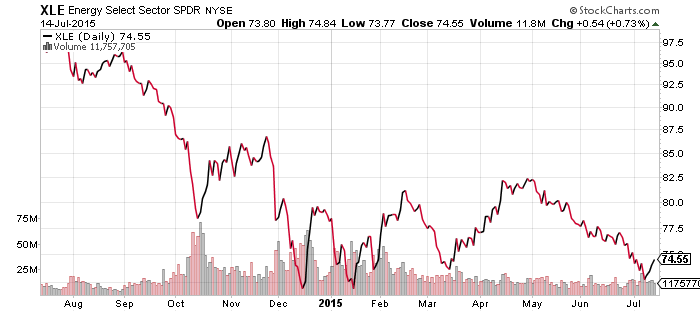

SPDR Energy (XLE)

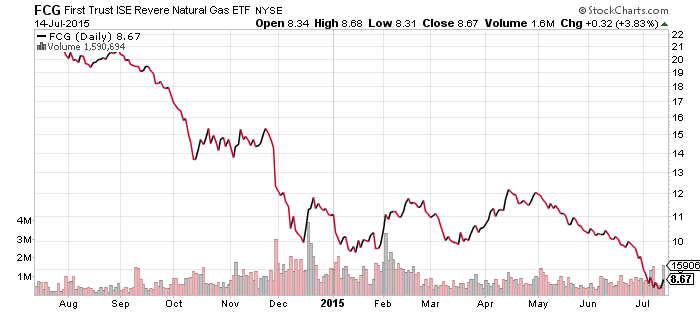

FirstTrust ISE Revere Natural Gas (FCG)

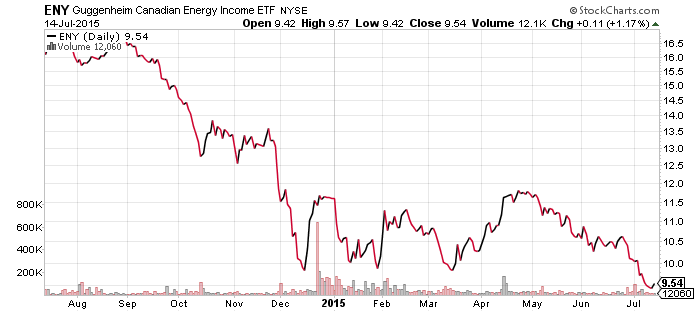

Guggenheim Canadian Energy Income (ENY)

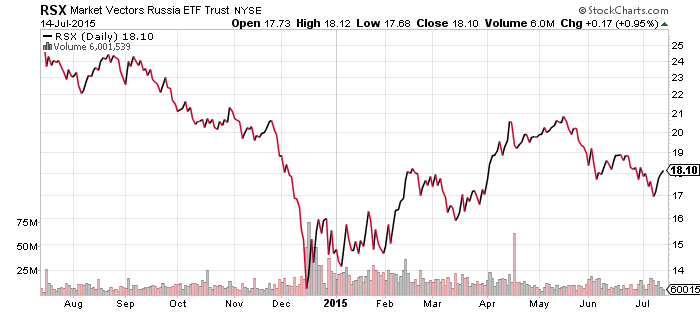

Market Vectors Russia (RSX)

Global X FTSE Norway 30 (NORW)

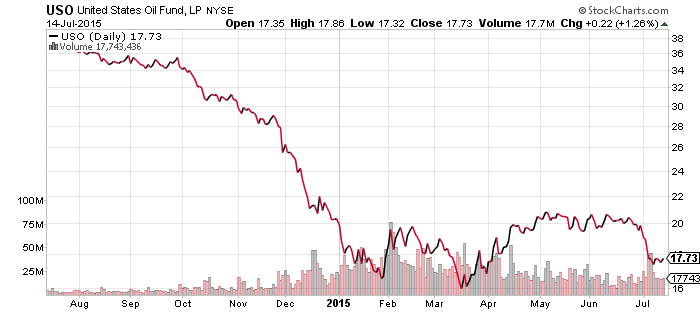

Yesterday’s nuclear deal will bring foreign investment back to Iran, eventually leading to greater energy production. Oil prices rallied about 1.5 percent on Tuesday, indicating much of the deal was already priced in by traders.

