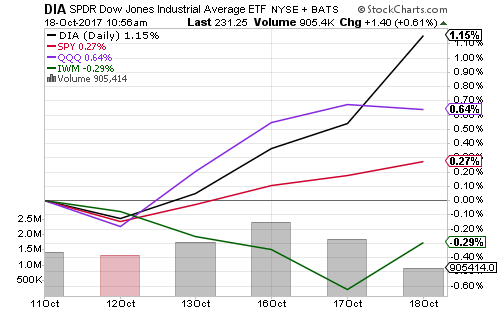

The Dow Jones Industrial Average topped 23,000 for the first time on Tuesday, driven by strong earnings at Johnson & Johnson (JNJ) and International Business Machines (IBM), whose shares rose almost 10 percent on Wednesday. Strength in financials, healthcare and industrials has also lifted the DJIA.

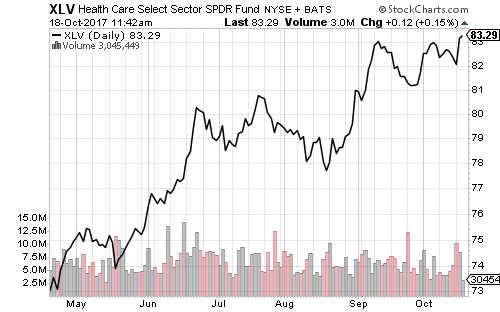

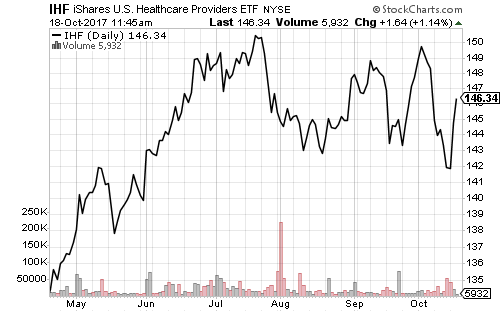

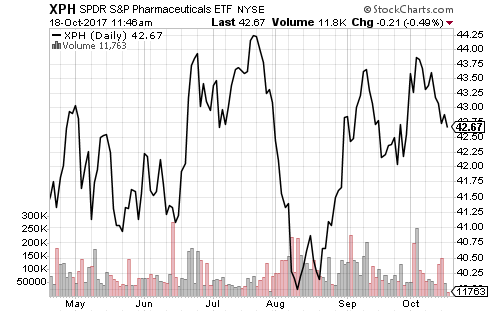

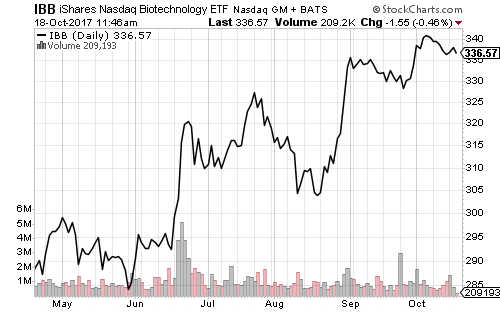

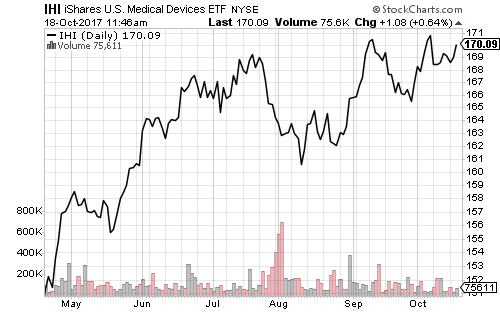

Healthcare hit a new all-time high on Tuesday following a bipartisan deal on insurance subsidies. Last week, President Trump ended payments to insurance companies, citing illegality under existing law. A proposed bill that would restore the payments for 2 years sent shares of health providers sharply higher.

