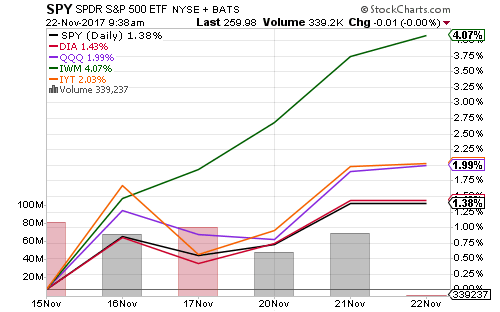

Equities rallied to new all-time highs this week. The S&P 500 has risen in 75 percent of Thanksgiving weeks since 1945, and is well on its way to another win.

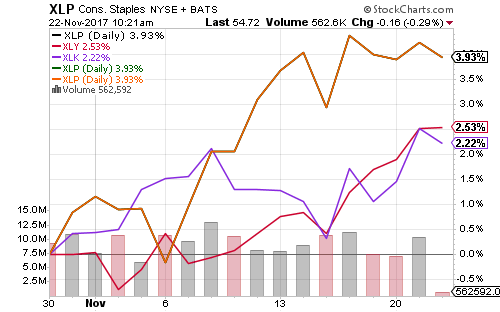

Consumer discretionary and staples have powered the push to new highs, supported by strong Wal-Mart (WMT) earnings.

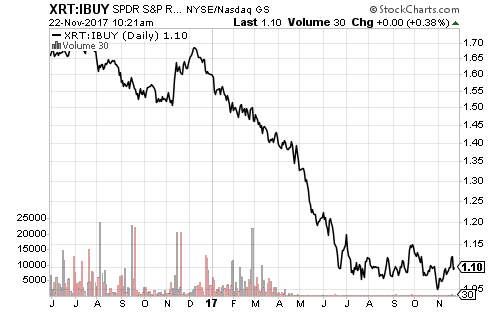

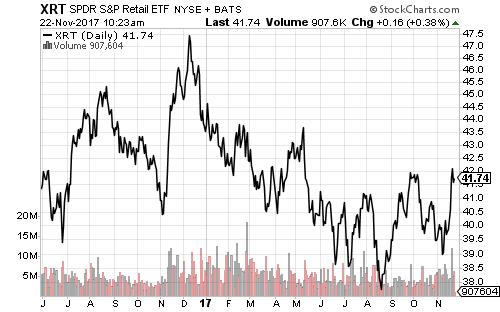

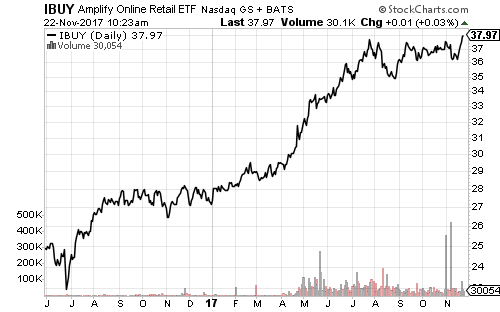

SPDR S&P Retail (XRT) climbed to a new 7-month high in the past week. It has matched the performance of Amplify Online Retail (IBUY) since the summer. IBUY rose to a new 52-week high in the past week.

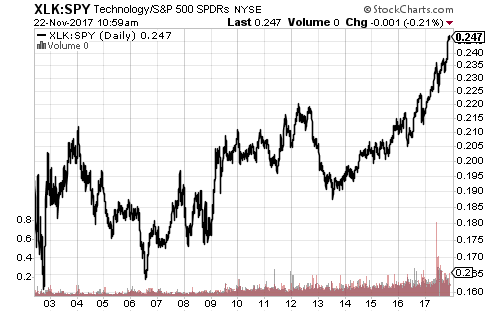

Hedge funds have remained heavily long-technology (as of September 30th). According to Goldman Sachs, 7 of the top 10 holdings are tech stocks: Facebook (FB), Amazon (AMZN), Alibaba (BABA), Alphabet (GOOGL), Microsoft (MSFT), Apple (AAPL) and NXP Semiconductors (NXPI). The other top holdings are Time Warner (TWX), Bank of America (BAC) and Citigroup (C).

