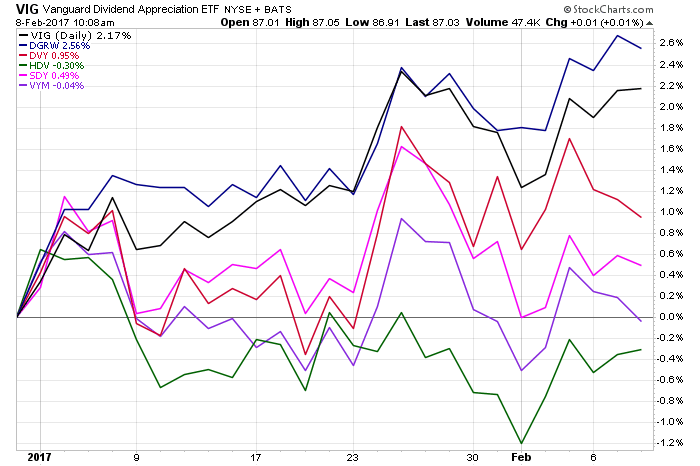

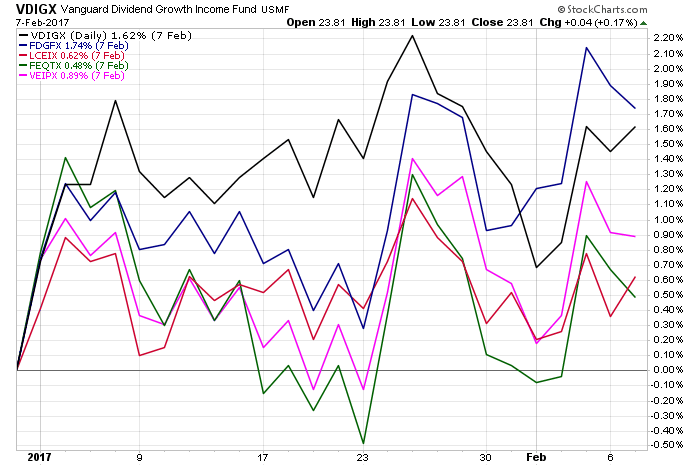

Dividend fund returns are within a 3-percent range in 2017, with funds such as WisdomTree U.S. Quality Dividend Growth (DGRW) and Vanguard Dividend Appreciation (VIG) performing well. Fidelity Dividend Growth (FDGFX) and Vanguard Dividend Growth (VDIGX) have also performed well.

