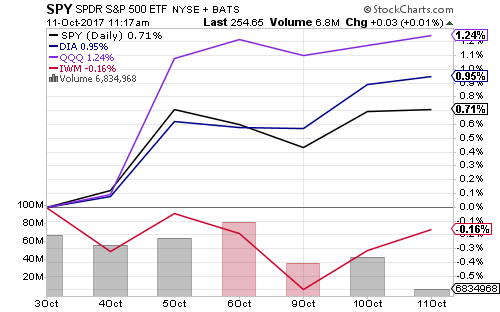

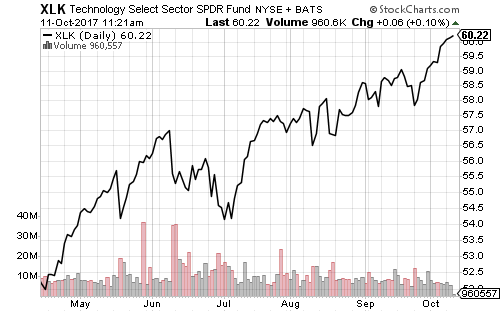

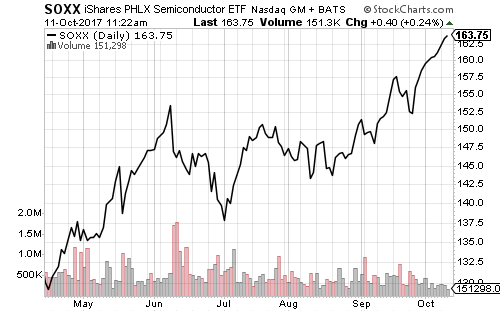

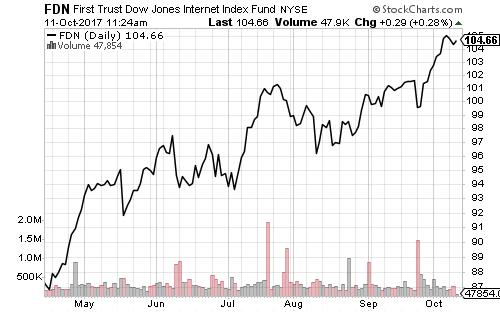

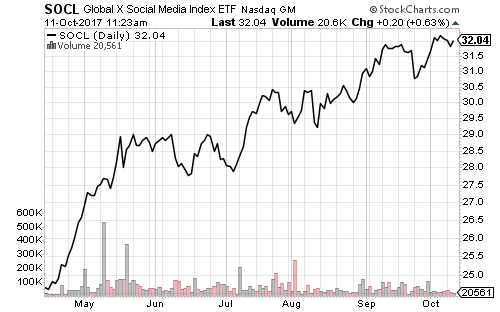

The Dow Jones Industrial Average and Nasdaq rallied to new highs over the past week, while the S&P 500 Index and Russell 2000 consolidated gains.  SPDR Technology (XLK) achieved a new all-time high this week. The semiconductor subsector has been strong since early 2016. Internet and cloud computing stocks have also performed well.

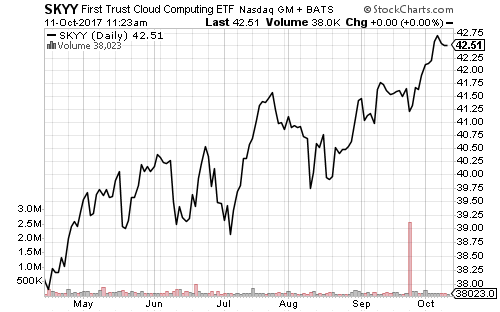

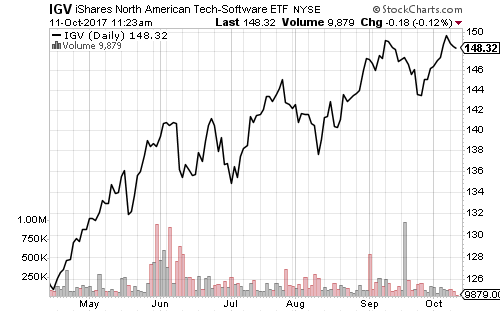

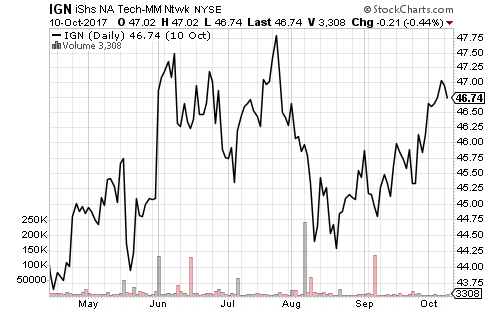

SPDR Technology (XLK) achieved a new all-time high this week. The semiconductor subsector has been strong since early 2016. Internet and cloud computing stocks have also performed well.

