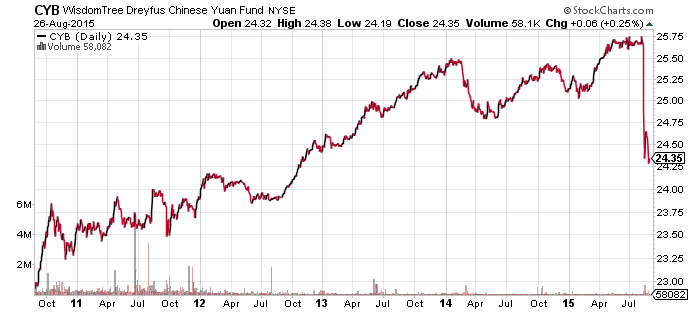

WisdomTree Chinese Yuan (CYB)

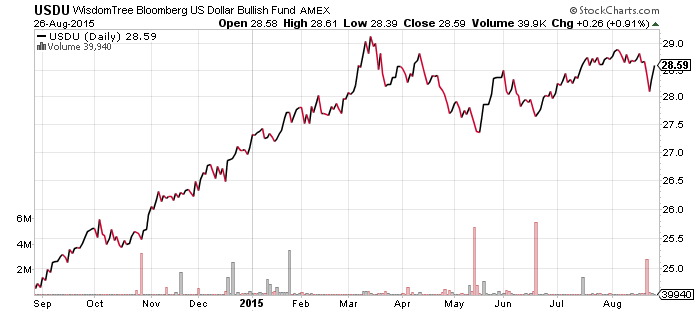

WisdomTree Bloomberg USD Bullish (USDU)

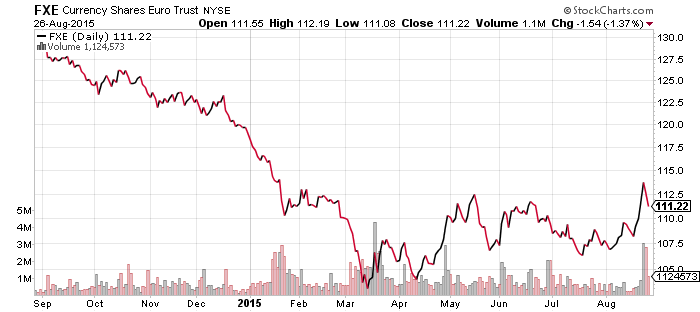

CurrencyShares Euro Trust (FXE)

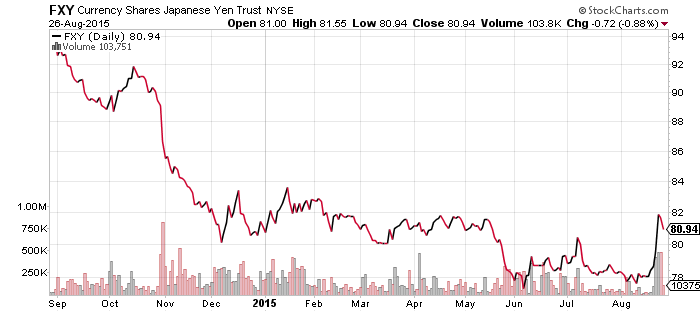

CurrencyShares Japanese Yen (FXY)

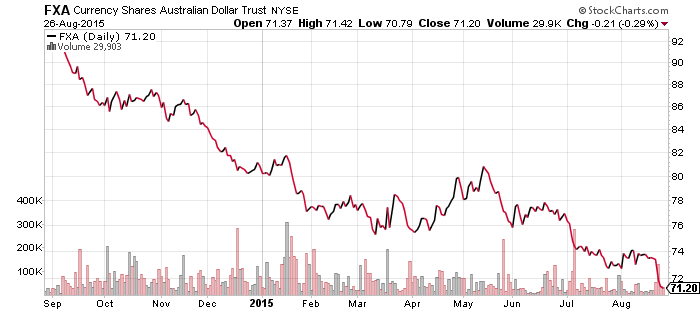

CurrencyShares Australian Dollar (FXA)

