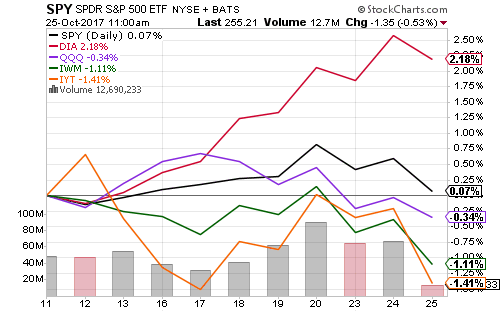

Over the past 10 days, SPDR DJIA (DIA) has climbed 2.18 percent, followed by SPDR S&P 500 (SPY) with an increase of 0.07 percent.

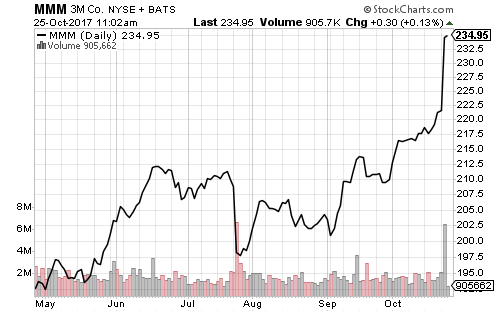

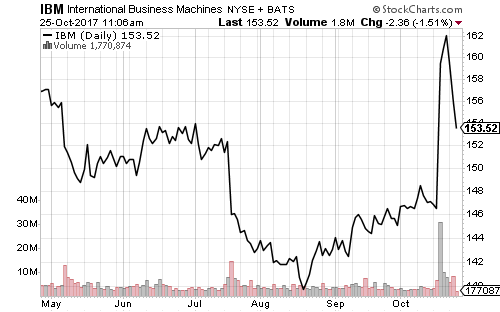

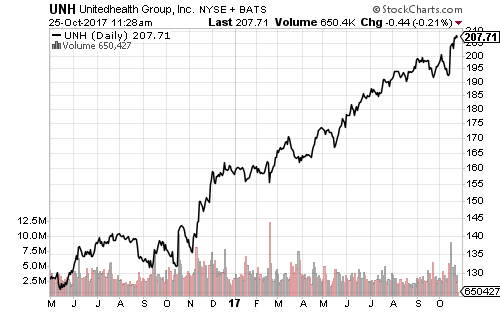

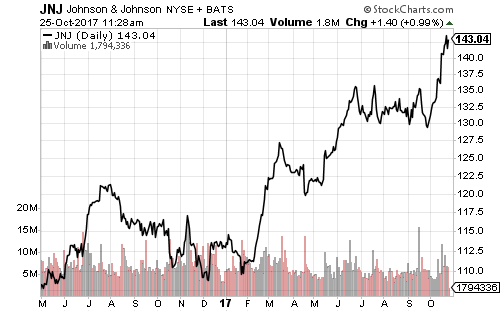

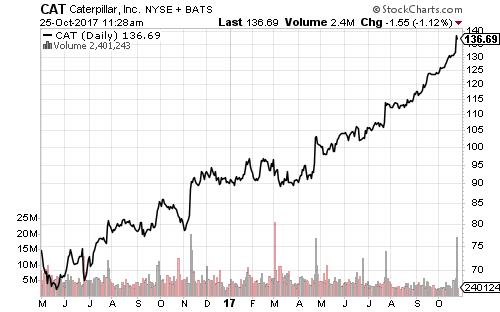

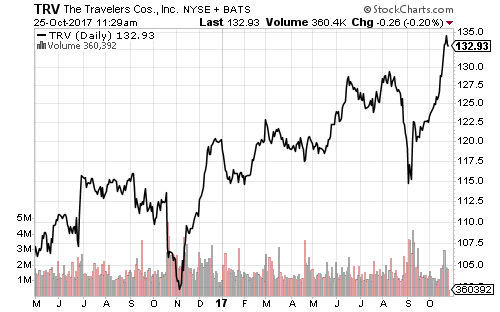

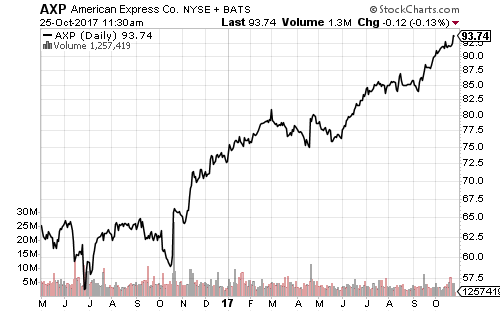

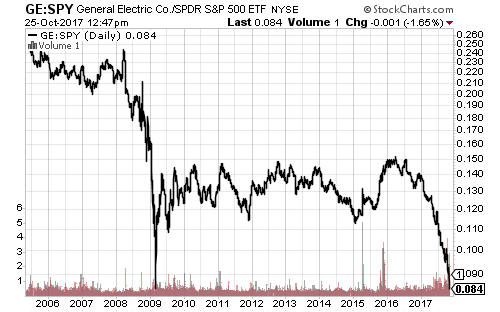

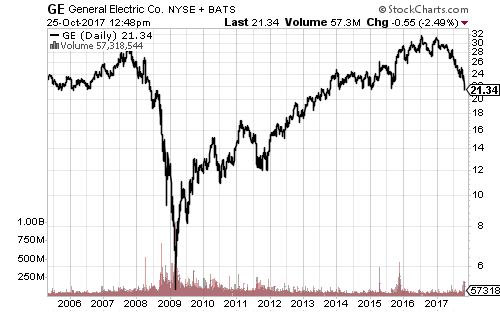

Since the Dow is a price-weighted index, the higher-priced stocks have a larger impact on index returns, as reflected in the following charts:

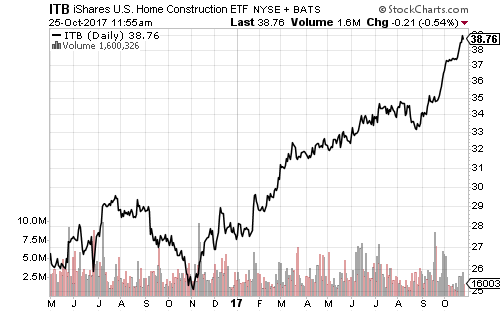