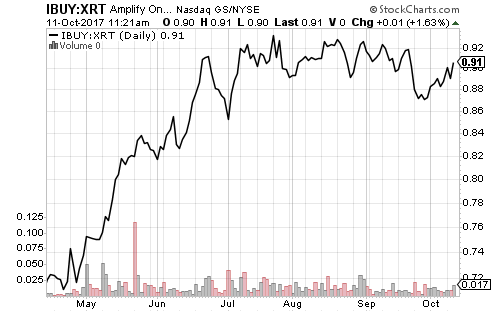

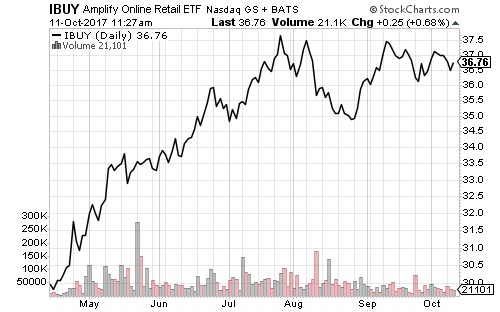

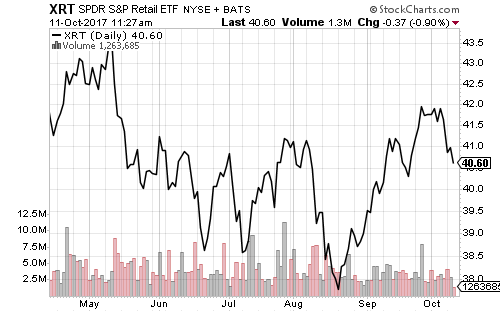

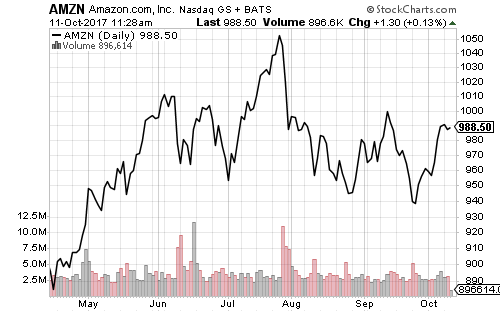

Online retail is still in a consolidation pattern versus brick-and-mortar sellers. SPDR S&P Retail’s (XRT) relative strength, however, suggests online retail may fare worse in the near-term.

Online retail is still in a consolidation pattern versus brick-and-mortar sellers. SPDR S&P Retail’s (XRT) relative strength, however, suggests online retail may fare worse in the near-term.

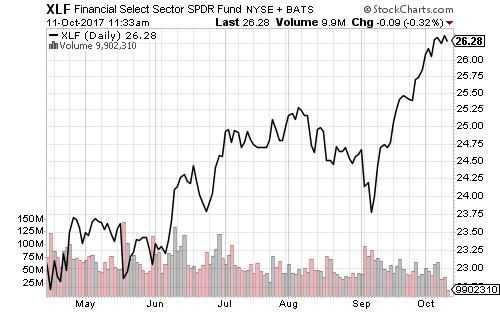

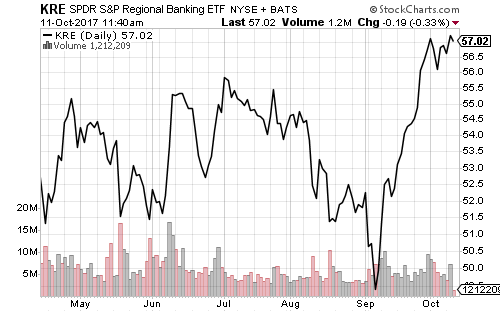

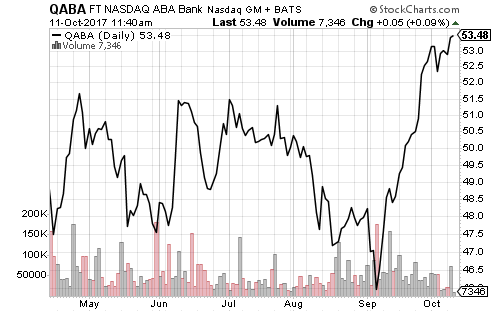

September lifted SPDR Financials (XLF) more than 10 percent. Banks, including smaller regional and community banks were the best performing subsector, all of which pushed on to new 52-week highs. Later this week, several mega banks and a few regional banks will deliver earnings reports. The most important are J.P. Morgan (JPM), Citigroup (C), Bank of America (BAC) and Wells Fargo (WFC). These four banks combine for 32.6 percent of XLF’s assets and dominate nearly all financial funds.

