Equities rallied over the past week, but slipped on Wednesday following a White House pledge to reduce the U.S. trade deficit with China by $100 billion.

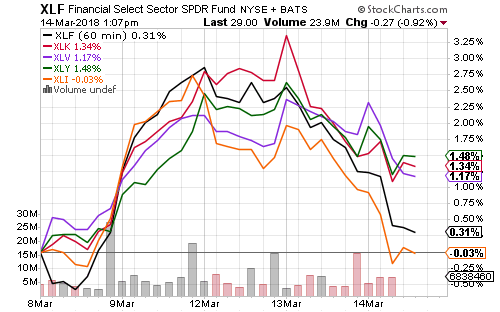

Technology, consumer discretionary and healthcare led the major sectors last week. Industrials and financials slipped as long-term interest rates came down.

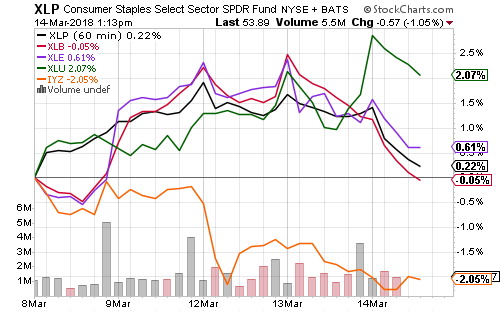

Utilities led performance among the smaller S&P 500 sectors, rising nearly 3 percent. Telecom was by far the weakest of all sectors.

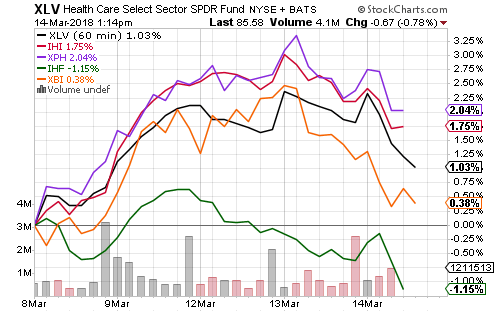

Pharmaceuticals, biotechnology and medical devices lifted the healthcare sector this week. Healthcare providers declined.

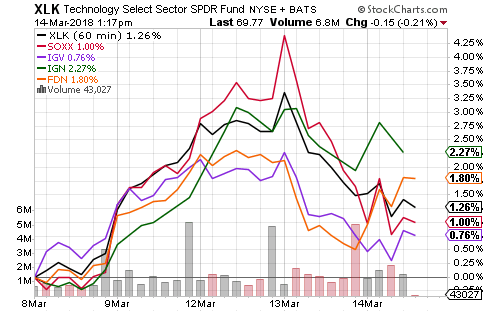

Networking and internet shares led the tech sector this week, while semiconductors and software lagged.

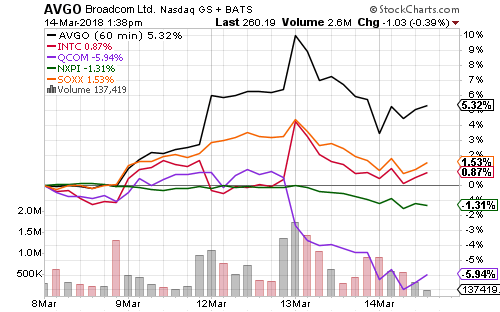

The Trump administration blocked Broadcom’s (BRCM) takeover of Qualcomm (QCOM) this week. Broadcom is located in Singapore and has ties to China. Shares of Broadcom rallied, while Qualcomm fell as the deal was priced out of shares. This also paves the way for Intel (INTC) who is rumored to be interested in Qualcomm.

