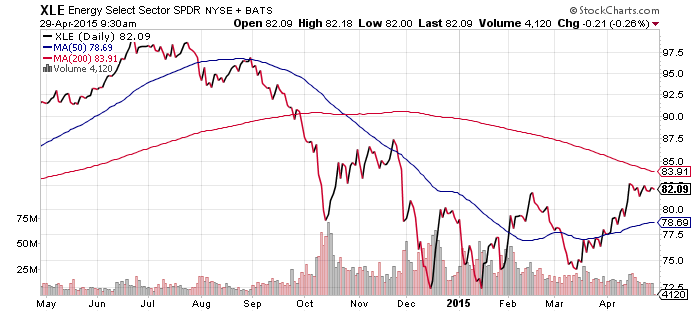

SPDR Energy (XLE)

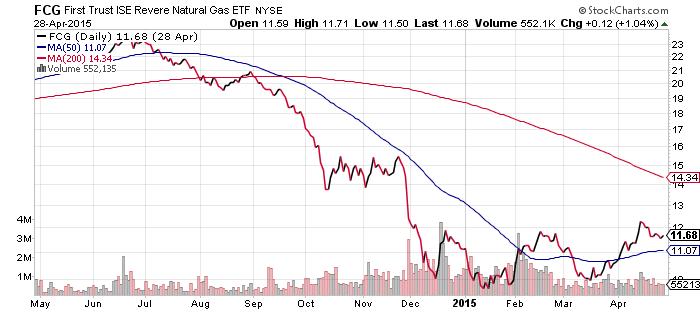

FirstTrust ISE Revere Natural Gas (FCG)

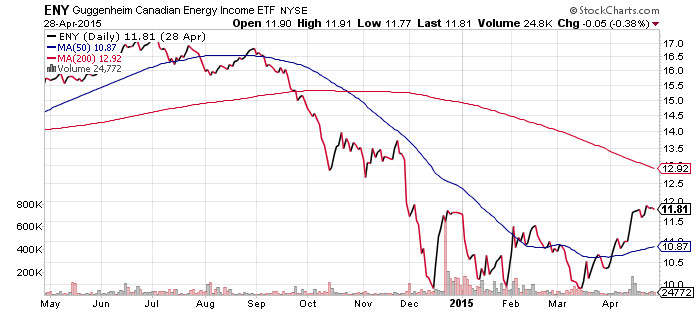

Guggenheim Canadian Energy Income (ENY)

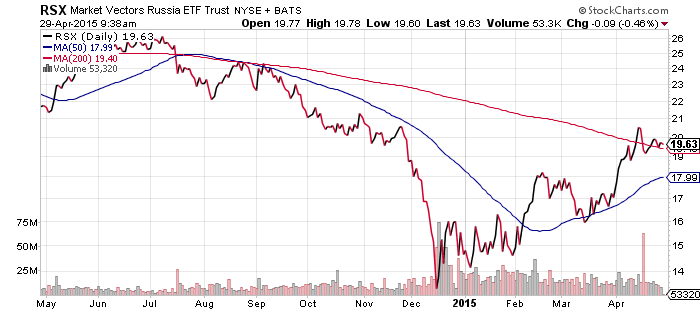

Market Vectors Russia (RSX)