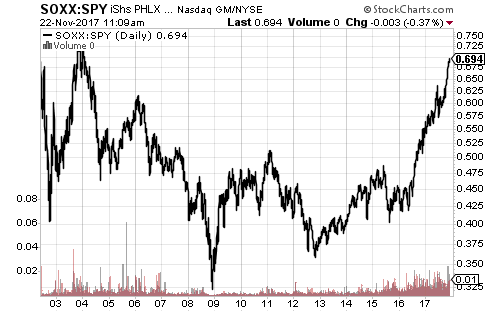

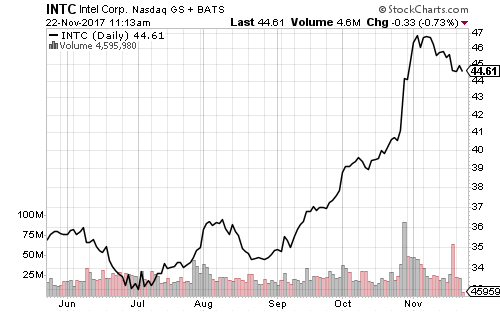

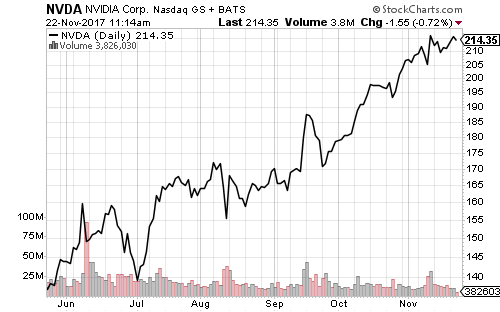

Semiconductors have driven technology’s rise over the past 18 months. Hedge funds have shorted Intel (INTC) and Nvidia (NVDA), but both stocks are up sharply in 2017. Hedge fund managers got burned by another top-10 short position in Wal-Mart last week.

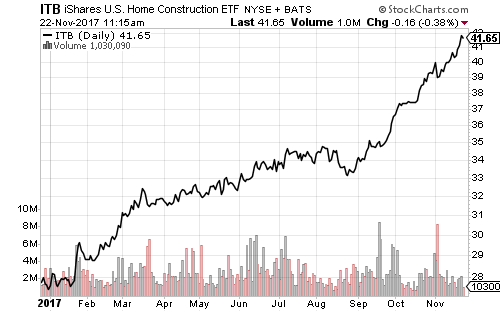

Homebuilders extended their 2017 rally last week. Existing home sales were stronger than expected, hitting an annualized pace of 5.48 million in October. Housing starts and building permits also beat expectations in October. Homebuilder confidence hit its second-highest level over the past 12 months in November.

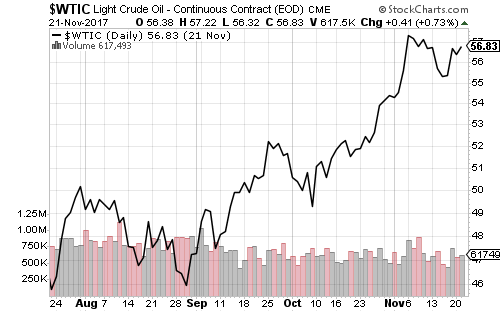

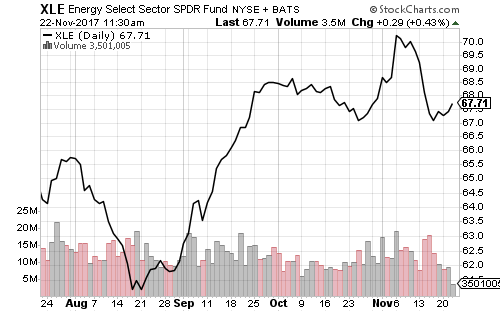

West Texas Intermediate crude took another run at $58 a barrel on Wednesday, but energy stocks have yet to follow it higher.

