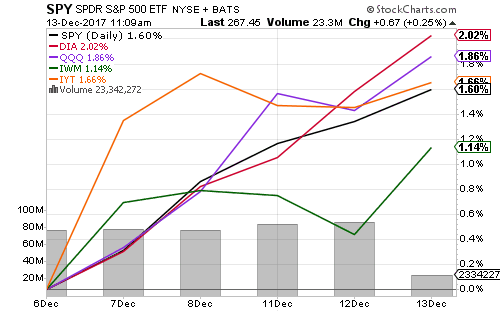

Strong November employment and tax reform have exerted upward pressure on stock prices this week. SPDR DJIA (DIA) led the index ETFs.

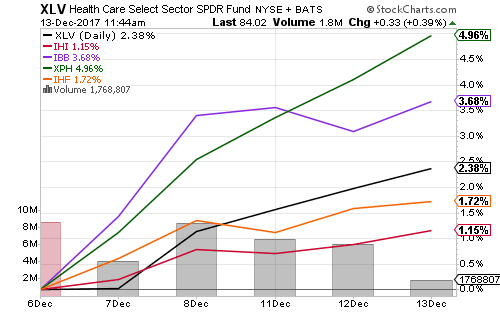

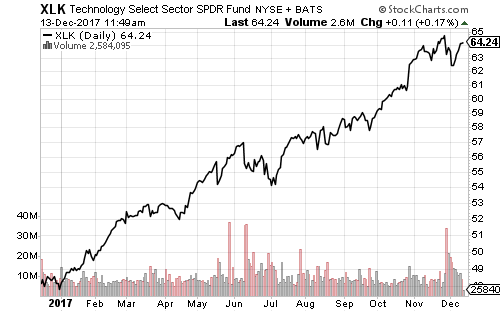

The week’s best performing large sectors were healthcare and technology.

Pharmaceuticals and biotech have lifted the healthcare sector over the past week.

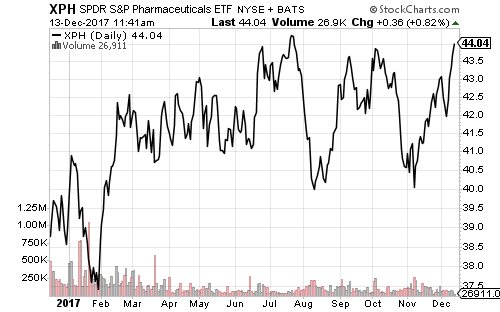

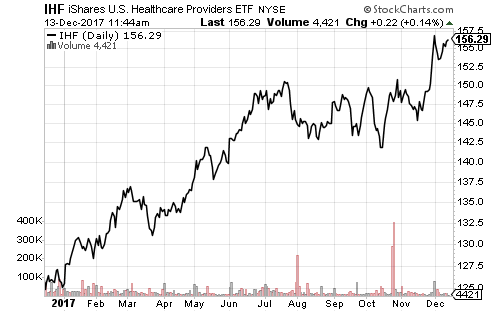

SPDR S&P Pharma (XPH) is approaching its 2017 high. Healthcare providers are trading near their 52-week high.

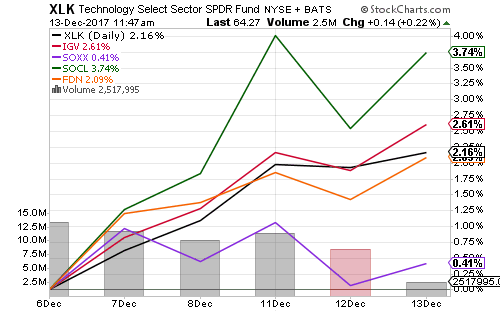

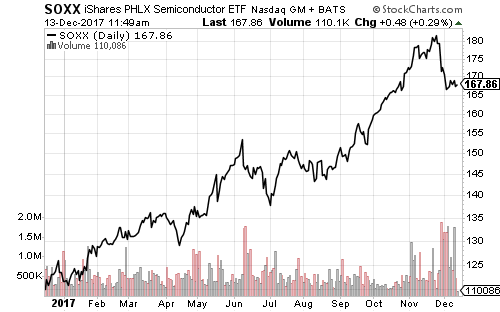

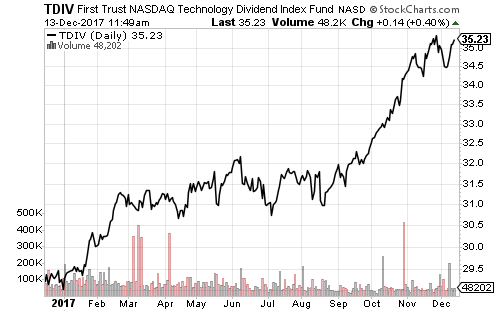

Social media and software shares led technology, while semiconductors weighed on the sector. First Trust Nasdaq Technology Dividend (TDIV) has bolstered sector performance.