XLE rebounded over the past week, despite weakness in oil prices. FCG and ENY saw much smaller gains. RSX and NORW saw rebounds similar to XLE. Energy is making an important base here and China is likely to become the center of attention when it comes to energy prices. If the country avoids a further slowdown, oil prices will be able to move higher. If China’s slowdown isn’t finished or investors simply worry that the slowdown is expanding, then a test of the March low is possible.

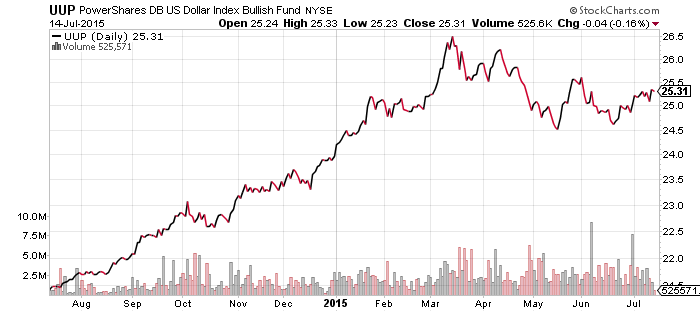

PowerShares U.S. Dollar Index Bullish Fund (UUP)

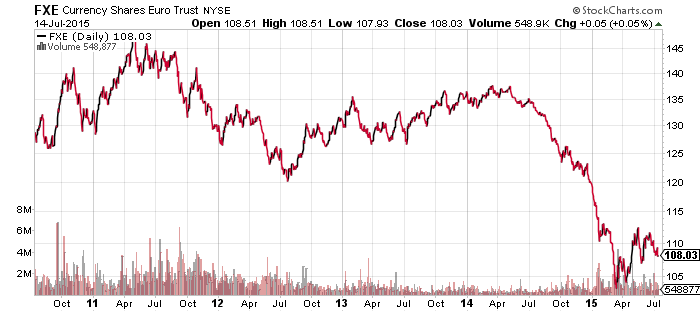

CurrencyShares Euro Trust (FXE)

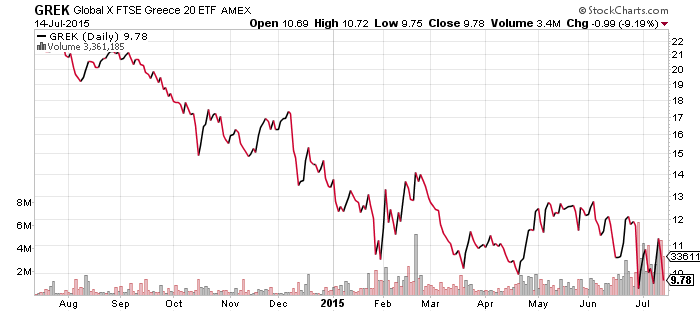

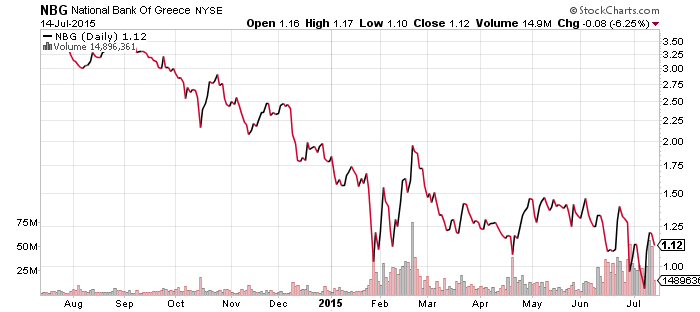

Global X FTSE Greece 20 (GREK)

