SPDR Energy (XLE)

United States Natural Gas (UNG)

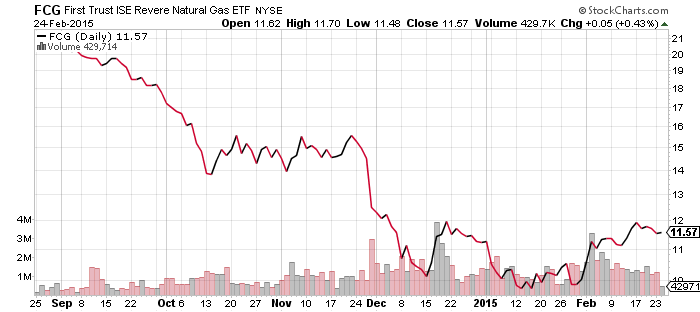

First Trust ISE Revere Natural Gas (FCG)

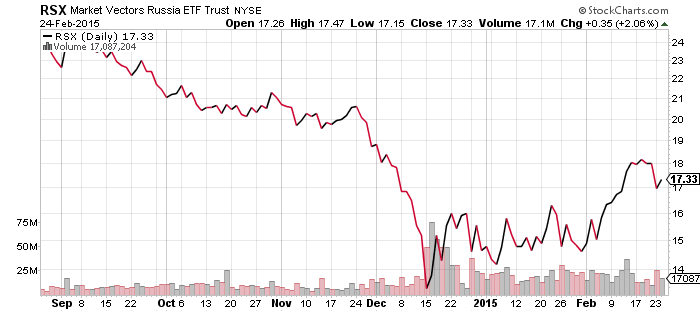

Market Vectors Russia (RSX)

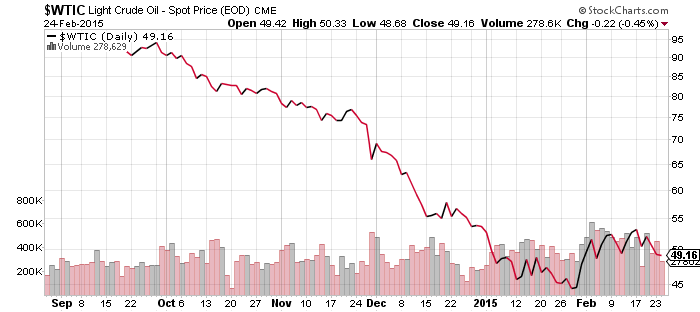

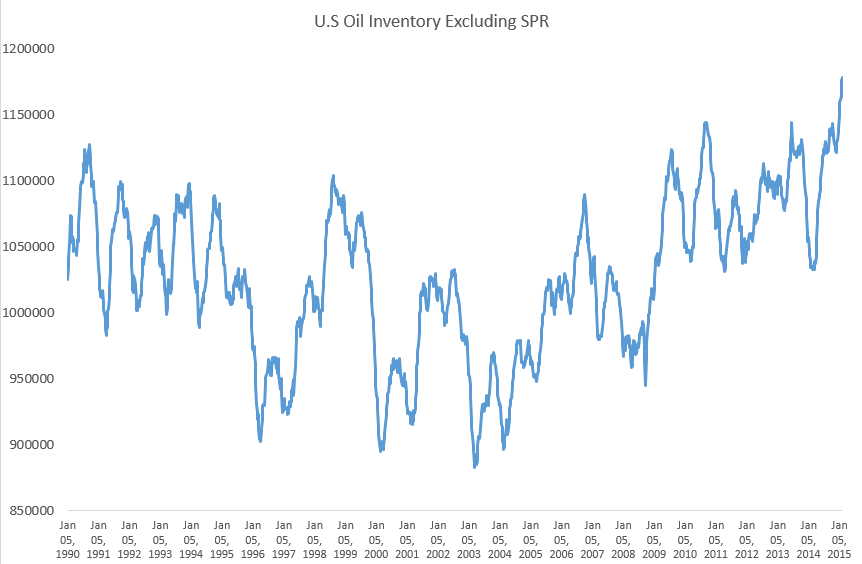

Oil prices may be stabilizing as demand rises and inventories increases. Today, Saudi Arabia’s oil minister said demand is recovering, signaling the drop in prices may be over. On the other side, rising crude inventories in the United States, now at all-time highs, indicate prices may struggle to rally in the immediate future.