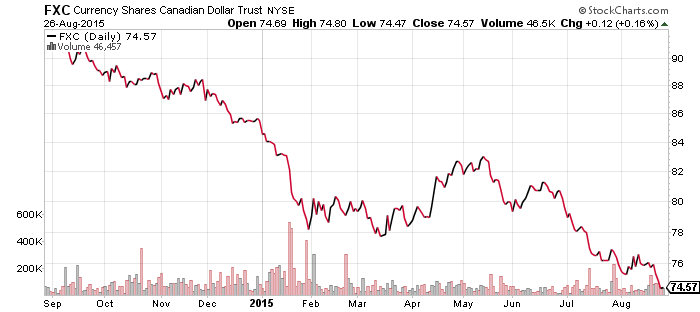

CurrencyShares Canadian Dollar (FXC)

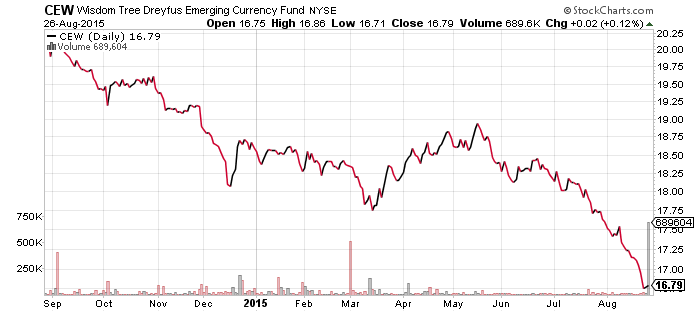

WisdomTree Emerging Market Currency (CEW)

Currency markets are at the heart of present turmoil in financial markets. The center of weakness has been emerging markets, though investors turned bullish on the sector today. Of particular note is the volume in CEW in the chart; the gray bar at the bottom is 69 times average trading volume for the fund. A very large buyer, or group of large buyers, is placing a large bet on emerging market currencies. This may signal at least a short-term bottom.

The U.S. dollar was weak against the yen and euro over the past week. However, it was strong against currencies in emerging markets, Australia and Canada. The latter are all tied to the China growth story, while the former were sources of U.S. dollar strength earlier in the year. It’s unclear if the spike in the euro and yen is a washout of shorts betting on further weakness, or a trend change.

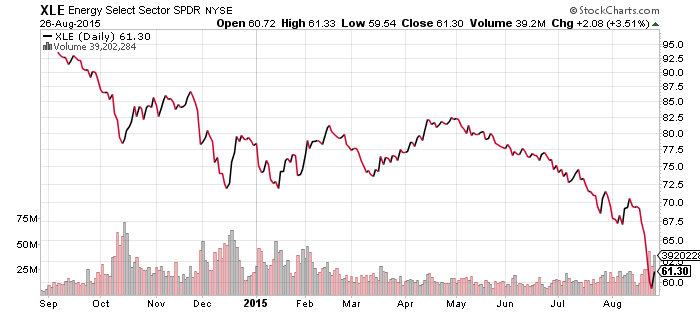

SPDR Energy (XLE)

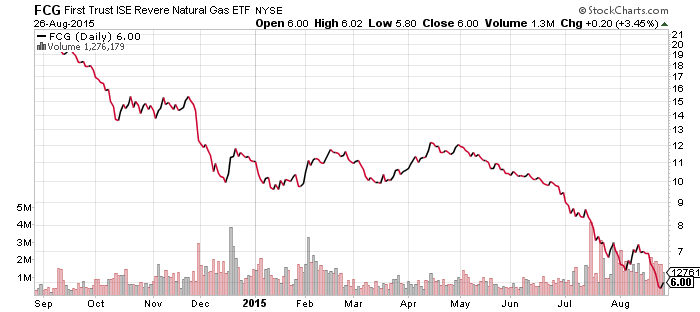

FirstTrust ISE Revere Natural Gas (FCG)

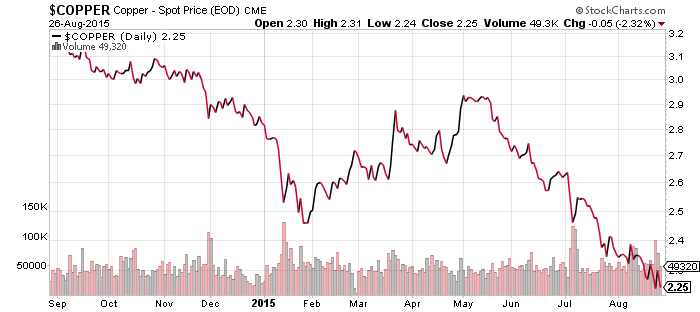

Global X Copper Miners (COPX)