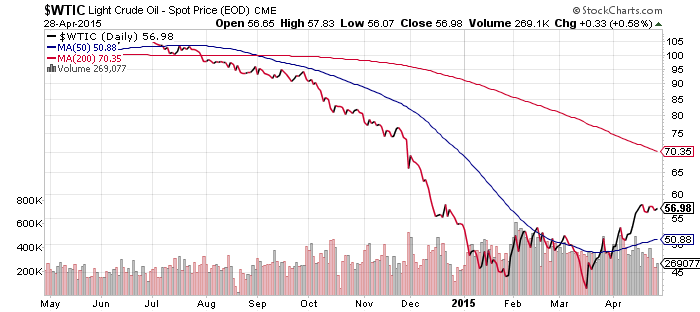

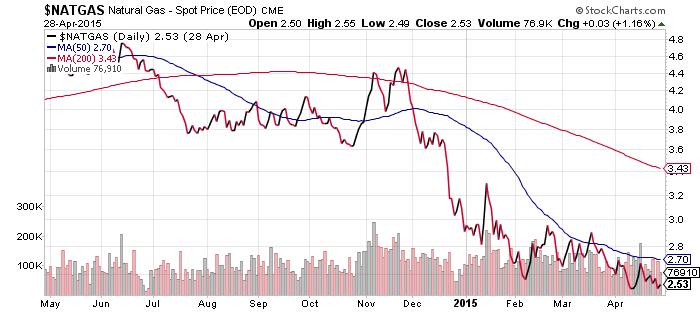

Energy related equities have run out of short-term positive momentum and over the next two weeks, a decline or sideways move in energy is likely. On the downside, $50 is the important near-term support level. A move to the upside is likely to be a very bullish move, with $60 the next target in the recovery.

Oil inventory continues to build, although there was a decline in inventory at the important Cushing site last week. Once inventory stops increasing, a more robust recovery in oil prices will likely begin.

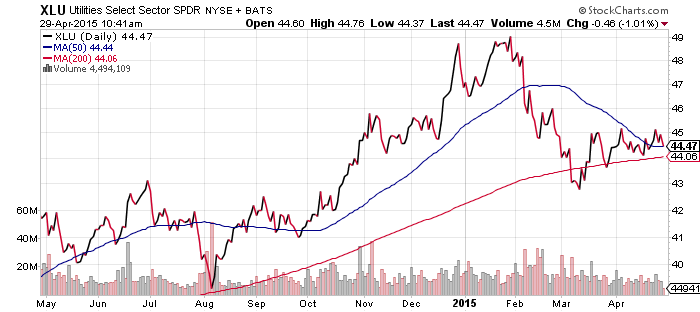

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

The materials sector has performed very well, thanks to a pop in shares of DuPont (DD). Activist investors won the endorsement of Institutional Shareholder Services in a battle over board seats. Technology also gained ground due to strong earnings reports. Healthcare was the worst performing sector over the past week due to a pullback in biotechnology.

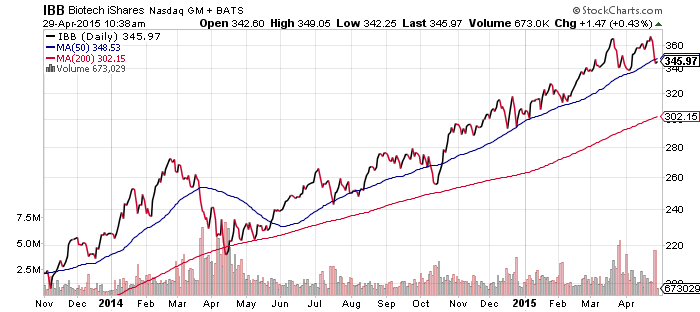

Speaking of biotechnology, the major funds have all broken below their 50-day moving averages. It’s the first time that’s happened since the October global sell-off in equities. As long as the broader stock market moves higher, shares are likely to regain the 50-day moving average in the days ahead.

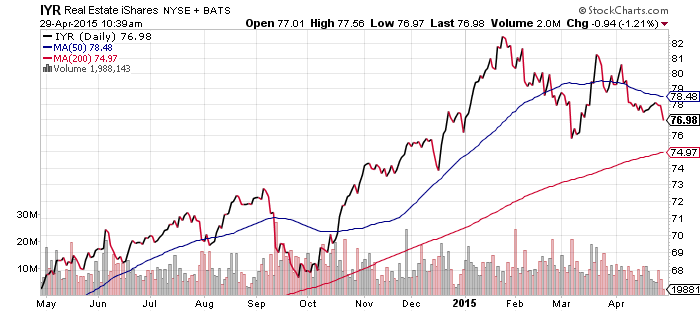

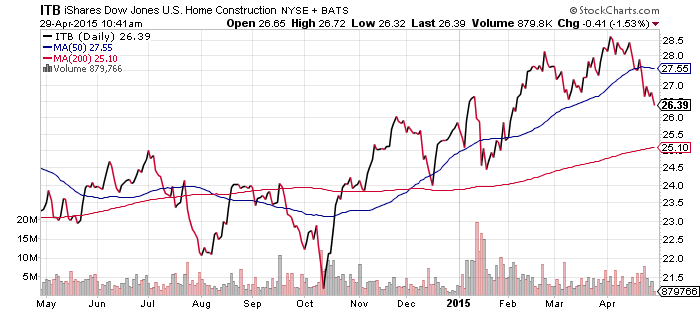

Real estate is not far from a test of its March low and the utilities sector is barely above its lows for the year. Homebuilders have also been sliding in April. Interest rates have been rising over the past two weeks, but more important than interest rates are expectations. Investors may sell holdings in rate sensitive sectors if they expect rate hikes later this year, regardless of where they move in the short-term.

