WisdomTree Chinese Yuan (CYB)

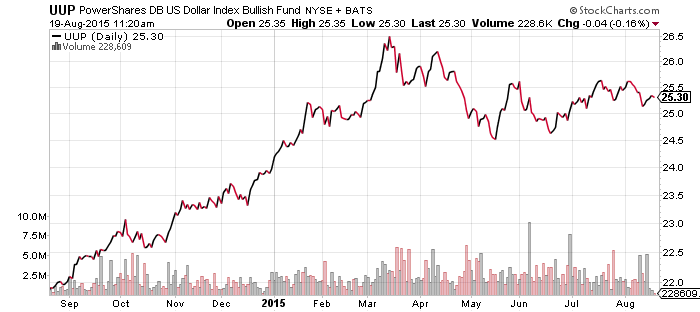

PowerShares U.S. Dollar Index Bullish Fund (UUP)

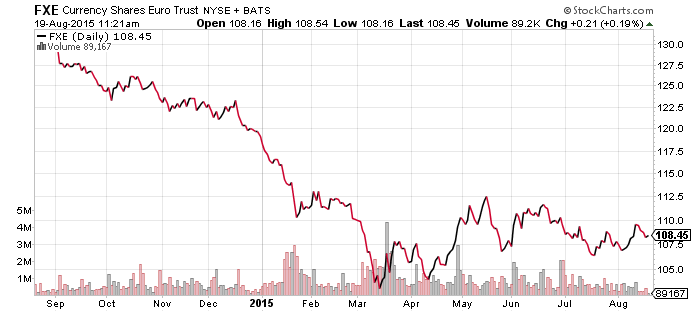

CurrencyShares Euro Trust (FXE)

Global X FTSE Greece 20 (GREK)

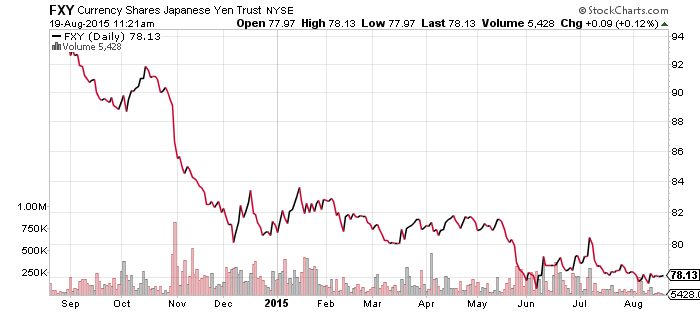

CurrencyShares Japanese Yen (FXY)

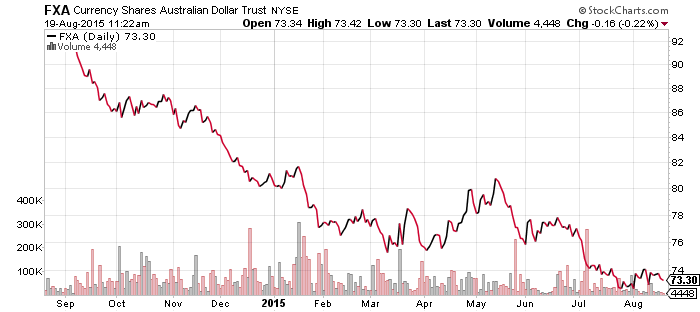

CurrencyShares Australian Dollar (FXA)

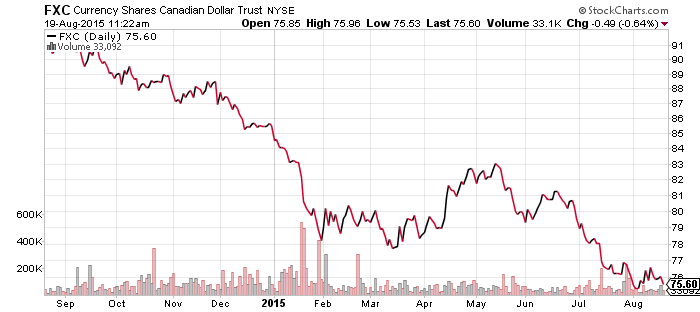

CurrencyShares Canadian Dollar (FXC)