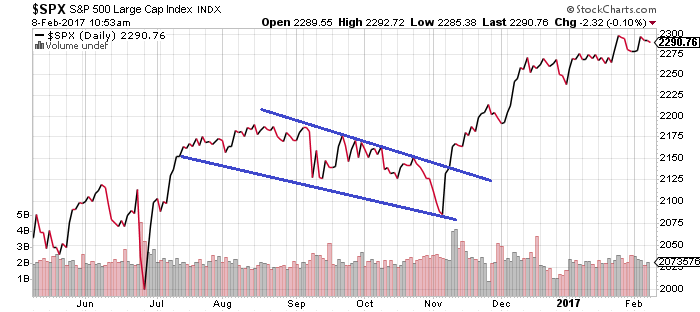

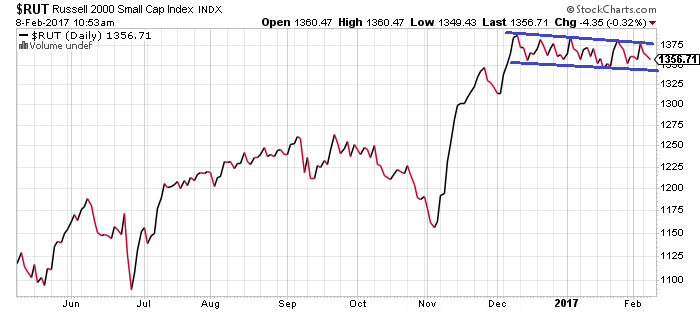

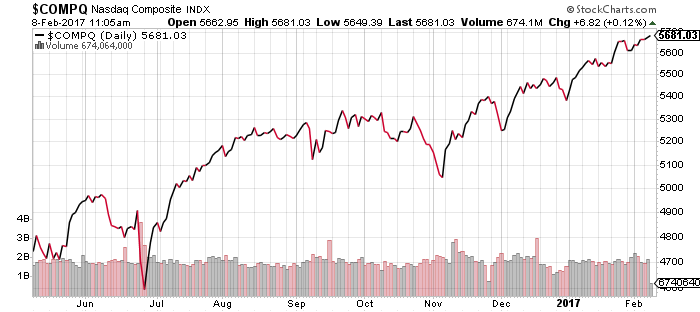

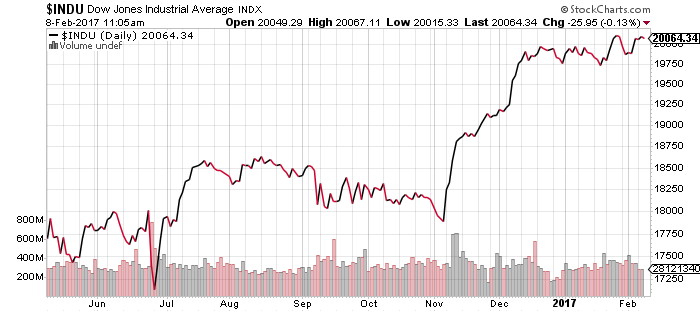

The Dow Jones Industrial Average, S&P 500 Index and Nasdaq Composite are all moving higher this year. Traders also expect the Russell 2000 will make a bullish breakout.