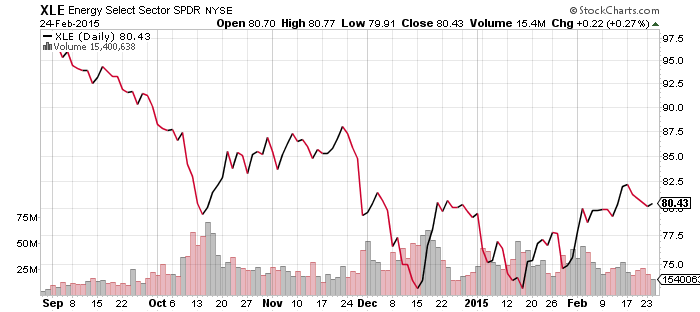

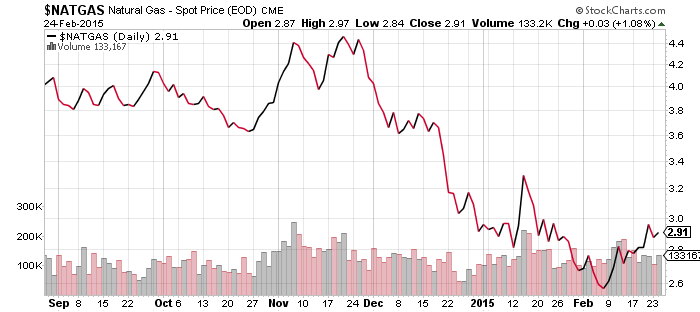

Energy stocks were flat on the week as oil slipped. Short-term traders betting on a rebound may be taking profits as well. Natural gas prices have come up, but natural gas producers continue to trade in line with the oil sector.

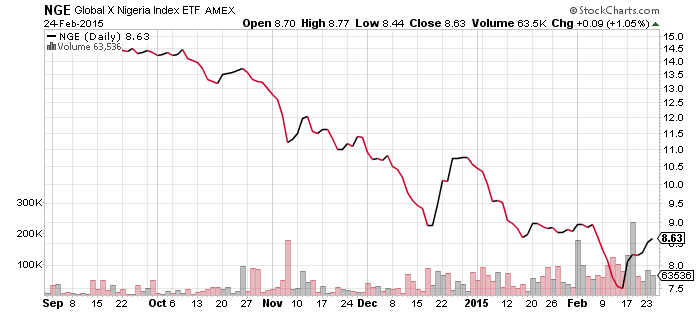

The Russian rally also paused last week, while Nigeria may have hit bottom.

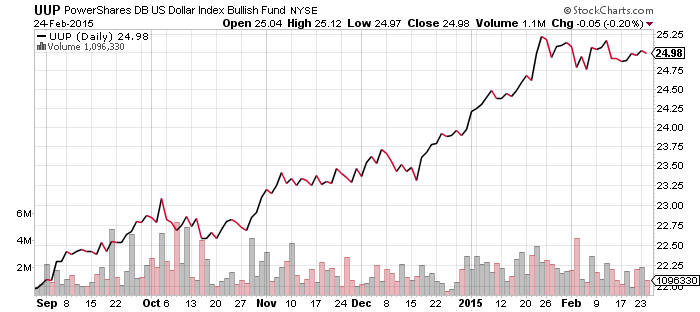

PowerShares U.S. Dollar Index Bullish Fund (UUP)

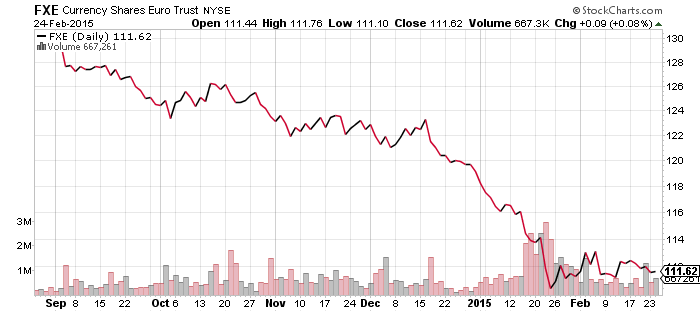

CurrencyShares Euro Trust (FXE)

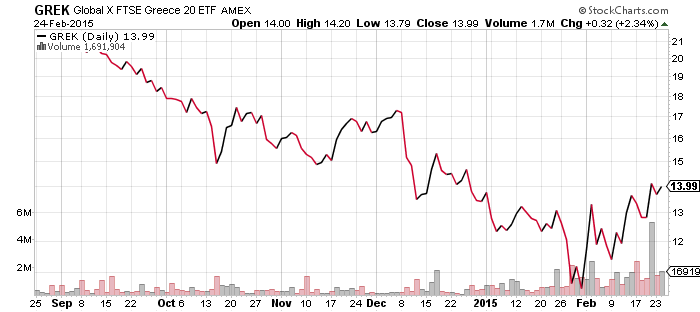

Global X FTSE Greece 20 (GREK)

