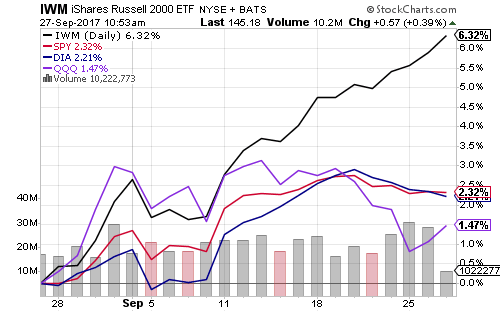

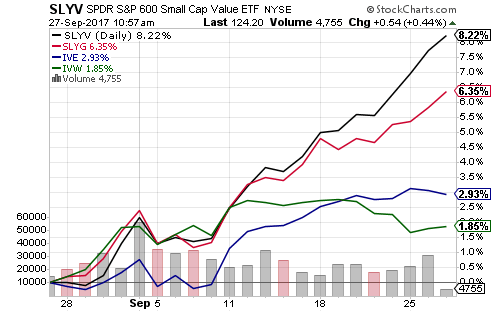

The Russell 2000 Index joined the S&P 500, Dow Jones Industrial Average and Nasdaq in record territory over the past week.

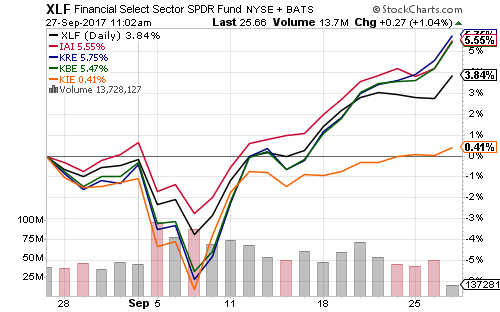

Financials rallied after last week’s Federal Reserve meeting. As of today, the odds of a December rate hike are at 83 percent.

Banking subsector ETFs are up roughly 10 percent and broker dealers have risen close to 8 percent over this period. Insurance has underperformed due to hurricanes.

Financials hit a new 2017 high on Wednesday.

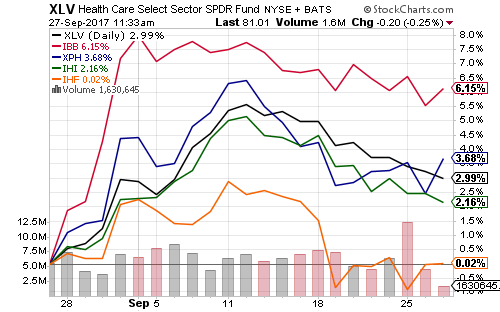

The healthcare sector has traded lower over the past two weeks. Biotech is still up a solid 6 percent, while healthcare providers are flat as uncertainty surrounding healthcare reform persists.

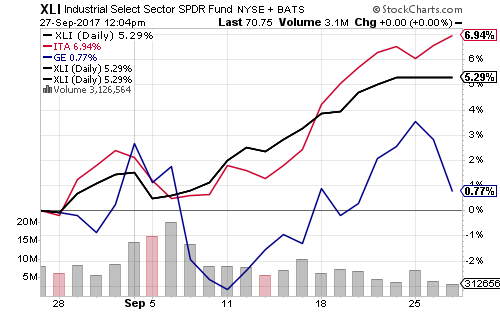

Defense stocks have continued to pull the industrial sector higher. The rhetoric around North Korea has intensified on both sides in the past week. General Electric (GE) has dragged on sector performance. It is the largest holding in the market capitalization-weighted indexes.

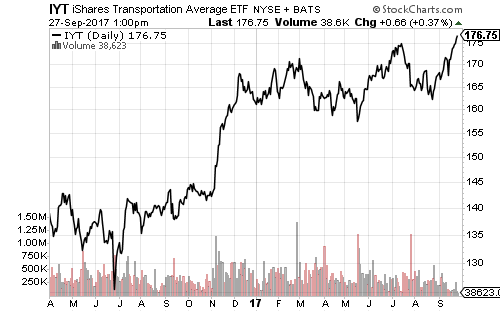

The Dow Transports, another key subsector within industrials, also moved on to a new 52-week high over the past week.