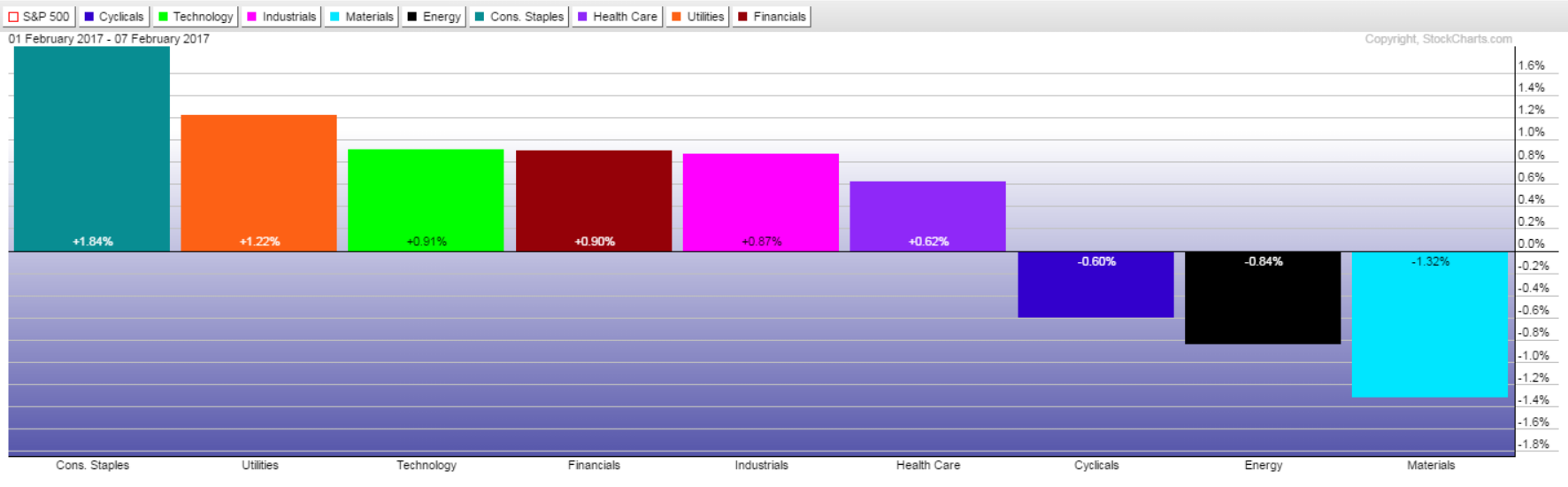

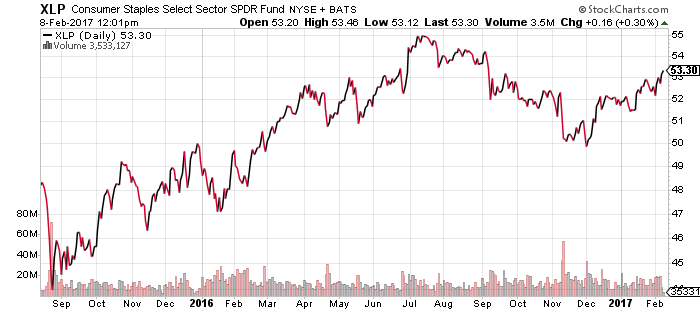

Consumer staples will dominate this week’s earnings. Roughly 20 percent of the sector, based on market capitalization, is scheduled to report. Coca-Cola (KO), Pepsi (PEP) and CVS Health (CVS) will report on Thursday. On Tuesday, Mondelez (MDLZ) missed earnings and revenue estimates, but shares are up more than 2 percent on Wednesday as demand for consumer staples shares rises, with SPDR Consumer Staples (XLP) delivering the best return over the past week.

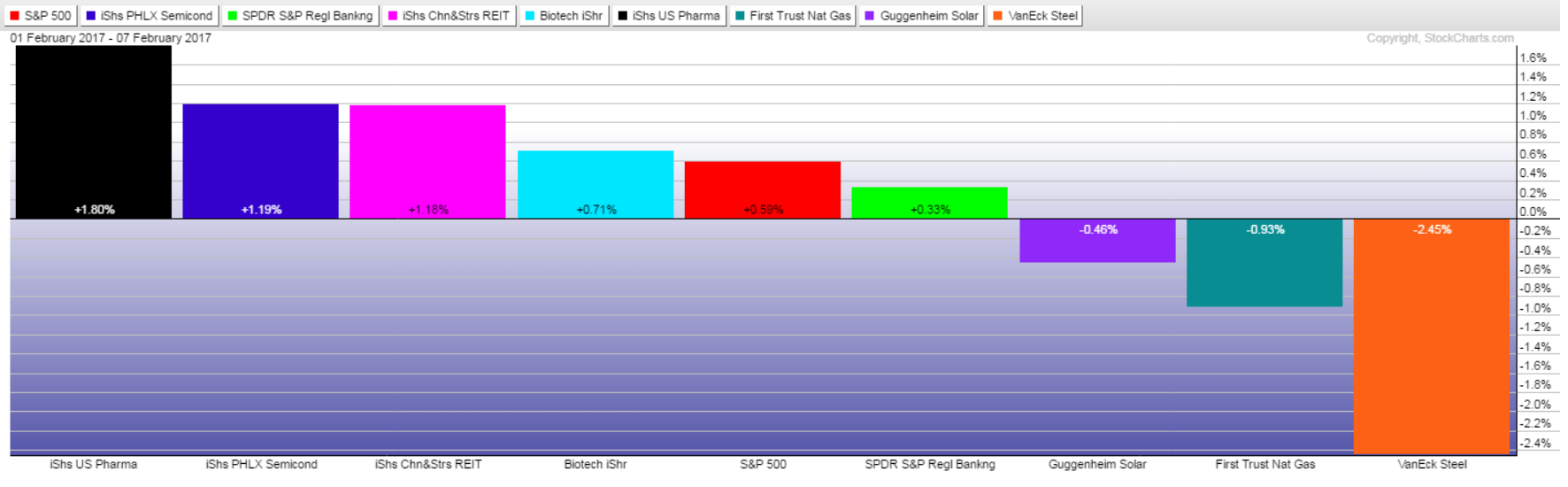

Utilities, real estate, pharmaceuticals, and biotechnology were also strong performers.

