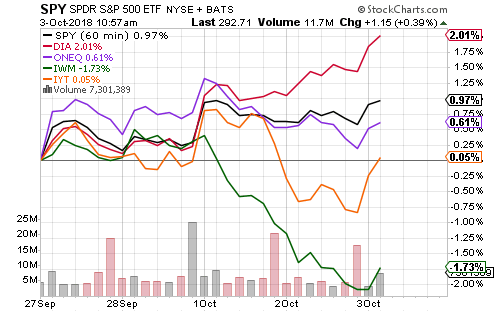

The Dow Jones Industrial Average led index performance on the week as General Electric (GE) announced a new CEO and wrote off $23 billion in goodwill.

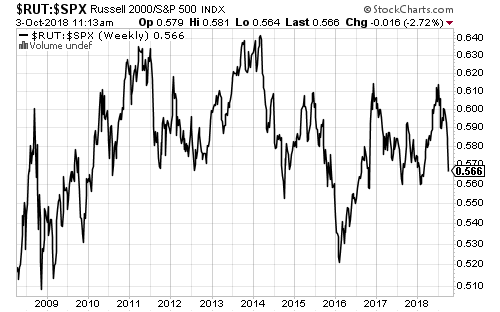

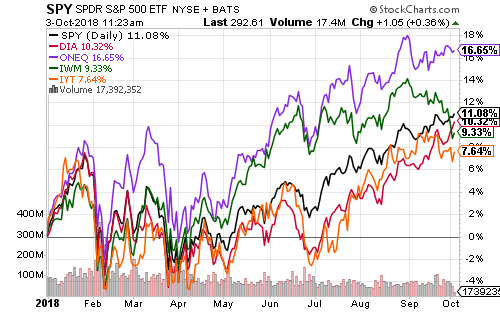

The Russell 2000 underperformed on the week. Relative to the S&P 500 Index, it has suffered one of its worst stretches in a decade. The Russell 2000 is now underperforming the Dow Jones Industrial Average and the S&P 500 Index on the year.

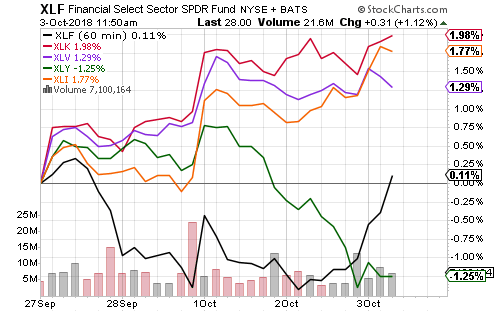

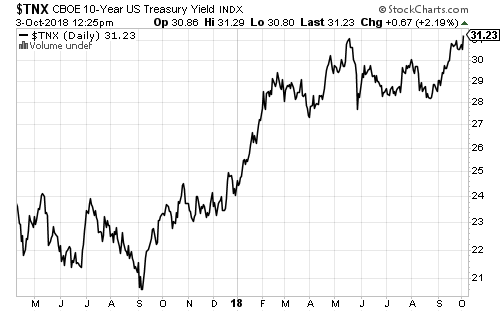

Financials rallied strongly on Wednesday as the 10-year yield broke out to a new multi-year high. Technology, healthcare and industrials all powered the market, while consumer discretionary was hit by Amazon’s decision to hike its minimum wage to $15. The news sent SPDR S&P Retail (XRT) down 3 percent on Tuesday.

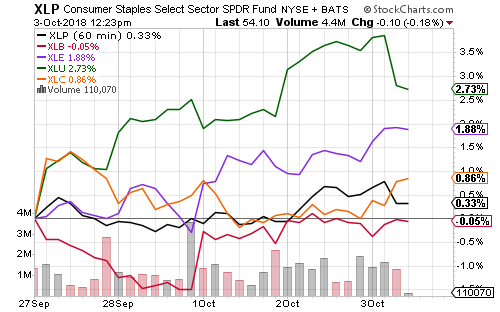

A rise in bond yields sank utilities on Wednesday, but it was still the best performing sector fund on the week.