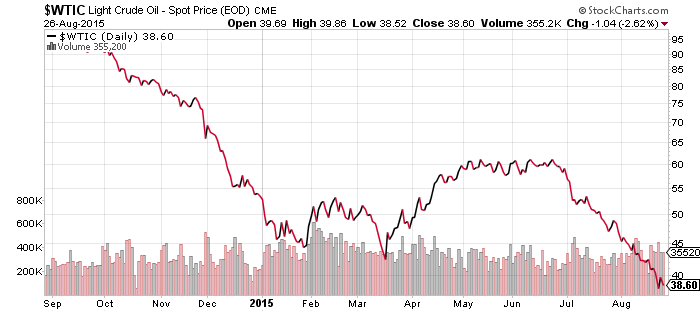

Oil and copper prices were under sustained pressure over the past week. Although they saw a small rebound when stock markets rallied, oil is still right near its 52-week low and copper has slumped to a new multi-year low. Energy was the worst performing S&P 500 sector over the past week. The yield on XLE has climbed above 3 percent, although some dividends may be under pressure if the sector doesn’t stabilize.

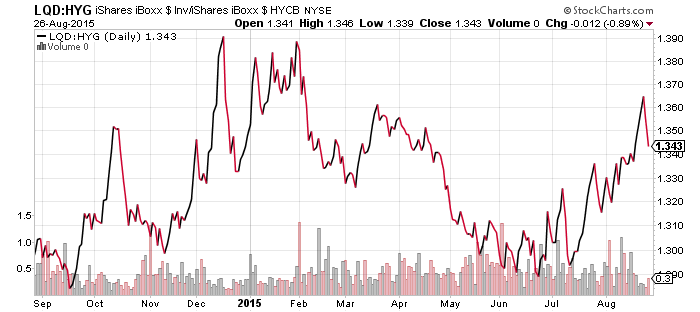

iShares iBoxx Investment Grade Corporate Bond (LQD)

iShares iBoxx High Yield Corporate Bond (HYG)

Investors are still favoring quality in corporate debt. There was a snap back to high-yield on Tuesday and Wednesday, but the trend is favoring quality credits over the near term.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

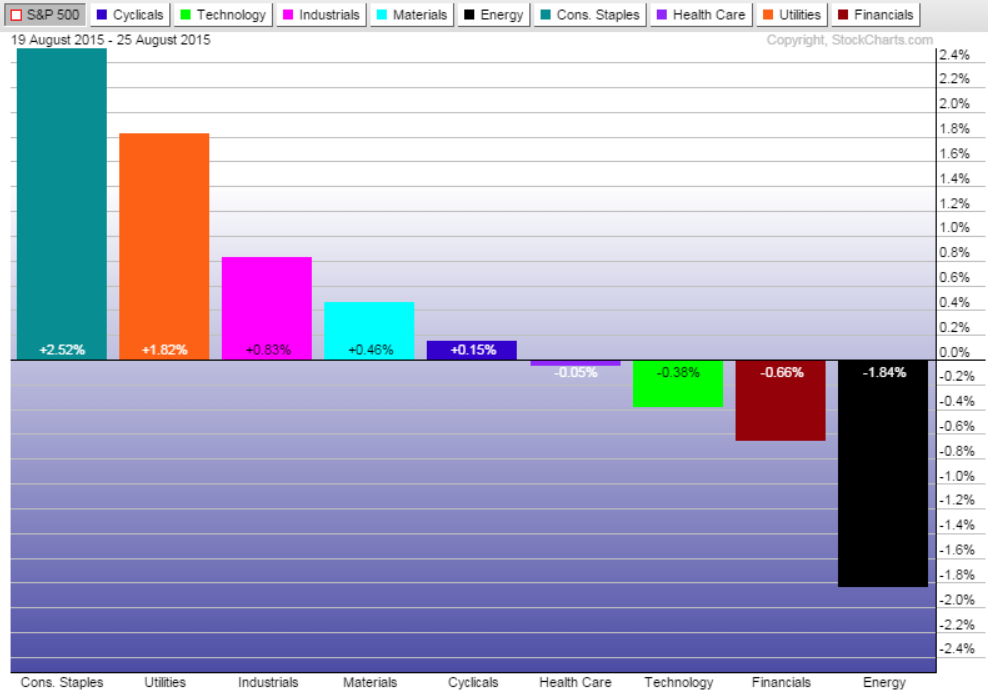

Before today’s rally, sector losses ranged from 7.7 percent for consumer staples to 12 percent for energy. In relative terms, consumer staples beat the S&P 500 Index by 2.5 percent, as did utilities, industrials and materials. The former two are defensive sectors, while the latter two are sectors that have been battered in 2015 and were not a focal point of selling.