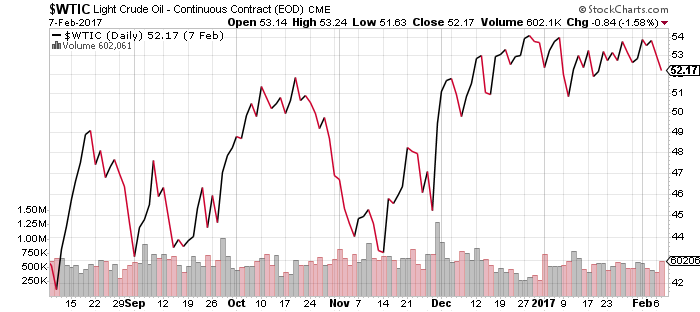

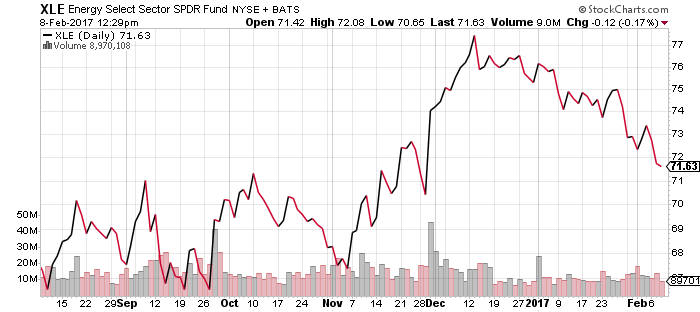

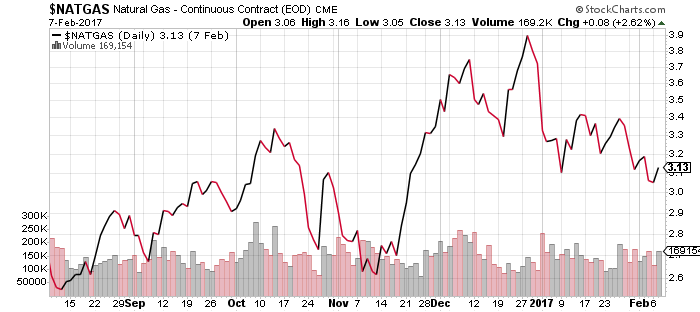

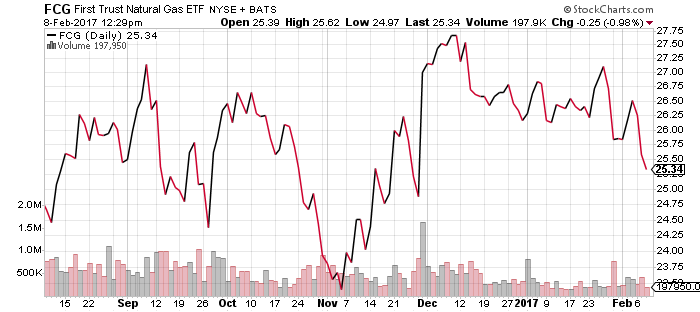

Oil prices slid this week, but have remained in an uptrend since early December. In contrast, shares of XLE peaked in early December.

Oil prices sank following an Energy Information Administration (EIA) report this week. The agency cut its estimate of U.S. crude oil production growth in 2017, but it hiked its 2018 growth estimate to 500,000 barrels per day. If the forecast proves accurate, U.S. production will reach its highest level in nearly 50 years next year. That will be good for oil services and pipeline firms, but it will put pressure on global prices if demand doesn’t pick up.

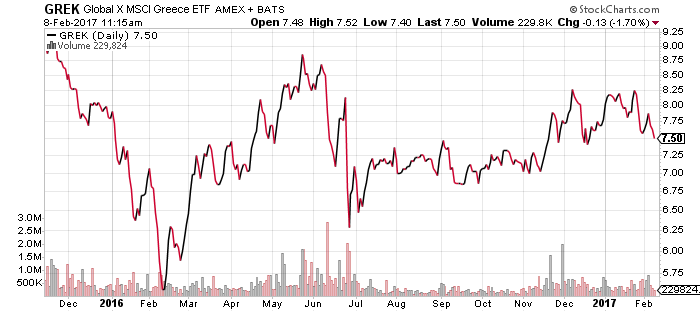

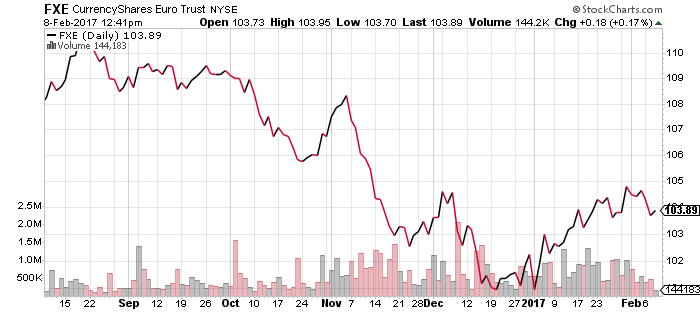

The IMF wants to ease the conditions of Greece’s debt deal with additional aid, but the Europeans are holding firm. Elections in Holland and Germany are turning in favor of opposition parties and the bailouts are already unpopular in Northern Europe. Meanwhile in Greece, senior politicians have started openly discussing a return of the drachma.

The market has yet to react. GREK has been in an uptrend since February 2016 and it would need to fall below $7 to break it.