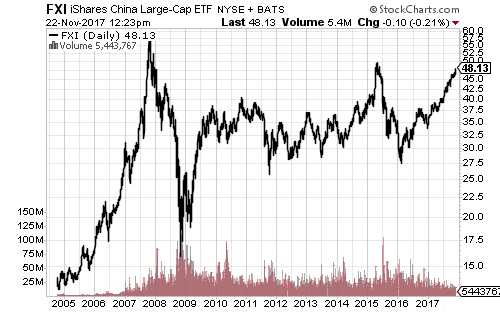

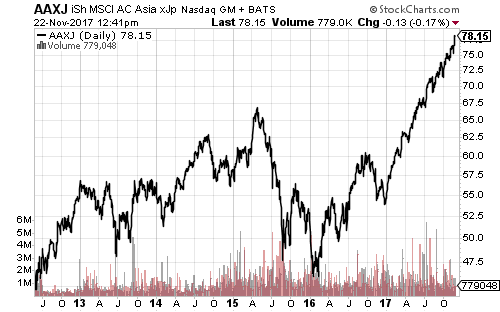

Asian markets rallied strongly in the past week, led by a spike in Chinese shares. Tencent passed Facebook (FB) in market capitalization, making it the largest social media company in the world.

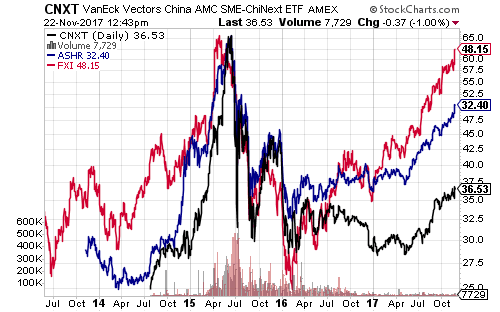

iShares China Large Cap (FXI) is approaching a major resistance line, but the rally comes as Chinese credit growth has stalled, and odds are the Chinese market is peaking.

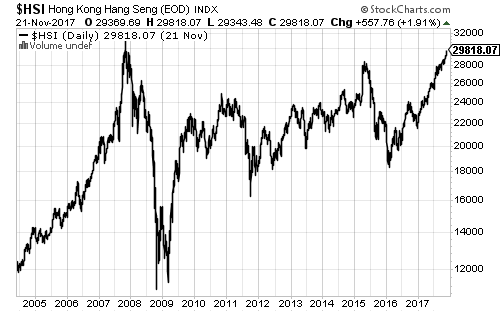

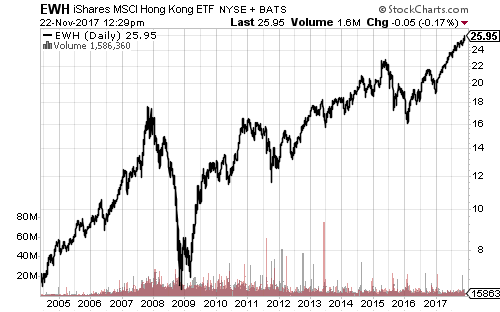

The Hang Seng Index is approaching its 2007 high as Chinese money flows into Chinese stocks only available in Hong Kong, such as Tencent. Asia ex-Japan funds such as AAXJ are tracking the Hong Kong market. Funds covering the mainland market, such as ASHR and CNXT, are still well below their 2015 highs.

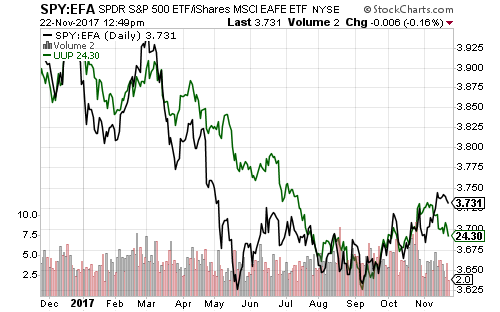

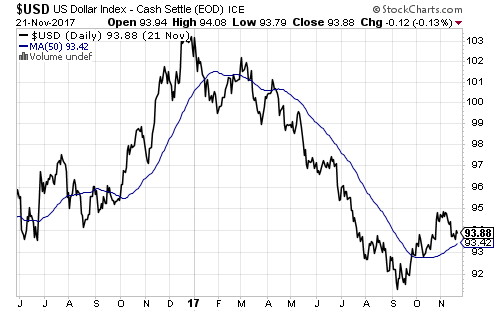

The U.S. Dollar weakened in November and the S&P 500 Index finally started underperforming the MSCI EAFE. The rally in U.S. technology giants pushed the S&P 500 into relative outperformance despite the weaker dollar in early November, but this gave way over the past week. This dip in relative performance could prove short lived.

The U.S. Dollar Index has bounced off its 50-day moving average multiple times since bottoming in early September.