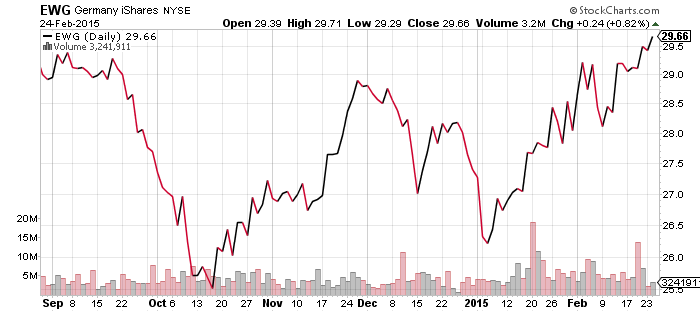

Europe can breathe a sigh of relief for another four months after a bailout extension for Greece was approved. European equities have rallied in response, but the currency market did not. At this point, a U.S. dollar correction is still possible, but far less likely. The sideways move in the greenback (and the euro) has moved the short-term technical indicators back towards normal. Without a catalyst to push the euro higher, the bull market in the dollar will likely reassert itself.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

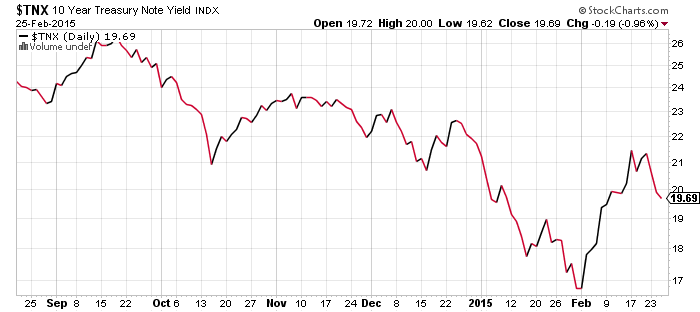

SPDR Financials (XLF)

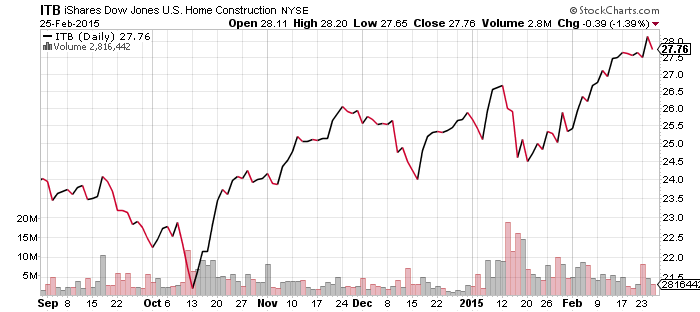

iShares US Home Construction (ITB)