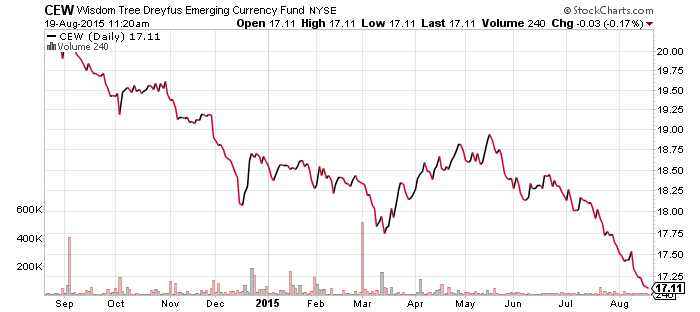

WisdomTree Emerging Market Currency (CEW)

China’s decision to devalue the yuan on Tuesday sent shockwaves through global financial markets, pushing currencies, commodities and equities lower in most countries. Overnight, the yuan was devalued a second time. Over the past two days, the offshore yuan (CNH) fell nearly 6 percent and the Chinese central bank has had to intervene to prevent the currency from dropping faster.

The chart below is a 7 year chart and the move in the yuan looks enormous because it has experienced very low volatility over this time, being tightly controlled by the central bank. On the one hand, the chart is misleading because the drop isn’t that large in percentage terms. However, the drop shown on the chart is reflective of how markets are reacting to this sudden change.

The immediate impact of China’s move pushed the U.S. dollar higher, though the U.S. Dollar Index ended up falling because the euro rallied on news of a deal for Greece. The euro is still below its highs from June and remains in a bearish pattern. A weaker yuan also threatens European exports to China, which could weigh on the euro moving forward. The agreement with Greece is not yet signed and some German officials have said the deal doesn’t go far enough.

Resource exporters Australia and Canada have seen their currencies fall over the last month but thus far, the yuan devaluation hasn’t pushed them to new lows. Emerging market currencies, mainly those in Asia, have been hit hard by China’s devaluation. The most important currency to watch here is the yen. Japan’s largest trading partner is China and the currency has been in a trading range near 125 for several months. Were the yen to break lower, with the U.S. dollar climbing through 126 yen, it could touch off more devaluation across Asia and push the euro lower.

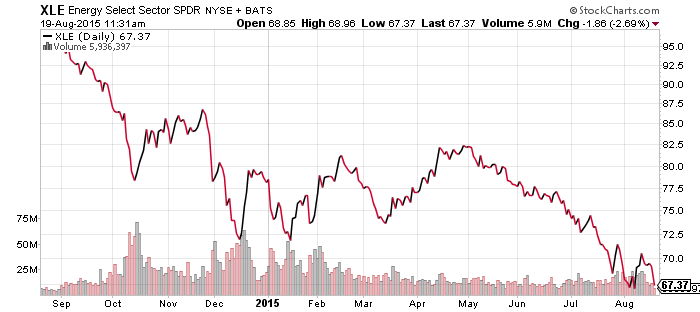

SPDR Energy (XLE)

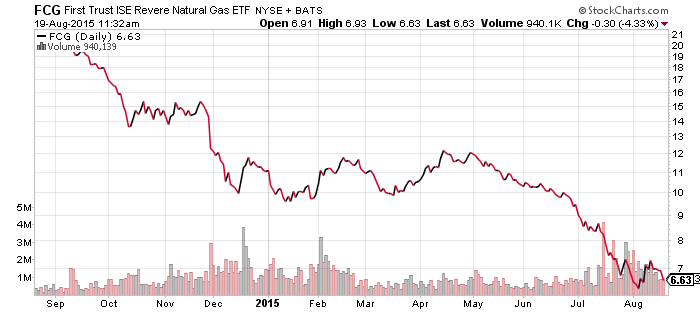

FirstTrust ISE Revere Natural Gas (FCG)

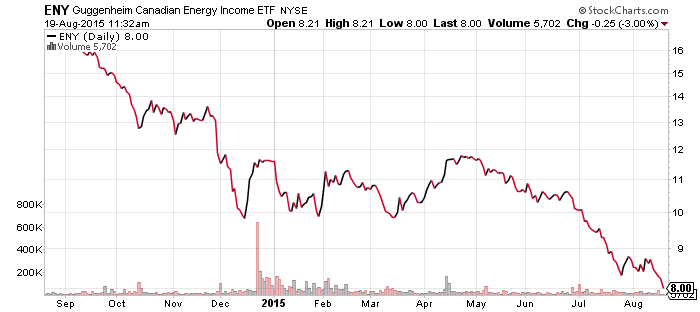

Guggenheim Canadian Energy Income (ENY)