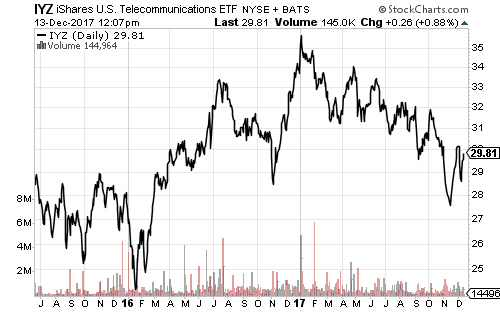

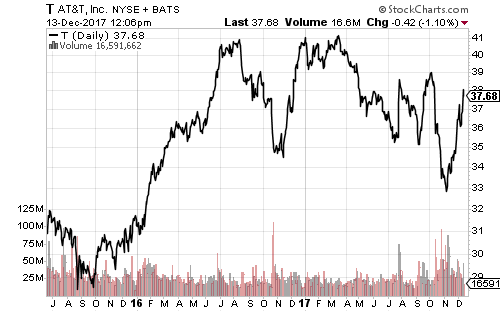

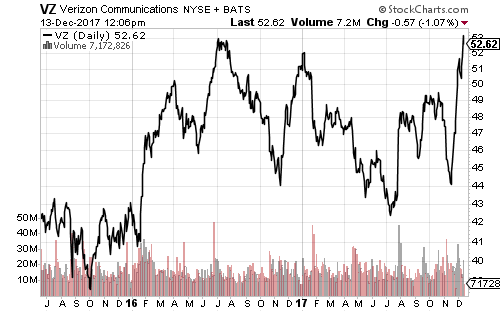

The telecom sector remains in a downtrend, but the two largest holdings in iShares U.S. Telecommunications (IYZ) both rallied last week. Verizon (VZ) achieved a new all-time on Tuesday.

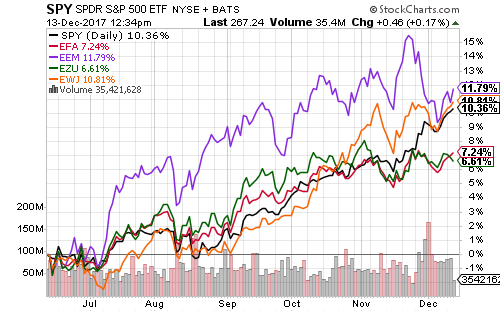

A rebounding U.S. dollar, rising interest rates and tax reform benefit U.S. equities. Over the past month, SPDR S&P 500 (SPY) has opened a healthy lead on developed-market stocks, while emerging markets have fallen. SPY now has the potential to outperform both EEM and EFA on the year. A slide in Chinese shares has also weighed on EM returns over the past month.

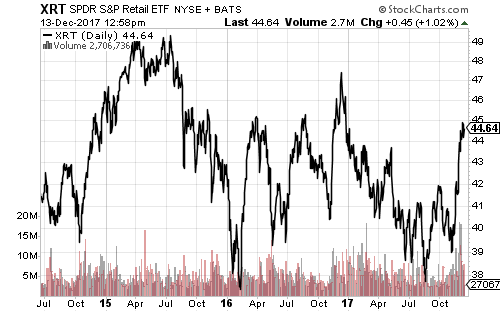

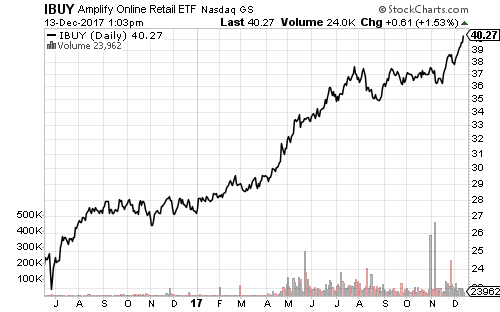

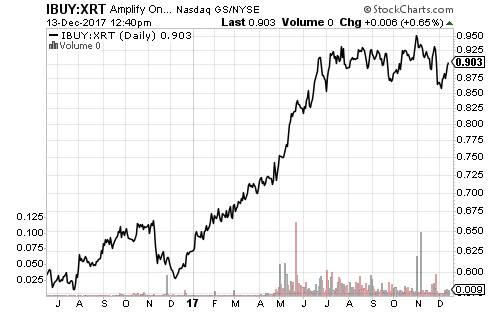

Retail stocks have enjoyed a strong rally over the past month, but shares remain in a multi-year downtrend. If a more substantial bull rally is underway, SPDR S&P Retail (XRT) will crack $46.

Online retail is rallying with XRT, however, the relative price of XRT has outperformed since the start of November.