Homebuilder stocks have risen sharply. New home sales jumped in September to an annualized pace of 667,000, crushing estimates of 555,000 and August’s pace of 561,000. It was the largest one-month increase since 1992. Sales of pre-construction homes in the South contributed to the growth as hurricane recovery began. Even without this bump, sales were strong across the nation.

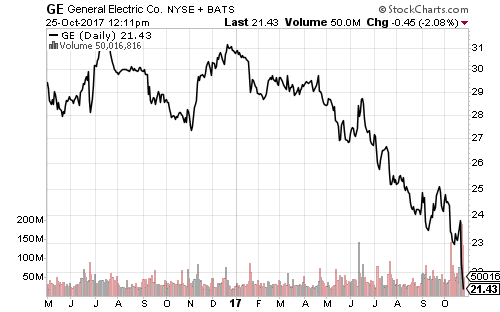

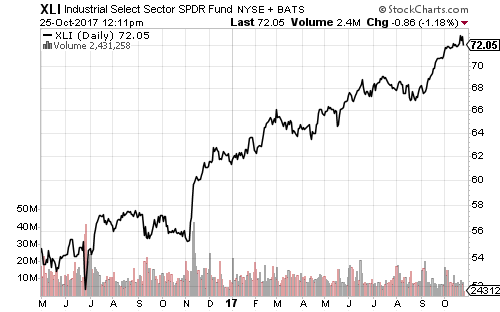

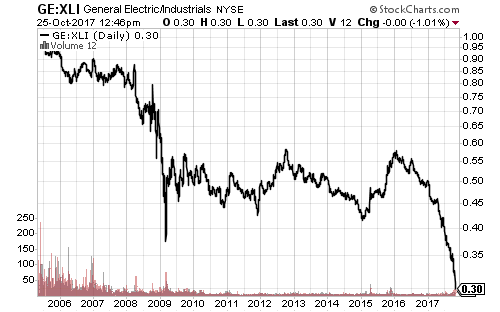

General Electric (GE) has weighed on the industrial sector this week. The company is considering a dividend cut and will announce its decision in November. Relative to SPDR Industrials (XLI), GE is cheaper than it has ever been. This increases the likelihood that shares could bottom, at least in the short- and intermediate-term, around the time of the November announcement.