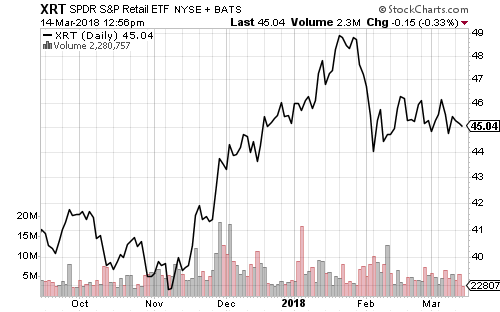

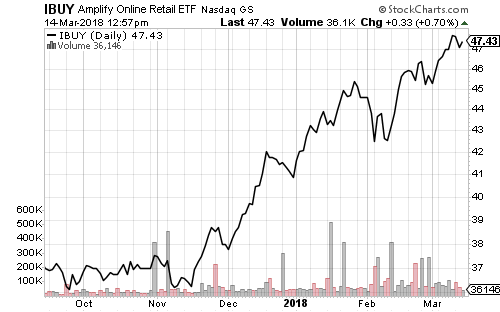

Retail sales missed expectations and declined 0.1 percent. The dip was primarily attributed to falling gas station sales as crude oil prices stabilized, continued weakness in department stores (down 0.9 percent versus a 1.0-percent increase in online sales) and a 0.9 percent decline in auto sales as the hurricane effect wore off. SPDR S&P Retail (XRT) fell on the news, but Amplify Online Retail (IBUY) rallied.

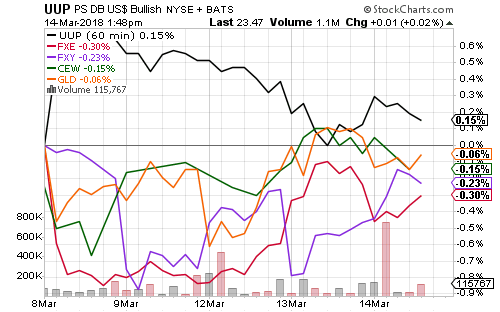

The U.S. Dollar Index gained ground on March 8th and eroded over time. The euro was weak as the European Central Bank moved towards a taper of quantitative easing.

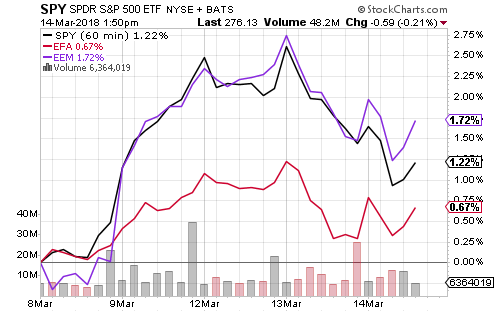

Although the dollar only saw a small gain this week, SPDR S&P 500 (SPY) outpaced iShares MSCI EAFE (EFA) by a wide margin, at one point by more than 1 percentage point. Emerging markets remain the stronger of the foreign markets.

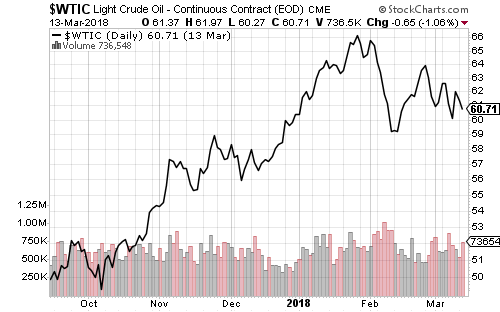

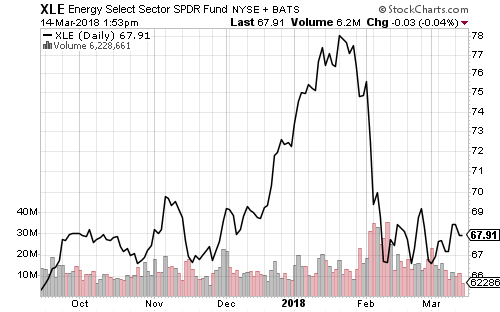

Crude oil and energy remained in consolidation patterns this week. Inventory data was bullish, while production data was bearish. The U.S. is now producing more than 10 million barrels per day, an all-time high. The Department of Energy forecasts shale production will hit a new high of 7 million bpd.