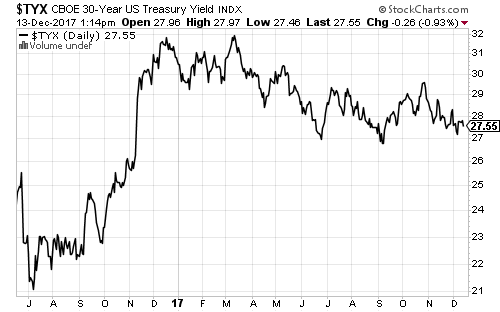

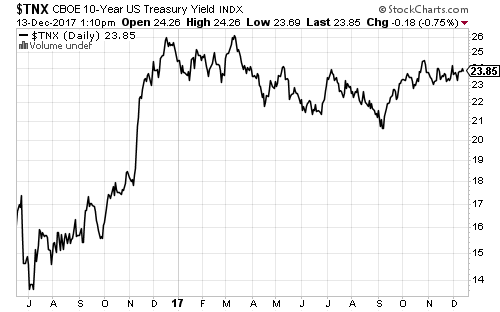

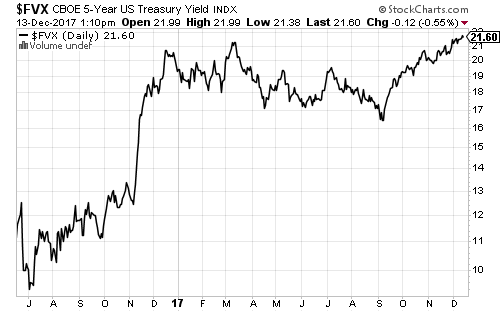

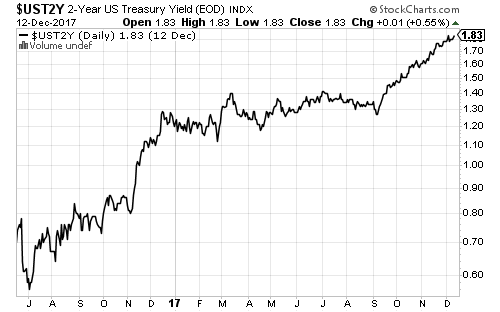

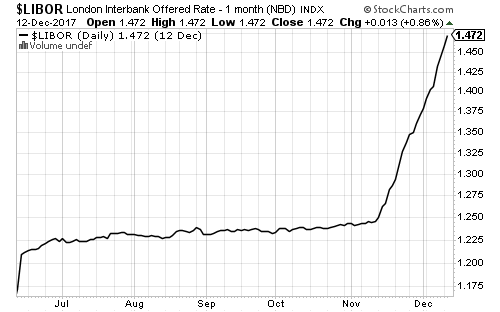

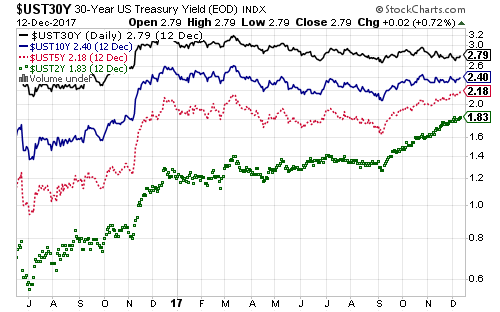

The Federal Reserve hiked interest rates today, as anticipated. The bond market expects the next increase in June 2018.

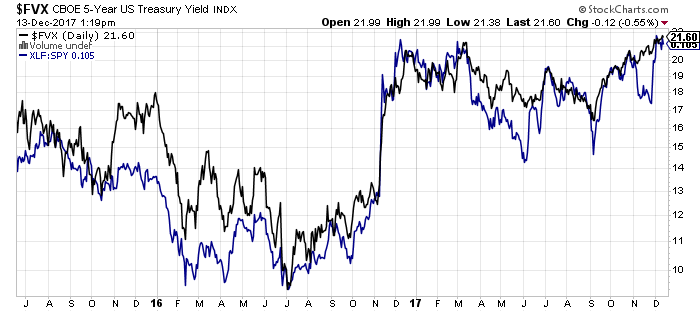

As the bond charts below reflect, the yield curve is flattening as short-term rates catch-up with long-term rates. The breakout in the 5-year yield is an early sign that long-term rates will move higher, with attention now focusing on the 10-year.

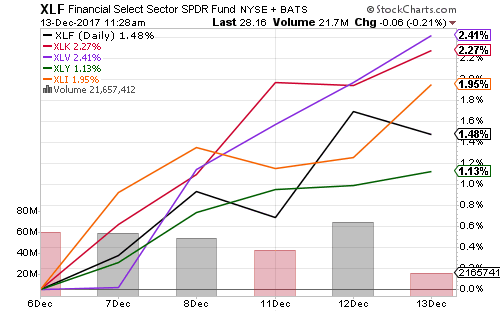

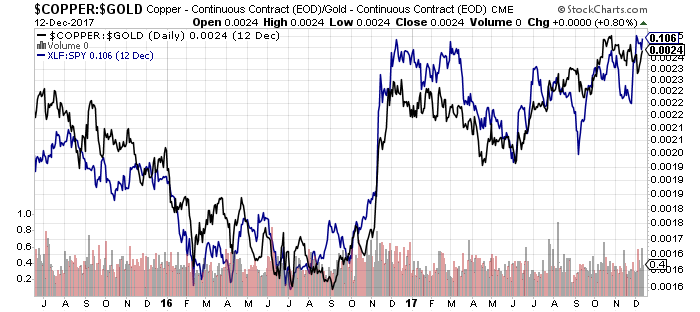

Financial stocks have broken out with the 5-year yield.