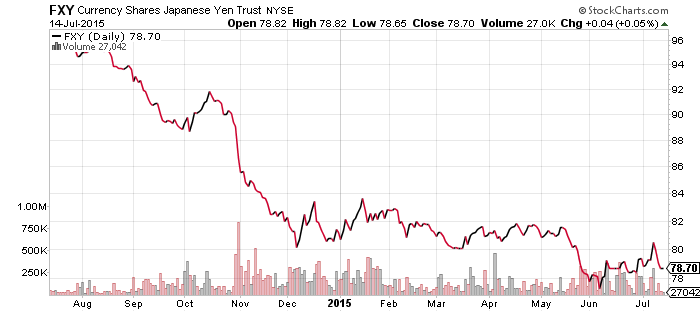

CurrencyShares Japanese Yen (FXY)

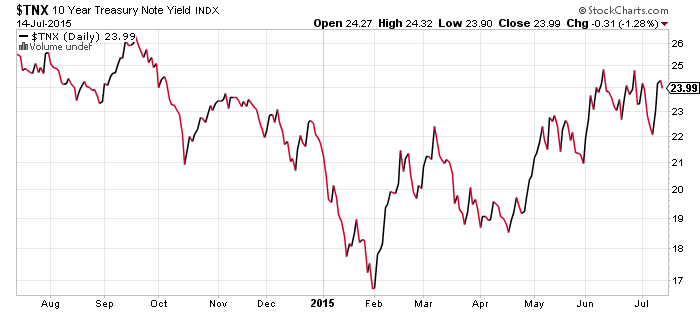

The U.S. dollar appears to be tracing out a multi-month correction. If the pattern continues at the present rate, the U.S. dollar could be challenging its old highs sometime in September or October. A major factor is the euro, which makes up 58.6 percent of the U.S. Dollar Index.

The euro’s chart is the opposite of UUP’s and is in an uptrend since March. Instead of signaling a rebound in the U.S. dollar, the chart of FXE shows a steady rebound. A longer-term chart appears less bullish though, with the recent bounce a very weak correction of the previous year’s plunge from about $135 per share down to less than $105 per share.

One of these two charts is wrong unless the Japanese yen, which has about one-fourth the euro’s weight in the index, collapses in value. The weak yen is supporting the greenback and currently sits near its lows for the year. It’s unlikely the yen would drop in isolation though; more likely the euro and other world currencies would also tumble versus the dollar.

We may get an indication of the future shortly if the Greek deal holds. The euro has been remarkably steady in the past couple of weeks. However, once a clear path is set for Greece, the euro may break out of its tight range. The bearish scenario would be a Greek bailout, since it will require a lot of money from Europe, much of which may be financed by the European Central Bank. While a deal is on the table for Greece, there are many opponents and failure to pass it would result in a Greek exit from the euro. Even if the government passes the bailout, it’s possible the current government would fall and a new government could choose to reject the deal and leave the euro.

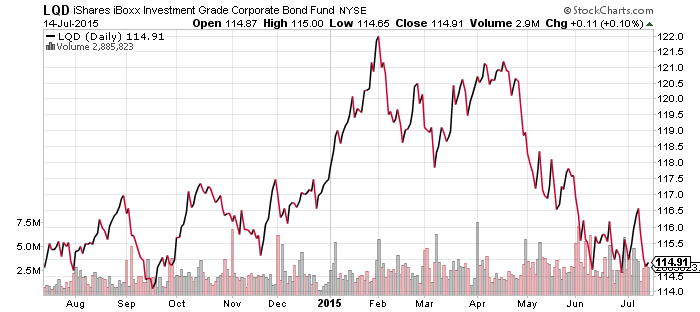

iShares iBoxx Investment Grade Corporate Bond (LQD)

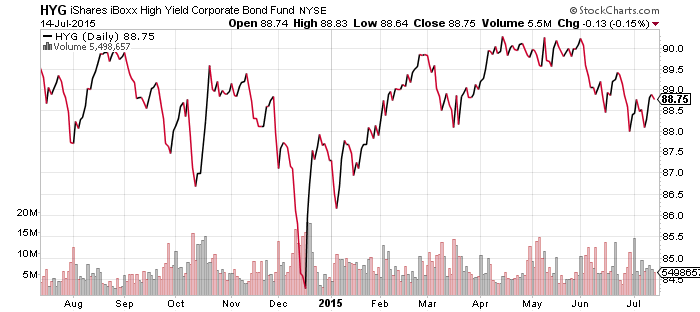

iShares iBoxx High Yield Corporate Bond (HYG)