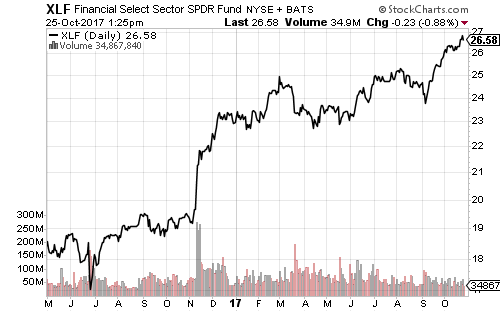

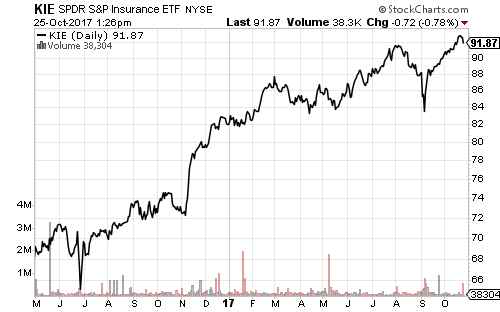

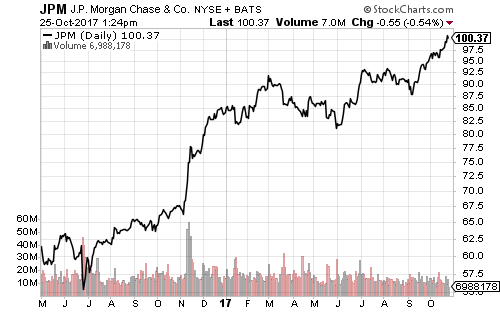

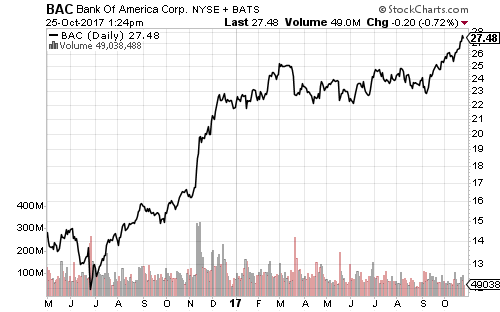

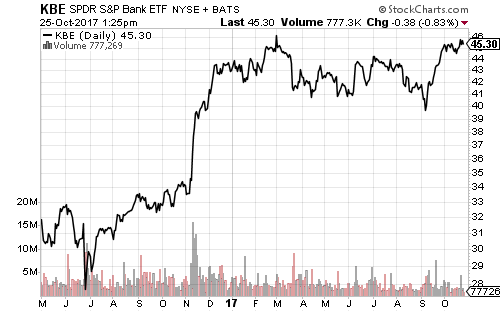

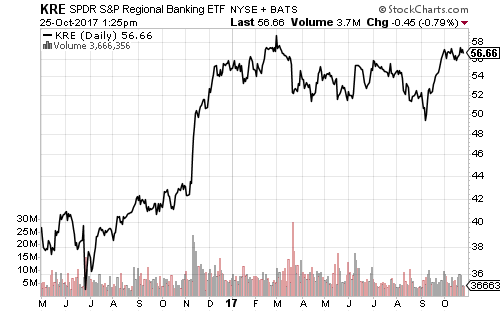

Financials hit a new 52-week high on Tuesday. Insurance stocks pulled the sector higher, aided by J.P. Morgan (JPM) and Bank of America (BAC).

