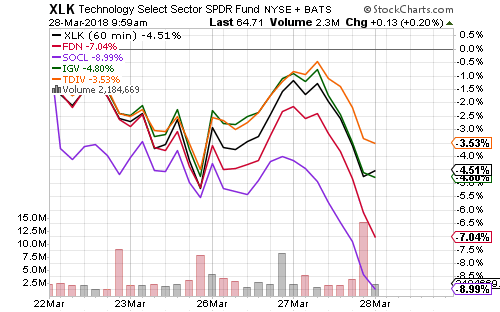

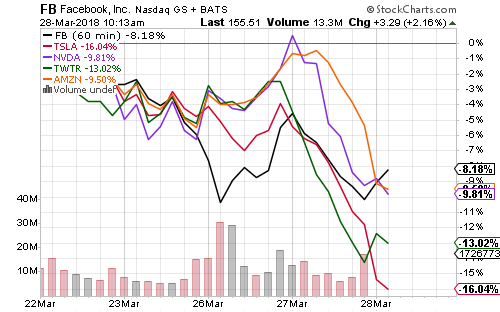

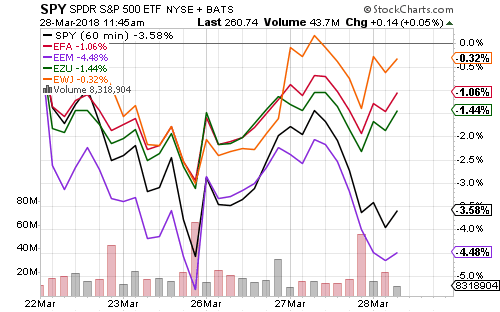

Index Internet and social media stocks pulled the Nasdaq lower over the past week.

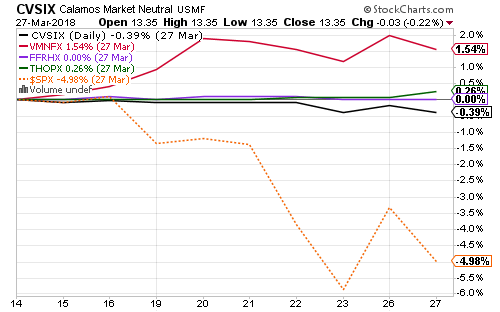

Market neutral and short-term bond funds have held up well. Vanguard Market Neutral (VMNFX) gained 1.54 percent in the 10 days through March 27. Calamos Market Neutral (CVSIX) saw a small decline, and Thompson Bond (THOPX) rose 0.26 percent.

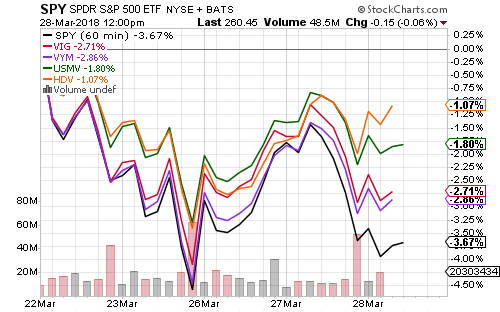

Dividend funds have benefited from lower interest rates and strength in defensive sectors. iShares Edge USA Min Vol (USMV) has also outperformed the market by a substantial margin over the past several days.

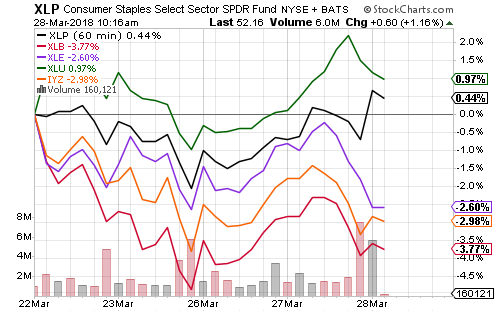

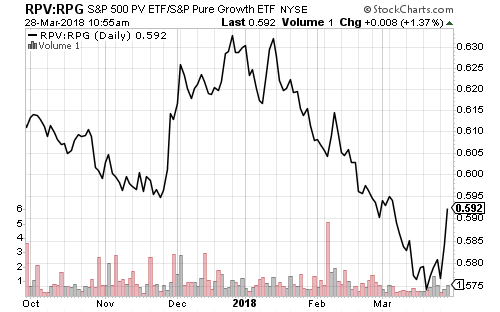

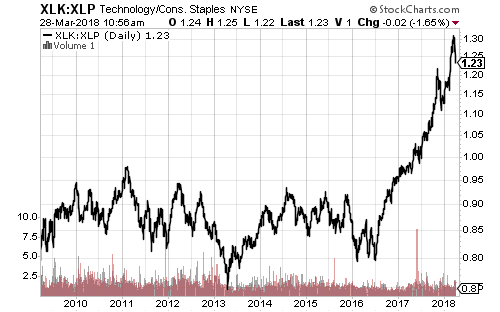

Falling interest rates have lifted utilities, real estate, and consumer staples this week. This also reflects concentrated selling in technology as investors rotated from growth to value.

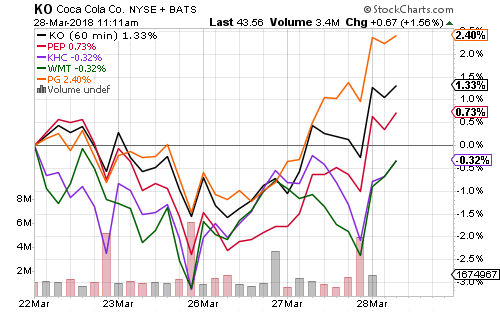

Dividend-paying technology stocks such as Microsoft (MSFT) have outperformed this week, while social media and Internet stocks have underperformed as Facebook’s (FB) troubles continued to mount. A decision by Uber and Nvidia (NVDA) to halt driverless car tests also sent shares lower. Tesla’s (TSLA) bonds tumbled after Moody’s downgraded them as well.