Investment grade bonds and high-yield bonds edged lower as interest rates climbed in the wake of solid economic data. Last week, we learned that inventories grew more than expected in May, which lifts GDP growth estimates for the quarter.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

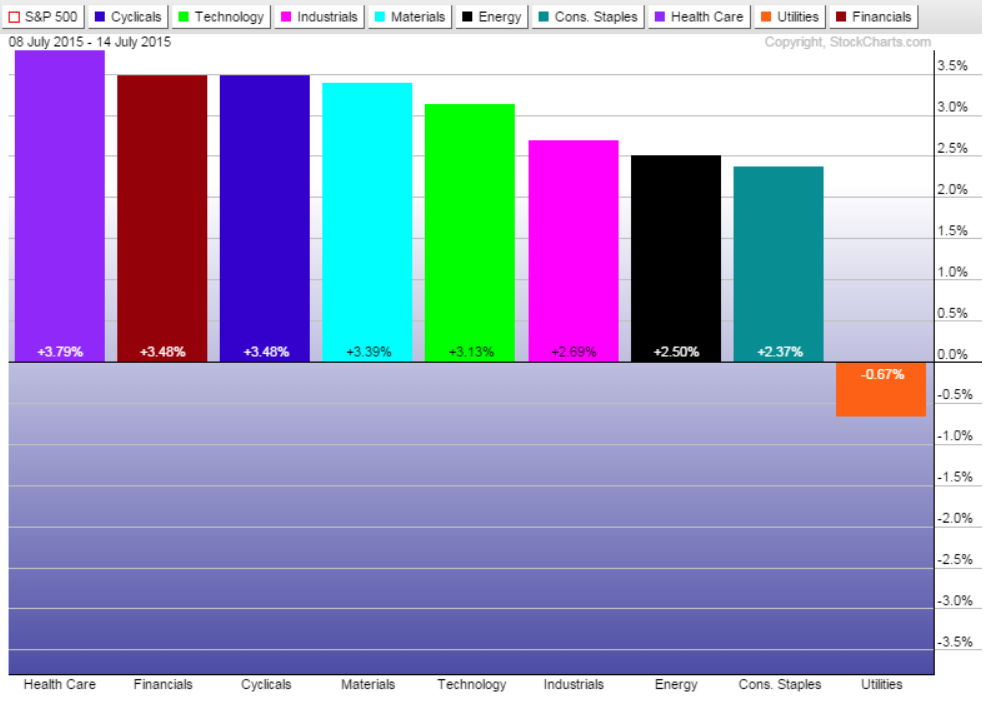

Utilities were up a week ago but have been hit by rising interest rates. It was the only sector that lost ground. Healthcare, financials and cyclicals led a relatively broad rally.

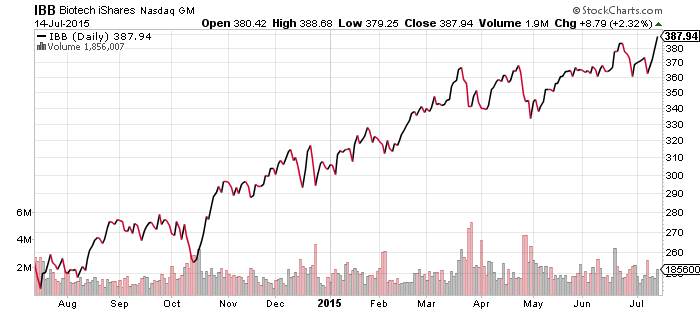

Biotechnology broke out to a new all-time high on Tuesday. Also breaking out to records was the overall healthcare sector, including pharmaceuticals and medical devices.