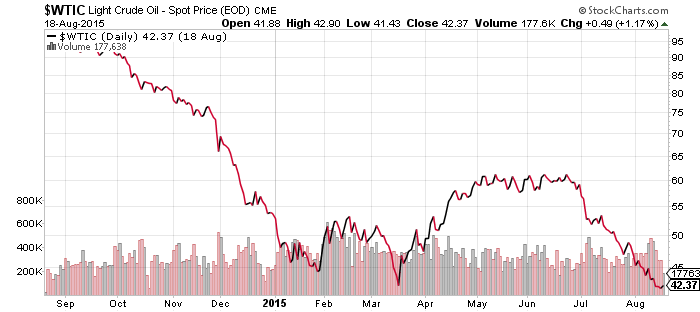

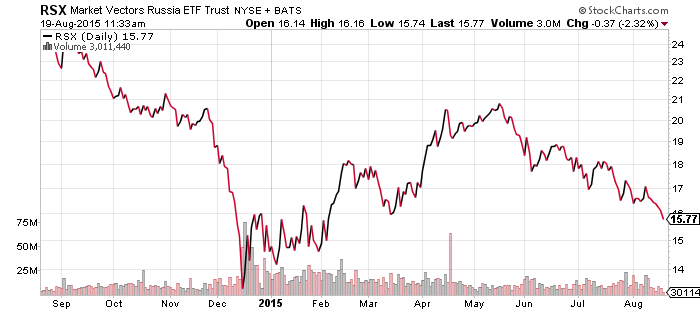

Market Vectors Russia (RSX)

While oil inventories fell last week, the impact of the yuan’s devaluation pushed crude oil prices slightly below its 2015 low. It wasn’t a clean break and oil has since rebounded a bit. This remains a battleground for the bulls and bears because a breakdown would have significant economic impact beyond the oil sector.

iShares iBoxx Investment Grade Corporate Bond (LQD)

As you might expect, the turmoil created by the weakening yuan led to demand for higher quality assets, which benefited LQD.

LQDHYG

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

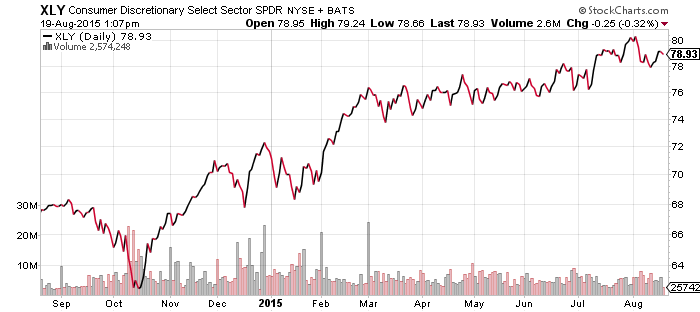

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

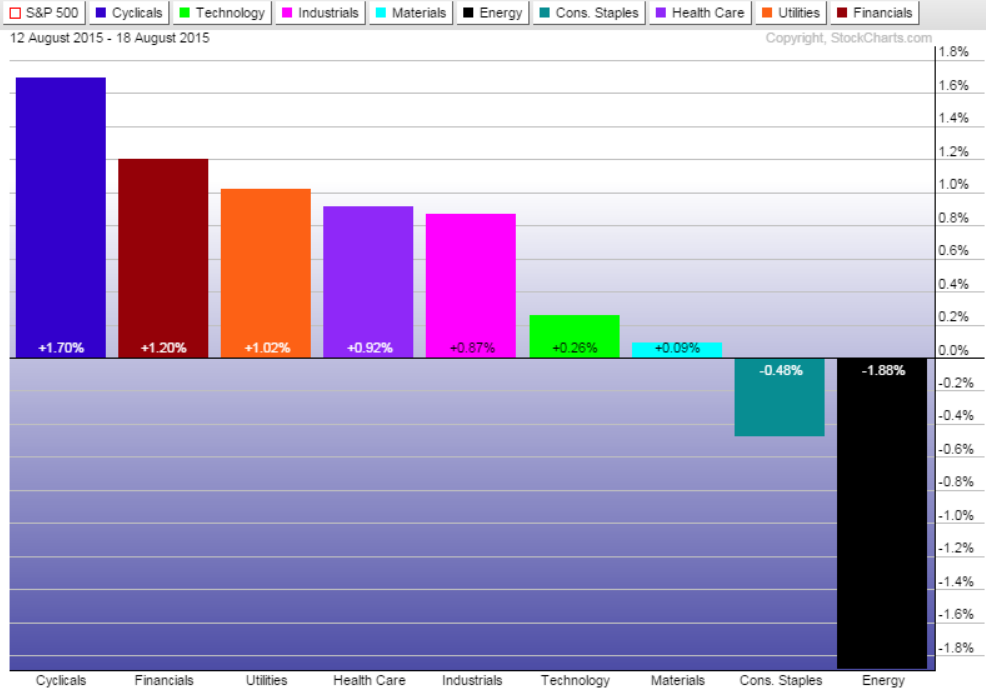

The past week was one that saw the most heavily shorted stocks lead the market higher. XLU gained 1.86 percent advance in XLU as lower bond yields lifted the utilities sector. Healthcare and consumer discretionary, the two best performing sectors in 2015, were the biggest decliners.

