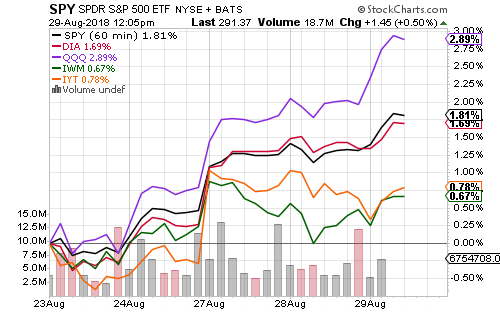

The S&P 500, Russell 2000 and Nasdaq all hit new all-time highs this past week. The Dow Transports remains near an all-time high set last week.

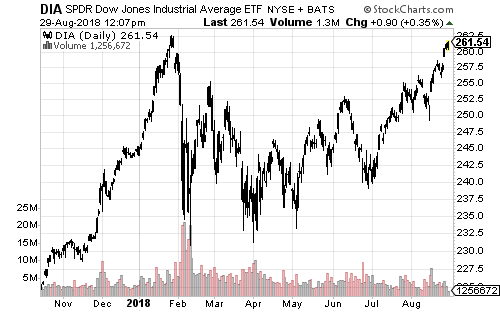

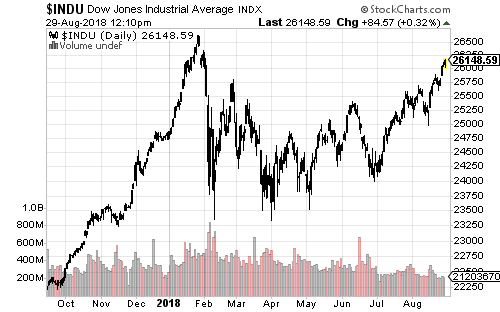

SPDR DJIA (DIA) is less than 0.5 percent from a new all-time closing high, while the Dow Jones Industrial Average is about 1.7 percent away.

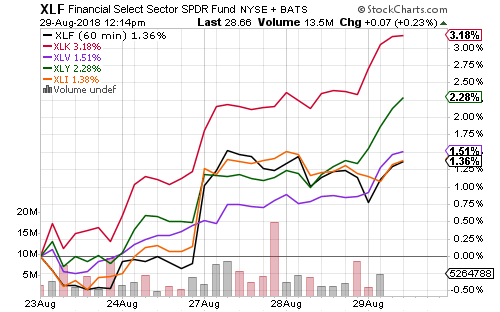

Technology has powered the week’s advance as Amazon (AMZN) and Netflix (NFLX) lifted consumer discretionary.

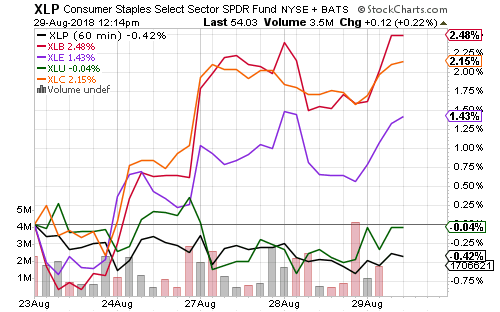

Rising interest rates weighed on utilities and consumer staples this week. DowDuPont (DDWP) lifted the materials sector. The telecom services sector’s new ETF from SPDR, trading under symbol XLC also benefited from this week’s rise in technology shares.

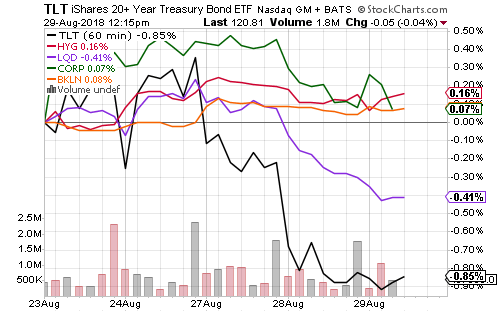

Long-term bonds weakened amid rising interest rates this week, but corporate, high-yield and floating- rate funds held steady. The 10-year Treasury yield hit 2.90 percent on Wednesday, the high for the past week. It remains in a trading rate that began in February.

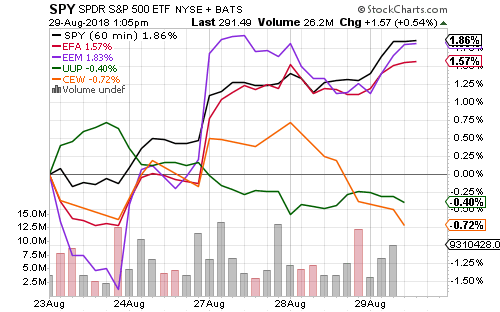

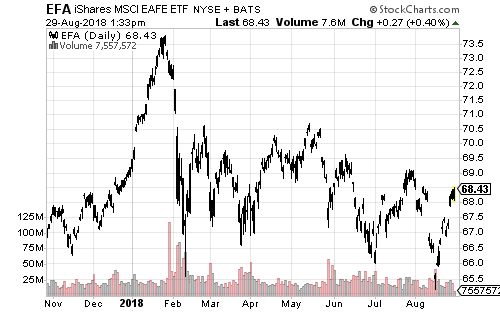

International ETFs did not outperform U.S. markets despite the weaker U.S. dollar. Emerging-market currencies weighed on the rebound in EM shares and the U.S. is more heavily weighted towards tech than most other nations.