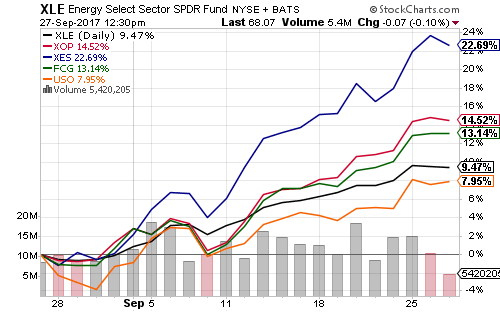

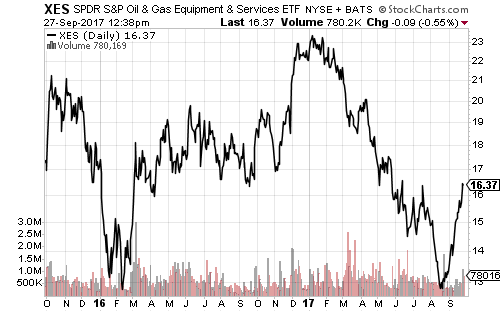

SPDR S&P Oil & Gas Equipment & Services (XES) has gained 22.7 percent with the recent energy rebound. Short-term indicators show energy is overbought. This doesn’t signal a correction is coming, but it warns us that a pullback is more likely. The chart of XES shows the fund nearing the bottom of the 2016 trading range.

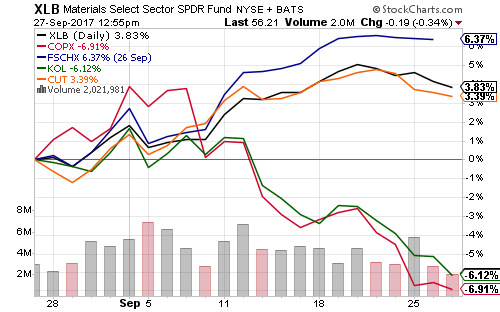

Materials stocks rallied in the wake of hurricanes Harvey and Irma. Over the past few weeks, chemicals have moved higher and timber held steady. Demand for new homes and repairs should boost timber. Slowing economic data in China has weighed on copper and coal.

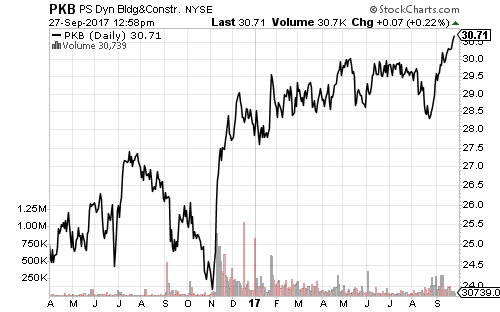

Shares of PowerShares Dynamic Building & Construction (PKB) broke out to a new 52-week high and has been one of the better performers among the “hurricane” plays.

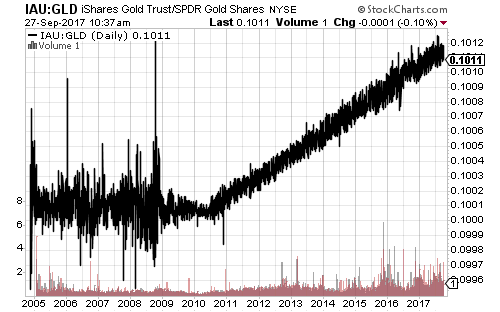

GraniteShares Gold Trust (BAR) has launched a new physical gold ETF. It is the lowest cost gold fund with an expense ratio of 0.20 percent. Below is a chart comparing the performance of iShares Comex Gold (IAU) to SPDR Gold Shares (GLD). IAU charges 0.25 percent, GLD 0.40 percent. IAU cut its fee in 2010 as the chart clearly shows.