due to many Syriza members opposing the bailout.

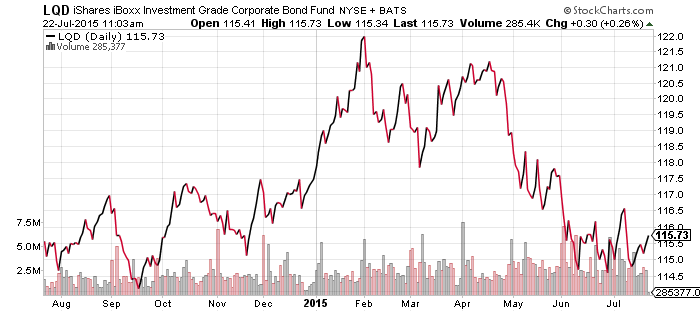

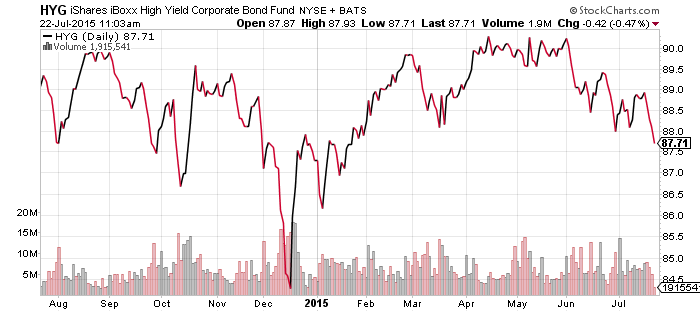

iShares iBoxx Investment Grade Corporate Bond (LQD)

iShares iBoxx High Yield Corporate Bond (HYG)

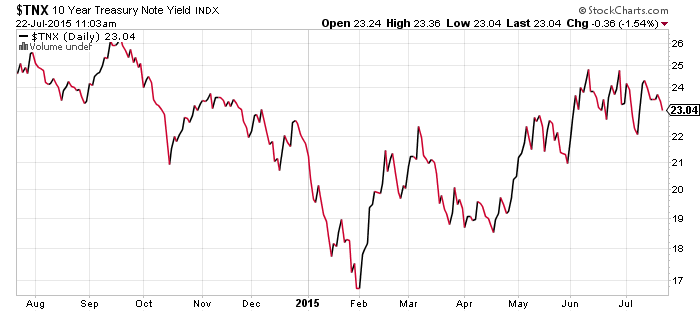

Weakness in energy prices weighed on HYG, due to exposure to shale drillers who issued high yield debt. Interest rates moved lower over the past week and lifted LQD, but the 10-year yield remains near its highs for the year. Federal Reserve Bank of St. Louis President Bullard recently said a September rate hike is a 50/50 possibility. Next week the Fed meets and if a September rate hike is coming, they are likely to signal it by changing the language of the policy statement.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