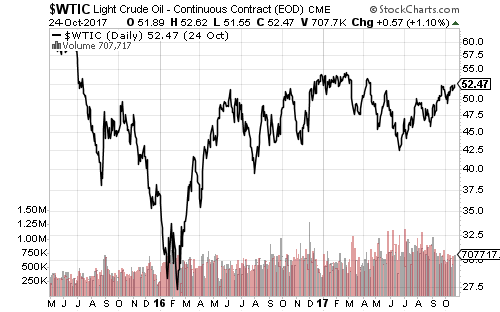

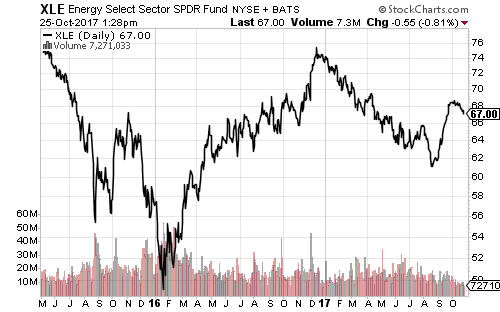

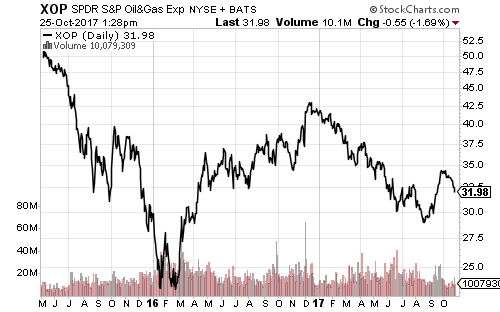

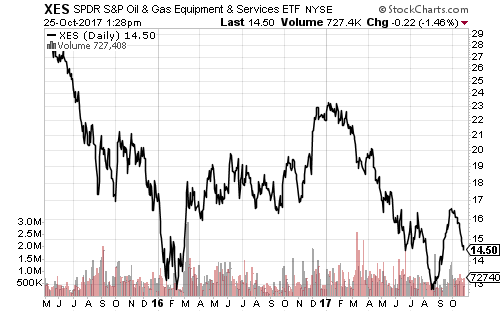

The energy sector has continued to decline despite crude oil holding its gains. The oil service subsector (tracked by XES) is on the cusp of being “oversold” following weak earnings reports.

Later this week, integrated oil giants Exxon Mobil (XOM) and Chevron (CVX) will report.

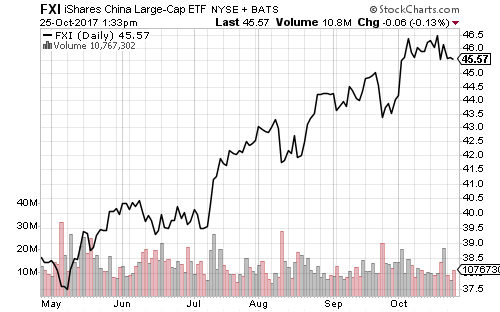

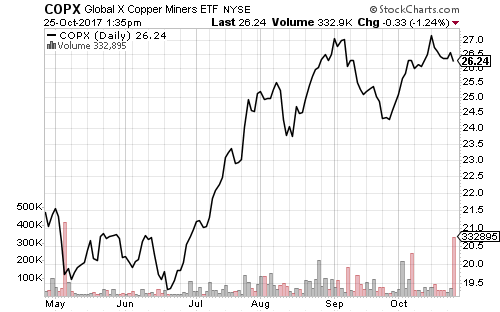

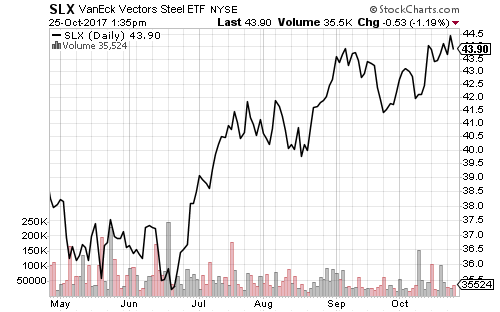

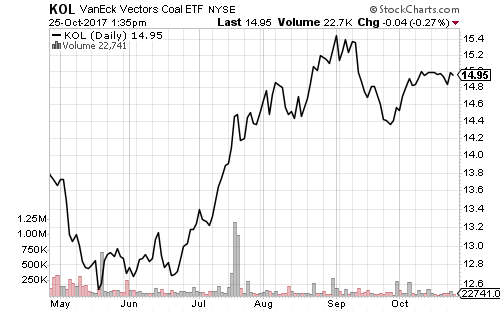

China completed its 5-year national congress this week. Last week, the head of China’s central bank warned of a financial crisis if credit growth isn’t contained. Economic data was solid, but real estate sales and prices declined. A credit-fueled boom in Chinese real estate has lifted commodities over the past 18 months.

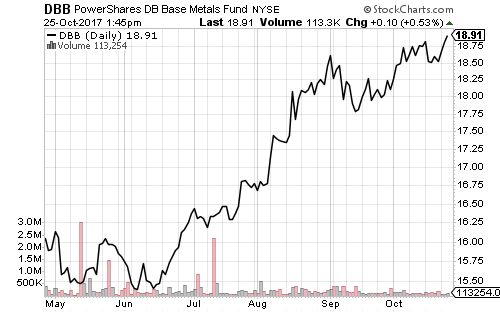

Global X Copper (COPX) fell on heavy volume on Wednesday, but steel (SLX) and coal (KOL) producers did not see a similar rise in volume. PowerShares DB Base Metals (DBB), however, rose to a new 52-week high.