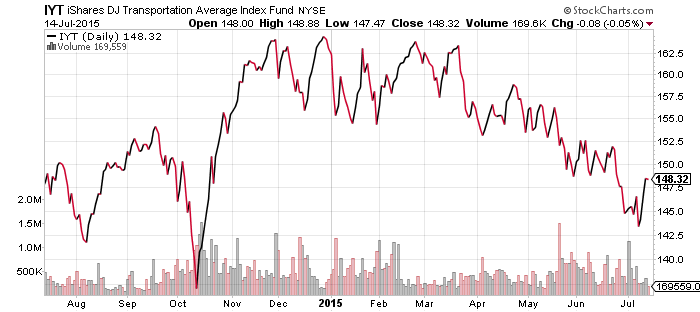

The transportation sector rebounded nicely over the past week, though it remains in a clear downtrend. A continued push higher over the next week could break this trend and improve the short-term technical outlook for the sector.

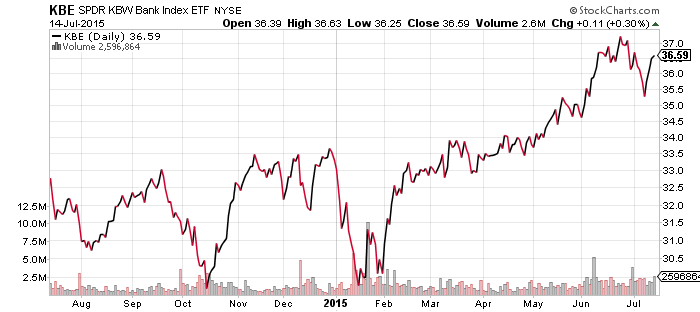

Bank shares have started reporting earnings, with J.P. Morgan (JPM) beating estimates on Tuesday. Interest rates are below their high for the year though and for now, that is weighing on the sector.

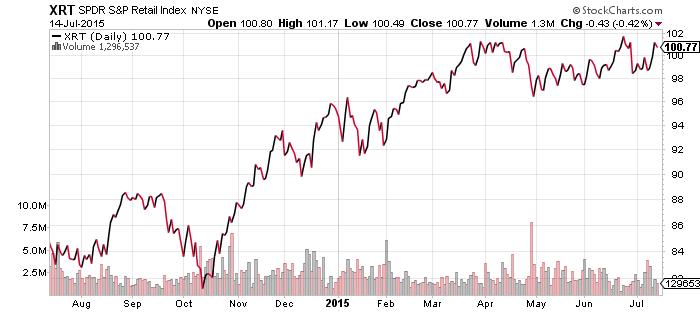

Retail sales fell 0.3 percent in June, versus expectations of 0.2 percent growth. The miss caused the retail sector to fall on a broadly strong day for the equity markets.

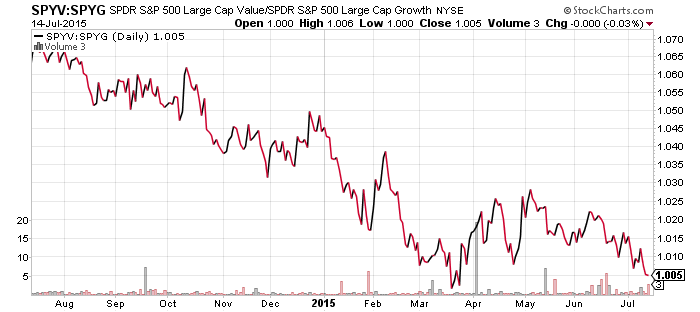

SPDR S&P 500 Large Cap Value (SPYV)

SPDR S&P 500 Large Cap Growth (SPYG)

Value is giving back its relative gains and a test of the lows could be coming. The potential shift from a growth-led market to a value-led market is looking increasingly less likely. Nevertheless, with financials doing well and energy likely to rebound, we won’t count value out just yet.