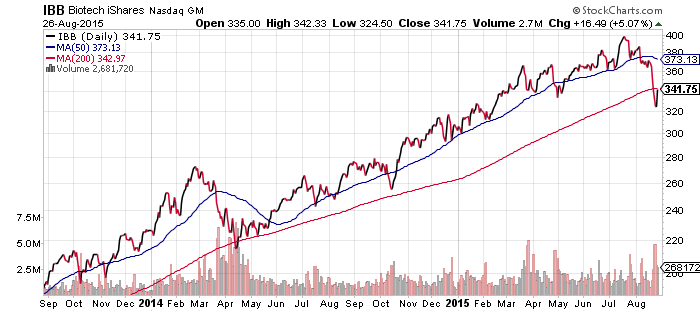

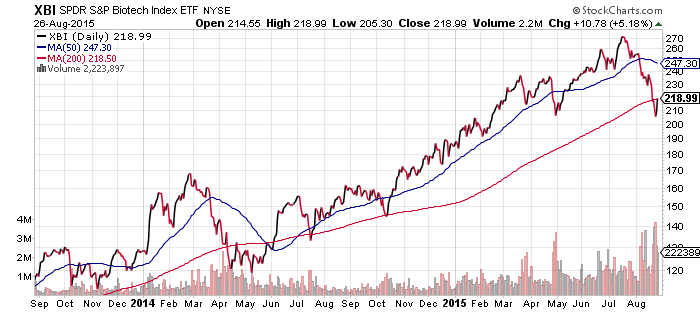

A number of sectors fell through their 50-day moving averages and bounced below their 200-day moving average, including biotechnology. This line could now be resistance, but for now, the more likely course is for these sectors to regain the 200-day line which has served as lower support during the bull market.

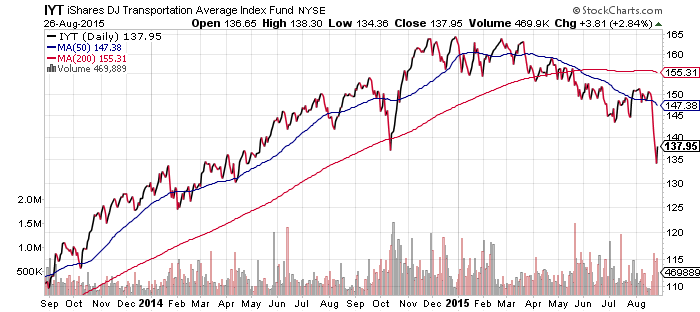

The transportation sector broke down during the sell-off. There is some technical support for the fund, but the overall trend is clearly bearish again. A rebound appears much less likely versus the main S&P 500 sectors.

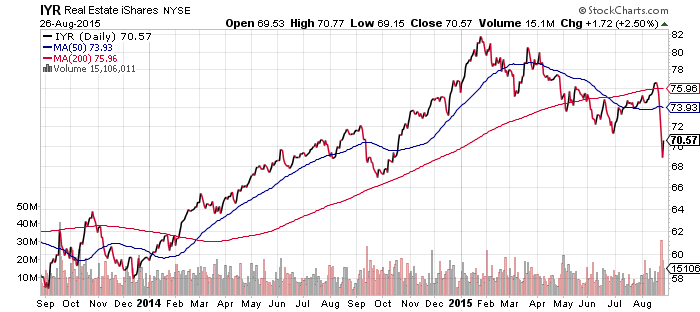

Another area that devolved was real estate. It had been climbing its way out of a bearish trend over many weeks, but over the past few days it gave up all of those gains and fell to a new 2015 low. There are rumors of China selling Treasuries to prop up the yuan and has the potential to keep yields elevated. That would be bad news for this rate-sensitive sector.

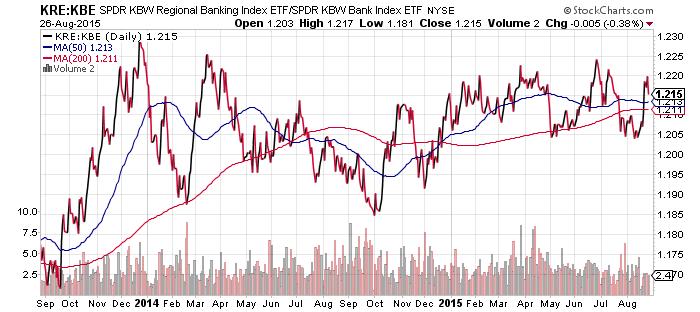

On the bright side, regional bank stocks outperformed large bank stocks over the past week. Regional banks are more volatile and their strength is a good signal.