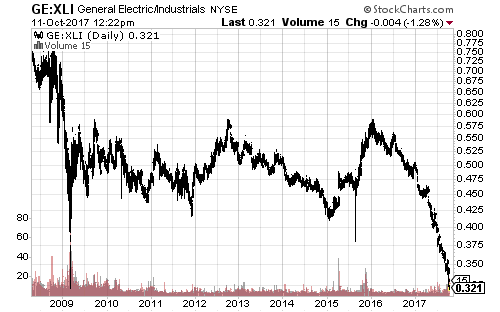

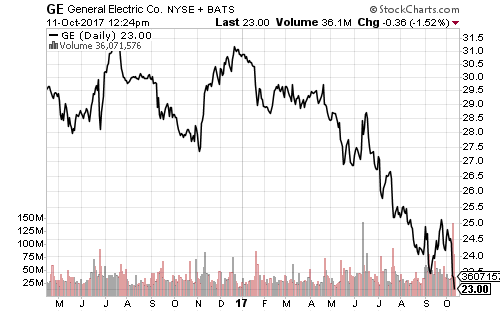

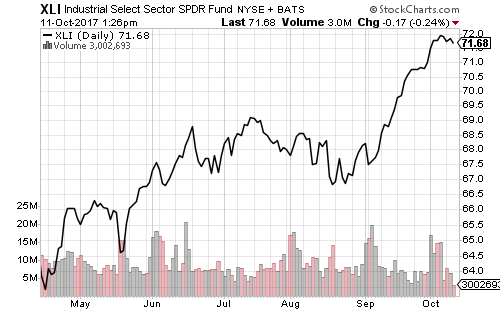

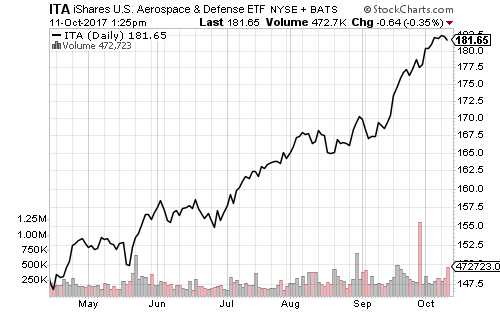

The industrial sector has performed very well in 2017. It has gained 17 percent, while its former top component General Electric (GE) is down about 25 percent. Shares of GE fell 6 percent this week after several top executives left the firm. Chairman Jeff Immelt retired three months early with two vice chairs and CFO Jeffrey Bornstein. On Wednesday, J.P. Morgan (JPM) said a dividend cut is growing “increasingly likely” and it also reduced its price target to $20. Due to the slide in shares, GE is no longer the largest stock in XLI. Boeing (BA) now tops it with 6.44 percent of assets to GE’s 6.37 percent. As for XLI, it trades near its all-time high due to strength in aerospace and defense stocks.