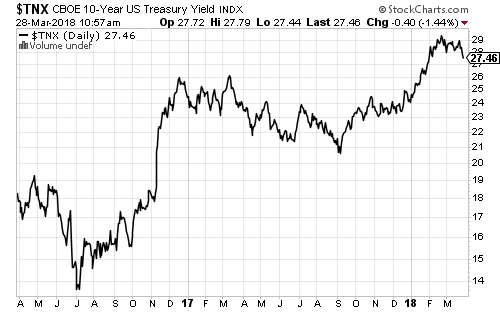

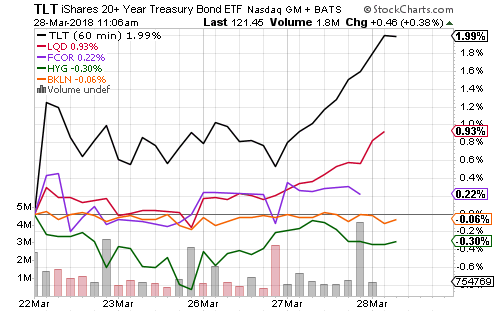

The 10-year yield is headed for a test of support at 2.6 percent. Falling yields lifted most bond funds, although high-yield bonds slipped as the credit spread rose to a one-month high.

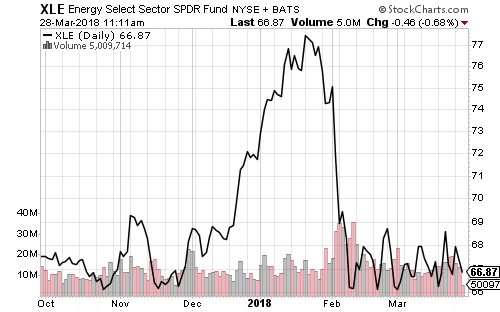

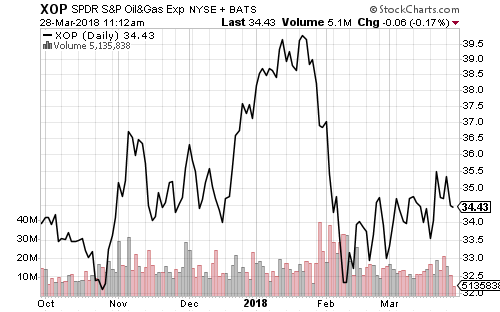

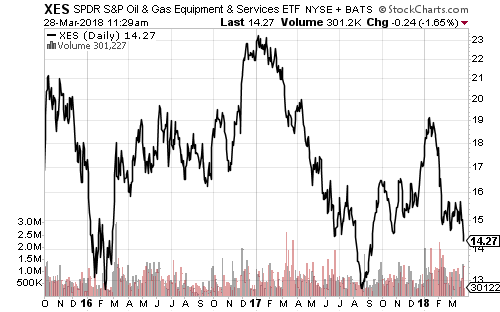

Energy shares held up well this week. West Texas Intermediate crude hit a new intraday 2018 high over the past week. First- quarter energy earnings should be strong given oil prices.

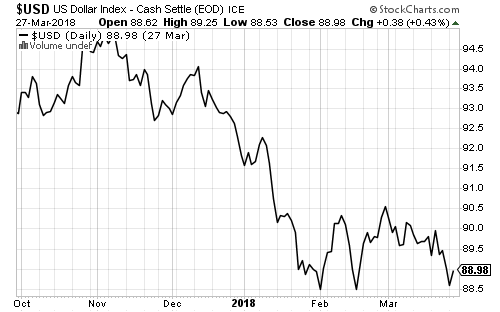

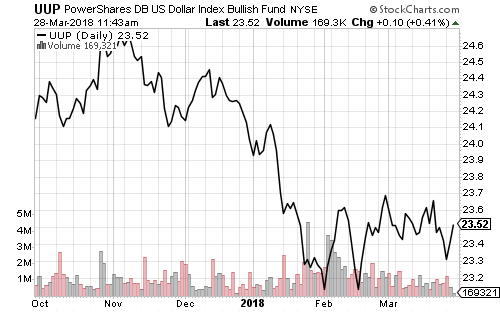

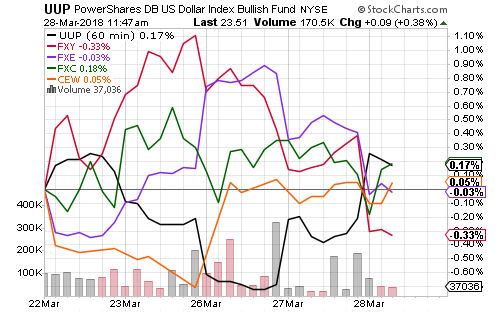

The U.S. Dollar Index was volatile this week. The dollar triple bottomed this week, but it needs to climb above 90.5 to signal at least a short-term bullish breakout.

Foreign shares outperformed, led by strength in Japanese shares. The yen was the weakest major currency on the week, while emerging-markets currencies were flat.

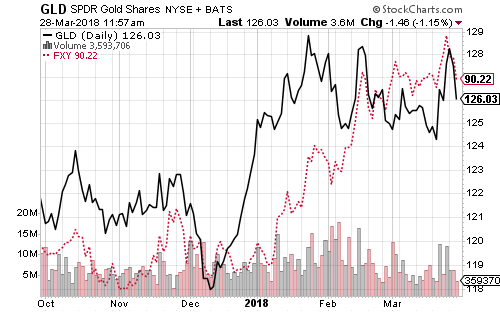

Gold declined in the face of a stronger U.S. dollar.