Guggenheim Solar (TAN)

TAN failed to break out to a new high last week. In early Wednesday trading, it was close to the $48 level that has served as support in April. Solar is a very volatile sector and a break to new highs or lows is only one volatile day away. A 10 percent dip into the low $40s is possible for this sector and with interest rates rising again, a move lower is likely in the short-term.

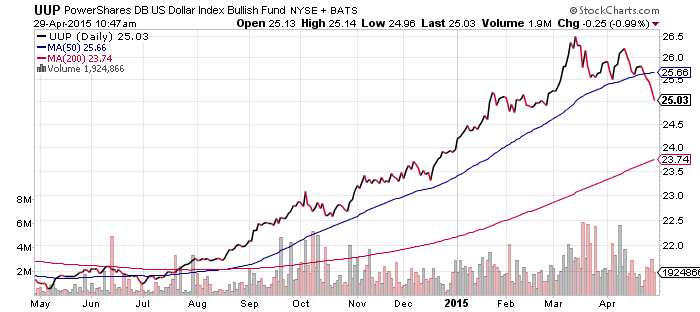

PowerShares U.S. Dollar Index Bullish Fund (UUP)

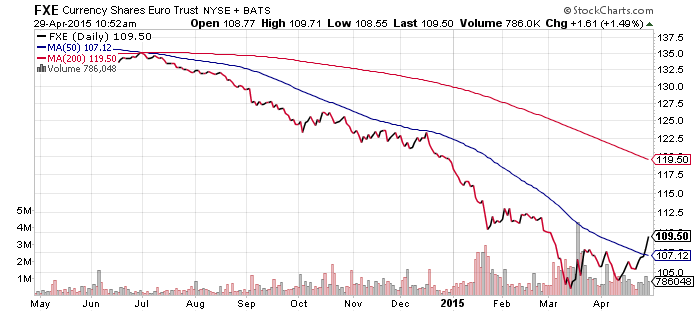

CurrencyShares Euro Trust (FXE)

Global X FTSE Greece 20 (GREK)

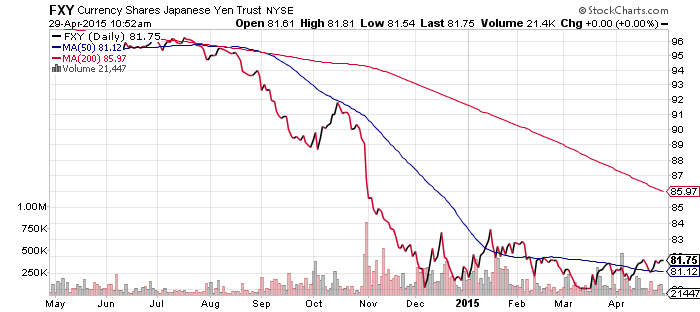

CurrencyShares Japanese Yen (FXY)

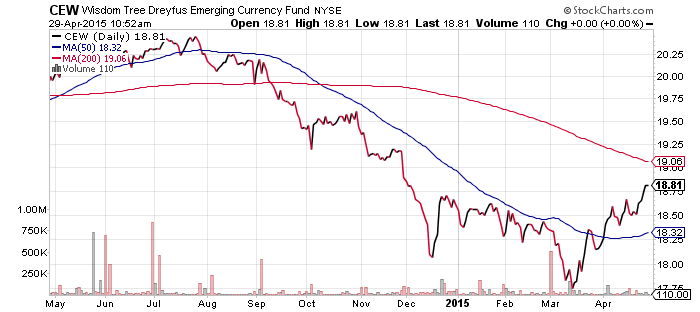

WisdomTree Dreyfus Emerging Currency (CEW)

The U.S. dollar broke lower last week and is now resting at the $25 level. If this support breaks, a potential drop of about 6 percent, down to the $23.50 level, would come into play. The 200-day moving average may also serve as support. A drop to this level would represent a roughly 50 percent retracement of the breakout since July.