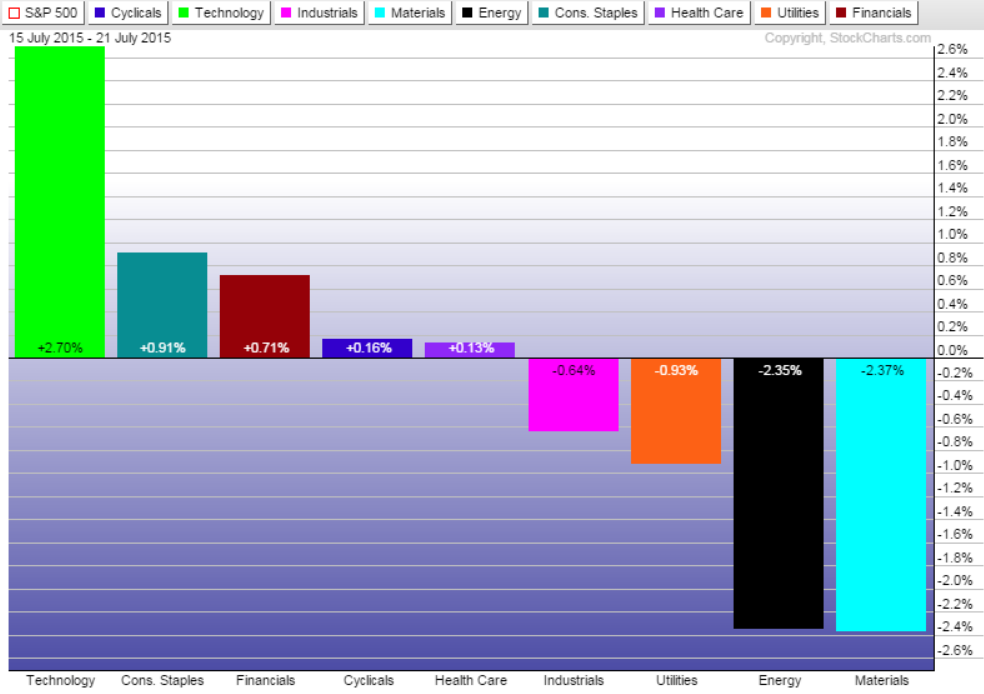

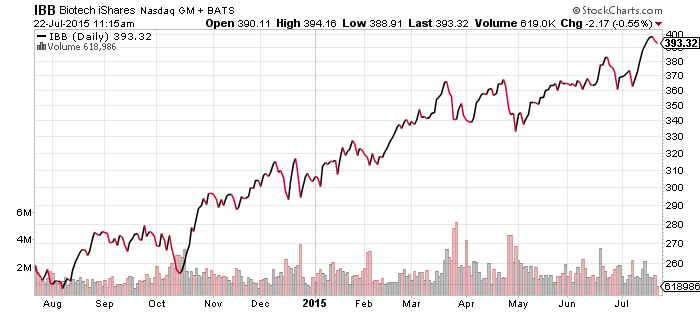

Technology has been the big winner of the week as of Tuesday’s close but the disappointing results from Apple and a few other firms weighed on the sector on Wednesday. Biotechnology hit a new all-time high in the past week.

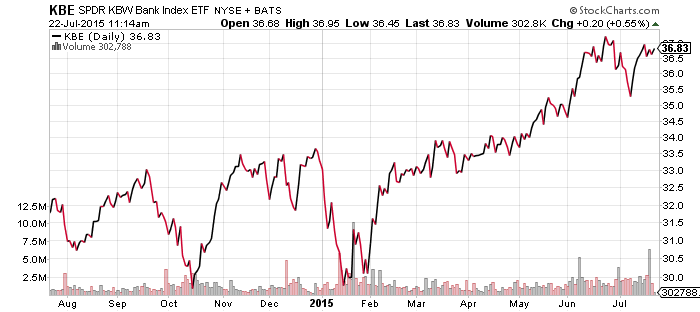

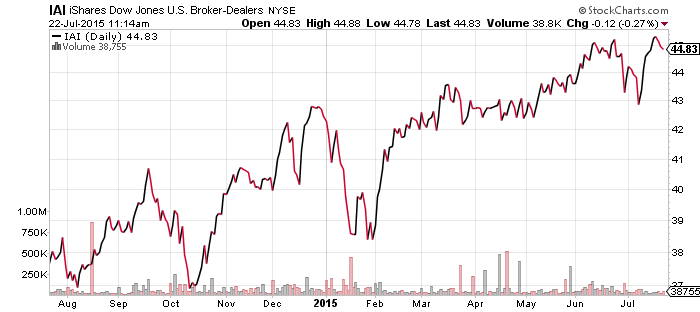

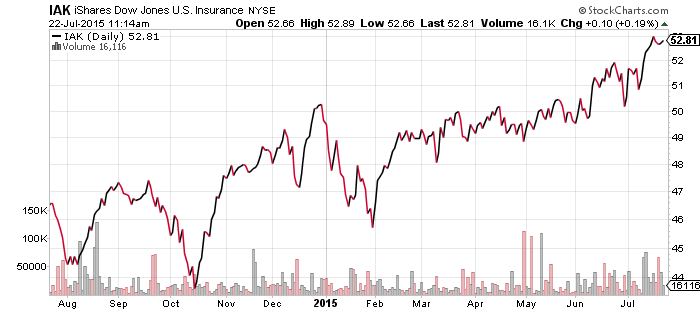

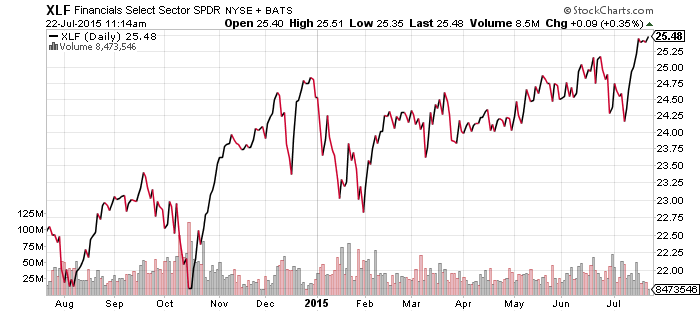

Financial ETFs are also marching to new highs, led by the broker-dealers and insurance companies. Banks are holding near their highs for the year but the rise in other financial shares was enough to push diversified financial ETFs to new 52-week records.