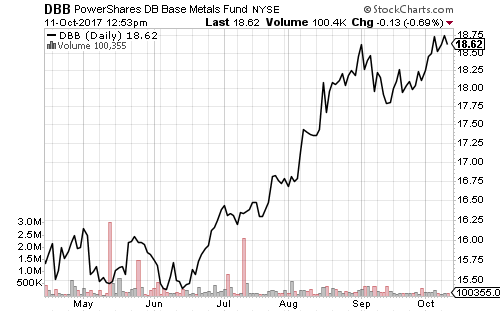

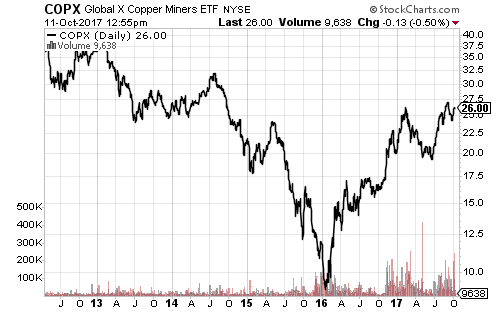

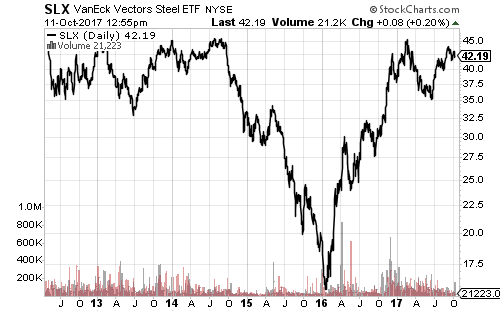

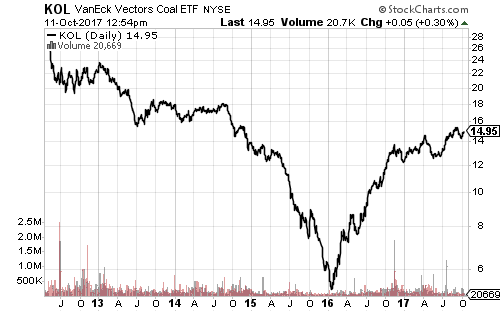

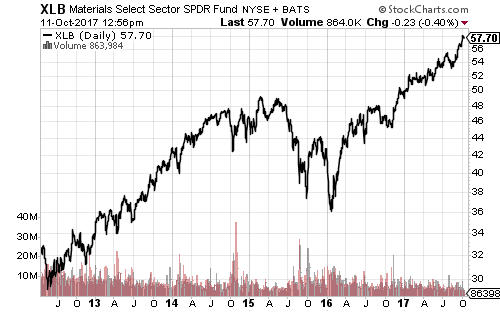

Industrial commodities moved higher this week, but copper, coal and steel producers all remain in a short-term consolidation pattern. The long-term charts of these stocks show all three formed inverse head-and-shoulders patterns. If these complete, gains of 60 percent or more for these sectors will be possible. SPDR Materials (XLB) formed a similar pattern between 2014 and late 2016 with a target of $60 per share. SLX needs to clear $46, KOL $15.50, and COPX around $27.50 for the pattern to complete. Until then, those levels will serve as resistance.

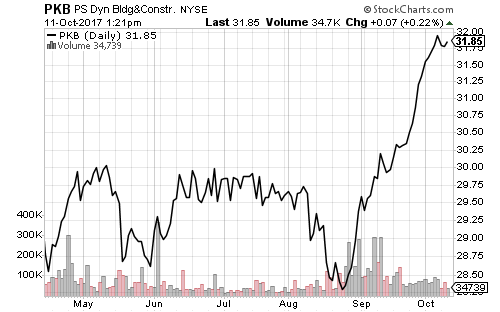

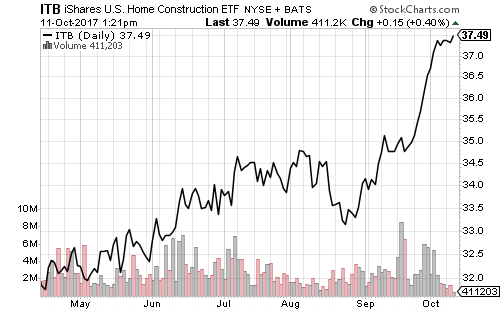

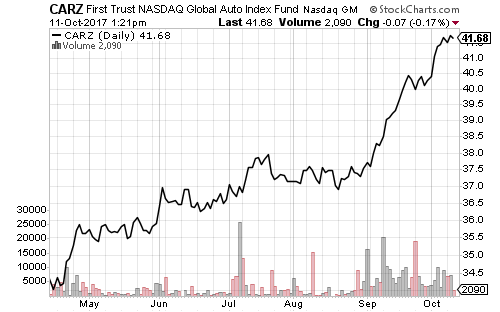

The U.S. dollar rally consolidated over the past week. The greenback was stronger against emerging market currencies following diplomatic challenges with Turkey. UUP USDU Emerging markets started underperforming developed markets in late August, just before the U.S. dollar rally began. The relative-price chart of iShares MSCI Emerging Markets (EEM) to iShares MSCI EAFE (EFA) mirrors charts of COPX, SLX and KOL because many EM countries are commodities exporters. EEMEFA Housing, automobiles and construction continue to benefit from hurricane recovery efforts. PowerShares Dynamic Building & Construction (PKB), iShares U.S. Home Construction (ITB) and First Trust Global Auto (CARZ) all hit new 52-week highs in the past week. September auto sales crushed expectations with an annualized sales pace of 18.6 million, more than 1 million above estimates and 2.5 million above August’s pace.