The drop in the U.S. Dollar Index has been driven by the Australian and Canadian dollars, along with the British pound. Emerging market currencies have also continued their upward march. The common factor between these moves, excepting the pound, is the recovery in energy and commodity prices.

The euro is spiking higher on Wednesday, to the highest levels since early March. European equities have been sliding on the rebound in the euro. The German DAX Index has lost more than 7 percent in a little over two weeks, but this drop is accelerating as the euro rebounds.

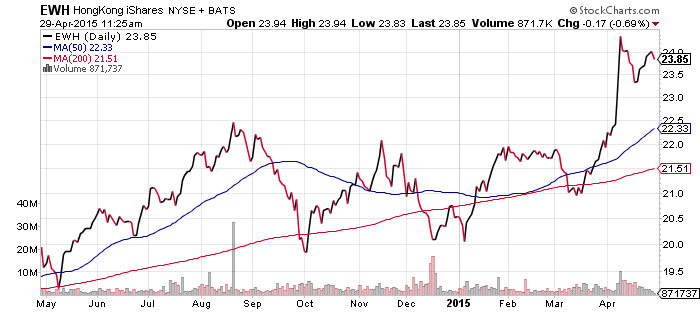

iShares MSCI Hong Kong (EWH)

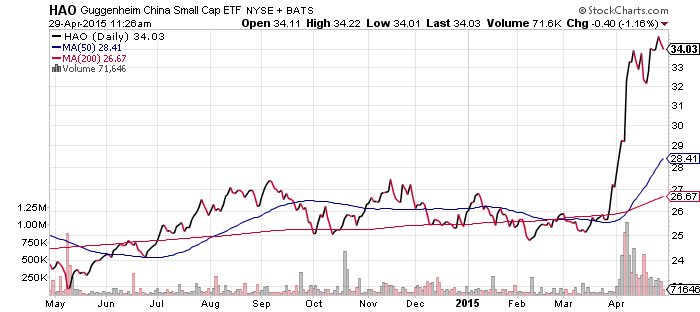

Guggenheim Small Cap China (HAO)

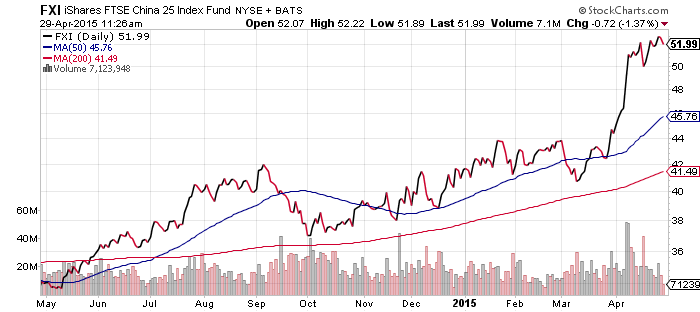

iShares China Large Cap (FXI)

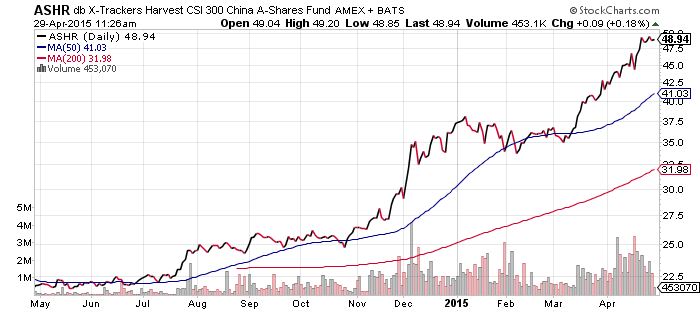

db X-Trackers China A Shares (ASHR)