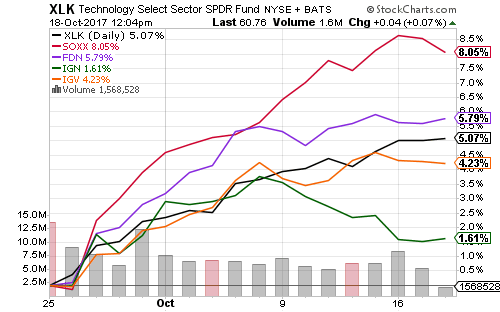

The technology sector has climbed on 15 of the past 17 trading days. SPDR Technology (XLK) gained 5 percent over this period. Semiconductors and Internet stocks have led the advance, while networking has lagged.

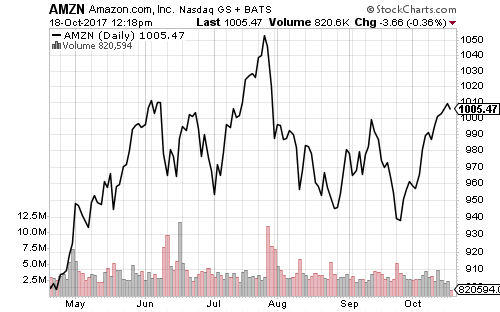

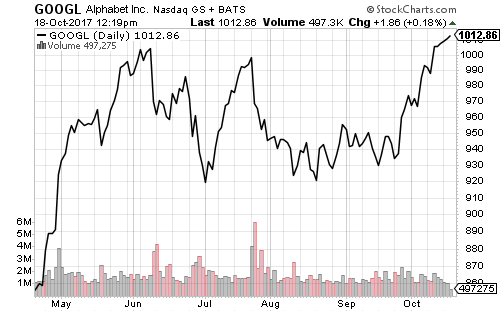

Shares of Amazon (AMZN) and Google (GOOGL) moved back above $1000 during this run. Both had struggled during the summer before rallying.

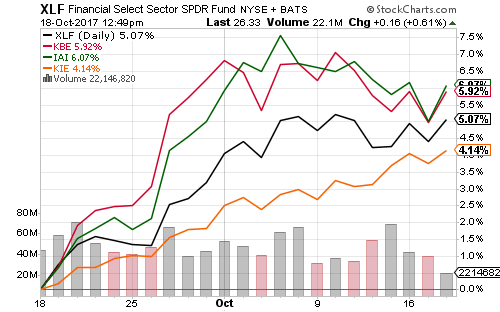

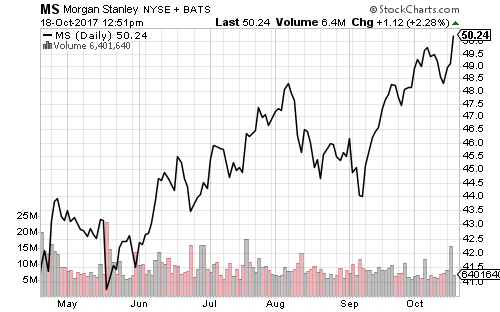

Financial shares held steady over the past week as rate hike expectations hardened. The odds of a December rate hike were at 93 percent on Wednesday in the futures market. This week investment banks and regional banks will begin reporting. Morgan Stanley (MS) hit a new 52-week high following its earnings release.

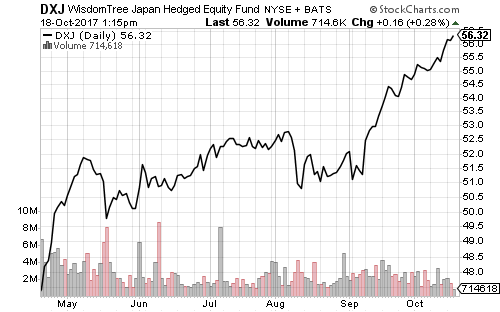

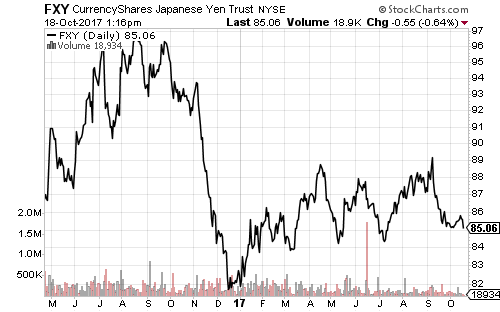

One of the better-performing country funds over the past month has been Japan. Both the currency hedged and unhedged funds have outperformed the developed and emerging market indexes.