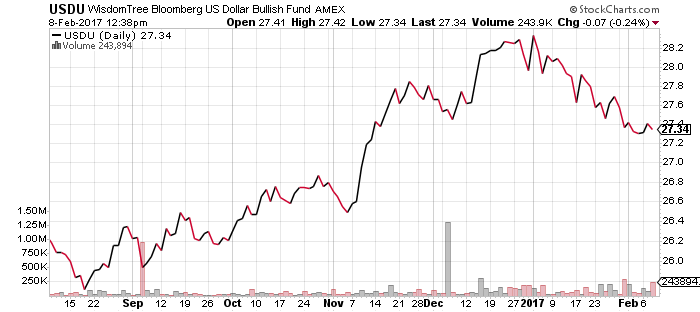

WisdomTree US Dollar Bullish (USDU)

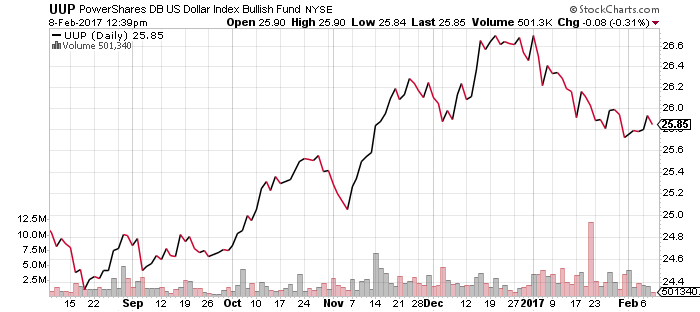

PowerShares DB US Dollar Bullish (UUP)

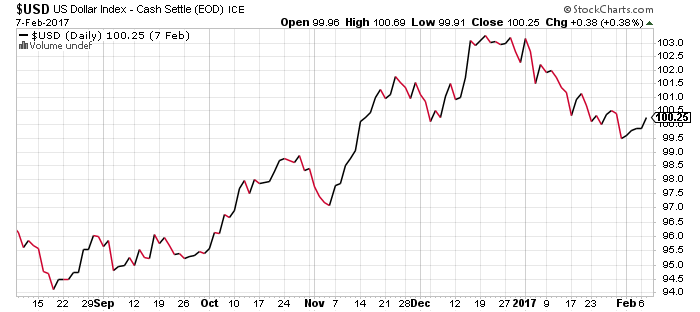

The U.S. Dollar Index enjoyed its longest winning streak since November, rising for 4 days straight before giving ground on Wednesday. Although the dollar correction could have longer to go, with an eventual bottom around 97, very short-term indicators point to a rally. The flipside of the dollar rally is the pullback in the euro.

If the Greek crisis keeps flaring up, it will weigh on the euro moving forward and could even reverse the correction in the dollar.

