Global X Copper Miners (COPX) +38

iShares Silver Trust (SLV) +28

VanEck Steel (SLX) +27

VanEck Gaming (BJK) +26

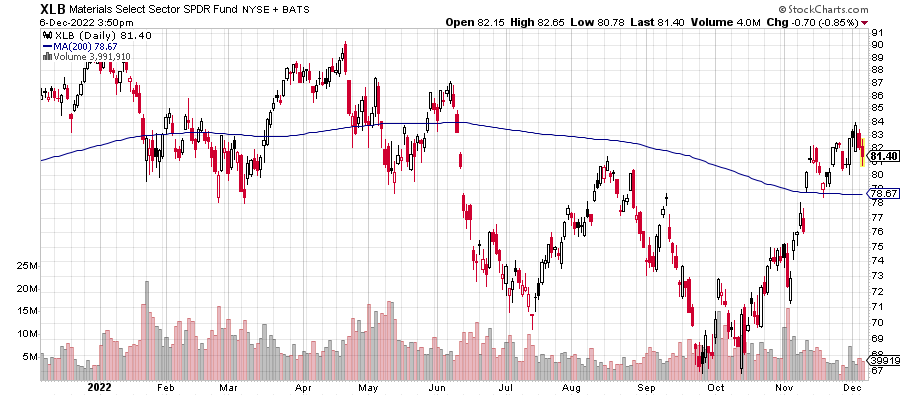

SPDR Basic Materials (XLB) +26

The month of November saw materials stocks lead the market higher. SPDR Materials (XLB) gained 13 percent in December 2, more than double the 5.5 percent rise in SPDR S&P 500 (SPY). Sectors such as copper and steel rallied as well, but oil, palladium and agricultural commodities were among the largest momentum losers. What explains this divergence?

In one word: China. Although one can look at the above funds and maybe guess China was the driver, the presence of VanEck Gaming (BJK) gives it away. Gaming stocks in that portfolio are heavily influenced by Chinese gamblers. As for the commodities, copper and steel are two of the main metals in demand when China increases stimulus spending.

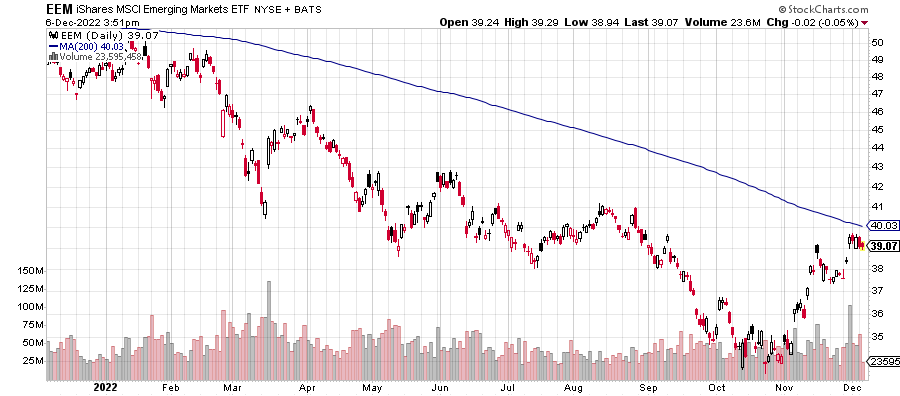

The past month saw several rumors of China reopening along with large protests against lockdowns in some cities. Combined with the general rally since October, it delivered substantial gains in equities with China exposure. Invesco China Technology (CQQQ) climbed 43 percent from its October low. As a large component in emerging market funds, China and Chinese tech stocks helped emerging markets outperform U.S. markets, as did the weaker U.S. dollar.

What’s next for these sectors will be an important signal for markets and the world economy.

VanEck Steel (SLX) is the only fund ranked high enough in our relative momentum rankings to be a possible portfolio addition anytime soon. Often times, sectors come close to making into the top-10 of the rankings only to fizzle out though. Is it headed for leadership or will this be another fizzle?

Overlaying technical signals such as the 200-day moving average on the major indexes shows the markets at a major decision point. Rallies in 2022 have ended around this level. Will this be the third major reversal or has the bottom been made?

A breakout in all assets will signal this past year was more like a large correction than a bear market. At the very least, it would signal extended rallies into the end of 2022. If optimism around China remains, then the momentum indicates China-related sectors should extend their momentum gains.

If sectors such as copper, steel, industrials and emerging markets extend their rallies, it could create a bifurcated market. If these shares are doing well, it doesn’t confirm inflation will be higher. Investors will make that assumption though, and it could be why stocks such as Amazon (AMZN) are lower now than they were in October. Strong growth amid higher inflation would weigh on technology-heavy indexes such as the Nasdaq.

Finally, it’s possible history repeats. Most assets turn lower from here and resume the downward trend that has dominated 2022. In that case, it’s possible some of the above sectors underperform as traders who piled in and created the upward momentum find themselves scrambling out.

When the market finally tips its hand, the momentum rankings will tell us which sectors are primed for leadership.