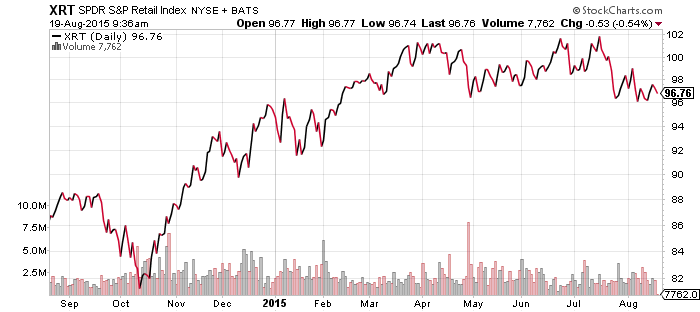

Consumer discretionary is in focus this week with retail earnings kicking off. Macy’s (M) missed earnings and revenue estimates on Wednesday, sending the stock down more than 4 percent in midday trading. XRT and XLY underperformed the broader market as a result.

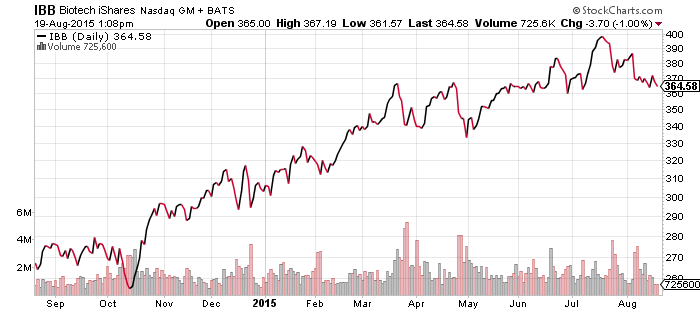

Biotech pulled back in the past week, towards levels seen back in March. IBB could pull back all the way to $340 per share, a drop of about 5 percent, before the chart would start looking bearish.

Bank stocks drifted lower after interest rates declined. Insurance stocks are also down, but have been a bit stronger of late.

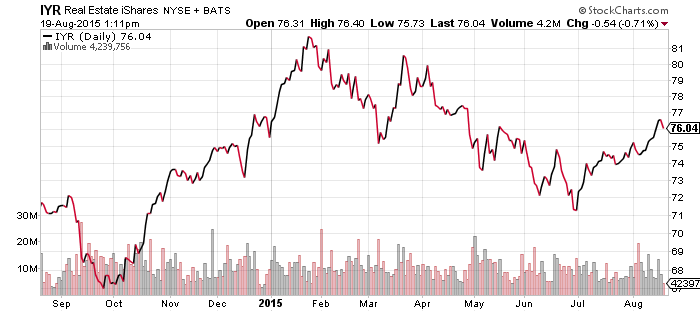

Falling interest rates have been good for the REIT sector, which has been stable in July and August. The sector remains close to its 2015 low than its high though.

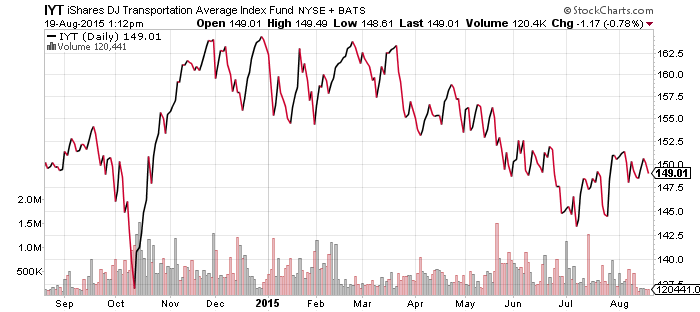

The transportation index remains in a short-term bullish trend since early July, but the trend is precarious at this point. It would take a decline of less than 3 percent to hit a new 2015 low.