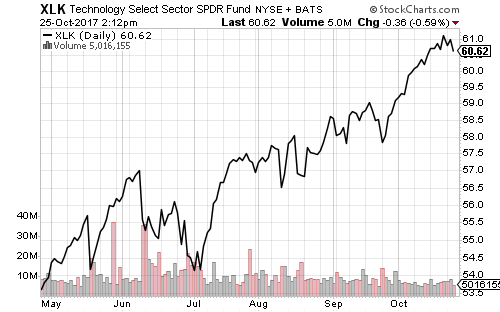

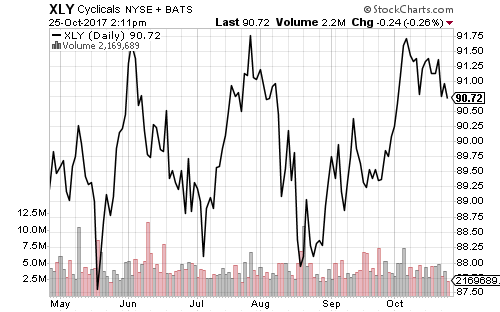

Alphabet (GOOGL), Microsoft (MSFT), Amazon (AMZN) and Intel (INTC) will report earnings on Thursday. SPDR Technology (XLK) hit a new 52-week high on Friday. Amazon (AMZN) is the top holding in SPDR Consumer Discretionary (XLY).

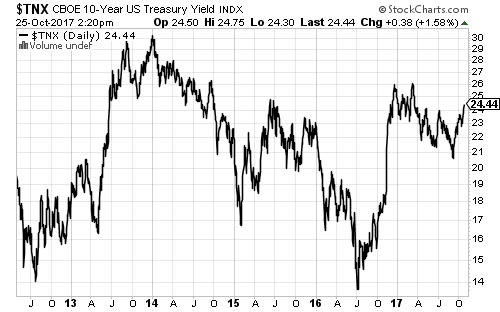

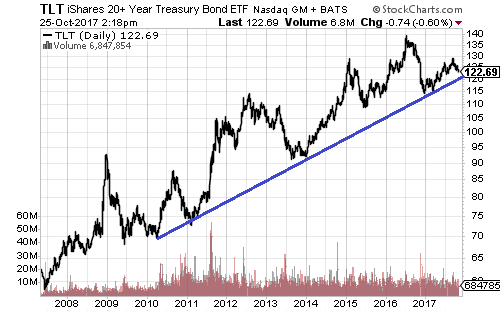

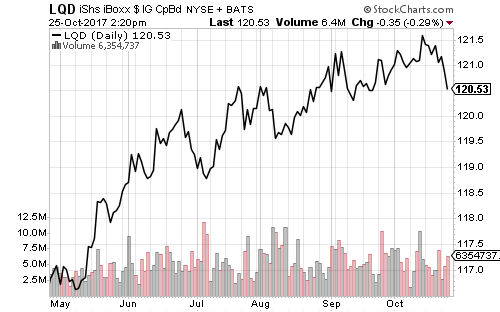

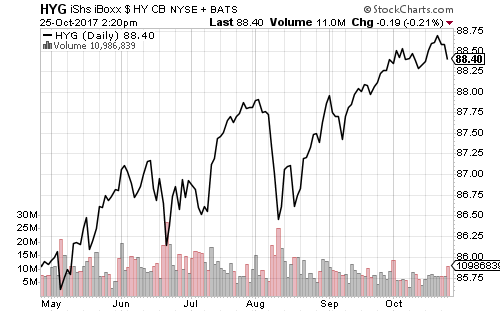

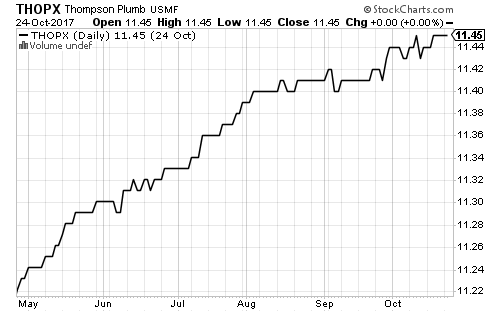

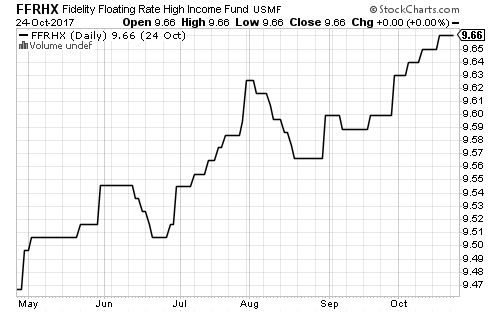

The 10-year Treasury yield crossed 2.4 percent on Tuesday. The yield pushed higher still on Wednesday. iShares 20+ Year Treasury Bond (TLT) is approaching a long-term trend line going back to 2010. The increase in rates over the past week hit investment grade and high-yield bonds. Thompson Bond (THOPX) and floating-rate funds ignored the rise in rates.