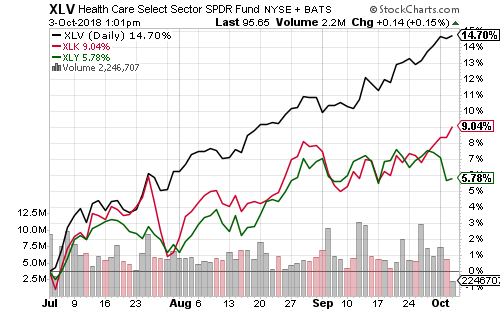

SPDR Healthcare (XLV) has outperformed technology and consumer discretionary over the past three months. Both sectors traded sideways for most of September, however, slowing momentum.

All four major subsectors within healthcare are performing well, led by large-cap pharmaceutical shares Johnson & Johnson (JNJ), Pfizer (PFE), and Eli Lilly (LLY).

The 10-year Treasury yield climbed to a new multi-year high on Wednesday. This will be a major breakout if it holds. It will benefit financials and the U.S. dollar, but bad news for bonds, utilities, foreign stocks and foreign currencies. March 2019 rate hike odds jumped above 50 percent following strong jobs numbers in the ADP report. The government’s employment report will be out on Friday. A similarly strong report should cement a bond-yield breakout.

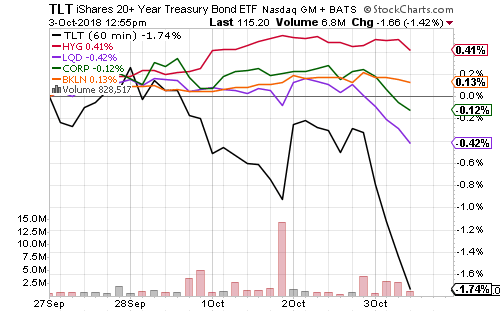

Rising bond yields sent long-term treasury bonds down sharply on Wednesday. Investment-grade, corporate, and a few high-yield bonds, followed. Floating-rate funds held predictably steady.

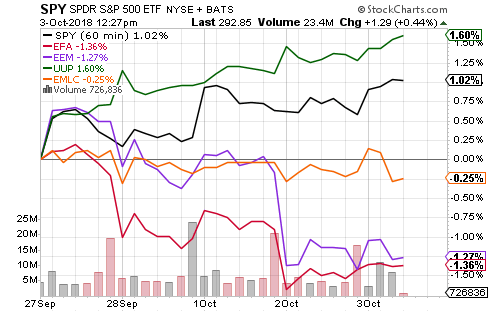

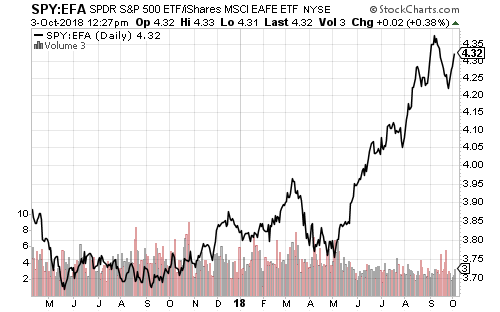

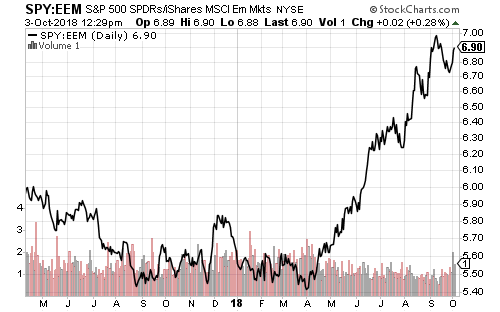

The U.S. Dollar Index outperformed the S&P 500 Index this week, and both outperformed foreign shares. The SPDR S&P 500 (SPY) to iShares MSCI EAFE (EFA) and iShares MSCI Emerging Markets (EEM) charts roughly track the performance of the U.S. Dollar Index.

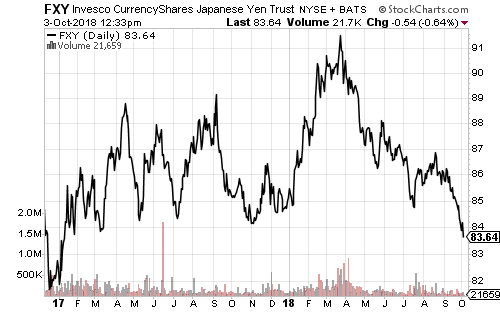

The yen broke to a new 52-week low versus the dollar this week. The euro is also on the verge of breaking to a new low, but it has a little farther to go. A battle over Italy’s budget weighed on the common currency this week.