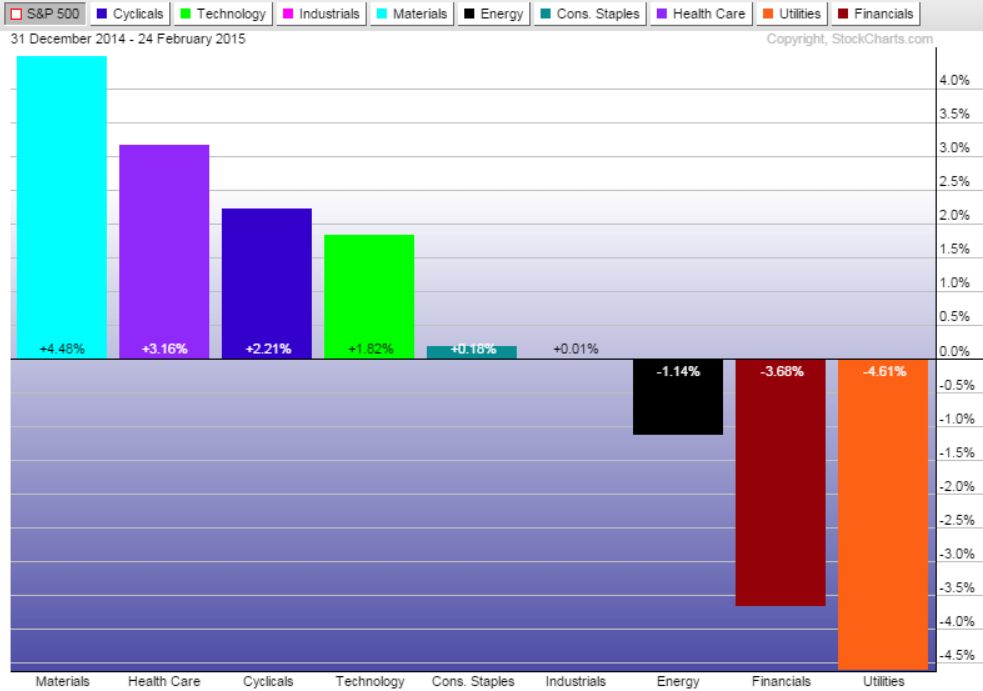

As noted above, the energy sector has retreated after a strong multi-week rebound. The sector performance chart below shows XLE trailed the S&P 500 Index by 1.83 percent last week. It was a positive week for the market overall though, which is why utilities and consumer staples also trailed the broader market. Financials were hurt by Fed meeting minutes which showed officials are not interested in hiking rates too soon, plus Janet Yellen’s comments that signaled rate hikes will come later rather than sooner. Healthcare was helped by a jump in pharmaceuticals and biotechnology.

Homebuilder ETFs rallied too, helped by strong fourth quarter earnings from Home Depot (HD). Sales came in ahead of expectations and earnings were up more than 40 percent from year-ago levels. The company also announced plans to repurchase $18 billion worth of shares and upped the dividend by 26 percent.

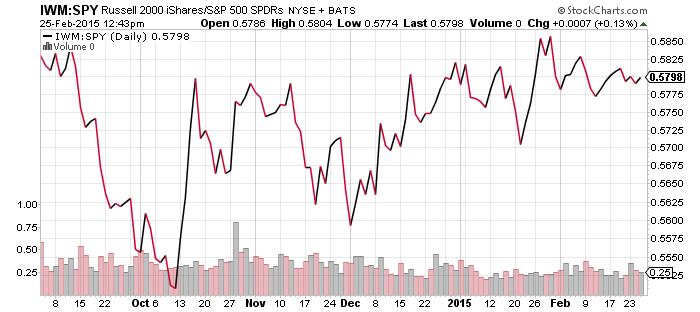

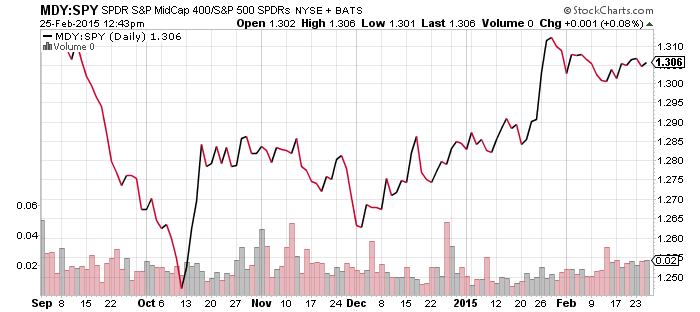

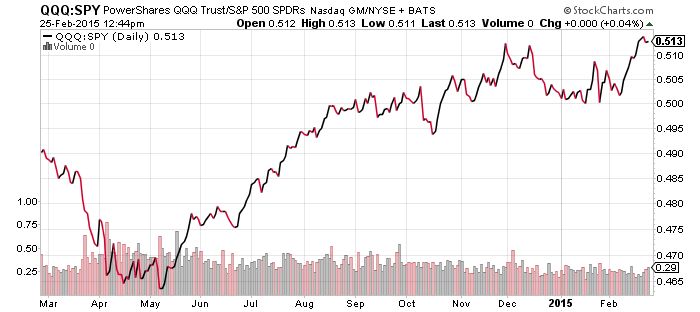

SPDR S&P 500 (SPY)

iShares Russell 2000 (IWM)

S&P Midcap 400 (MDY)

PowerShares QQQ (QQQ)

Small and mid-caps are still keeping pace with large caps as the major indexes push on to new all-time highs.

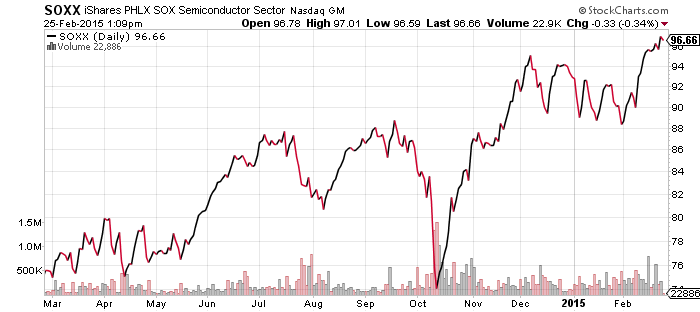

The Nasdaq is below its all-time high, but not by much. One good day would be enough to push the index up 1.5 percent to a new all-time closing high, while a gain of a little more than 3 percent will send the index to an all-time intraday record. Among the sectors propelling the Nasdaq is semiconductors, which has broken out to a new 52-week high.