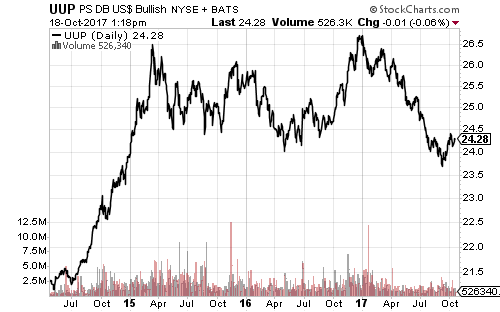

The yen is approaching 2017 lows amid a rally in the U.S. dollar. A breakdown in the yen would benefit currency-hedged funds.

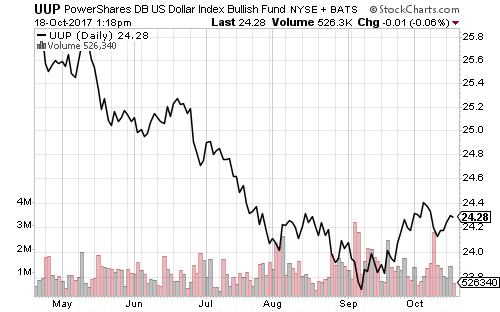

The U.S. Dollar Index is approaching an important resistance area. PowerShares U.S. Dollar Index Bullish (UUP) needs to climb above $24.50 to signal the next leg up.

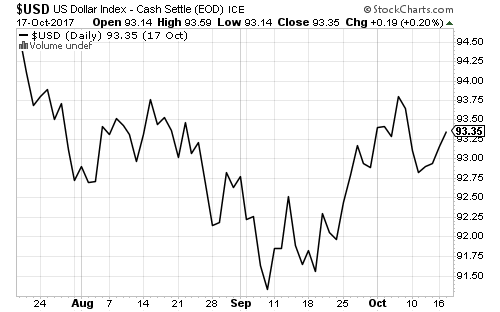

The U.S. Dollar Index has traced out an inverse head-and-shoulders pattern. A bullish breakout of this pattern would have an upside target around 96.

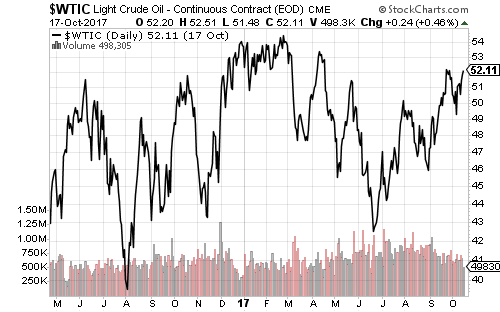

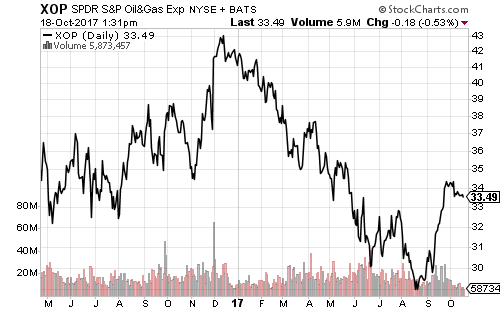

Oil prices hit a four-month high on Wednesday. Crude oil has not traded above $55 a barrel since July 2015.

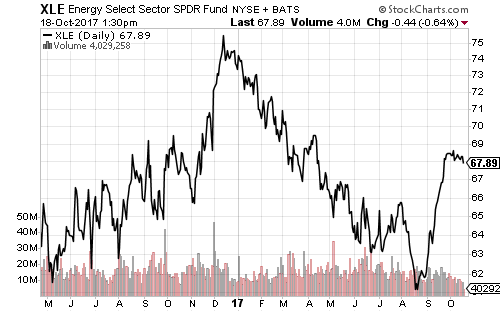

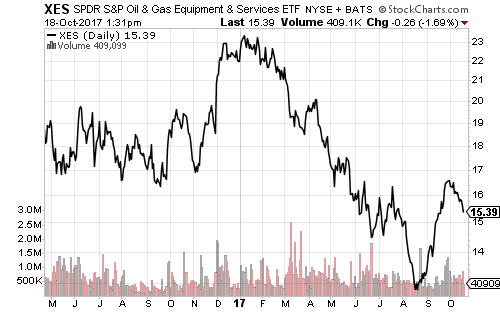

Currently, oil-related equities are consolidating gains following a powerful six-week rally. Oil services ETFs such as XES have been the weakest segment of the energy market this year and are performing worst during the current consolidation.