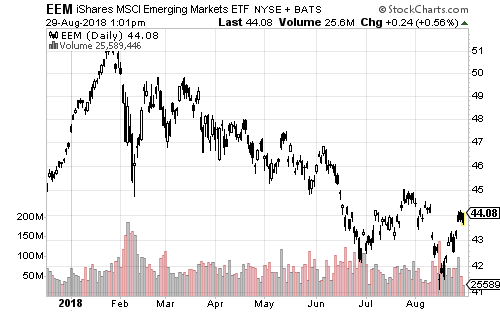

iShares MSCI Emerging Markets (EEM) extended its rally over the past week. If EEM can push towards $45 per share, it will break the downtrend that has been in effect since March. That wouldn’t swing the outlook to bullish, but it would mean a new low could take time to materialize. If instead EEM turns lower this week, the downtrend since March is still in effect and a new 52-week low is likely to occur sometime before the end of September.

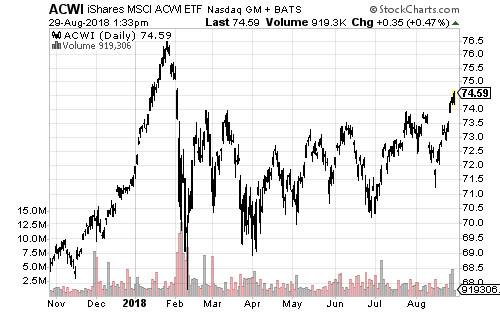

Global stock indexes broke out of a consolation pattern this week. Emerging markets and to a lesser extent developed markets had weighed on performance, as U.S. markets marched on to new all-time highs. The bounce in emerging and developed markets since mid-August has lifted iShares MSCI All Country World Index (ACWI) out of this pattern. It remains about 8 percent below its January high.

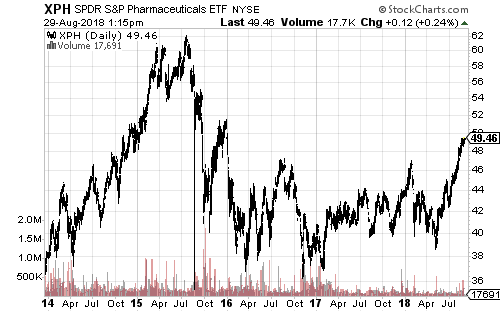

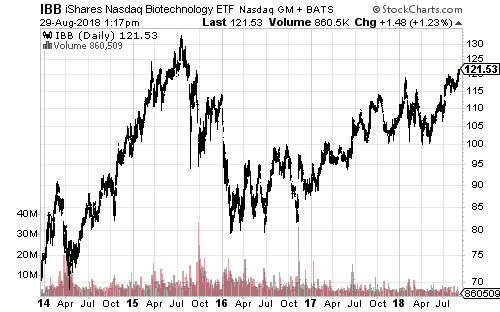

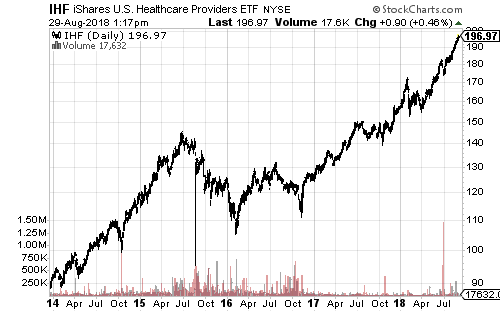

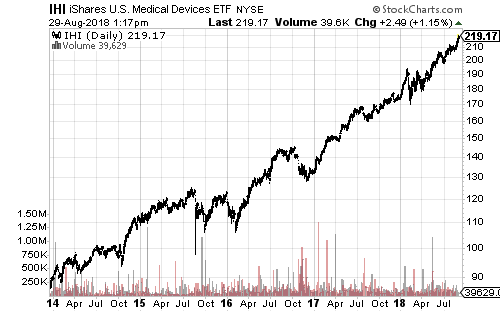

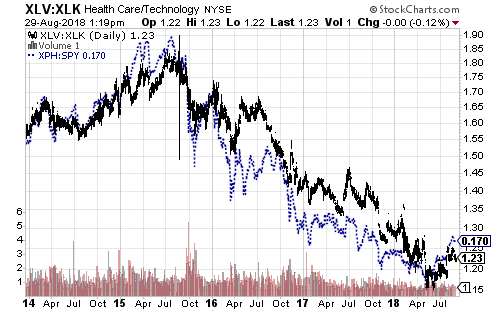

Healthcare has benefited in recent months from the rebound in pharmaceutical shares. SPDR S&P Pharmaceuticals (XPH) still needs to rally 27 percent to exceed its all-time high set in the summer of 2015. Large-cap biotech is closing in on its ATH. Healthcare providers and medical devices (along with the broader healthcare sector) have been setting new ATHs for several years.

The final chart illustrates the impact of pharma on the relative performance of the healthcare sector. SPDR Healthcare (XLV) has underperformed SPDR Technology (XLK) consistently since the sector peaked in 2015.