SPDR S&P 500 (SPY)

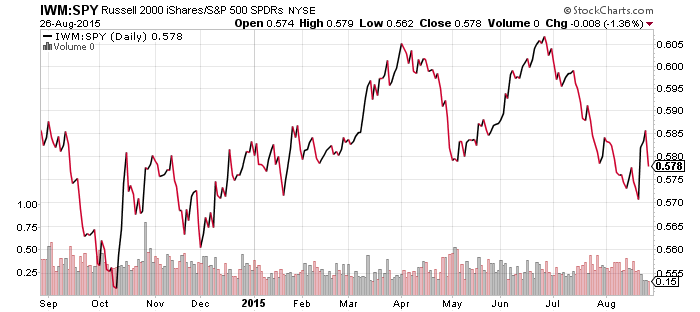

iShares Russell 2000 (IWM)

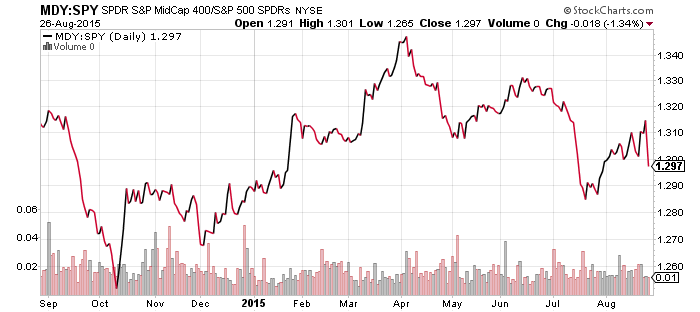

S&P Midcap 400 (MDY)

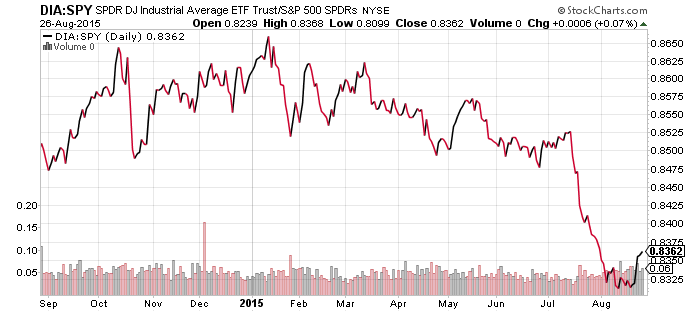

SPDR DJIA (DIA)

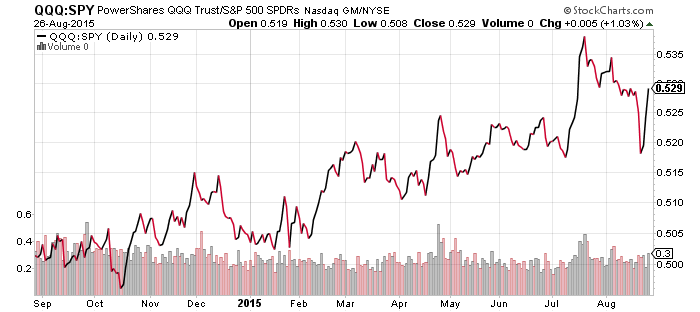

PowerShares QQQ (QQQ)

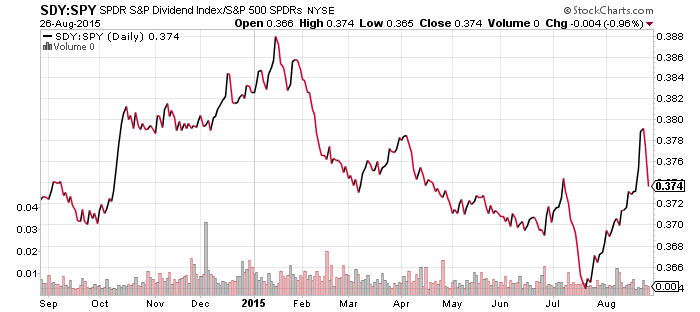

SPDR S&P Dividend (SDY)

Small-caps, the Dow Jones Industrial stocks and dividend shares outperformed the S&P 500 Index over the past week, while the Nasdaq initially underperformed but strongly rebounded.