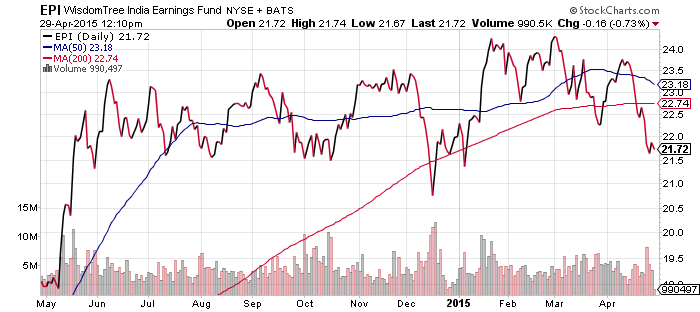

WisdomTree India Earnings (EPI)

Chinese A-shares hit another new high in the past week, but the market finally pulled back after the securities regulator issued a warning to investors about risk. It didn’t stop the bubbliest of stocks from rising though. One technology company involved in online music and other entertainment has seen its shares gain 10 percent every day since its IPO in March. The mainland market doesn’t allow shares to rise more than 10 percent a day and trading effectively halts once the limit is reached.

The rally in China is having an effect on India as investors shift assets away from India. Most investors, including many institutional investors, were caught off guard by the explosive rally in China. If the trend continues, investors may be given an opportunity to buy India at a discount.

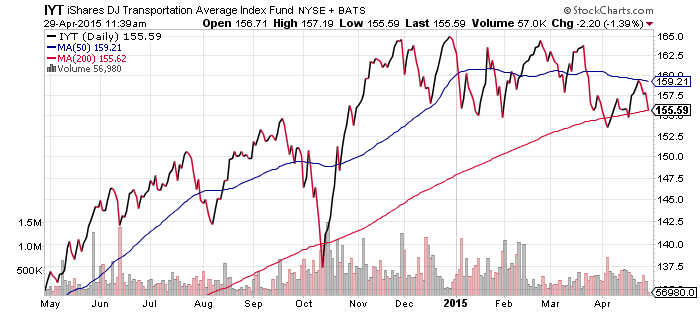

iShares DJ Transportation (IYT)

IYT remains in a trading range, but it is very close to breaking down. It topped out in November when oil prices started to tumble, but with oil prices recovering, it hasn’t yet followed. In terms of costs, higher energy prices are bad news for transportation companies, but since demand for transportation and logistics is dependent on economic activity, rising energy prices often accompany a growing economy.

SPDR S&P 500 (SPY)

iShares Russell 2000 (IWM)

S&P Midcap 400 (MDY)

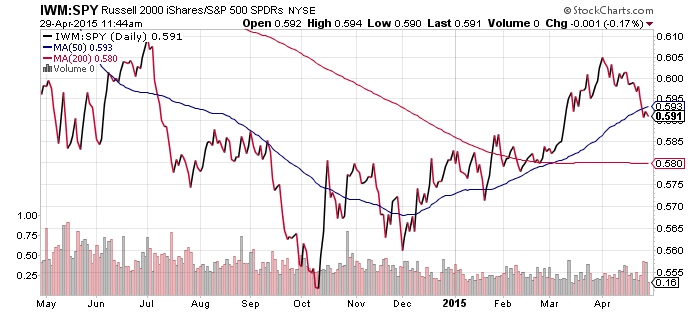

Mid- and small-caps are still in a correction relative to large-caps. The falling U.S. dollar is bullish for multinationals and investors who had moved into smaller companies to avoid the rising greenback may be moving back into large-caps. Energy is also a sector dominated by large-cap companies, so the recovery in energy helps the large cap index more than the smaller indexes. SPY has about 8 percent in energy, versus less about 5 percent and 4 percent in MDY and IWM, respectively.

iShares iBoxx Investment Grade Corporate Bond (LQD)

iShares iBoxx High Yield Corporate Bond (HYG)

LQD has slumped following the spike in interest rates. LQD has a relatively long duration of more than 8 years, which roughly translates into an 8 percent move in the fund for every 1 percent change in interest rates. The 10-year treasury yield increased about 0.1 percent in early trading on Wednesday, and LQD fell 0.9 percent, in line with what the duration forecasts.

High-yield bonds are holding up better because of their lower duration; HYG has a duration of approximately 5 years. Shares did better than duration predicts, partially because energy prices have rebounded. A significant slice of HYG and other high-yield index funds are exposed to energy sector debt, much of it used to fund shale oil and shale gas operations.