SPDR S&P 500 Large Cap Value (SPYV)

SPDR S&P 500 Large Cap Growth (SPYG)

Value rebounded sharply over the past week thanks to a jump in energy shares. The short-covering rally cannot go on for very long, but the devaluation of the yuan may be favorable to the value sectors if it causes investors to turn defensive. If oil prices bottom soon, a bull rally in the sector would also be favorable for value funds.

SPDR S&P 500 (SPY)

iShares Russell 2000 (IWM)

S&P Midcap 400 (MDY)

SPDR DJIA (DIA)

PowerShares QQQ (QQQ)

SPDR S&P Dividend (SDY)

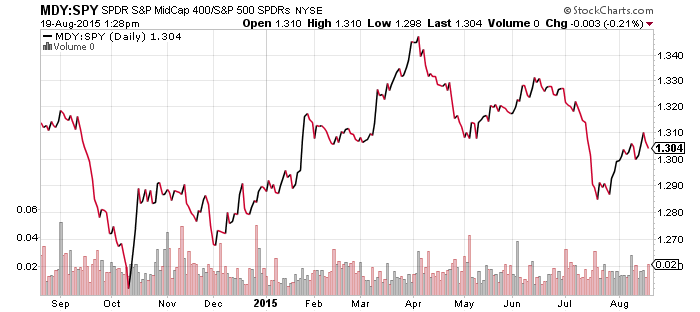

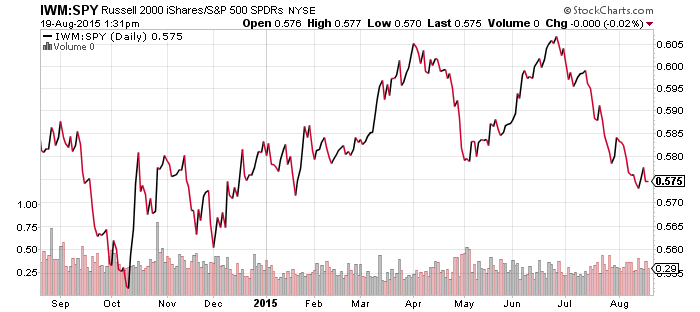

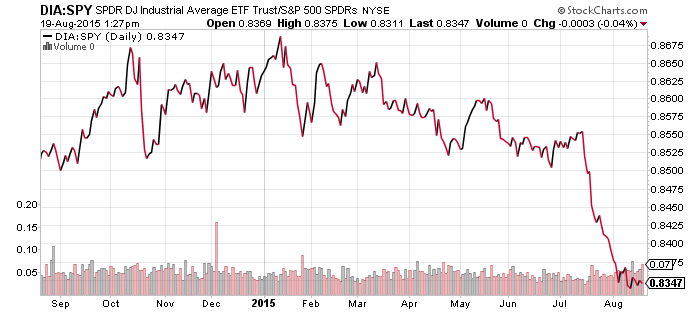

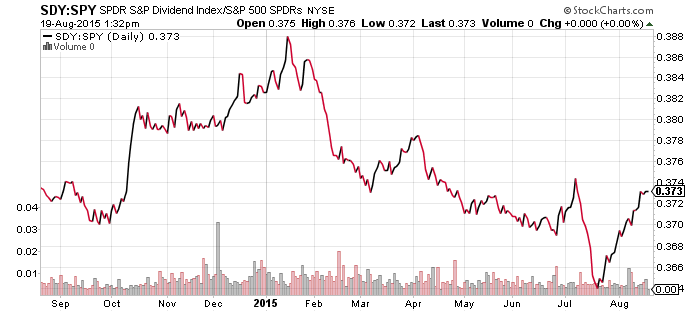

Technology shares have been pulling back relative to the broad market, with the S&P 500 narrowing the gap with the Nasdaq. That hasn’t been the case with the Dow, which continues to hit new lows relative to the S&P 500 Index. Small-caps also declined relative to the S&P 500 Index last week, but midcap stocks have rebounded, pointing to a possible bullish turn for the market. Recent weakness in the market have investors on a defensive footing, which benefits dividend shares. SDY has rebounded sharply relative to SPY as a result.

SPDR Gold Shares (GLD)

Market Vectors Gold Miners (GDX)

PowerShares DB Base Metals (DBB)

Gold and gold mining shares have rallied recently but remain in an overall bearish trend. For instance, GDX could rally 40 percent before the chart starts to improve. Gold would need to climb back to $1200 an ounce or around $112 for GLD. The metal tends to do well when currency markets experience volatility and buying gold is one of the few ways Chinese citizens can hedge against a depreciating currency. The rebound in gold and other precious metals is in contrast to the industrial metals, which have hit new lows. Whether investors continue to make the distinction remains to be seen.