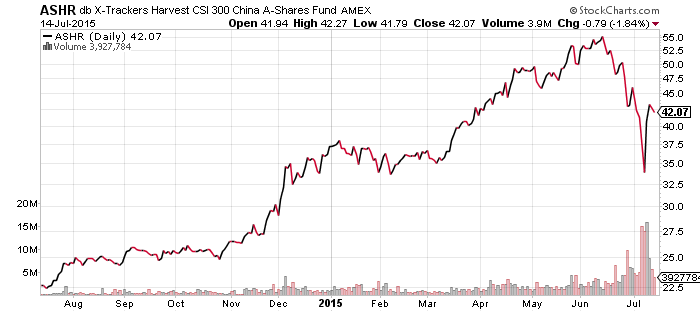

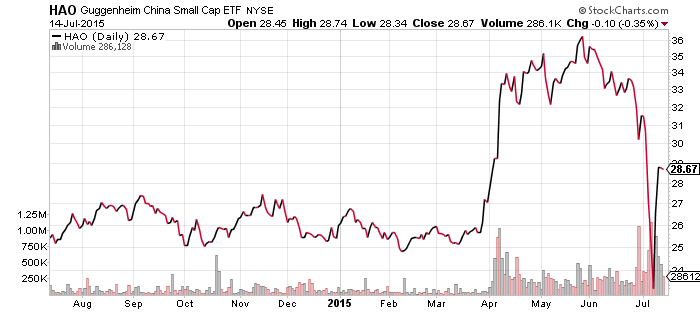

db X-Trackers Harvest CSI 300 China A-Shares (ASHR)

Guggenheim China Small Cap (HAO)

Extreme volatility marked the China ETF space in the past week. Last week, we noted that ASHR was selling at 10 percent discount to its NAV. That gap closed on Thursday and Friday. The Chinese government has launched a number of measures, including threatening short-sellers with jail time. Stocks responded with a strong rally, though many shares are still halted. Friday is the expiration date for futures contracts the government has targeted as the source of “malicious” short-selling activity. The market could continue rallying into Friday as the government tries to squeeze bears but it may have a harder time doing it next week and beyond.

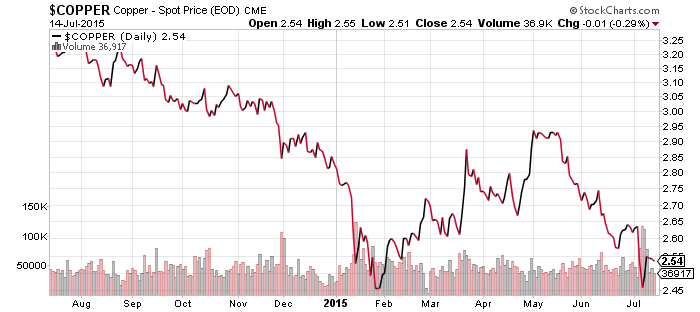

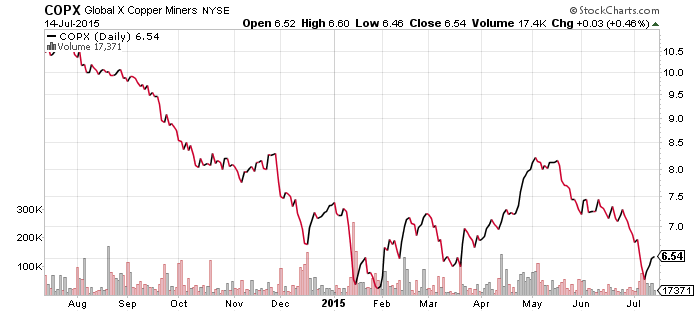

Global X Copper Miners (COPX)

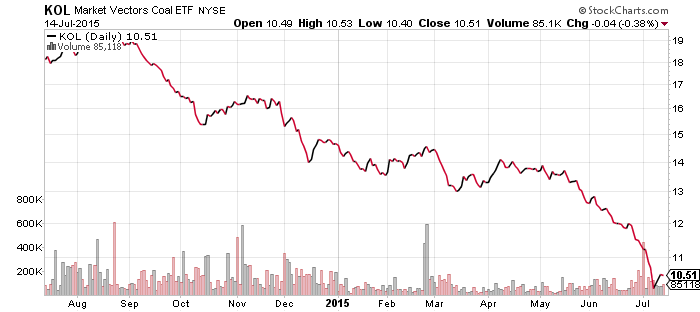

Market Vectors Coal (KOL)

Copper and coal rebounded along with Chinese stocks in the past week. That said, they are still weak and at risk of falling to new lows. China’s GDP data is scheduled to be released and will greatly influence the short-term trend in these commodities.