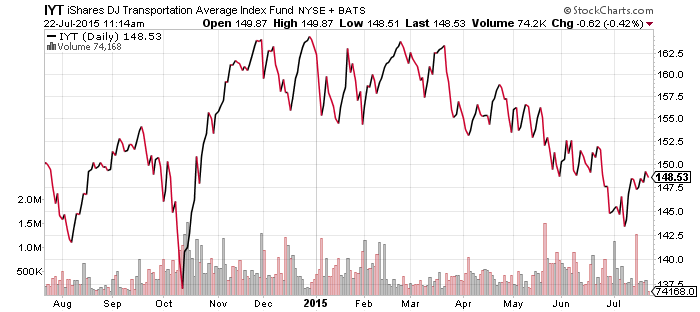

Transports remain in a downtrend, though it did rebound last week. The $150 level is a near term hurdle for the shares.

SPDR S&P 500 (SPY)

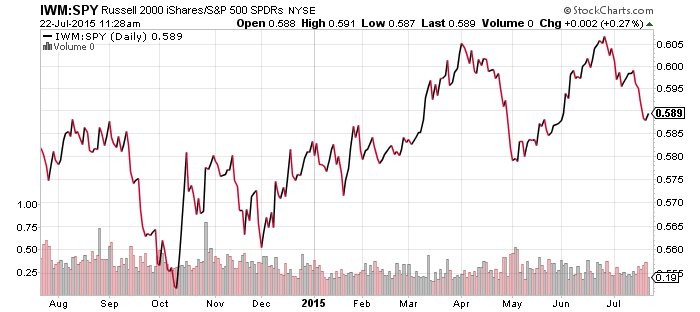

iShares Russell 2000 (IWM)

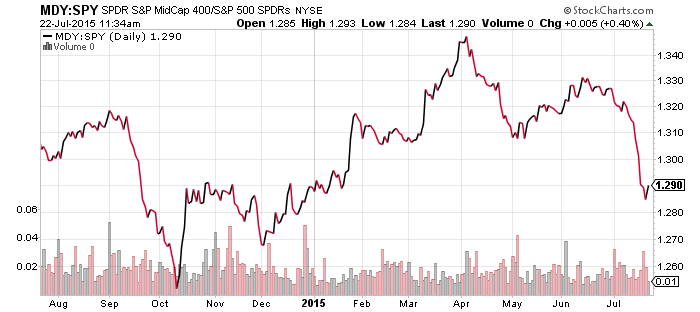

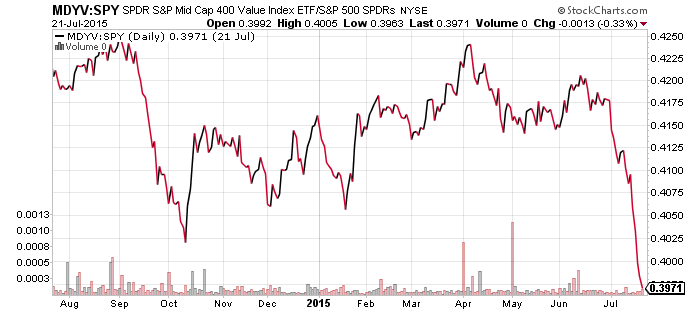

S&P Midcap 400 (MDY)

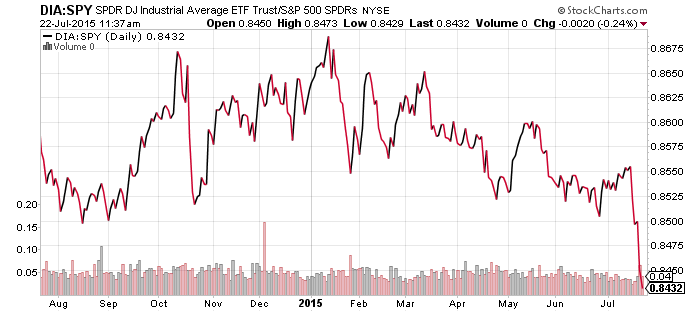

SPDR DJIA (DIA)

PowerShares QQQ (QQQ)

Small-caps underperformed last week, as they have for all of July. Nevertheless, they are still in an uptrend since May. Mid-caps have been a disappointment and it’s almost all due to the slide in value stocks. The main weakness is in industrials, which also pulled the Dow lower versus the S&P 500 Index. Finally, last week’s bounce in technology is very evident in the chart of QQQ versus SPY.