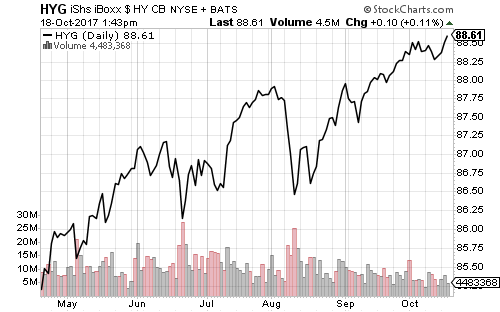

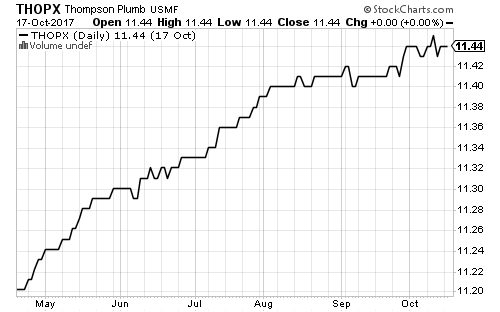

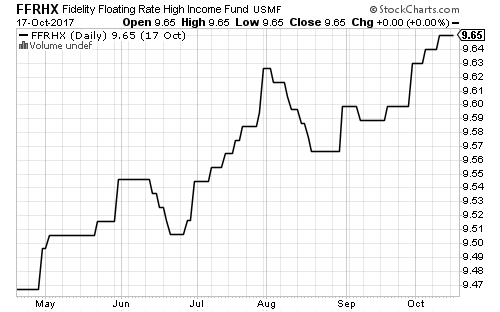

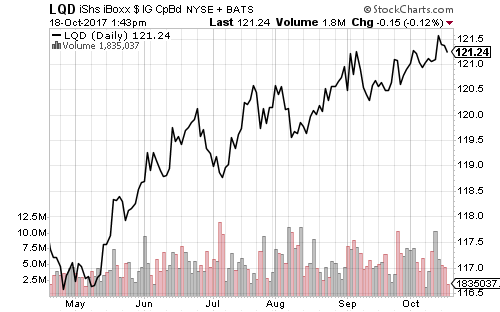

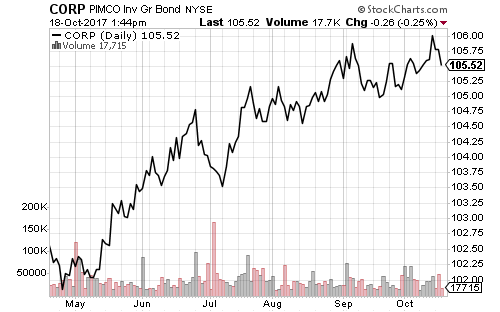

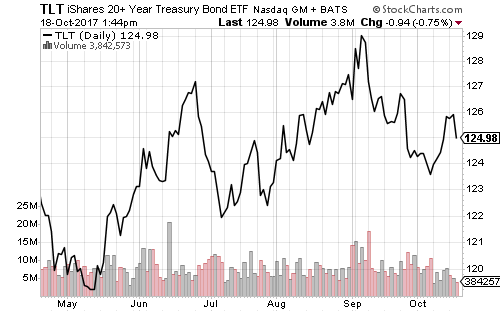

Interest rates have increased over the past month and Treasury bonds have fallen. Investment-grade, corporate and high-yield bonds have advanced, however, as investors demand income. Strong economic data has also lowered credit risk over this period, offsetting much of the rise in rates.