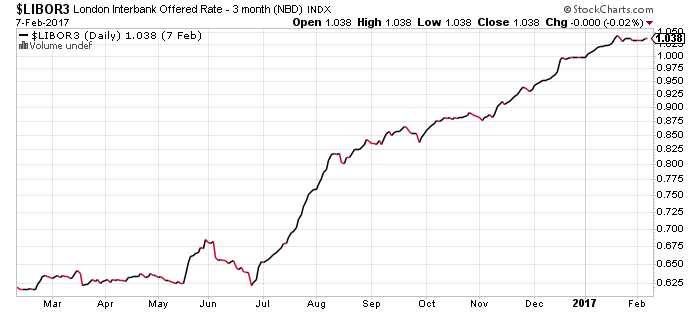

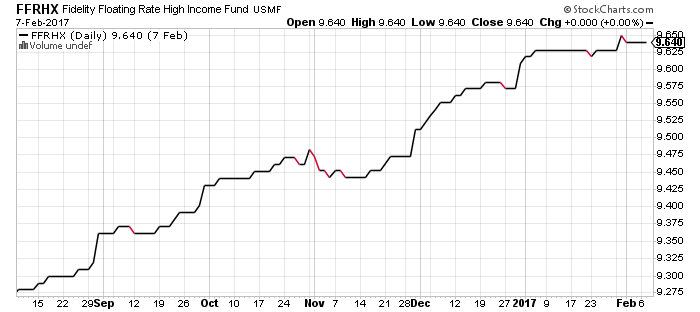

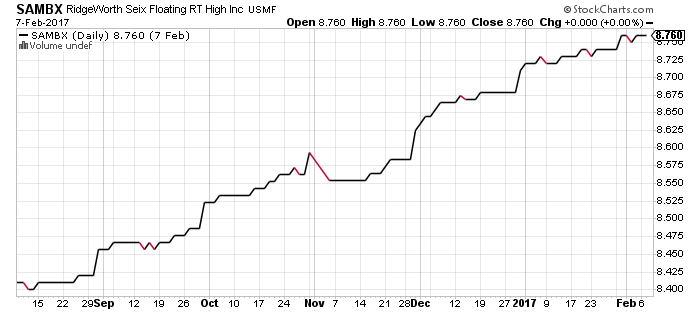

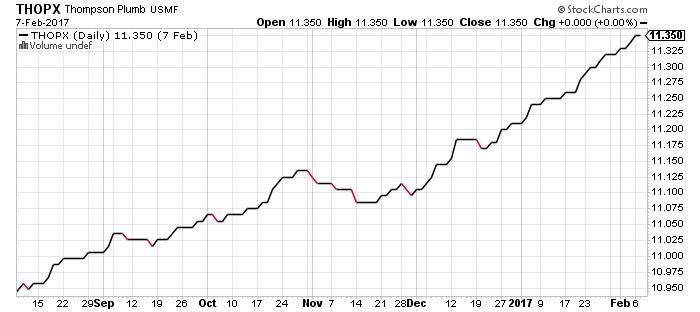

Floating-rate funds such as Fidelity Floating Rate High Income (FFRHX) held steady with 3-month LIBOR, while RidgeWorth Seix Floating Rate High Income (SAMBX) edged higher. Thompson Bond (THOPX) continues to rise at a consistent pace.

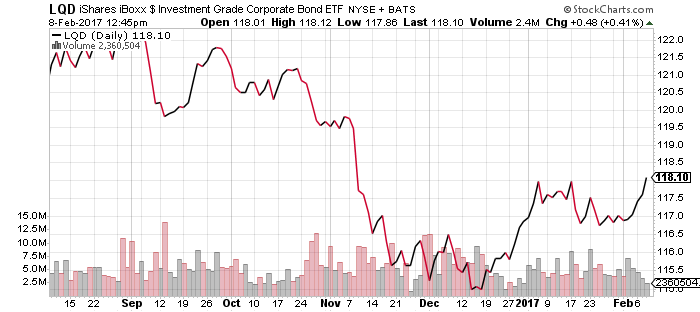

iShares iBoxx Investment Grade Corporate Bond (LQD) rebounded on the dip in interest rates this week. Shares have broken out to a 2017 high and could signal a breakdown in the 10-year Treasury yield discussed above.

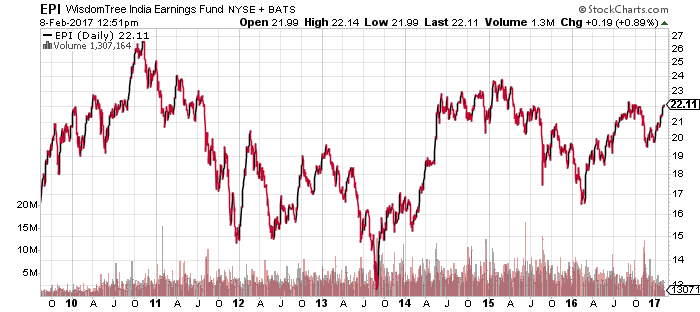

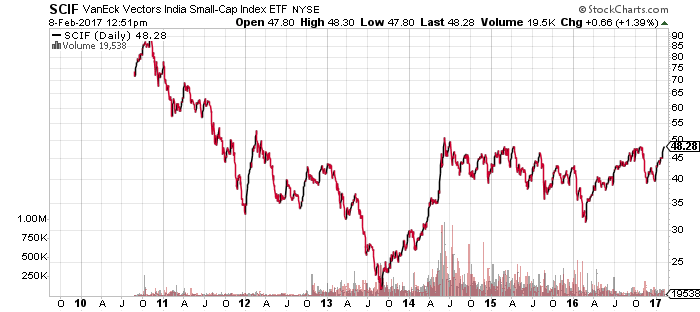

India ETFs have retraced their losses and returned to levels last seen before the crackdown on cash. The small-cap SCIF is close to a new multi-year high.